Press release

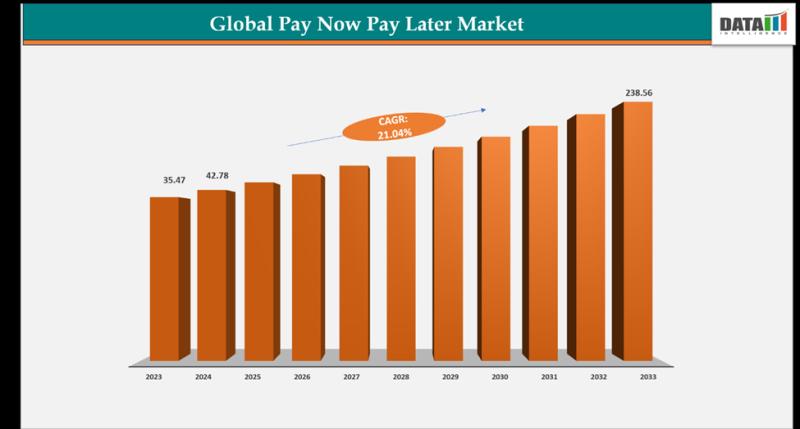

Global Buy Now Pay Later Market is growing at a CAGR of 21.04%, North America led 35% of global market share | key Players:- Affirm, Inc., Klarna Inc., Splitit USA Inc., Sezzle, Perpay Inc.

The global buy now pay later market reached US$ 35.47 billion in 2023, with a rise to US$ 42.78 billion in 2024, and is expected to reach US$ 238.56 billion by 2033, growing at a CAGR of 21.04% during the forecast period 2025-2033. The global buy now pay later market is witnessing robust growth, driven by rising consumer demand for flexible payment options, rapid digitalization of commerce, and increasing adoption among younger demographics. The shift toward e-commerce, coupled with growing smartphone penetration and strong fintech innovation, is fueling the widespread use of BNPL solutions across retail, travel, healthcare, and other sectors.Download your exclusive sample report today: (corporate email gets priority access):https://www.datamintelligence.com/download-sample/buy-now-pay-later-market?pratik

Key Industry Development-

✅ June 2025: Klarna launched a pilot debit card (with Visa and WebBank) that enables users to make instant payments or interest-free installments usable both online and in-store across the U.S.

✅ March 2025: DoorDash added Klarna's BNPL option to its platform, allowing food delivery customers to split payments into four interest-free installments or defer payment expanding BNPL use into everyday spending beyond retail.

✅ January 2025: Affirm expanded its financing capacity via a new partnership with Liberty Mutual Investments, securing up to US$ 750 million to support increased BNPL lending and consumer credit activities.

✅ March 2025: Smartpay partnered with Chubb Insurance Japan to introduce embedded insurance services for BNPL platforms the first of its kind in Japan aiming to provide added financial protection alongside installment payments. Insurance Business

✅ March 2025: Smartpay partnered with Chubb Insurance Japan to introduce embedded insurance services for BNPL platforms the first of its kind in Japan aiming to provide added financial protection alongside installment payments.

✅ November 2025: A market report updated for Q3 2025 estimates that the Japanese BNPL market will grow to roughly US$ 20.11 billion in 2025, reflecting strong uptake among younger consumers and expansion of BNPL across e-commerce platforms.

✅ 2025 (general): Domestic BNPL providers such as Paidy continue to dominate, offering zero-interest installment payments and integrating with major retailers (including major e-commerce platforms), strengthening BNPL's role in Japan's digital payment ecosystem.

Recent M&A updates:-

→ April 2025: Klarna raised a significant USD 650 million funding round, bringing its valuation to USD 45.6 billion, a strategic move to secure capital and enhance its market position rather than an M&A deal.

→ May 2025: Affirm secured key regulatory approval in the UK, allowing it to operate as a lender and offer its point-of-sale financing solutions to a broader range of merchants and consumers, a significant regulatory development aimed at market expansion.

→ May 2024: Kredivo, a major player in Southeast Asia, acquired a regional fintech platform to bolster its BNPL services in the area.

→ July 2023: Upgrade Inc., a U.S.-based fintech company, acquired Uplift for $100 million. This acquisition aimed to leverage Uplift's technology and expertise to provide more flexible financing options across various consumer segments.

Report Objectives

The Global Buy Now Pay Later market report delivers a detailed analysis with 64 key tables, more than 54 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

"Secure your 30% year-end discount - get this report before the offer expires."

:https://www.datamintelligence.com/buy-now-page?report=buy-now-pay-later-market?pratik ((Purchase 2 or more Repots and get 50% Discount)

Market Segment Analysis

→ By Channel

• Online BNPL (67%):

Largest channel, driven by e-commerce and mobile app integration.

• In-store BNPL (33%):

Growing rapidly as BNPL expands into retail terminals and physical stores.

→ By Enterprise Size

• Large enterprises (73%):

Major e-commerce and big-box retailers dominate BNPL transaction value.

• SMEs (28%):

Growing adoption through plug-and-play BNPL integrations and embedded finance tools.

→ By End User - BFSI

• BFSI segment (6%):

Small but fast-growing, focused on credit-card refinancing and short-term installment products; banks increasingly partner or white-label BNPL solutions.

Regional insights:-

• North America - 35% share The region (led by the U.S.) is a leading revenue market thanks to deep e-commerce penetration, large merchant integration (Amazon, Walmart partners), and major BNPL players scaling consumer and merchant adoption. Reports commonly place North America near the top of global share.

• Asia-Pacific - 25% share . APAC's share is driven by massive e-commerce volumes and rapid fintech adoption in China, India, Japan, Korea and Southeast Asia; some market studies identify APAC as the largest regional GMV/revenue contributor (36% in one 2024 estimate), while others report a smaller but fast-growing share.

• Europe - 23% share . Europe is a mature BNPL market (Klarna, Afterpay/PayPal presence) with high adoption in Nordics and the UK; growth continues but tightens under increasing regulatory scrutiny and affordability checks. Recent summaries place Europe around mid-20s percent of global revenue/GV.

Get Customization in the report as per your requirements:https://www.datamintelligence.com/customize/buy-now-pay-later-market?pratik

Market Drivers:-

1. Rising e-commerce penetration

Explosive growth of online shopping is the primary catalyst, as BNPL is now deeply integrated into major e-commerce platforms, boosting adoption globally.

2. Demand for flexible, interest-free payment options

Consumers-especially millennials and Gen Z-prefer short-term, transparent installment plans over traditional credit cards, increasing BNPL usage.

3. Expansion of mobile wallets & digital payments

Smartphone-driven payments and embedded checkout options make BNPL easily accessible, accelerating everyday use across retail categories.

4. Merchant push for higher conversion rates

Retailers adopt BNPL to reduce cart abandonment, increase average order values, and improve customer retention, driving merchant-side uptake.

5. Financial inclusion & credit accessibility

BNPL provides credit to consumers with limited credit history or low card penetration, enabling broader access to small-ticket financing.

Competitive Landscape

→ The major players in the buy now pay later include Affirm, Inc., Klarna Inc., Splitit USA Inc., Sezzle, Perpay Inc., Zip Co, Ltd, Afterpay, Openpay, PayPal Holdings, Inc., LatitudePay Financial Services.

→ Affirm, Inc.: Affirm, Inc. is a leading provider in the buy now pay later market, specializing in transparent and flexible consumer financing solutions. The company's flagship offering allows customers to split purchases into simple, interest-free or low-interest installments, enhancing affordability and convenience across online and offline retail. Affirm partners with major e-commerce platforms, travel providers, and lifestyle brands to deliver seamless checkout experiences while empowering consumers with clear repayment terms and no hidden fees, thereby reducing financial stress and driving higher merchant conversion rates.

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?pratik

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About DataM Intelligence

DataM Intelligence is a renowned provider of market research, delivering deep insightsthrough pricing analysis, market share breakdowns, and competitive intelligence. Thecompany specializes in strategic reports that guide businesses in high-growth sectors suchas nutraceuticals and AI-driven health innovations.

To find out more, visit https://www.datamintelligence.com/ or follow us on Twitter,LinkedIn and Facebook.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Buy Now Pay Later Market is growing at a CAGR of 21.04%, North America led 35% of global market share | key Players:- Affirm, Inc., Klarna Inc., Splitit USA Inc., Sezzle, Perpay Inc. here

News-ID: 4310077 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

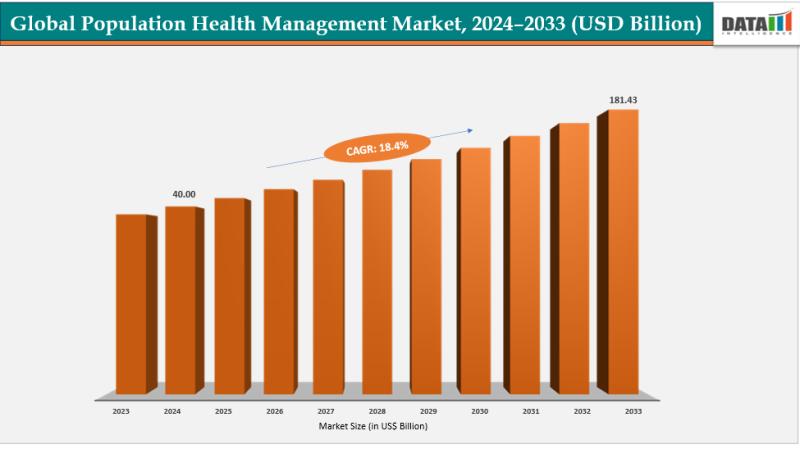

Population Health Management Market Set for Explosive Growth to USD 181.43 Billi …

The Global Population Health Management Market size reached USD 40.00 billion in 2024 and is expected to reach USD 181.43 billion by 2033, growing at a CAGR of 18.4% during the forecast period 2025-2033.

Market growth is driven by the rising prevalence of chronic diseases, increasing adoption of digital health solutions, and growing demand for value-based care models. Advancements in AI and predictive analytics, expanding healthcare IT infrastructure, surging investments in…

Organic Infant Formula Market Set to Grow to US$ 36,046 Million by 2032 at 6.3% …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Organic Infant Formula Market Size reached US$ 20,800 million in 2023, rose to US$ 22,110 million in 2024 and is projected to reach US$ 36,046 million by 2032, expanding at a CAGR of 6.3% from 2025 to 2032. The Organic Infant Formula Market is transforming early childhood nutrition by providing parents with certified organic, high-quality alternatives free from synthetic pesticides,…

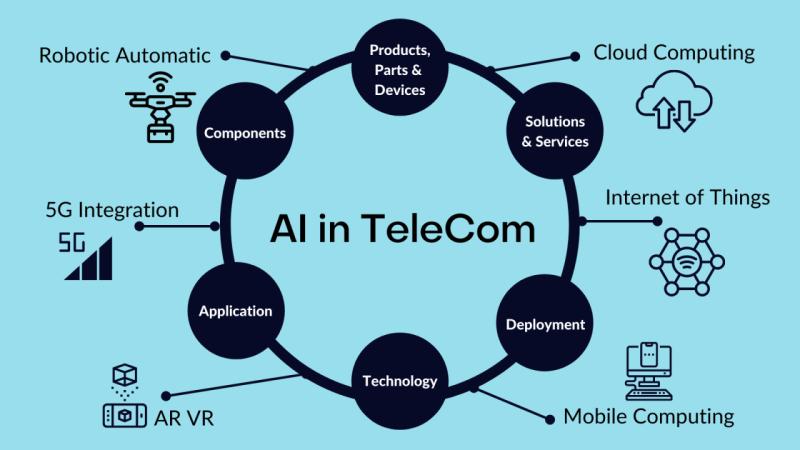

Future of Ai in telecommunication market. AI + Telecommunications Top Technologi …

The global AI in telecommunication market reached US$ 2.25 billion in 2023, with a rise to US$ 2.90 billion in 2024, and is expected to reach US$ 48.98 billion by 2033, growing at a CAGR of 36.9% during the forecast period 2025-2033.

AI in telecommunication market growth is driven by rising data traffic, demand for automated network optimization, predictive maintenance, improved customer experience, cost reduction, and rapid deployment of 5G and…

Bioresorbable Implants Market to Double, Reaching US$ 14.34 Billion by 2033 at 7 …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Bioresorbable Implants Market Size reached US$ 7.00 billion in 2024 and is projected to reach US$ 14.34 billion by 2033, expanding at a CAGR of 7.4% during the forecast period 2025-2033. The Bioresorbable Implants Market is transforming surgical outcomes by dissolving after fulfilling their role, leaving no permanent foreign body and lowering revision risks.

The shift from traditional metallic implants to…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…