Press release

Future of Fintech Market Growth by RegTech, InsurTech in 2025: Key Developments, Future Growth, Investment | Most Leading Companies - Robinhood Markets Inc, Credit Karma Inc, Social Finance Inc, Ant Financial Services Group, Circle Internet Financial Inc

Fintech Market reached USD 140.1 billion in 2022 and is expected to reach USD 610.0 billion by 2031 and is expected to grow with a CAGR of 20.3% during the forecast period 2024-2031Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/Fintech-Market?kb

United States: Recent Industry Developments

✅ November 2025: PayPal launched AI-driven fraud detection upgrades to strengthen real-time transaction security across U.S. users.

✅ October 2025: Stripe expanded its embedded finance suite, enabling U.S. retailers to integrate instant lending and insurance options.

✅ September 2025: JPMorgan Chase rolled out blockchain-based interbank settlement solutions to accelerate cross-border payments.

Japan: Recent Industry Developments

✅ November 2025: Rakuten Bank introduced biometric-based authentication for mobile banking, enhancing digital security.

✅ October 2025: Mitsubishi UFJ Financial Group expanded its digital wallet integrations with NFC-enabled micro-payments.

✅ September 2025: Japan's fintech ecosystem saw increasing adoption of AI robo-advisory platforms among millennial investors.

GCC: Recent Industry Developments

✅ November 2025: Saudi Arabia launched new open banking APIs enabling fintech startups to offer advanced financial services.

✅ October 2025: UAE fintech firms accelerated blockchain adoption for cross-border remittances and digital identity management.

✅ September 2025: Bahrain strengthened its fintech regulatory sandbox, attracting global startups focused on digital payments and InsurTech.

List of Top Key Player:

PayPal Holdings, Inc, Ant Financial Services Group, Tencent Holdings Ltd., Square, Inc, Envestnet, Inc, Stripe, Coinbase Inc, Robinhood Markets Inc, Ripple Labs Inc, Social Finance Inc, Credit Karma Inc, Circle Internet Financial Inc, Plaid Technologies Inc, Avant LLC, and Gusto.

Industry Developments:

1. Major banks expanded AI-driven fraud detection systems to enhance real-time transaction security.

2. Fintech startups accelerated adoption of blockchain for cross-border payments and settlement efficiency.

3. Digital lending platforms introduced automated credit scoring using alternative data analytics.

4. Open banking partnerships grew as financial institutions integrated third-party apps via APIs.

5. BNPL (Buy Now, Pay Later) providers launched stricter compliance frameworks amid rising regulatory scrutiny.

6. Wealth-tech firms rolled out AI-powered robo-advisors for hyper-personalized investment portfolios.

7. Neobanks expanded global footprints with mobile-first accounts targeting underserved populations.

8. Insurtech players introduced on-demand micro-insurance products linked to real-time usage data.

9. Crypto platforms enhanced custody solutions with institutional-grade security features.

10. Regtech companies launched automated compliance monitoring tools to reduce operational risk.

Forecast Projection:

The Global Fintech Market is poised for significant growth between 2025 and 2032. In 2024, the market maintained a steady upward trajectory, and with strategic initiatives by leading players accelerating adoption, the market is expected to soar throughout the forecast period. Companies leveraging these trends are well-positioned to capture emerging opportunities and maximize revenue potential.

Market Intelligence Research Process:

The Fintech Market research report by DataM Intelligence combines primary and secondary data to deliver deep, actionable insights. It examines the full spectrum of factors shaping the industry, from government regulations and market conditions to competitive dynamics, historical trends, technological breakthroughs, upcoming innovations, and potential challenges. This comprehensive analysis not only highlights growth prospects but also identifies barriers, equipping businesses to navigate market volatility and capitalize on emerging opportunities.

Buy Now & Get 30% OFF - Grab 50% OFF on 2+ reports: https://www.datamintelligence.com/buy-now-page?report=Fintech-Market?k

Key Segmentation:

By Technology: (Data Analytics, Artificial intelligence, Cybersecurity, Robotic process automation, Biometric, and Identity management, Blockchain, and Others)

By Service: (Payments, Fund Transfer, Personal Finance, Personal Loans, Insurance, Wealth Management)

By Application: (Trading, Banking, Insurance, Taxation, Others)

Global Growth Regional Analysis:

⇥ United States / North America: 35.8% share of the global fintech market in 2024.

⇥ Europe: 23.7% share of the global fintech market in 2024.

⇥ Japan: 4.20% share of the global fintech market in 2024.

⇥ South Korea: 1.91% share of the global fintech market in 2024.

Benefits of the Report:

Chapter 1 - Market Overview: Kickstarts the report with a comprehensive snapshot of the Fintech Market, summarizing key segments by region, product type, and application. Highlights include market size, segment growth potential, and short- & long-term industry outlook.

Chapter 2 - Emerging Trends: Uncovers the game-changing trends and high-impact innovations shaping the future of the industry.

Chapter 3 - Competitive Landscape: Offers a deep dive into market competition, detailing revenue shares, strategic initiatives, and recent mergers & acquisitions.

Chapter 4 - Top Player Profiles: Features detailed company profiles, covering revenue, profit margins, product lines, and major milestones for leading market players.

Chapters 5 & 6 - Regional & Country Analysis: Breaks down revenue performance across global regions, providing insights on market sizes, opportunities, and growth prospects worldwide.

Chapter 7 - Segmentation Analysis: Explores market segmentation by type, revealing high-potential categories and guiding businesses towards lucrative areas.

Chapter 8 - Application Insights: Examines downstream markets and identifies promising sectors for expansion, showing how different applications are driving growth.

Chapter 9 - Supply Chain Mapping: Maps the entire industry supply chain, highlighting upstream and downstream activities for a holistic market perspective.

Chapter 10 - Key Takeaways: Concludes with critical insights and actionable strategies, equipping stakeholders to make informed decisions and stay ahead in the market.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/Fintech-Market?b

FAQ's

Q1: What is the current size of the Fintech Market and its future potential?

A: The Fintech Market was valued at USD$ 140.1 billion in 2022 and is projected to surge to USD$ 610.0 billion by 2031

Q2: How fast is the Fintech Market expected to grow in the coming years?

A: The market is forecast to expand at a robust CAGR of 20.3% between 2025 and 2032, signaling strong global growth and investment potential.

Q3: Which regions are dominating the Fintech Market and which are fastest-growing?

A: North America dominating the Fintech market.

Request 2 Days Free Trials with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?kb

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future of Fintech Market Growth by RegTech, InsurTech in 2025: Key Developments, Future Growth, Investment | Most Leading Companies - Robinhood Markets Inc, Credit Karma Inc, Social Finance Inc, Ant Financial Services Group, Circle Internet Financial Inc here

News-ID: 4309418 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

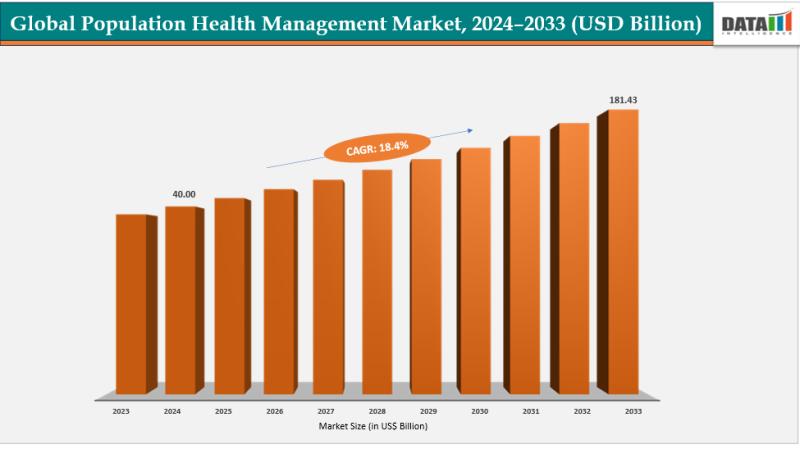

Population Health Management Market Set for Explosive Growth to USD 181.43 Billi …

The Global Population Health Management Market size reached USD 40.00 billion in 2024 and is expected to reach USD 181.43 billion by 2033, growing at a CAGR of 18.4% during the forecast period 2025-2033.

Market growth is driven by the rising prevalence of chronic diseases, increasing adoption of digital health solutions, and growing demand for value-based care models. Advancements in AI and predictive analytics, expanding healthcare IT infrastructure, surging investments in…

Organic Infant Formula Market Set to Grow to US$ 36,046 Million by 2032 at 6.3% …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Organic Infant Formula Market Size reached US$ 20,800 million in 2023, rose to US$ 22,110 million in 2024 and is projected to reach US$ 36,046 million by 2032, expanding at a CAGR of 6.3% from 2025 to 2032. The Organic Infant Formula Market is transforming early childhood nutrition by providing parents with certified organic, high-quality alternatives free from synthetic pesticides,…

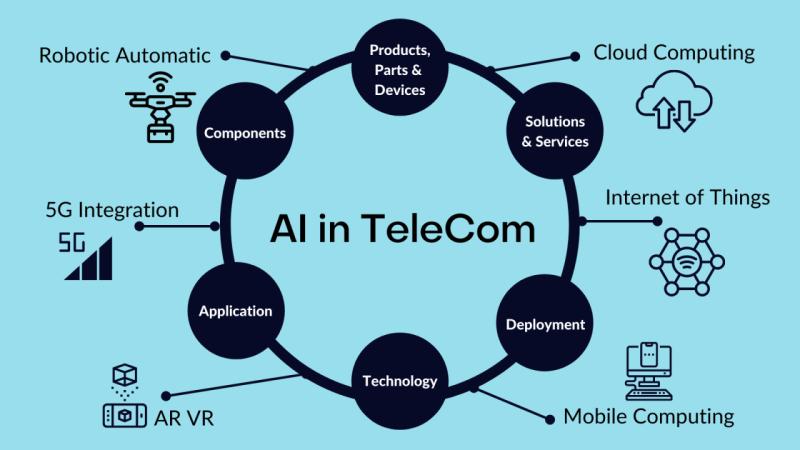

Future of Ai in telecommunication market. AI + Telecommunications Top Technologi …

The global AI in telecommunication market reached US$ 2.25 billion in 2023, with a rise to US$ 2.90 billion in 2024, and is expected to reach US$ 48.98 billion by 2033, growing at a CAGR of 36.9% during the forecast period 2025-2033.

AI in telecommunication market growth is driven by rising data traffic, demand for automated network optimization, predictive maintenance, improved customer experience, cost reduction, and rapid deployment of 5G and…

Bioresorbable Implants Market to Double, Reaching US$ 14.34 Billion by 2033 at 7 …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Bioresorbable Implants Market Size reached US$ 7.00 billion in 2024 and is projected to reach US$ 14.34 billion by 2033, expanding at a CAGR of 7.4% during the forecast period 2025-2033. The Bioresorbable Implants Market is transforming surgical outcomes by dissolving after fulfilling their role, leaving no permanent foreign body and lowering revision risks.

The shift from traditional metallic implants to…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…