Press release

Top 30 Indonesian Construction Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)PT Waskita Karya Tbk (WSKT).

PT Wijaya Karya Tbk (WIKA).

PT PP (Persero) Tbk PTPP.

PT Adhi Karya (Persero) Tbk ADHI.

PT Nusa Raya Cipta Tbk NRCA.

PT Total Bangun Persada Tbk TOTL.

PT Jaya Konstruksi Manggala Pratama Tbk JKON.

PT Wijaya Karya Beton Tbk WTON (WIKA Beton).

PT Acset Indonusa Tbk ACST.

PT Surya Semesta Internusa Tbk SSIA (construction + property & hotels).

PT Cipta Kridatama / PT (where listed) (contracting/engineering).

PT Pembangunan Perumahan (other subsidiaries) / regional contractors.

PT Ciputra Development Tbk (construction + property).

PT Metropolitan Land Tbk (construction related segments).

PT Surya Semesta / subsidiaries beyond SSIA.

PT Citra Marga Nusaphala Persada (toll / infra developer).

PT Istaka Karya (if publicly listed parts/subsidiaries).

PT Brantas Abipraya (where applicable / state construction players).

PT Modernland, PT Summarecon (project / developer groups with construction divisions).

PT PP Presisi Tbk (PPRE)

PT Bukaka Teknik Utama Tbk (BUKK)

PT Nusa Konstruksi Enjiniring Tbk (DGIK)

PT Indonesia Pondasi Raya Tbk (IDPR)

PT Indonesia Pondasi Raya Tbk (IDPR)

PT Koka Indonesia Tbk (KOKA)

PT Meta Epsi Tbk (MTPS)

PT Mitra Pemuda Tbk (MTRA)

PT Fimperkasa Utama Tbk (FIMP)

PT Cahayasakti Investindo Sukses Tbk (CSIS)

PT Superkrane Mitra Utama Tbk (SMKM) / PT Lancartama Sejati Tbk (TAMA)

Q3/9M-2025 reporting for Indonesias construction sector shows a mixed picture: several large state-owned contractors (Waskita, Wijaya Karya, PTPP, Adhi) reported weaker revenues and in some cases sizeable net losses YoY through September 2025, while some private contractors and mid-caps (e.g., Nusa Raya Cipta, Total Bangun Persada, selected precast firms) posted improved profitability or stable results. The weakness for the large SOE contractors is driven by a slowdown in new contract wins and project execution bottlenecks during the period, while mid-cap contractors benefited from select private and property projects that resumed activity.

2) Q3 2025 earnings call / Q3 (9M) results - Top 10 Indonesian public construction companies

PT Waskita Karya Tbk (WSKT) - Net loss to Sep-2025: IDR -3.174.7 billion (≈ USD -190.2 million).

Waskita's 9M-2025 showed a steep loss driven by plunging construction revenues and high interest expense; the company disclosed a net loss of ~Rp 3.17 trillion as of September 30, 2025. Waskita's interim filing and market coverage provide the details.

PT Wijaya Karya Tbk (WIKA) - Net loss to Sep-2025: IDR -3,210 billion (≈ USD -192.3 million).

WIKA reported a net loss (9M) of ~Rp 3.21 trillion to September 2025, linked to weaker new contract inflows and lower project revenue recognition in the period. Source: WIKA investor releases / market writeups.

PT PP (Persero) Tbk - PTPP - Net (9M-2025): IDR +5.6 billion (≈ USD +0.34 million).

PTPP's interim statement shows a small net positive bottom line (Rp ~5.6 billion) for Q3/9M-2025, a sharp YoY decline from prior year profit levels, reflecting margin pressure and lower topline.

PT Adhi Karya (Persero) Tbk - ADHI - Net (9M-2025): IDR +4.4 billion (≈ USD +0.26 million).

Adhi Karya recorded a very small profit (~Rp 4.4 billion) to September 2025 after revenue fell materially YoY (reported in Adhi's Q3 release). The result highlights margin compression and lower contract activity.

PT Nusa Raya Cipta Tbk - NRCA - Net (9M-2025): IDR +156.3 billion (≈ USD +9.36 million).

NRCA reported improved 9M performance, with net profit ~Rp 156.3 billion and revenue growth driven by project deliveries and private sector contracts. NRCA's Q3-2025 financial statements provide the detail.

PT Total Bangun Persada Tbk - TOTL - Net (9M-2025): IDR +295.3 billion (≈ USD +17.69 million).

TOTL posted stronger 9M revenue and a net profit of ~Rp 295.3 billion to Sep-2025, beating parts of market expectations as property-related projects and cost control helped margins.

PT Jaya Konstruksi Manggala Pratama Tbk JKON Net (9M-2025): IDR +17.9 billion (≈ USD +1.07 million).

Jaya Konstruksi reported a modest profit of Rp 17.9 billion to Sep-2025; revenue and margins were weaker YoY but still positive at the net level for the period.

PT Wijaya Karya Beton Tbk - WTON (WIKA Beton) - Net (9M-2025): IDR +8.4 billion (≈ USD +0.50 million).

WTON (concrete/ precast arm) reported a much smaller profit in Q3-2025 vs prior year, with revenue and asset reductions noted in the interim filing.

PT Acset Indonusa Tbk - ACST - Net (9M-2025): IDR -104.4 billion (≈ USD -6.26 million) loss.

Acset's Q3/9M filing showed a net loss to September 2025 (~Rp 104.4 billion), though improved vs prior-year loss levels; the company cited project timing and margins.

PT Surya Semesta Internusa Tbk - SSIA - Net (9M-2025): IDR +6.5 billion (≈ USD +0.39 million).

SSIA's diversified exposure (construction + hotels + property) meant weaker recurring income in 9M-2025; the company reported a small net profit to Sept-2025.

3) Key trends & insights from Q3 2025

Divergence between large SOE contractors and mid-cap private firms. Major state contractors (Waskita, Wijaya Karya) reported notable net losses or weak profitability due to weaker new contract flows and execution delays; mid-caps with exposure to private property projects (NRCA, TOTL) fared relatively better.

Working-capital and interest expense pressure. Several large contractors showed high interest expense and elevated debt loads that magnified earnings weakness when project revenue slid this is visible in Waskita and other SOE filings.

Project mix matters: contractors with a larger share of private property, corporate, and precast sales saw steadier revenues in 9M-2025, while those dependent on large state projects (which slowed or delayed) saw revenue drop. Examples: NRCA and TOTL (stronger) vs WIKA/WSKT (weaker).

Selective recovery in residential & private commercial projects a modest tailwind for some contractors as private investment picks up in late-2025 in certain regions. Market commentary and company filings noted pockets of contract wins among mid-caps.

4) Outlook for Q4 2025 and beyond

Near term (Q4 2025): Expect continued pressure on margins for large SOEs as they work down slow-moving contracts and manage refinancing; mid-cap contractors could continue to capture private property and commercial work if pipeline conversion stays positive. Market watchers will watch new contract announcements and government capex timetables closely.

Medium term (2026): Recovery for the construction sector will depend on (a) acceleration of public infrastructure spending (state budget / SOE project awards), (b) interest-rate trajectory (affects financing costs), and (c) the private property cycle. Companies with lower leverage and diversified order books are positioned to outperform.

What to watch: new contract backlog announcements (published monthly/quarterly by contractors), Bank Indonesia policy moves (affecting FX / funding costs), and any government package to accelerate infrastructure projects.

5) Conclusion

Q3/9M-2025 showed a split Indonesian construction sector: large state contractors struggled with contract slowdowns and debt/interest burdens that pushed some to net losses, while several mid-cap contractors that executed private projects and controlled costs reported healthier results. For investors and stakeholders, the immediate focus should be on backlog growth, contract awards through Q4-2025, and how companies manage leverage.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Construction Public Companies Q3 2025 Revenue & Performance here

News-ID: 4321442 • Views: …

More Releases from QY Research

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA) Tile & ceramic producer (IDX).

PT Cahayaputra Asa Keramik Tbk (CAKK) Ceramic tiles (IDX).

PT Intikeramik Alamasri Industri Tbk (IKAI) Porcelain & tiles (IDX).

PT Keramika Indonesia Assosiasi Tbk (KIAS) Ceramic manufacturer (IDX).

PT Mulia Industrindo Tbk (MLIA) Ceramic tiles (via subsidiaries) and glass (IDX).

PT Asahimas Flat Glass Tbk (AMFG) Glass &…

Healthier Sweetening Solutions: A Strategic Look at the Organic Powdered Sugar I …

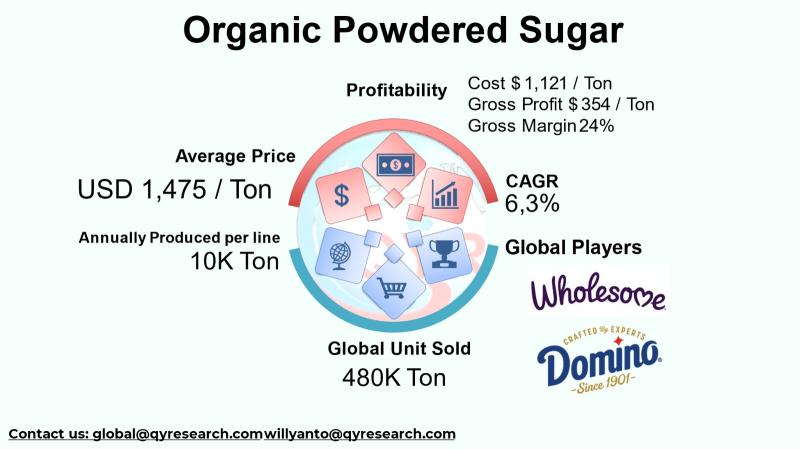

The global organic powdered sugar industry represents a specialized segment within the broader sweeteners and organic ingredient market, catering to increasing consumer demand for clean-label, sustainable, and health-oriented food products. As shoppers and food manufacturers alike seek alternatives to conventionally produced sugar, organic powdered sugar has emerged as a preferred input for bakery, confectionery, beverage, and specialty food applications. Its positioning as an ingredient free from synthetic pesticides and additives…

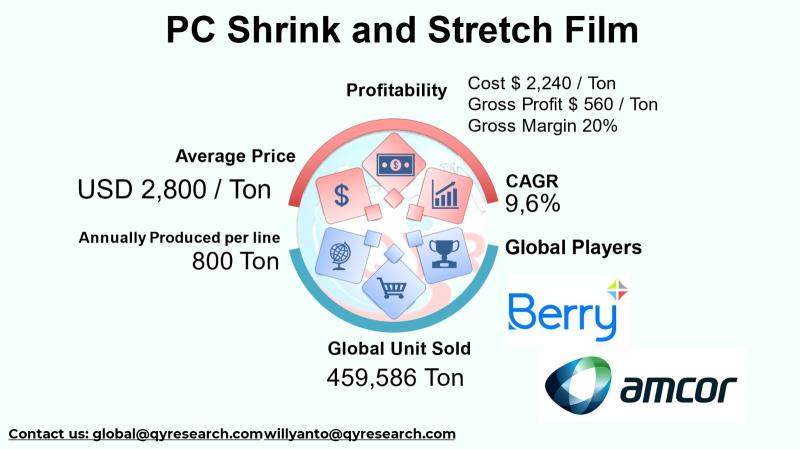

Investment Outlook: The High-Growth Global PCR Shrink and Stretch Film Market

The Global PCR Shrink and Stretch Film market is a dynamic segment within flexible packaging that directly intersects sustainability demands and industrial packaging efficiency. PCR (Post-Consumer Recycled) shrink and stretch films are polymer films made with recycled resin content that are widely used for pallet wrapping, logistics unitization, retail bundling, protective packaging, and specialty applications. These films are critical in optimized supply chains seeking lightweight, durable, and environmentally compliant packaging…

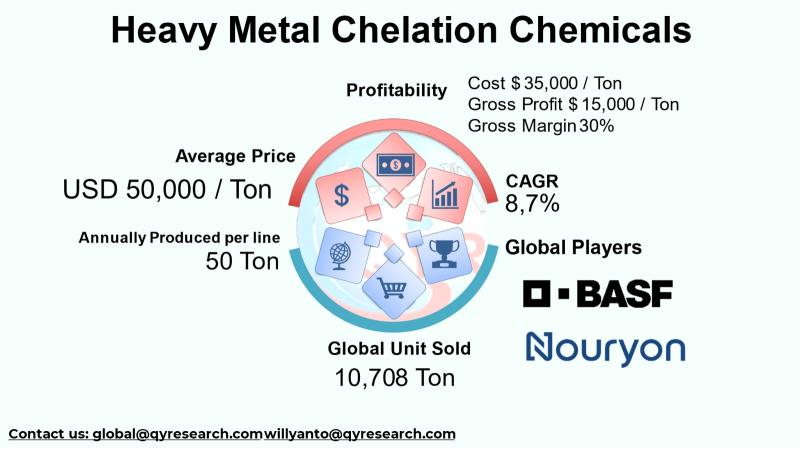

From Wastewater to Profit: Technological Innovation and Strategic Growth in Chel …

The global market for heavy metal chelation chemicals is a specialized segment within the broader chemicals industry focused on compounds that bind and immobilize heavy metal ions to facilitate their removal in industrial processes or environmental treatment. Unlike broader chelating agents used in agriculture or household cleaning, heavy metal chelation chemicals are formulated for rigorous applications such as industrial wastewater treatment, mining effluent remediation, electroplating waste management, and soil clean-up…

More Releases for Tbk

Indonesia Textile Industry Market Valuation Expected to Hit USD 28.57 billion by …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Textile Industry Market size was valued at USD 21.7 Billion in 2023 and is projected to reach USD 28.57 Billion by 2031, growing at a CAGR of 3.50% from 2024 to 2031

How AI and Machine Learning Are Redefining the future of Indonesia Textile Industry Market?

AI-powered production planning systems optimize yarn selection, fabric blends, and loom utilization, improving output…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…