Press release

Inside the USD 1.3 Billion Bio Lactase Boom: Trends, Technologies, and High-Growth Asian Markets

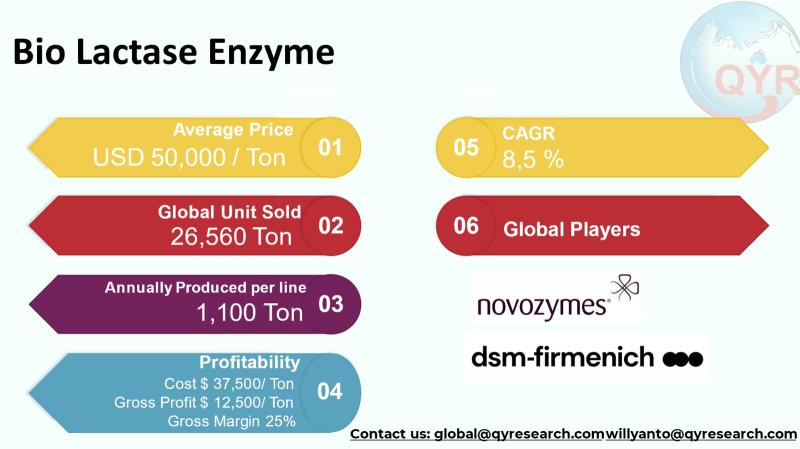

The bio lactase enzyme industry converts biological fermentation and downstream processing into functional enzymes used to break down lactose and to formulate lactose-reduced and lactose-free products across food, infant nutrition, pharmaceutical and supplement markets. This report synthesizes the current market picture, regional dynamics in Asia and Southeast Asia, technology and competitive developments, and practical investor insights for stakeholders seeking exposure to the lactase value chain.The global bio lactase enzyme market in 2024 is USD 1,328 million with an expected compound annual growth rate of 8.5% through 2031, reaching market size USD 2,345 million by 2031. With an average selling price at USD 50,000 per ton, the market volume equates to about 26,560 tons sold globally in 2024. The factory gross margin is 25%, implying a cost of goods sold is USD 37,500 per ton and an average factory gross profit roughly USD 12,500 per ton. The COGS breakdown is raw materials, fermentation utilities, downstream processing, labor and quality control, packaging and formulation, maintenance and depreciation of equipment, logistic and overhead. A single line full machine capacity production is around 1,100 ton per line per year, Downstream demand is concentrated in dairy processing followed by infant formula, dietary supplements and food ingredients.

Latest Trends and Technological Developments

The industry continues to show two linked trends: consolidation among major enzyme producers and incremental enzyme performance improvements that shorten processing time or increase thermostability. In December 2023, several strategic moves reshaped the competitive landscape when key lactase portfolios and business units moved between global players; regulatory reviews and subsequent clearances were part of that consolidation story. Product innovation examples include DSM-Firmenichs launch of a higher-performance lactase product (Maxilact®Next) marketed for faster hydrolysis and higher purity (June 2023), and other firms continuing to introduce formulations optimized for cold-processing or for application in liquid infant formulas and ice cream. Recent market reports and industry news also document increased commercial activity in biosensor and in-line monitoring (to improve dosing accuracy) and a growing focus on non-GMO strain portfolios for certain label segments. These competitive and technical developments have been documented in industry press and market research summaries.

Nestlé S.A. purchases a proprietary fungal-derived bio lactase enzyme, optimized for low-temperature hydrolysis, from Chr. Hansen Holding A/S for use in its lactose-free milk line. The contract involves the supply of 5 metric tons of purified enzyme concentrate annually at a price of USD 2,800 per kilogram, amounting to a total annual procurement value of approximately USD 14 million. This premium cost reflects the enzyme's high purity, specific activity, and stability in continuous processing.

The dairy cooperative Arla Foods utilizes this bio lactase enzyme in its massive lactose-free dairy production facility in Esbjerg, Denmark. The enzyme is immobilized on a carrier within fixed-bed reactors, where it continuously hydrolyzes lactose in millions of liters of skimmed milk. For a specific plant expansion project, Arla invested USD 3.2 million in the immobilized enzyme system, which included an initial charge of 1.2 metric tons of the lactase enzyme (valued at USD 3.36 million), integrated into the new processing line to increase production capacity by 40%. This capital expenditure enabled Arla to meet rising demand for lactose-free products efficiently and with consistent product quality.

Asia is the fastest growing regional market for bio lactase enzymes driven by rising dairy consumption, growth of retail cold-chain infrastructure, expanding infant nutrition markets in China, India and Southeast Asia, and greater awareness and diagnosis of lactose intolerance. Demand in China and India is driven both by large dairy processors converting existing lines to lactose-reduced products and by a growing retail segment of lactose-free milk and yogurt. Local contract manufacturers and regional enzyme formulators are expanding distribution partnerships with multinational enzyme suppliers while several domestic enzyme firms in India and China are increasing capacity for bulk enzyme formulations targeted at regional dairy co-ops and infant nutrition manufacturers. Pricing sensitivity is more pronounced in many Asian markets compared with Europe and North America, so blended commercial strategies (bulk standard grades vs. premium tailored grades) are common among suppliers. Recent regional market reports highlight Asia-Pacifics rising share in global lactase demand and dedicated country sections for China, India, South Korea and Southeast Asian nations.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5537419

Bio Lactase Enzyme by Type:

Liquid Bio Lactase

Powder Bio Lactase

Capsule and Tablets

Bio Lactase Enzyme by Product Category:

Fungal Lactase

Yeast Lactase

Recombinant Lactaces

Others

Bio Lactase Enzyme by Market Segment:

Cold Active Lactases

Thermostable Lectases

Shelf Stable Lacatases

Bio Lactase Enzyme by Features:

High Activity Lactase

Fast Acting

Heat Stable Enzyme

Microencapsulated Stability Enhanced Lactase

Others

Bio Lactase Enzyme by Shape:

Powdered Enzyme

Liquid Enzyme Concentrate

Chewable Form

Capsule Form

Others

Bio Lactase Enzyme by Application:

Dairy Processing

Infant Formula and Nutrition

Dietary Supplements

Food Ingredients Manufacturers

Others

Global Top 20 Key Companies in the Bio Lactase Enzyme Market

BASF SE

Merck KGaA

DSM Firmenich AG

DuPont De Nemours

Kerry Group plc

Novozymes A/S

Oenon Holdings Inc

Amano Enzyme Inc

Advanced Enzyme Technologies Ltd

Nature BioScience Pvt Ltd

SternEnzym GmbH & Co KG

Biopharma

Rajvi Enterprise

Calze Clemente S.r.l.

Antozyme Biotech Pvt Ltd

Biolaxi Corporation

Kono Chem

Aumgene Biosciences

Fengchen Group

Meihua BioTech

Regional Insights

Within ASEAN the market shows strong heterogeneity. Indonesia, as one of the regions largest dairy consumption markets after Thailand and the Philippines, features rapidly growing retail demand for UHT lactose-reduced milks, a rising infant formula market, and an expanding supplements channel. Manufacturers in Indonesia typically source bulk lactase either from regional distributors or through local enzyme formulators; localizing value-added services (technical support for dosing and shelf-life) is a differentiator for suppliers. Southeast Asian growth is also supported by expanding cold-chain retail and by food-service adoption for lactose-reduced ingredients (ice cream and dairy-based desserts). Regulatory alignment within ASEAN on enzyme labeling and food additive status remains gradual, so market entrants prepare for country-by-country compliance. Several market intelligence reports show Southeast Asia as a prioritized growth region for major enzyme players and increasingly targeted by both multinational and regional suppliers.

The industry faces a handful of structural and operational challenges. First, the market is concentrated among a few large enzyme conglomerates and specialty enzyme businesses; consolidation can raise barriers to entry and place pressure on mid-sized suppliers. Second, raw material and energy cost volatility affects fermentation economics and pushes margins during periods of higher feedstock prices. Third, regulatory scrutiny especially for genetically modified production strains or novel processing aids requires sustained compliance and documentation, which increases fixed costs. Fourth, pricing pressure in cost-sensitive Asian and emerging markets limits premiumization unless suppliers can demonstrate clear performance or label benefits. Finally, supply chain logistics (cold chain, traceability) and the need for technical support at customer sites are operational constraints that new entrants must plan for. These challenges are emphasized in recent market analyses and regulatory notices.

Producers should balance capacity investments with flexible contract manufacturing options; mid-sized firms can compete by specializing in tailor-made formulations, technical service, and shorter lead times. Buyers (dairy processors, infant formula makers) should consider multi-supplier sourcing to mitigate concentration risk and negotiate performance-based supply agreements (e.g., enzyme activity per USD) rather than strictly price-per-ton contracts. Given the importance of time-to-hydrolysis and thermostability in processing economics, product differentiation that demonstrably reduces plant processing time or increases finished product quality commands a premium in many markets. Strategic M&A and licensing deals will likely continue as larger players rationalize portfolios and regionally focused suppliers seek scale. Market research and company filings point to continued strategic activity in portfolio reshuffling and technology licensing.

Product Models

Bio lactase enzymes are widely used across food, nutraceutical, and digestive-health industries to break down lactose into simpler sugars, enabling lactose-intolerant individuals to digest dairy more easily.

Liquid Bio Lactase is commonly used in dairy manufacturing due to its ease of dosing and rapid mixing capabilities. Notable products include:

Maxilact® LGi DSM/Firmenich: High-purity liquid lactase used for low-lactose milk production.

Lactozyme® Pure L Novozymes: Liquid enzyme optimized for dairy beverage lactose reduction.

Saphera® Lactase Chr. Hansen: Designed for consistent hydrolysis in milk and yogurt processing.

Enzeco® Lactase L Enzyme Development Corporation: Food-grade liquid lactase for dairy applications.

Lactase Liquid F Jiangsu Boli Bioproducts: Industrial-grade enzyme suitable for milk and whey.

Powder Bio Lactase is preferred for dry formulations, industrial blending, and stable storage. Notable products include:

Lactase Powder 100,000 U Specialty Enzymes & Biotechnologies: High-activity dry lactase for formulations.

Lactase Enzyme Powder Biocon India: Fine powder enzyme for nutritional blends and supplements.

Enzeco® Lactase Powder Enzyme Development Corporation: Stable powder for dry dairy mixes.

Lactase HP Powder Novozymes: High-potency powder for industrial lactose reduction.

PureLactase Powder Advanced Enzyme Technologies: Ultra-refined powder for nutraceutical formulations.

Capsule and Tablet Bio Lactase are finished oral supplements for individuals with lactose intolerance. Notable products include:

LactoJoy® 14,500 FCC LactoJoy GmbH: High-strength lactase tablet for severe intolerance.

NOW® Lactase Enzyme NOW Foods: Capsule enzyme for general digestive support.

Enzymedica® Dairy Assist Enzymedica: Dual-action lactase capsule with probiotics.

GNC® Lactase Enzyme GNC: Capsule supplement offering lactase digestive aid.

Nutrilite® Lactase Amway: Tablet formulated for enhanced dairy tolerance.

The global bio lactase enzyme market in 2024 is sizable and growing, with Asia and Southeast Asia representing high-growth regional opportunities due to changing diets, infant nutrition demand and rising lactose-intolerance awareness. Industry structure favors well-capitalized, technology-intensive firms but leaves room for regional specialists that offer technical service, faster lead times and locally adapted formulations. Investors and industry participants should watch consolidation activity, capacity expansions, and product innovations that improve processing efficiency as primary value drivers over the next five to seven years.

Investor Analysis

This report highlights three investor-relevant pillars. What to watch: market scale and its projected 8.5% CAGR to 2031, unit demand and the concentration of supply among a few major players. How to act: consider targeted exposure via companies expanding capacity in Asia, firms with proprietary high-performance lactase formulations and service-oriented regional suppliers that can win share in ASEAN. Why it matters: enzyme businesses with reliable fermentation scale, validated regulatory dossiers and proven product performance can convert top-line growth into durable margins; given the estimated factory gross margin around 25%, incremental improvements in yield, strain efficiency or process inputs translate directly to investor returns. The combination of steady end-market growth (dairy reformulation, infant formula, supplements) and relatively high per-ton pricing creates an attractive risk/reward profile for investors who understand supply-chain and regulatory exposures.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5537419

5 Reasons to Buy This Report

Comprehensive market sizing and unit-volume perspective, so buyers can translate revenue forecasts into manufacturing and logistics requirements.

Asia & ASEAN focus with country-level insights that identify high-growth demand pockets and procurement patterns.

Technology and product innovation tracking (faster hydrolysis, thermostable formulations, biosensor dosing) to support product R&D and sourcing decisions.

Competitive landscape and consolidation coverage (top players, recent portfolio moves) that informs M&A and partnership strategies.

Practical financial and operational KPIs (price/ton, COGS %, factory gross margin, representative per-line capacity ranges) useful for valuation, TEA and capex planning.

5 Key Questions Answered

What is the 2024 market size and projected CAGR to 2031 for bio lactase enzymes?

How many metric tons of lactase were sold globally in 2024 at an average price point?

What are typical COGS, factory gross profit per ton, and representative production capacity per line?

What are the primary demand segments (dairy processing, infant formula, supplements) and their relative commercial importance?

Who are the markets top 10 players and what recent strategic/portfolio moves should investors be aware of?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Bio Lactase Enzyme Market Research Report 2025

https://www.qyresearch.com/reports/5537419/bio-lactase-enzyme

Global Bio Lactase Enzyme Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5537412/bio-lactase-enzyme

Bio Lactase Enzyme - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5537420/bio-lactase-enzyme

Global Bio Lactase Enzyme Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5537421/bio-lactase-enzyme

Global Lactase Enzyme Market Research Report 2025

https://www.qyresearch.com/reports/4192330/lactase-enzyme

Global Bio Enzymes Market Research Report 2025

https://www.qyresearch.com/reports/3953383/bio-enzymes

Global Bio-deinking Enzyme Market Research Report 2025

https://www.qyresearch.com/reports/4501220/bio-deinking-enzyme

Global Bio-Enzyme Fertilizer Market Research Report 2025

https://www.qyresearch.com/reports/3800659/bio-enzyme-fertilizer

Global Compound Bio-Enzyme Products Market Research Report 2025

https://www.qyresearch.com/reports/4514447/compound-bio-enzyme-products

Global Bio-neutral Polishing Enzyme Market Research Report 2025

https://www.qyresearch.com/reports/3492837/bio-neutral-polishing-enzyme

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Inside the USD 1.3 Billion Bio Lactase Boom: Trends, Technologies, and High-Growth Asian Markets here

News-ID: 4310245 • Views: …

More Releases from QY Research

Top 30 Indonesian Sugar Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Aman Agrindo Tbk sugarcane & sugar products (IDX:GULA)

PT Sugar Group Companies largest private sugar producer (not publicly listed)

PT Prima Alam Gemilang (PAG) major sugar mill operator (private)

PT Sinergi Gula Nusantara sugar mill operator (private)

PT Indofood Sukses Makmur Tbk (IDX:INDF) major food company using sugar inputs

PT Mayora Indah Tbk (IDX:MYOR) food & beverage…

Smart Factories, Smart Sensors: Investment Opportunities in Pressure Monitoring …

Pressure level sensors are electro-mechanical or MEMS-based devices that measure liquid or gas pressure and convert it into electrical signals for level monitoring, process control, and safety automation.

Widely deployed across industrial automation, water management, automotive systems, oil & gas, HVAC, chemical processing, and medical devices.

Growing demand for real-time monitoring, smart factories, and predictive maintenance is accelerating sensor integration in both legacy and new equipment.

Miniaturization, digital connectivity, and ruggedization enable deployment…

Inside the USD 14.5B Cookie Dough Boom: Asia & ASEAN Drive the Next Growth Wave

Cookie dough refers to ready-to-bake, ready-to-eat (heat-treated flour), frozen, chilled, or shelf-stable dough products used by households, foodservice, bakeries, cafés, QSR chains, and industrial bakery processors.

The industry sits at the intersection of frozen desserts, bakery ingredients, and convenience foods, driven by home baking trends, quick-service restaurants, and private label retail expansion.

Growth is supported by:

rising demand for convenience snacks

growth of frozen retail chains

increasing foodservice pre-mix adoption

premium flavors and indulgence culture

Asia &…

Inside the USD 440M Ceramic RF Filter Industry: ASEAN Expansion & IoT Demand

Inside the USD 440M Ceramic RF Filter Industry: ASEAN Expansion & IoT Demand

Ceramic band pass filters are compact radio-frequency (RF) components that allow a defined frequency band to pass while attenuating signals outside the range, enabling stable signal integrity in wireless, automotive, IoT, and industrial communication systems.

Built using piezoelectric ceramic resonators, they offer low insertion loss, small footprint, high selectivity, and strong thermal stability, making them widely adopted in smartphones,…

More Releases for Lactase

Lactase Market Leaders, Region, Product & Application

Persistence Market Research (PMR) has published a research report titled "Lactase Market: Global Industry Analysis 2012-2016 and Forecast 2017-2025." The report states that the global market for lactase is expected to be impacted by the growing application of lactase enzyme and its various benefits. The increasing awareness among people is further expected to bode well for the growth of the market in the coming years. According to PMR, the global…

Lactase Market Overview by Advance Technology, Future Outlook 2028

Lactase Market size was valued at USD 240.6 Million in 2020 and is projected to reach USD 482.1 Million by 2028, growing at a CAGR of 6.60% from 2021 to 2028.

Lactase, also known as lactase-phlorizin hydrolase, is an enzyme naturally found in yeast, fungi and the small intestines of mammals, which hydrolyzes beta(β)-galactosides into simple sugar glucose and galactose. Its deficiency in the gut can lead to the development of…

Lactase Market | Smart Technologies Are Changing in Industry

Fairfield Market Research has conducted an exhaustive and fact-driven study on the Lactase market taking demand and supply, profitability, growth potential, and all other critical aspects into careful consideration. Our report can be considered the definitive source of relevant data points that enable you to make important decisions with far-reaching implications.

Our research analysts come with years of experience in diverse industries and deploy our proprietary, in-house methodology to verify primary…

Lactase Market Size, Share, Development by 2025

LP INFORMATION recently released a research report on the Lactase market analysis, which studies the Lactase's industry coverage, current market competitive status, and market outlook and forecast by 2025.

Global “Lactase Market 2020-2025” Research Report categorizes the global Lactase market by key players, product type, applications and regions,etc. The report also covers the latest industry data, key players analysis, market share, growth rate, opportunities and trends,…

Lactase Enzyme Market Forecast by 2025: QY Research

In the recently published report, QY Research has provided a unique insight into the global Lactase Enzyme market for the forecasted period of 7-years (2018-2025). The report has covered the significant aspects that are contributing the growth of the global Lactase Enzyme market. The primary objective of this report is to highlight the various key market dynamics such as drivers, trends, and restraints that are impacting the global Lactase Enzyme…

Lactase Enzyme Market - Lactase Enzyme Remains on the Crest of Demand Graph as …

Established Lactase Enzyme Manufacturers Eye Latent Opportunities in Emerging Markets

Well-established manufacturers of lactase enzymes, with their occupancy largely concentrated in Europe, are eyeing consolidation in emerging markets to strengthen their global market foothold. These manufacturers are now targeting untapped opportunities in the developing nations. Leading players such as Koninklijke DSM N.V. are witnessing significant business expansion related to dietary supplements, which is a key application area of lactase enzyme, in…