Press release

Latin America Fintech Market Hits USD 15.2 Billion in New 2026 Report

Market OverviewThe Latin America fintech market reached a size of USD 15.2 Billion in 2025. The market is expected to grow significantly, reaching USD 54.0 Billion by 2034, with a CAGR of 15.11% during the forecast period of 2026-2034. This growth is fueled by increasing digital banking adoption, widespread smartphone penetration, and supportive open banking regulations, making the region a rapidly expanding fintech hub.

Download a sample copy of the report: https://www.imarcgroup.com/latin-america-fintech-market/requestsample

Study Assumption Years

Base Year: 2025

Historical Years: 2020-2025

Forecast Period: 2026-2034

Latin America Fintech Market Key Takeaways

The market size reached USD 15.2 Billion in 2025.

The market is forecasted to exhibit a CAGR of 15.11% during 2026-2034.

The market is expected to grow to USD 54.0 Billion by 2034.

The number of fintech startups in Latin America and the Caribbean surged over 340% from 703 companies in 2017 to 3,069 companies in 2023.

Rapid growth is driven by expanding digital banking, embedded finance, and supportive open banking regulations.

The region has witnessed increasing adoption of cryptocurrency and blockchain-based solutions.

Neo-banks and digital wallets have gained strong traction, especially among unbanked and underbanked populations.

Market Growth Factors

The Latin America fintech market is growing rapidly due to the expansion of digital banking and embedded finance. Increased smartphone penetration, financial inclusion initiatives, and demand for seamless digital financial services have heightened digital banking adoption. Brazil's central bank reported an increase in digital banks' return on equity (ROE) from 11.45% in December 2023 to 19.1% in June 2024, outpacing the broader banking sector. Digital banks such as C6 Bank, Banco Inter, and Nubank demonstrate improved profitability due to lower provisioning costs and operating leverage. Embedded finance integration into platforms like e-commerce and ride-hailing apps further drives growth.

Cryptocurrency and blockchain-based financial services are gaining momentum in Latin America amid economic challenges like inflation and currency devaluation. Countries including Brazil, Argentina, and Mexico have seen increased crypto transactions for remittances, payments, and savings. Stablecoins make up nearly 90% of crypto flows, primarily used for international transfers, according to Brazil's central bank. Initiatives like Brazil's Drex aim to enhance credit with collateralized assets, while efforts to integrate national instant payment systems with global networks are underway, supporting cross-border fintech innovation.

The surge of neo-banks and digital wallet adoption has revolutionized finance in the region. Neo-banks provide mobile-first, user-friendly solutions targeting younger and previously unbanked populations, offering fast onboarding and transparent pricing. Digital wallets have transformed transaction methods, with mobile payments and QR-code transfers becoming common in Brazil, Mexico, and Colombia. The COVID-19 pandemic accelerated the shift toward cashless payments. Key players like Nubank, Mercado Pago, and Ualá have rapidly expanded user bases, prompting traditional banks to modernize and collaborate with fintech firms. Regulatory support and strong smartphone adoption underpin sustained market momentum.

Request Customization: https://www.imarcgroup.com/request?type=report&id=28771&flag=E

Market Segmentation

Deployment Insights

On-premises

Cloud Based

Segments are analyzed based on deployment method, distinguishing between on-premises and cloud-based solutions, reflecting differing infrastructure and operational preferences within the fintech industry.

Technology Insights

Application Programming Interface

Artificial Intelligence

Blockchain

Robotic Process Automation

Data Analytics

Others

The market categorizes technologies including APIs enabling integration, AI for automation and intelligence, blockchain for secure transactions, robotic process automation, and data analytics driving informed decisions.

Application Insights

Payment and Fund Transfer

Loans

Insurance and Personal Finance

Wealth Management

Others

Applications encompass key fintech services such as payments, lending, insurance, personal finance management, wealth advisory, and other emerging financial solutions.

End User Insights

Banking

Insurance

Security

Others

End users include banking institutions, insurance companies, security firms, and other sectors employing fintech solutions.

Regional Insights

Brazil

Mexico

Argentina

Colombia

Chile

Peru

Others

The report covers all major Latin American regional markets, highlighting localized trends and market dynamics across these countries.

Regional Insights

Brazil is the dominant region in the Latin America fintech market. The country shows robust digital banking profitability, with digital banks increasing their return on equity (ROE) from 11.45% in December 2023 to 19.1% in June 2024, surpassing other banking sectors. Brazil leads innovation initiatives such as Drex and Pix integration with global networks. This positions Brazil as a strategic leader in fintech expansion across Latin America.

Recent Developments & News

In July 2025, Thredd partnered with Puerto Rico-based Payblr to aid fintech expansion in Latin America and the Caribbean by combining modular payments technology with cross-border issuing expertise.

In April 2025, Nu Holdings, parent company of Nubank, expanded its presence in Mexico, Brazil, and other markets, advancing accessible tech-driven banking.

In March 2025, Prometeo launched its Borderless Banking platform integrating US and Latin American banking systems to enhance cross-border financial transactions.

In February 2025, Brazilian fintech Juca expanded to over 3,000 points of sale, facilitating FGTS Advance loans with a fully integrable API.

In December 2024, Fiserv, Inc. introduced Clover in Brazil, launching the nation's first multi-acquirer ecosystem providing comprehensive payment solutions for businesses.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=28771&flag=C

Key Players

C6 Bank

Banco Inter

Nubank

Mercado Pago

Ualá

Thredd

Payblr

Nu Holdings

Prometeo

Juca

Fiserv, Inc.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Latin America Fintech Market Hits USD 15.2 Billion in New 2026 Report here

News-ID: 4315016 • Views: …

More Releases from IMARC Group

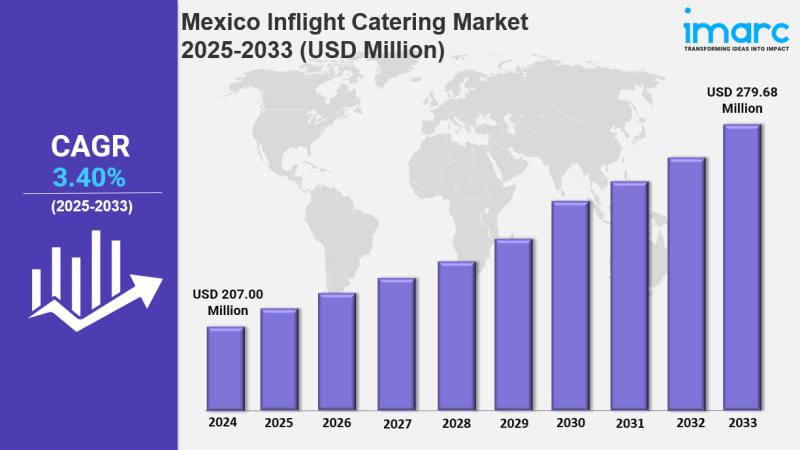

Mexico Inflight Catering Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Inflight Catering Market Size, Share, Trends and Forecast by Food Type, Flight Service Type, Aircraft Seating Class, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico inflight catering market size reached USD 207.00 Million in 2024. The market is…

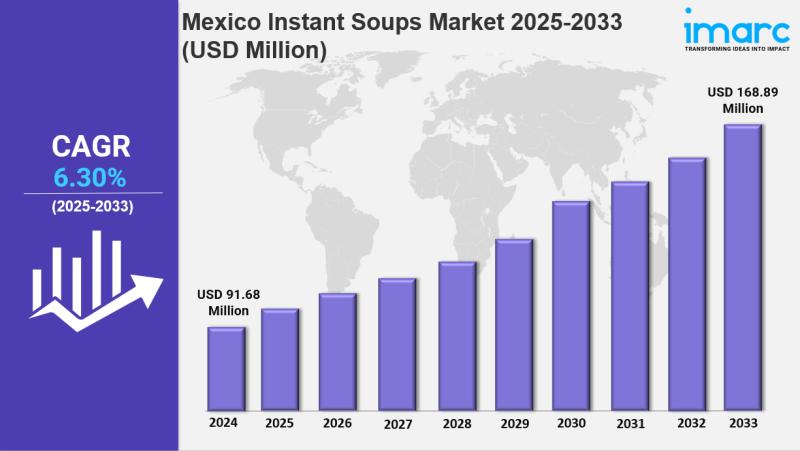

Mexico Instant Soups Market Size, Share, Latest Insights and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Instant Soups Market Size, Share, Trends and Forecast by Nature, Form, Source, Distribution Channel, End Use, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico instant soups market size reached USD 91.68 Million in 2024 and is projected to…

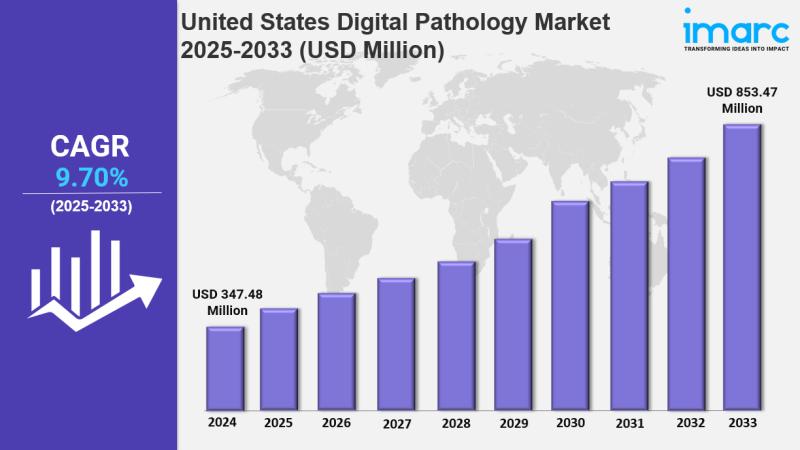

United States Digital Pathology Market : Trends, Drivers, and Growth Opportuniti …

IMARC Group has recently released a new research study titled "United States Digital Pathology Market Size, Share, Trends and Forecast by Product, Type, Delivery Model, Application, End User, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States digital pathology market size was valued at USD 347.48 Million in 2024…

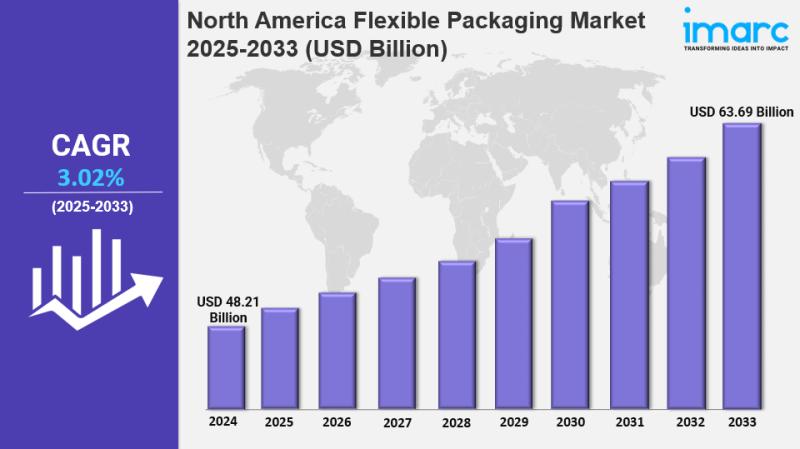

North America Flexible Packaging Market Share, Size, In-Depth Insights, Trends a …

IMARC Group has recently released a new research study titled "North America Flexible Packaging Market Size, Share, Trends and Forecast by Product Type, Raw Material, Printing Technology, Application, and Country, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The North America flexible packaging market was valued at USD 48.21 Billion in 2024 and is…

More Releases for Latin

Latin America Smart Packaging Market

The research report "Latin America Smart Packaging Market: By Technology Type ((Modified Atmosphere Packaging (MAP), Active Packaging, Intelligent Packaging (IP)), End User Type (Food & Beverages, Personal Care, Healthcare, Automotive), and Geography- Global/Region/Country Forecast to 2028. Latin America smart packaging market is anticipated to grow at a CAGR rate of x% during the forthcoming years 2022-2028.

View the detailed report description here - https://precisionbusinessinsights.com/market-reports/latin-america-smart-packaging-market/

Changes in lifestyle patterns foster the…

Latin America Energy Drinks Market

El nuevo estudio de Informes de Expertos titulado 'Mercado Latinoamericano de Bebidas Energizantes, Informe y Pronostico 2022-2027′, presenta una evaluacion exhaustiva del mercado, analizandolo segun el tipo de producto, canal de distribucion y las regiones importantes. La investigacion rastrea las tendencias mas recientes en el mercado y examina sus efectos sobre los principales factores de exito y restricciones. Ademas, evalua la dinamica del mercado y realiza analisis FODA y Cinco…

Latin America Electroceuticals Market

Latin America registers the significant growth of the electroceutical market during the forecast period especially in the countries including Brazil, Mexico among others, attributing to various driving factors. The growing prevalence of ischemic heart disease, age-related and other hearing loss, and epilepsy is creating demand for electroceuticals, thereby, anticipated to drive the growth of electroceuticals market in Latin America. As per the Institute for Health Metrics and Evaluation, in…

A Game Changer for Latin America? Shale Experts Analyse the Future of Unconventi …

Shale experts recently gathered in Buenos Aires to examine the potential impact of shale oil and gas resources in the Latin America region and globally. The CWC Summit was hosted in partnership with YPF and Y-TEC, and delegations in attendance included Chevron, Shell, Total, Schlumberger, Emerson and Halliburton, amongst others.

The welcoming address was delivered by Gonzalo Lopez Nardone, head of institutional relations for YPF and the opening address was given…

Successful launch for DISTREE Latin America

SAO PAULO, PARIS, LONDON, DUBAI, and MOSCOW – The inaugural DISTREE Latin America took place earlier this month at the Sofitel Jequitimar Hotel in Sao Paulo State, Brazil. More than 300 delegates attended DISTREE Latin America 2011, including representatives from approximately 50 vendors looking to launch, build or manage channels within the region.

“It is always an exciting moment to launch a new DISTREE event in a dynamic market such…

Latin America Oil & Gas Potential

Produced by The CWC Group, Latin American Oil and Gas Conference takes place on 25 – 27 October 2011, Mandarin Oriental Hotel, Miami, U.S.A. Organisers confirmed that the strategic conference will feature advanced insights from important organisations in the region alongside NOC’s showcases from Brazil, Mexico, Colombia, Trinidad & Tobago, Venezuela, Uruguay and Bolivia. Content centres on the development of the Latin America’s resources, the impact of shale…