Press release

Demand for Automotive Grade Inductor in USA Landscape 2026: Strategic Benchmarking, Pricing Trends & Regional Hotspots

The USA automotive grade inductor market continues to demonstrate structurally stable growth, supported by rising electronic content per vehicle and gradual electrification of powertrain architectures. In 2025, demand for automotive grade inductors in the United States is valued at USD 1.0 billion and is projected to reach USD 1.3 billion by 2035, expanding at a compound annual growth rate (CAGR) of 2.8% over the forecast period.While growth remains moderate compared to high-voltage semiconductor markets, automotive grade inductors occupy a foundational position within vehicle electronics. Their role in power conditioning, electromagnetic interference (EMI) suppression, and signal integrity makes them indispensable across engine control units (ECUs), braking electronics, power steering modules, infotainment systems, and emerging electrified architectures. The sustained demand profile reflects the maturity of the US automotive market, where incremental value creation is driven more by system complexity and reliability requirements than by sharp increases in vehicle production volumes.

Get access to comprehensive data tables and detailed market insights - request your sample report today!

https://www.futuremarketinsights.com/reports/sample/rep-gb-29148

Early Growth Anchored in Stable Vehicle Mix and OEM Demand

Between 2025 and 2030, the US automotive grade inductor market is expected to expand from USD 1.0 billion to USD 1.1 billion, adding USD 0.1 billion in absolute value. This phase reflects volume-anchored growth tied to steady electronic content expansion across conventional internal combustion engine (ICE) and hybrid vehicle platforms. Inductor demand during this period is largely supported by routine platform upgrades, regulatory requirements for EMI control, and consistent production of mid-range passenger vehicles.

The US vehicle mix remains heavily weighted toward pickup trucks and sport utility vehicles, which carry significantly higher electronic content per unit than compact passenger cars. These vehicles integrate multiple ECUs, digital displays, advanced body control modules, and power-assist electronics, all of which rely on automotive-qualified inductors for stable operation. Original equipment manufacturer (OEM) demand dominates market volumes, supported by domestic vehicle assembly across the Midwest and Southern manufacturing corridors. Aftermarket demand remains limited, as inductors are rarely replaced independently and are typically serviced only as part of complete electronic module replacement.

Post-2030 Expansion Driven by Electrification Intensity

From 2030 to 2035, the market expands from USD 1.1 billion to USD 1.3 billion, adding a larger USD 0.2 billion on a higher base. This back-weighted acceleration reflects a transition toward system-driven value growth rather than shipment-led expansion. Electric vehicles (EVs), hybrids, and 48-volt mild-hybrid platforms increase inductor intensity per vehicle through onboard chargers, DC-DC converters, battery management systems, and traction inverter subsystems.

While full displacement of combustion platforms remains gradual in the US, electrification significantly raises power conversion requirements. Automotive grade inductors gain higher value density as silicon carbide-based power electronics, higher switching frequencies, and tighter thermal envelopes become standard. As a result, pricing increasingly reflects enhanced current ratings, thermal stability, electromagnetic shielding performance, and miniaturized designs rather than simple volume growth.

1 to 10 Microhenry Segment Leads by Functional Versatility

By inductance range, 1 to 10 microhenry inductors account for 32% of total demand, making this the leading segment in the US automotive market. This dominance reflects the broad applicability of this range across DC-DC converters, EMI suppression circuits, signal filtering, and onboard power regulation. These inductors strike an optimal balance between size, current handling capability, and energy storage, making them well-suited for compact automotive electronic modules.

They are widely deployed in engine control units, body control modules, ADAS electronics, infotainment systems, and digital instrument clusters. Standardization of this inductance range across multiple applications simplifies sourcing and inventory management for OEMs and Tier-1 suppliers, reinforcing its sustained leadership across the US automotive electronics supply chain.

Passenger Vehicles Drive the Majority of Consumption

By application, passenger vehicles account for 68% of total automotive grade inductor demand in the United States. This reflects both higher production volumes and faster growth in electronic feature density compared to commercial vehicles. Modern passenger vehicles integrate start-stop systems, electric steering, digital cockpits, connectivity modules, and advanced driver assistance systems, each adding incremental inductor requirements.

Shorter model refresh cycles and higher feature penetration in passenger vehicles further increase inductor intensity per unit. While commercial vehicles increasingly adopt electrified drivetrains and advanced electronics, their longer product lifecycles and lower production volumes moderate overall inductor consumption relative to passenger platforms.

Electrification and ADAS Adoption Strengthen Structural Demand

The primary drivers shaping automotive grade inductor demand in the USA are powertrain electrification and ADAS adoption. Electric and hybrid vehicles require multiple high-current inductors to manage voltage conversion between batteries, motors, and auxiliary systems. ADAS features-including radar, cameras, domain controllers, and sensor fusion modules-depend on clean power conditioning, increasing demand for shielded, low-loss inductors.

Pickup trucks and large SUVs equipped with towing electronics, advanced infotainment, and 48-volt subsystems further raise inductor content per vehicle. Ride-hailing fleets and commercial EVs introduce higher duty cycles, reinforcing demand for components with superior thermal stability and vibration resistance.

Constraints Moderate Pace of Expansion

Despite positive fundamentals, several factors moderate rapid market acceleration. Automotive-grade qualification under AEC standards involves long validation cycles and high upfront costs. Volatility in ferrite core materials and copper pricing compress supplier margins, while concentrated magnetics processing capacity introduces supply-chain risk. Platform consolidation among automakers limits part diversity and places downward pressure on pricing leverage. Together, these factors favor predictable, long-term sourcing relationships over rapid supplier turnover.

Regional Growth Patterns Reflect Manufacturing Footprint

Regionally, the West leads US demand growth at a CAGR of 3.2%, supported by EV development activity, advanced electronics integration, and strong R&D presence. The South follows at 2.8%, anchored by expanding vehicle assembly and power electronics manufacturing. The Northeast grows at 2.5%, supported by stable replacement demand and established supply chains, while the Midwest records 2.2% growth, reflecting steady but slower electronics upgrades within mature manufacturing bases.

Personalize Your Experience: Ask for Customization to Meet Your Requirements

https://www.futuremarketinsights.com/customization-available/rep-gb-29148

Competitive Landscape Focused on Reliability and Long-Term Supply

The competitive environment is led by global passive component manufacturers with strong automotive qualification portfolios and US distribution networks. Key players include TDK Corporation, Murata Manufacturing Co., Ltd., Vishay Intertechnology, Panasonic Corporation, and Taiyo Yuden Co., Ltd. Competitive differentiation centers on vibration resistance, electromagnetic shielding, high-temperature performance, and long-term supply commitments aligned with OEM platform lifecycles.

Outlook: Value Stability Through 2035

The USA automotive grade inductor market represents a stable, infrastructure-oriented segment within the broader automotive electronics ecosystem. Growth through 2035 will be shaped less by vehicle volume expansion and more by increasing electrical complexity, electrification intensity, and reliability expectations. As vehicles evolve toward software-defined architectures and higher power densities, automotive grade inductors will remain essential components underpinning performance, safety, and durability. The full market report provides detailed segmentation, regional analysis, and competitive insights to support strategic decision-making across this foundational electronics market.

Similar Industry Reports

Automotive Grade Inductors Market

https://www.futuremarketinsights.com/reports/automotive-grade-inductors-market

Automotive Grade Inductor Market

https://www.futuremarketinsights.com/reports/automotive-grade-inductor-market

Demand for Automotive Grade Inductor in Japan

https://www.futuremarketinsights.com/reports/japan-automotive-grade-inductor-market

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Demand for Automotive Grade Inductor in USA Landscape 2026: Strategic Benchmarking, Pricing Trends & Regional Hotspots here

News-ID: 4322036 • Views: …

More Releases from Future Market Insights

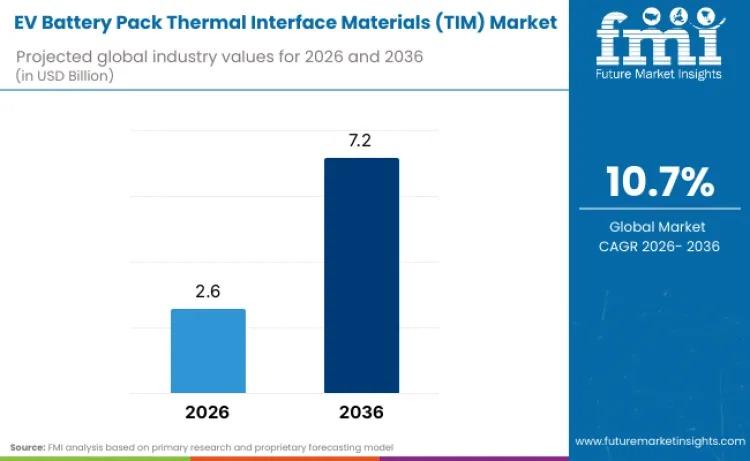

Global EV Battery Thermal Interface Materials Market to Reach USD 7.2 Billion by …

The global EV battery pack thermal interface materials (TIM) market is projected to grow from USD 2.6 billion in 2026 to USD 7.2 billion by 2036, advancing at a robust CAGR of 10.7%, according to recent analysis by Future Market Insights. This expansion reflects the accelerating electrification of transportation, rising energy density in battery systems, and increasingly stringent safety requirements that position thermal management as a critical determinant of vehicle…

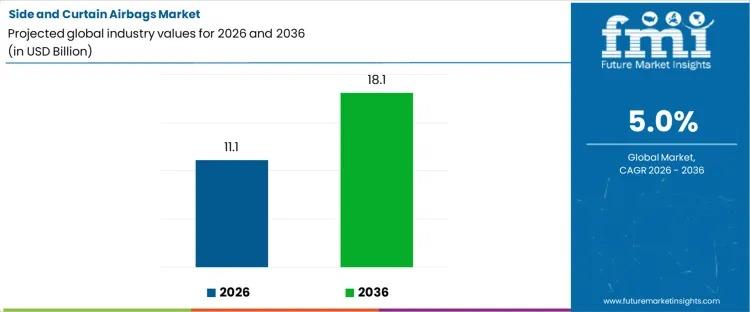

Global Side and Curtain Airbags Market to Reach USD 18.2 Billion by 2036 as Safe …

The global side and curtain airbags market is poised for sustained expansion as automotive manufacturers prioritize occupant protection and compliance with stringent crash safety regulations. According to the latest analysis by Future Market Insights, the market is projected to grow from USD 11.1 billion in 2026 to USD 18.2 billion by 2036, advancing at a CAGR of 5.0% during the forecast period.

This growth reflects the automotive industry's increasing emphasis on…

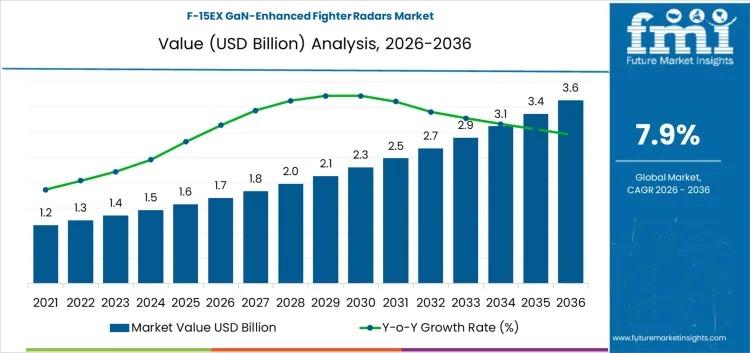

F-15EX GaN-Enhanced Fighter Radars Market to Reach USD 3.6 Billion by 2036 as De …

The global F-15EX GaN-enhanced fighter radars market is projected to grow from USD 1.7 billion in 2026 to USD 3.6 billion by 2036, registering a compound annual growth rate (CAGR) of 7.9% during the forecast period. This growth trajectory reflects the increasing integration of Gallium Nitride (GaN) semiconductor technology into advanced airborne radar systems, enabling superior detection, tracking, and electronic warfare resistance for modern fighter aircraft such as the F-15EX.

The…

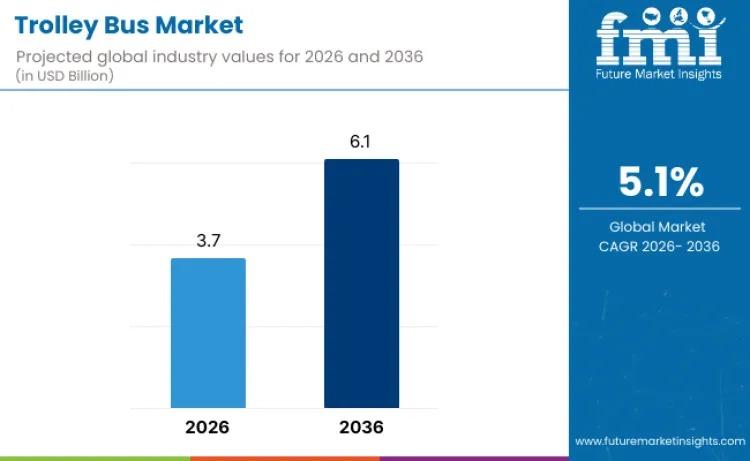

Global Trolley Bus Industry to Reach USD 6.1 Billion by 2036 as Urban Electrific …

The global trolley bus industry is entering a phase of sustained expansion, with market valuation projected to grow from USD 3.7 billion in 2026 to USD 6.1 billion by 2036, reflecting a steady compound annual growth rate (CAGR) of 5.1%. This upward trajectory is being driven by accelerating urban electrification programs, stringent zero-emission mandates, and mounting investment in sustainable public transportation infrastructure across major metropolitan regions worldwide.

As cities confront escalating…

More Releases for Automotive

Automotive Grommet Market set for explosive growth: Cooper Standard Automotive, …

According to HTF MI, "Global Automotive Grommet Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2030". The Global Automotive Grommet Market is anticipated to grow at a compound annual growth rate (CAGR) of 5.96% from 2024 to 2030, reaching USD 100 Billion in 2024 and USD 150 Billion by 2030.

Automotive grommets are protective rings or eyelets made from rubber or plastic, used to protect or cover holes in metal…

KSA Automotive Market | KSA Automotive Industry | KSA Automotive Industry Resear …

Saudi Arabia’s automotive market faced a decline in new car sales due to tripling of value-added tax (VAT) rates. Effective in July 1, 2020, Saudi Arabia hiked its VAT from 5% to 15%.

Vision 2030 trying to attract foreign investment to kick start Dammam manufacturing city to aid re-exports & fulfill domestic demand

Surge in Domestic Manufacturing to gain independence of Imports: With Vision 2030, KSA is trying to gain impendence of…

Automotive Fuel Injectors Market: Growing Automotive Sales Fueling Automotive Fu …

Automotive fuel injectors market is likely to grow at a steady pace in the long run, according to a new report by Fact.MR. The demand for automotive fuel injectors continues to remain influenced with a multitude of industry-specific and macroeconomic factors. Significant growth in the automotive sector, coupled with increasing vehicle fleet remain instrumental in driving the demand for automotive fuel injectors worldwide. Fact.MR estimates that the sales of automotive fuel injectors are expected…

Global Automotive Safety Market 2019 Worldwide Outlook By Autoliv, Delphi Automo …

Automotive safety systems are designed to comply with the standards and regulations prescribed by government agencies and transport authorities worldwide. Passive safety systems are designed to protect passengers, drivers, and pedestrians during an accident.

In terms of region, the global Automotive Passive Safety Systems market can be segmented into North America, Europe, Asia Pacific, and Middle East & Africa. Asia Pacific is likely to hold a prominent share of the global…

Global Oil Pump for Automotive Market 2018 Analysis -Bosch,Denso,Aisin Seiki,Del …

According to this study, over the next five years the Oil Pump for Automotive market will register a xx% CAGR in terms of revenue, the global market size will reach US$ xx million by 2023, from US$ xx million in 2017. In particular, this report presents the global market share (sales and revenue) of key companies in Oil Pump for Automotive business.

Get Sample Copy of this Report for more Information…

Global Automotive Body Welded Assembly Market 2018 - Daesan, Baylis Automotive, …

Accord Market, recently published a detailed market research study focused on the “Automotive Body Welded Assembly Market” across the global, regional and country level. The report provides 360° analysis of “Automotive Body Welded Assembly Market” from view of manufacturers, regions, product types and end industries. The research report analyses and provides the historical data along with current performance of the global PP Pipe industry, and estimates the future trend of…