Press release

Leading Companies Fueling Growth and Innovation in the Side A Difference-in-Conditions Insurance Market

The side A difference-in-conditions insurance market is positioned for substantial growth in the coming years, driven by increasing risks and evolving needs within the corporate insurance landscape. This report explores the market's size, key players, emerging trends, and segmentation to provide a comprehensive overview of this specialized sector.Projected Market Expansion of the Side A Difference-In-Conditions Insurance Market

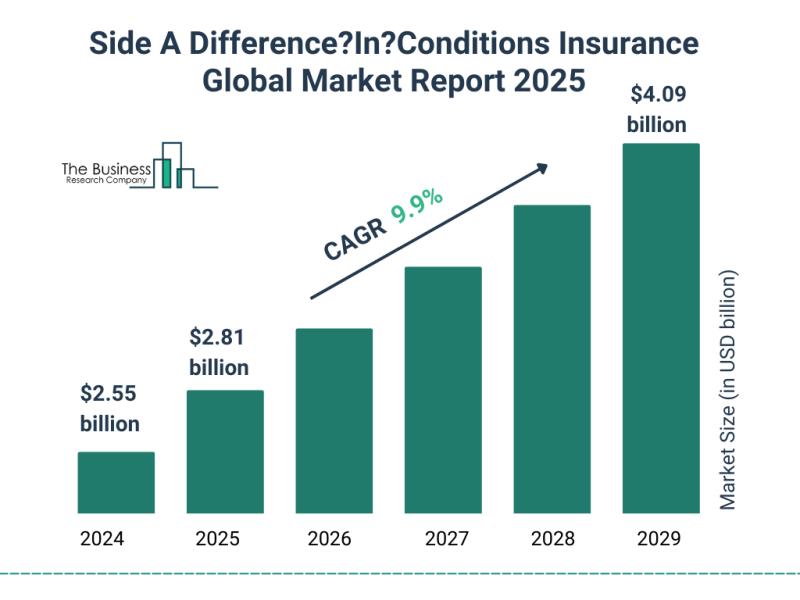

The side A difference-in-conditions insurance market is anticipated to expand significantly, reaching a valuation of $4.09 billion by 2029. This represents a robust compound annual growth rate (CAGR) of 9.9% during the forecast period. The acceleration in market size is largely fueled by the rising frequency of cybersecurity threats, growing shareholder litigation risks, a surge in class-action lawsuits, and increasing geopolitical as well as economic uncertainties. Additionally, there is a heightened demand for tailored insurance products that address these complex challenges. Key trends shaping the market include advancements in technology-driven risk assessments, the development of new cyber liability extensions, incorporation of enterprise risk management systems, innovations in coverage triggers, and the use of digital platforms to streamline brokerage services.

Download a free sample of the side a difference-in-conditions insurance market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=30390&type=smp

Primary Factors Influencing Growth in the Side A Difference-In-Conditions Insurance Market

An escalating number of cybersecurity incidents is a crucial driver for growth in this insurance segment. As cyberattacks become more sophisticated and frequent, companies are seeking specialized policies to protect executives and board members from related liabilities.

Moreover, increasing shareholder litigation and class-action lawsuits are contributing to heightened risk exposure for corporate leaders, prompting organizations to invest more in difference-in-conditions insurance coverage. This demand is further intensified by geopolitical tensions and economic instability, which create unpredictable environments that heighten the necessity for comprehensive executive protection.

Key Players Shaping the Side A Difference-In-Conditions Insurance Industry

The market features a strong presence of leading insurance firms and underwriters including Allianz Global Corporate And Specialty SE, Zurich Insurance Group Ltd., Munich Reinsurance Company, Liberty Mutual Insurance Company, Chubb Limited, Tokio Marine HCC Insurance Group, The Travelers Companies Inc., American International Group Inc., Sompo International Holdings Ltd., The Hartford Financial Services Group Inc., QBE Insurance Group Limited, Markel Corporation, Everest Reinsurance Company, Arch Capital Group Ltd., CNA Financial Corporation, AXA SA, Aspen Insurance Holdings Limited, Berkshire Hathaway Specialty Insurance Company, Beazley plc, and Swiss Re Ltd.

In a notable recent development, Arthur J. Gallagher and Co., a US-based global brokerage and risk consultancy, acquired Woodruff Sawyer in April 2025. This strategic move aims to expand Gallagher's specialty insurance offerings in areas like management liability, construction, real estate, and cyber risk, while also strengthening its footprint on the U.S. West Coast. Woodruff-Sawyer & Co. is recognized for providing standalone side A policies with difference-in-conditions features, complementing Gallagher's growth strategy.

View the full side a difference-in-conditions insurance market report:

https://www.thebusinessresearchcompany.com/report/global-side-a-difference-in-conditions-insurance-market-report

Emerging Trends Driving Innovation in the Side A Difference-In-Conditions Insurance Sector

Insurers in this market are focusing on creating innovative products that fill coverage gaps in traditional Directors and Officers (D&O) policies. One such innovation is enhanced first-party executive coverage that includes bankruptcy protection. This feature offers executives direct personal coverage for losses, including legal and financial liabilities, even if the company faces insolvency or bankruptcy, providing a valuable safety net in high-risk scenarios.

For example, in June 2024, UK-based Relm Insurance Ltd. launched a proprietary Side A Difference-in-Conditions solution tailored for D&O liability. This product aims at clients in challenging and emerging markets who often struggle to obtain adequate coverage or consistent terms. It improves protection by covering first-party expenses such as bankruptcy-related costs and permits up to two policy reinstatements. This solution particularly benefits companies in risk-prone sectors like technology and digital assets.

Market Segmentation Overview of the Side A Difference-In-Conditions Insurance Industry

This report segments the side A difference-in-conditions insurance market comprehensively:

1) Coverage Type: Non-Indemnifiable Loss, Difference in Conditions, and Difference in Limits

2) Organization Size: Small and Medium Enterprises (SMEs), Large Enterprises

3) Distribution Channel: Direct Sales, Brokers, Online Platforms, and Other Channels

4) End-User Categories: Public Companies, Private Companies, Non-Profit Organizations, Financial Institutions, and Others

Further subcategories include:

- For Non-Indemnifiable Loss: Direct Loss Coverage, Legal Defense Costs, Settlement Costs, Judgment Coverage

- For Difference in Conditions: First-Party Coverage, Bankruptcy Protection, Policy Reinstatement, Excess Coverage

- For Difference in Limits: Layered Coverage, Excess Limit Coverage, Aggregate Limit Coverage, Follow-Form Coverage

These detailed classifications help stakeholders understand the diverse product offerings and target markets within this rapidly evolving insurance segment.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Leading Companies Fueling Growth and Innovation in the Side A Difference-in-Conditions Insurance Market here

News-ID: 4321305 • Views: …

More Releases from The Business Research Company

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the M …

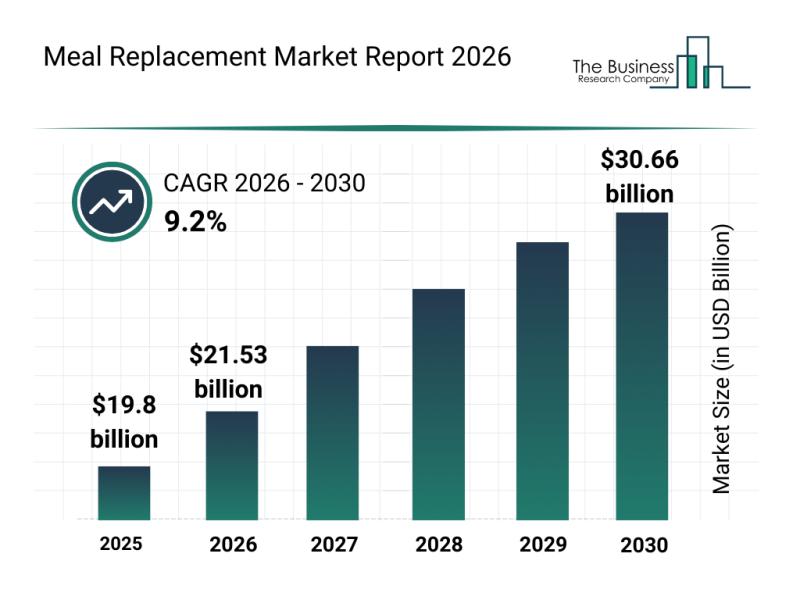

The meal replacement market is gaining significant momentum as consumer preferences shift toward convenient and health-focused nutrition solutions. With rising awareness about preventive healthcare and personalized diets, this sector is set for considerable expansion. Let's explore how the market size is expected to evolve, who the key players are, emerging trends, and the main segments driving this growth.

Projected Growth Trajectory of the Meal Replacement Market Size

The meal replacement…

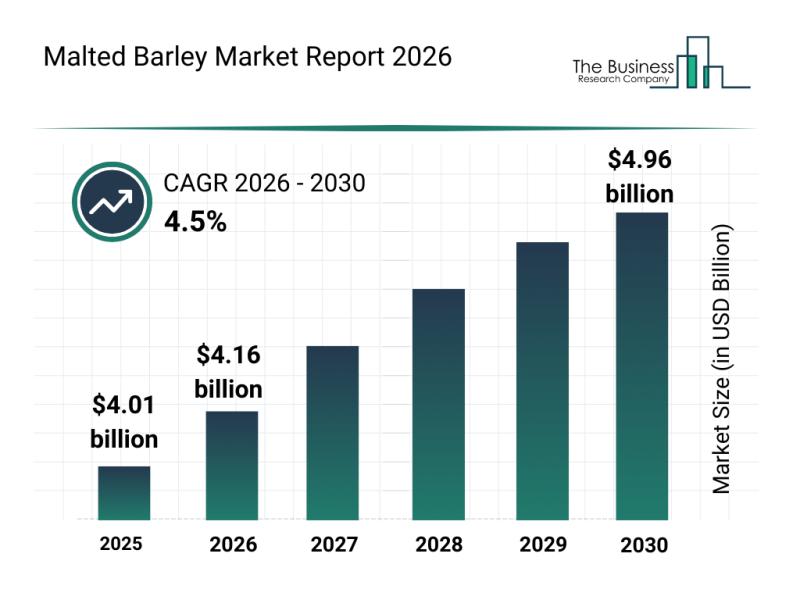

Leading Companies Reinforcing Their Presence in the Malted Barley Market

The malted barley industry is positioned for steady expansion as demand grows across various sectors. With increasing interest from craft brewers and functional food producers, this market is set to experience meaningful growth driven by innovation and sustainability efforts. Let's dive into the current market size, key players shaping the industry, trends influencing its trajectory, and detailed segment insights.

Projected Market Size and Growth Outlook of the Malted Barley Market …

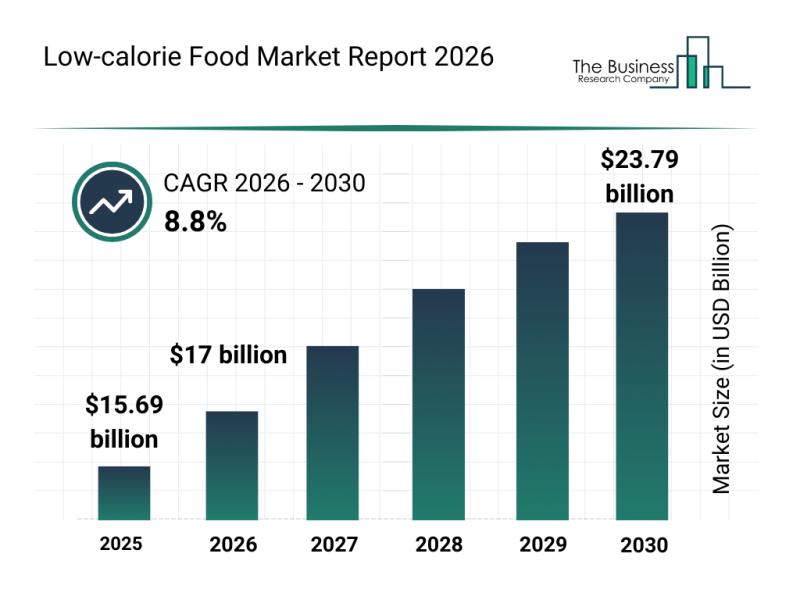

Future Perspective: Key Trends Shaping the Low-calorie Food Market up to 2030

The low-calorie food market is poised for significant expansion as consumer preferences shift toward healthier eating habits and more personalized nutrition options. Advances in product innovation and supportive regulatory frameworks are expected to drive rapid growth over the coming years. Here's an overview of the market size, key players, emerging trends, and segmentation shaping this evolving industry.

Projected Expansion of the Low-calorie Food Market Size Through 2030

The low-calorie food…

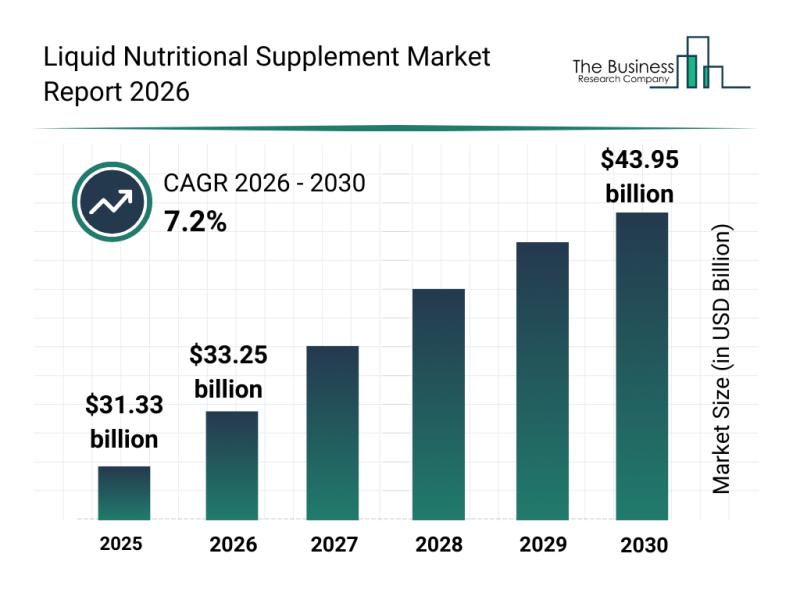

Competitive Landscape: Leading Companies and New Entrants in the Liquid Nutritio …

The liquid nutritional supplement sector is on the rise, driven by evolving consumer preferences and innovations in health and wellness. With growing awareness about personalized nutrition and preventive healthcare, this market is set to witness substantial growth over the coming years. Let's explore the market's projected size, major players, emerging trends, and key segments shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Liquid Nutritional Supplement Market …

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…