Press release

Pectin Market Size, Share, Analysis And Industry Growth 2026-2034

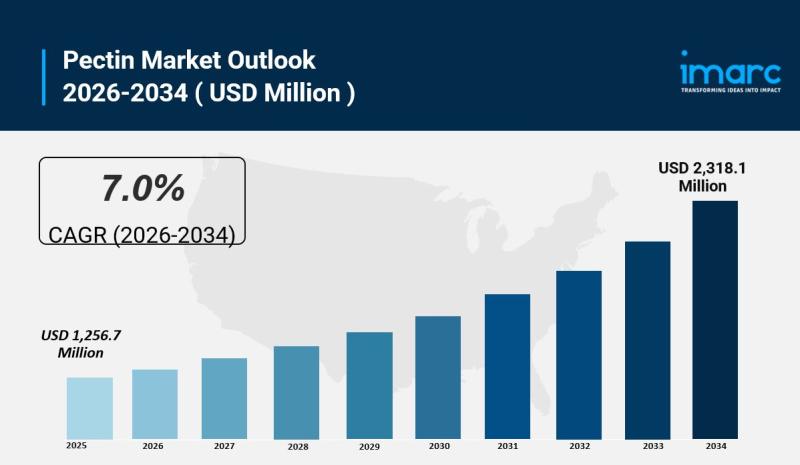

Pectin Market OverviewThe global pectin market was valued at USD 1,256.7 Million in 2025 and is projected to reach USD 2,318.1 Million by 2034, exhibiting a CAGR of 7.0% during the 2026-2034 forecast period. Growing consumer interest in natural and clean-label food ingredients, expanding demand for plant-based products, and heightened awareness about health and wellness are driving this growth. The pectin market size is expanding rapidly due to increasing application across the thriving food and beverage industry and growing consumer preference for natural gelling agents, thickeners, and stabilizers. Pectin, a naturally occurring polysaccharide extracted from fruits, particularly citrus and apples, is widely recognized for its excellent gelling properties, stabilizing capabilities, and versatility in food applications. Rising demand for ready-to-eat (RTE) and packaged food products, along with growing consumer concerns about synthetic additives, are fueling global demand. Manufacturers are introducing specialized pectin formulations, organic variants, and functional pectin types to attract a wider audience. Additionally, the expansion of pharmaceutical and personal care applications and the growing popularity of vegan and vegetarian diets worldwide are expected to further boost the global pectin market size over the forecast period.

Study Assumption Years

• Base Year: 2025

• Historical Year/Period: 2020-2025

• Forecast Year/Period: 2026-2034

Pectin Market Key Takeaways

• Current Market Size: USD 1,256.7 Million (2025)

• CAGR: 7.0% (2026-2034)

• Forecast Period: 2026-2034

• The market is estimated to reach USD 2,318.1 Million by 2034.

• Europe dominates as the largest market, holding over 37.6% market share, driven by strong demand for clean-label and natural food products.

• Citrus peel is the leading raw material segment, accounting for 75.0% of the market.

• Jams and preserves is the largest end-use segment with 43.7% market share, followed by dairy products and beverages.

• Market growth is supported by expanding plant-based diets, pharmaceutical applications, and broader adoption of natural food ingredients.

Request For A Sample Copy Of This Report: https://www.imarcgroup.com/pectin-technical-material-market-report/requestsample

Market Growth Factors

The pectin market is being propelled by rising consumer interest in natural and clean-label food ingredients worldwide. Consumers are increasingly shifting to pectin as a plant-based gelling agent and stabilizer alternative to synthetic additives, due to growing health consciousness and concerns about artificial ingredients. Pectin's natural origin from fruits, along with its beneficial properties for digestive health and cholesterol management, make it a preferred choice for health-focused consumers and manufacturers seeking clean-label solutions. The introduction of diverse pectin formulations-specialized types for specific applications, organic variants, and enhanced functional properties-caters to evolving consumer preferences and is expanding the application reach of pectin products globally. According to IMARC Group, the global organic food market is projected to reach USD 587.0 Billion by 2033, growing at a CAGR of 10.42% during 2025-2033.

Vegan and vegetarian populations worldwide continue to expand, supporting pectin's market growth. Pectin serves as a natural substitute for animal-derived gelatin in various food products, aligning perfectly with plant-based dietary trends. Pectin's versatile applications across food products-including jams, jellies, dairy items, bakery goods, and confectionery-meet the requirements of both traditional food manufacturers and innovative plant-based product developers. The popularity of pectin is further spurred by innovations in extraction and processing technologies, improved production efficiency, and convenient ready-to-use formats, meeting the needs of both industrial food processors and home cooking enthusiasts. Recent industry reports indicate that 3.2% of the population in Europe is vegan, while more than 40% of consumers give natural ingredients top priority when purchasing cosmetics and personal care items, highlighting the broader acceptance of natural ingredients like pectin.

Another contributor is the increased adoption of functional foods and pharmaceutical applications requiring natural stabilizers and texturizers. Pectin is increasingly used in drug delivery systems, wound healing products, and as an excipient in various pharmaceutical formulations. In processed food, pectin accounted for 23.4% of total agricultural exports in India during 2023-24, demonstrating its significant role in the food processing sector. Pectin's wide presence in ready-to-eat foods, beverages, and dairy products, coupled with urbanization-driven demand for convenience foods, has made pectin easier to incorporate into diverse product formulations. Major food manufacturers and pharmaceutical companies implement pectin solutions for enhanced texture, extended shelf life, and improved functionality, inspiring broader industrial acceptance. Manufacturers have improved pectin accessibility and application diversity through specialized product lines dedicated to specific food and pharmaceutical applications, supporting market expansion.

Market Segmentation

Raw Material:

• Citrus Peel: Dominates the market with 75.0% share due to higher pectin content and yield compared to other sources; increasingly utilized as a gelling agent, thickener, and stabilizer in food and beverage products, with growing recognition of health benefits including cholesterol-lowering effects and anti-inflammatory properties.

• Apple Peel: Valued for its quality pectin extraction and traditional use in various food applications, particularly in regions with abundant apple production.

• Others: Includes additional fruit sources such as sugar beet pulp and other agricultural byproducts used for pectin extraction.

Product Type:

• High Methoxyl (HM) Pectin: Used in traditional jams and jellies requiring sugar for gelling, preferred for its rapid gelling properties.

• Low Methoxyl (LM) Pectin: Suitable for low-sugar and sugar-free products, gels with calcium ions, increasingly popular in health-focused formulations.

• Amidated Pectin: Enhanced functional properties for specialized applications in dairy products and confectionery.

End Use:

• Jams and Preserves: The largest share with 43.7% of market, reflecting pectin's critical role as a gelling agent providing desired consistency and texture while extending shelf life.

• Drinkable and Spoonable Yoghurt: Used as a stabilizer and texturizer in dairy products, improving mouthfeel and preventing separation.

• Bakery and Confectionary: Incorporated into various baked goods and candies for texture improvement and moisture retention.

• Fruit Beverages: Essential for stabilizing fruit juices and providing consistent texture in beverage formulations.

• Other Milk Drinks: Applied in flavored milk drinks and dairy-based beverages for stabilization and texture enhancement.

• Pharmaceuticals: Used in drug delivery systems, wound healing products, and as an excipient in various formulations.

• Personal Care: Applied in lotions, creams, and cosmetic products for texture enhancement and natural ingredient appeal.

• Others: Includes additional applications in nutraceuticals and specialized food products.

Distribution Channel:

• Direct Sales: Manufacturers sell pectin directly to large food processors, pharmaceutical companies, and industrial users.

• Distributors and Dealers: Specialized ingredient suppliers and food additive distributors providing technical support and regional availability.

• Online Platforms: E-commerce sales of pectin for small-scale food manufacturers, home cooking enthusiasts, and specialty applications.

• Others: Additional distribution formats including specialty ingredient retailers and regional representatives.

Regional Insights

Europe currently dominates the market with over 37.6% market share, driven by well-developed food processing sectors and strong consumer demand for organic and natural products. Major contributors include Germany, France, and the United Kingdom, utilizing advanced food manufacturing technology to develop diverse pectin-based products such as jams, jellies, and dairy items. The region's strict food safety standards and focus on clean-label ingredients further support the use of pectin as a natural gelling agent and stabilizer. The trend toward plant-based and health-focused diets among European consumers is also driving pectin demand, aligned with growing vegan and vegetarian food preferences. In January 2024, 21.6% of the population in the European Union was aged 65 years and above, with this demographic seeking functional foods that aid digestion and cardiovascular health. Europe's focus on reducing food waste also supports pectin production through valorization of fruit byproducts, making it both economically and environmentally sustainable.

In North America, the United States accounts for over 80.50% of the regional market share. The US pectin market is primarily driven by health-conscious consumer trends, technological advancements in food processing, and growing demand for natural and clean-label ingredients. In 2021, organic retail sales accounted for approximately 5.5% of all retail food sales in the United States, exceeding USD 52 Billion, according to the United States Economic Research Service. Moreover, ranches and farms in the country sold almost USD 11 Billion worth of organic products in the same year. The expanding market for fruit-based products such as jams, jellies, fruit spreads, and beverages, where pectin serves as a gelling agent and stabilizer, further supports market growth. The functional benefits of pectin, particularly its role in improving digestive health due to soluble fiber content, align well with the broader wellness movement in the U.S. Strategic acquisitions like Tate & Lyle's purchase of CP Kelco demonstrate the strategic value of pectin to the American food industry.

The Asia Pacific region is experiencing rapid growth facilitated by urbanization, changing dietary habits, and growing demand for processed and convenience foods. As per estimates by Worldometers, 53.6% of the population of Asia lives in urban areas in 2025, equating to 2,589,655,469 individuals. As the middle-class population expands in countries such as China, India, and Southeast Asian nations, there is increased consumption of fruit-based products, dairy items, and beverages where pectin is commonly used. The region's rising health consciousness is propelling demand for natural, plant-based ingredients, with pectin gaining popularity due to its fiber content and digestive health benefits. Local production of citrus fruits and apples also provides cost-effective sources for pectin extraction.

Latin America shows significant growth potential driven by abundant availability of raw materials, particularly citrus fruits. Countries such as Brazil and Mexico are major citrus producers, supporting both domestic production and export opportunities. In 2020, the food and beverage sector in Brazil brought in USD 152 Billion in sales annually, recording growth of 12.7% in nominal terms and 3.3% in real terms. Rising consumer awareness about health and wellness trends is contributing to a shift toward clean-label and plant-based ingredients, further supporting market growth across the region.

The Middle East and Africa market is being increasingly propelled by rising demand for processed and convenience foods, fueled by rapid urbanization and population growth. According to reports, the population of Africa is estimated to be growing at an annual rate of 2.29% in 2025. The expanding dairy, confectionery, and beverage sectors in countries such as South Africa, UAE, and Saudi Arabia are contributing to pectin uptake for its thickening, stabilizing, and gelling properties. The rise in dietary concerns such as diabetes and obesity is boosting demand for low-sugar and fiber-rich products, further supporting pectin usage.

Recent Developments & News

• 2024: Tate & Lyle's acquisition of CP Kelco, an American pectin and natural ingredients supplier, reflects the strategic value of pectin to the food industry and commitment to expanding product lines with natural ingredients.

• 2024: Major manufacturers continued developing specialized pectin types with enhanced functionality for targeted applications in dairy, confectionery, and beverages.

• 2024: Companies focused on sustainability initiatives by streamlining extraction processes, employing green technology, and sourcing raw materials responsibly from citrus peels and apple pomace.

• Ongoing: Food manufacturers increasingly replacing animal-derived gelatin with plant-based pectin alternatives to meet growing vegan and vegetarian consumer demands.

• Ongoing: Pharmaceutical and personal care industries expanding pectin applications in drug delivery systems, wound healing products, and cosmetic formulations, leveraging its natural, hypoallergenic properties.

Related Reports:

Plant-based Seafood Market: https://www.imarcgroup.com/plant-based-seafood-market/requestsample

Organic Food Market: https://www.imarcgroup.com/organic-food-market/requestsample

Seafood Market: https://www.imarcgroup.com/seafood-market/requestsample

Food Processing Blades Market: https://www.imarcgroup.com/food-processing-blades-market/requestsample

Baby Food Packaging Market: https://www.imarcgroup.com/baby-food-packaging-market/requestsample

Key Players

• Cargill, Incorporated

• Ceamsa

• dsm-firmenich

• Foodchem International Corporation

• Herbstreith & Fox GmbH & Co. KG

• Ingredion Incorporated

• International Flavors & Fragrances Inc.

• Kraft Heinz

• Pacific Pectin Inc.

• Silvateam S.p.a

• Tate & Lyle PLC

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=644&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Pectin Market Size, Share, Analysis And Industry Growth 2026-2034 here

News-ID: 4320938 • Views: …

More Releases from IMARC Group

United States AI Governance Market Size, Growth, Latest Insights and Forecast 20 …

IMARC Group's Latest Research Reveals a CAGR of 28.10% from 2026-2034, Supported by Expanding Certification, Auditing, and Impact Assessment Processes

NEW YORK, USA - The United States artificial intelligence (AI) governance industry is witnessing rapid expansion as organizations intensify efforts to implement responsible AI practices. According to the latest market intelligence report by IMARC Group, the United States AI Governance Market, valued at USD 81.6 Million in 2025, is projected to…

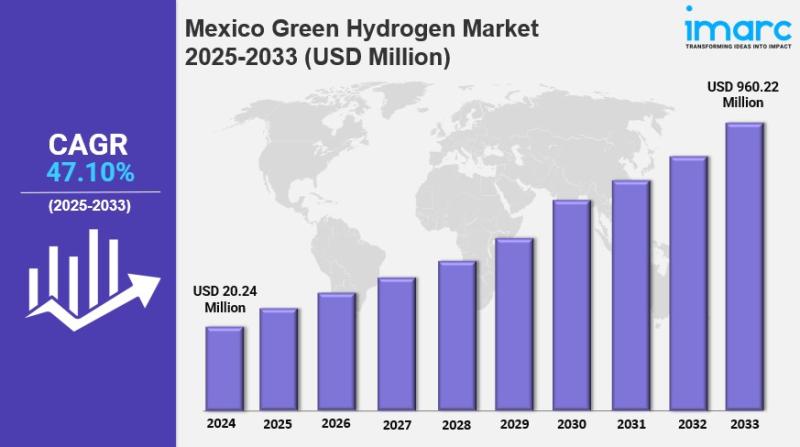

Mexico Green Hydrogen Market Size, Share, Demand, Trends & Forecast to 2033

IMARC Group's Latest Research Reveals a CAGR of 47.10% from 2025-2033, with Renewable-Powered Electrolysis and Export-Oriented Projects Accelerating Market Expansion

NEW YORK, USA - The Mexico green hydrogen industry is entering a high-growth phase, supported by national decarbonization initiatives and rising global demand for clean fuels. According to the latest report by IMARC Group, the Mexico Green Hydrogen Market reached a value of USD 20.24 Million in 2024 and is projected…

U.S. Pet Insurance Market Growth, Outlook & Key Players Analysis 2033

IMARC Group's Latest Research Reveals a CAGR of 10.8% from 2025-2033, with Customized Coverage Plans and Digital Platforms Accelerating Market Expansion

NEW YORK, USA - The U.S. pet insurance industry is witnessing rapid and sustained growth. According to a new market intelligence report by IMARC Group, the U.S. Pet Insurance Market, valued at USD 2.0 Billion in 2024, is projected to reach USD 5.1 Billion by 2033, registering a compound annual…

United States Home Healthcare Market Set to Reach USD 186.5 Billion by 2034, Dri …

PRESS RELEASE

FOR IMMEDIATE RELEASE

Date: February 24, 2026

Contact: sales@imarcgroup.com | +1-201-971-6302 | www.imarcgroup.com

IMARC-Style Industry Analysis Reveals a CAGR of 6.70% During 2026-2034, Supported by Expansion of Telehealth and Remote Patient Monitoring

The United States Home Healthcare Market reached a value of USD 103.7 Billion in 2025 and is projected to grow to USD 186.5 Billion by 2034, exhibiting a steady CAGR of 6.70% during 2026-2034.

Market growth is primarily driven by the rapidly…

More Releases for Pectin

Citrus Pectin Market Thriving Worldwide: Cargill, CP Kelco, DSM Andre Pectin

HTF MI introduces new research on Citrus Pectin covering the micro level of analysis by competitors and key business segments (2024-2030). The Citrus Pectin explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing.

Some of the major key players profiled…

Global Pectin Market 2019 - Yantai Andre Pectin, Silvateam, Naturex, Jinfeng Pec …

Pectin is a structural heteropolysaccharide contained in the primary cell walls of terrestrial plants. It is produced commercially as a white to light brown powder, mainly extracted from citrus fruits, and is used in food as a gelling agent, particularly in jams and jellies. It is also used in fillings, medicines, sweets, as a stabilizer in fruit juices and milk drinks, and as a source of dietary fiber.

Pectin is a…

Global Fruit Pectin Market 2019 Key Players:Cargill, Yantai Andre Pectin, DuPont …

Fruit Pectin Market:

WiseGuyReports.com adds “Fruit Pectin Market 2019 Global Analysis, Growth, Trends and Opportunities Research Report Forecasting 2025” reports tits database.

Executive Summary

Pectin has become a prominent ingredient in processed dessert fillings, drinks, sweets, etc. The product is also used as a stabilizer in various types of fruit juice and milk drink as well as added in food products to increase their fiber content. The consumption of processed food has reached…

HM Pectin Dominates Citrus Pectin Demand, LM Pectin Sales Growing on the Back of …

Global consumption of citrus pectin is expected to reach nearly 10,000 tonnes in 2018, a marginal rise of 400 tonnes over 2017, according to Fact.MR’s new study. Overall growth of the Citrus Pectin Market can be attributed to,

Considerable demand for natural hydrocolloid emulsifiers in the food and beverage sector

Promising results regarding modified citrus pectin’s anti-cancer properties

FDA’s recent guidance on certain non-digestible carbohydrates including citrus fibers to be termed as dietary…

Pectin Market Report 2018 Companies included CP Kelco, Danisco (DuPont), Cargill …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com *********

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides…

Global Pectins Market: Top Manufacturers - Yantai Andre Pectin, Silvateam, Natur …

Latest industry research report on: Global Pectins Market : Industry Size, Share, Research, Reviews, Analysis, Strategies, Demand, Growth, Segmentation, Parameters, Forecasts

Request For Sample Report @ http://www.marketresearchreports.biz/sample/sample/1070753

Geographically, this report is segmented into several key Regions, with production, consumption, revenue (million USD), market share and growth rate of Pectins in these regions, from 2012 to 2022 (forecast), covering

North America

Europe

China

Japan

Southeast Asia

India

Global Pectins market competition by top manufacturers, with production, price, revenue (value) and…