Press release

State Level Tax Trends: Expats Should Know in 2025

IntroductionState-level taxes continue to evolve, and for US citizens living abroad, these trends can have significant implications. Even as many expats earn income overseas, they may still have obligations to their state of residence. Understanding current state-level tax trends helps expats remain compliant, optimize deductions, and avoid surprises when filing federal and state taxes.

Why State-Level Tax Trends Matter for Expats

Although the federal government sets overall tax rules, each state has its own system, which can include:

* Income taxes - some states tax worldwide income, others do not.

* Property taxes - applicable even if you live abroad, depending on ownership.

* Sales taxes and other assessments - may affect business and investment activity.

Key trends that impact expats include increasing state tax rates, new reporting requirements, and innovative credits or deductions for residents living overseas.

Current State-Level Tax Trends

* Rising state income taxes: Many high-tax states are adjusting rates to fund public services, affecting expats who maintain state residency.

* New remote work tax policies: States are implementing "convenience of the employer" rules and nexus laws, which can affect income sourced to that state.

* Property tax adjustments: States are reassessing property taxes, including on foreign-held assets or investments.

* Enhanced tax credits and incentives: Some states offer credits for taxes paid abroad or for business operations conducted internationally.

Strategies for US Expats

* Track state residency rules carefully: Establishing non-residency where allowed can reduce liability.

* Claim available credits: Foreign tax credits and state-specific credits can offset some exposure.

* Monitor legislation changes: Keep up with evolving tax laws in your state to avoid unexpected obligations.

* Partner with expat tax professionals: Specialized advisors can ensure compliance and optimize deductions.

Common Mistakes to Avoid

* Assuming no state tax applies while living abroad.

* Missing changes in remote work or nexus laws.

* Failing to document state taxes or foreign income properly.

* Overlooking opportunities to claim credits or deductions.

Resources for US Expats

* IRS International Taxpayers: https://www.irs.gov/individuals/international-taxpayers [https://www.irs.gov/individuals/international-taxpayers]

* State tax websites for residency and filing rules

* Expat Tax Online:for expert guidance

FAQs

Q1: Do state taxes apply if I live abroad full-time?

A: It depends on your state of residency. Some states tax worldwide income regardless of location, while others allow non-residency status.

Q2: How can I reduce state tax liability as an expat?

A: Consider establishing non-residency where allowed, claiming foreign tax credits, and consulting with a tax advisor.

Q3: Are remote work rules affecting expats?

A: Yes. Some states tax income based on where the work is performed, even for remote employees abroad.

Q4: Can I claim property tax deductions while living overseas?

A: Possibly, depending on the state and whether the property generates income. Proper documentation is required.

Conclusion

State-level tax trends are evolving rapidly and can directly impact US expats. By staying informed, monitoring state legislation, and leveraging professional guidance, expats can remain compliant and optimize their tax situation.

Stay ahead of state-level tax changes. Visit ExpatTaxOnline [https://www.expattaxonline.com/] to download our free Expat Tax Country Guides for 2026 or schedule a consultation with our experts for personalized advice.

Media Contact

Company Name: Expat US Tax

Contact Person: Clark Stott

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=state-level-tax-trends-expats-should-know-in-2025]

City: North Sydney

State: NSW 2060

Country: Australia

Website: https://www.expatustax.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release State Level Tax Trends: Expats Should Know in 2025 here

News-ID: 4313747 • Views: …

More Releases from ABNewswire

Newman's Brew Proves Smooth, Flavorful Coffee Begins with Ethical Sourcing and P …

Newman's Brew has built its reputation on delivering the smoothest coffee available by combining organic bean sourcing with fresh-per-order roasting. The rapidly expanding company demonstrates that ethical business practices and exceptional product quality are not mutually exclusive, while supporting abandoned animal feeding programs as part of its commitment to positive social impact.

In an industry where freshness is often sacrificed for operational convenience, Newman's Brew has chosen a different path. The…

Playground Play Equipment Innovation Sets New Benchmark for Safe, Engaging Space …

As schools, communities, and commercial venues worldwide continue to invest in healthier and more inclusive outdoor environments, playground play equipment [https://www.indooroutdoorplayground.com/what-makes-playground-play-equipment-truly-safe-and-engaging/] is entering a new era-one defined by higher safety standards, smarter design, and broader community engagement. Golden Times (Wenzhou Golden Times Amusement Toys CO., LTD.) today announced an expanded product and market strategy focused on delivering next-generation playground solutions that balance safety, durability, and creativity.

Industry expectations for playgrounds have…

Time.so Reports 300% Growth in Business Users

Time.so reports 300% growth in business users as global teams rely on its fast world clock, city times, time zones, and weather for planning.

Jan 31, 2026 - Time.so today announced a 300% increase in business users, reflecting rising demand for dependable time data across distributed teams, global customer support, and cross border operations.

The surge follows a clear shift in how companies schedule work. Meetings span continents. Deadlines move with daylight…

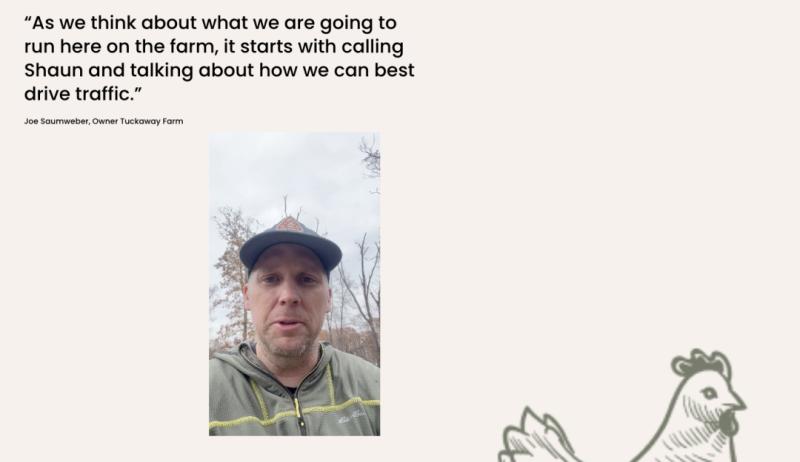

Shaun Savvy Helps Tuckaway Farm in Bentonville, Arkansas Sell Out Two CSA Season …

Buffalo-based SEO consultant Shaun Savvy partnered with Tuckaway Farm in Bentonville, Arkansas to help the farm sell out two consecutive CSA seasons, generating over $80,000 in revenue while spending less than $1,000 on paid advertising through a strategic blend of local SEO, high-intent content, and targeted social media campaigns.

Shaun Savvy, a Buffalo-based SEO and digital marketing consultant, announced a successful local marketing case study showcasing how Tuckaway Farm sold out…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…