Press release

Explore RBD Palm Oil Price Trend 2025: Latest Index Insights & Forecast Update

RBD Palm Oil Prices in APAC 2025: What the Latest Index RevealsRBD Palm Oil Prices in Malaysia:

Malaysia's RBD palm oil price at USD 1223/MT reflects stable fundamentals shaped by production cycles and export demand. Based on RBD Palm Oil Historical Price Analysis, Malaysia often sets the market tone in Asia. In the RBD Palm Oil Price Trend Overview 2025, moderate growth is expected as domestic output normalizes and seasonal labor constraints ease. Its competitive pricing continues to influence regional procurement strategies.

RBD Palm Oil Prices in Indonesia:

Indonesia's RBD palm oil price of USD 1151/MT underscores its role as a cost-effective supplier. Through RBD Palm Oil Historical Price Analysis, Indonesia consistently maintains lower price points due to abundant feedstock and government-backed export policies. According to the RBD Palm Oil Price Trend Overview 2025, slight upward movement is anticipated as biodiesel mandates tighten. Buyers may continue leveraging Indonesia's affordability for long-term sourcing.

RBD Palm Oil Prices in China:

China's RBD palm oil price stands at USD 1276/MT, driven by strong consumption in food processing and industrial sectors. Insights from RBD Palm Oil Historical Price Analysis show China's pricing is closely tied to global supply fluctuations. Within the RBD Palm Oil Price Trend Overview 2025, steady demand and import adjustments are likely to support price resilience. China remains a key influencer in Asia's downstream market structure.

RBD Palm Oil Prices in India:

India posts the highest price at USD 1736/MT, shaped by heavy import dependency and tariff-related costs. Through RBD Palm Oil Historical Price Analysis, India's prices frequently reflect currency volatility and domestic consumption surges. The RBD Palm Oil Price Trend Overview 2025 suggests continued firmness as refining margins and festival-season demand rise. India's position as a major importer keeps its pricing notably above regional averages.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/rbd-palm-oil-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

Regional Analysis: The price analysis can be extended to provide detailed RBD Palm Oil price information for the following list of Asian countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries.

RBD Palm Oil Prices in Europe 2025: What the Latest Index Reveals

RBD Palm Oil Prices in Netherland:

The Netherlands records an RBD palm oil price of USD 1345/MT, influenced by Europe's sustainability regulations and refined product demand. RBD Palm Oil Historical Price Analysis highlights how EU policies often elevate price levels compared to Asian markets. As per the RBD Palm Oil Price Trend Overview 2025, expectations lean toward a stable-to-slightly bullish trajectory. The Netherlands remains a central distribution hub for Europe's palm oil trade.

Regional Analysis: The price analysis can be extended to provide detailed RBD Palm Oil price information for the following list of European countries.

Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries.

RBD Palm Oil Price Trend, Factors, Recent Developments, History, and Forecast - 2025

As of December 2025, RBD palm oil prices hover near 1220-1270 USD/MT in Malaysia and Indonesia, 1730 USD/MT in India, 1270 USD/MT in China, and 1340 USD/MT in the Netherlands. Q3 trends strengthened across Asia from seasonal output moderation and festive export pulls, with Europe softening slightly on ample availability.

Key Influencing Factors

• Production Moderation: Seasonal yield dips and weather delays tightened supplies in origin countries.

• Export Policies: Biodiesel mandates and levies diverted volumes from trade flows.

• Demand Patterns: Food processing and festive needs boosted imports in India and China.

• Logistics Costs: Freight hikes and port scheduling inflated landed expenses.

• Currency Shifts: Weaker local currencies aided export parity amid rival oil competition.

• Regulatory Pressures: EU traceability rules added compliance overheads.

Recent Developments

• Malaysia firmed to 1223 USD/MT in September on peaking inventories and export acceleration.

• Indonesia rose to 1151 USD/MT via biodiesel blending and levy adjustments.

• China edged to 1276 USD/MT amid stable crusher demand and smooth port logistics.

• India advanced to 1736 USD/MT from duty gaps favoring crude refining.

• Netherlands softened to 1345 USD/MT on paced buying and EUDR delays.

RBD Palm Oil Historical Context

Q2 2025 saw Malaysia at 1150 USD/MT, Indonesia 1060 USD/MT from policy tweaks; Q1 China 1293 USD/MT amid supply constraints. Earlier quarters reflected 5-10% gains tied to weather and biodiesel shifts.

RBD Palm Oil Price Forecast

Volumes reached USD 43.32 Billion in 2024, targeting USD 58.03 Billion by 2033 at 3.14% CAGR. Food and biofuel resilience sustains upward firmness into 2026, tempered by yield recoveries and soft oil rivalry.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=23544&flag=C

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, RBD Palm Oil Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition, presents a detailed analysis of RBD Palm Oil price trend, offering key insights into global RBD Palm Oil market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines RBD Palm Oil demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Explore RBD Palm Oil Price Trend 2025: Latest Index Insights & Forecast Update here

News-ID: 4308890 • Views: …

More Releases from IMARC Group

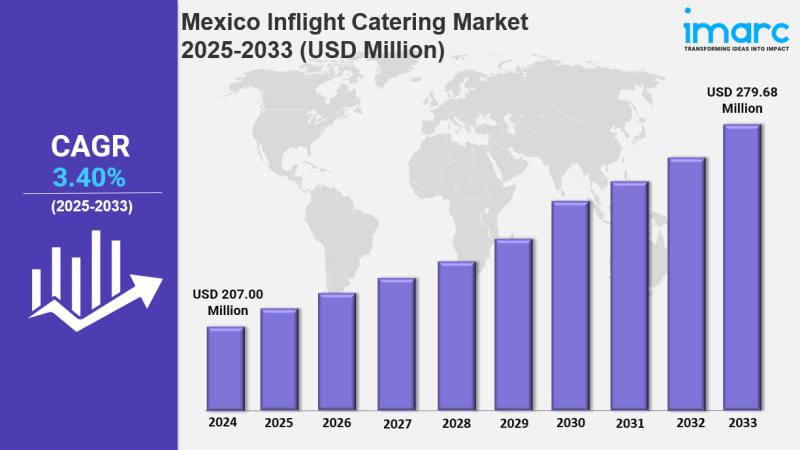

Mexico Inflight Catering Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Inflight Catering Market Size, Share, Trends and Forecast by Food Type, Flight Service Type, Aircraft Seating Class, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico inflight catering market size reached USD 207.00 Million in 2024. The market is…

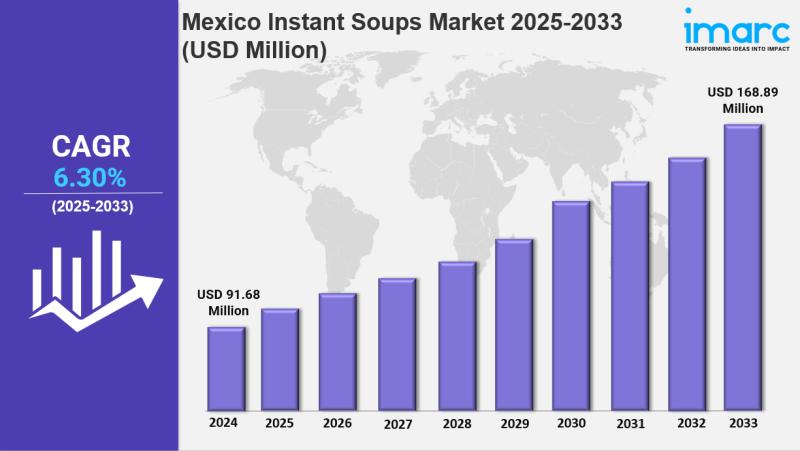

Mexico Instant Soups Market Size, Share, Latest Insights and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Instant Soups Market Size, Share, Trends and Forecast by Nature, Form, Source, Distribution Channel, End Use, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico instant soups market size reached USD 91.68 Million in 2024 and is projected to…

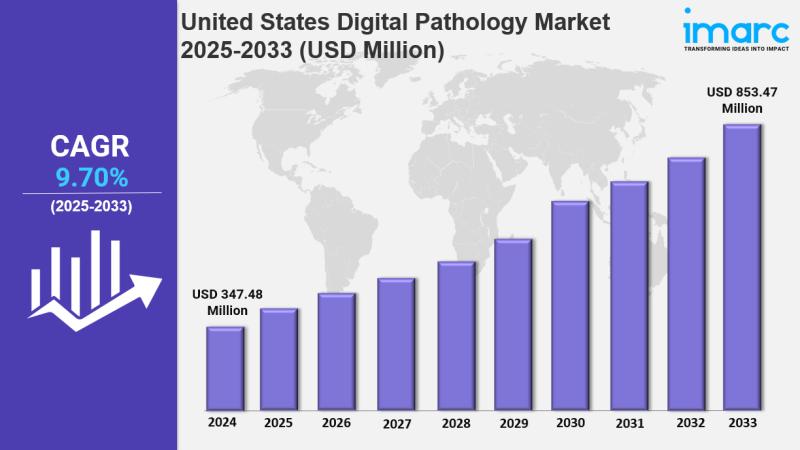

United States Digital Pathology Market : Trends, Drivers, and Growth Opportuniti …

IMARC Group has recently released a new research study titled "United States Digital Pathology Market Size, Share, Trends and Forecast by Product, Type, Delivery Model, Application, End User, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States digital pathology market size was valued at USD 347.48 Million in 2024…

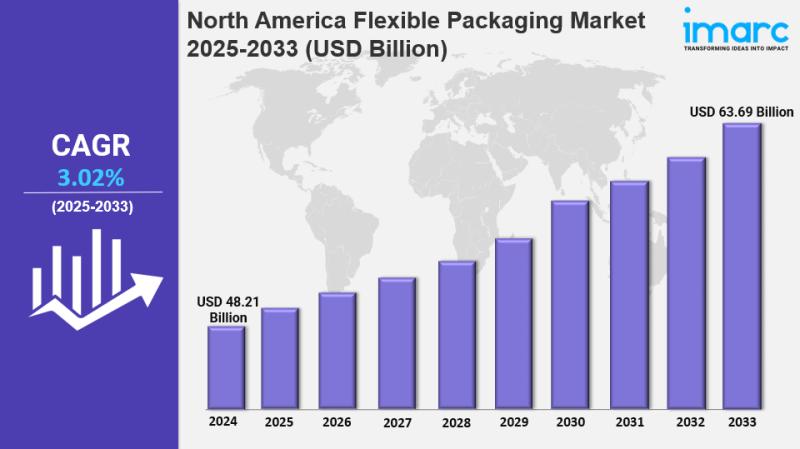

North America Flexible Packaging Market Share, Size, In-Depth Insights, Trends a …

IMARC Group has recently released a new research study titled "North America Flexible Packaging Market Size, Share, Trends and Forecast by Product Type, Raw Material, Printing Technology, Application, and Country, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The North America flexible packaging market was valued at USD 48.21 Billion in 2024 and is…

More Releases for RBD

RBD Palm Olein Prices 2025: Global Key Trend & Forecast Data - See Insights

RBD Palm Olein Price Index Analysis in APAC: 2025 Overview

RBD Palm Olein Prices in Malaysia:

Malaysia recorded USD 1165/MT in Q3, supported by steady export demand and improved milling efficiency. The RBD Palm Olein Price Trend 2025 in Malaysia shows balanced fundamentals, with stable inventories and moderate production. When reviewing the RBD Palm Olein Historical Price Chart, Malaysia's pricing remains aligned with seasonal patterns and global edible-oil market signals that…

RBD Palm Oil Pricing Report with Global and Regional Insights | IMARC Group

APAC RBD Palm Oil Prices Movement Q1 2025:

RBD Palm Oil Prices in China:

RBD palm oil prices in China have been inching up in the first quarter of 2025 to about around 1,293 USD/MT in March, mainly on the back of weaker output from big producers such as Malaysia and Indonesia. Disruptions at some of the most important regions driven by the weather and ongoing labour shortages impacted global supply balances…

RBD Palm Olein Prices, Trends & Forecasts | Provided by Procurement Resource

In Q1 2023, Asia's RBD palm olein prices declined due to weak trading sentiments and domestic demand. Q2 saw a mid-quarter surge from positive end-user industry growth, followed by a steep fall as cooking oil demand dropped in major producing nations. Europe experienced low consumer confidence in Q1, with excessive stock and Asian imports further increasing inventories.

Request for Real-Time RBD Palm Olein Prices: https://www.procurementresource.com/resource-center/rbd-palm-olein-price-trends/pricerequest

Early Q2 showed price improvement driven by…

RBD Palm Oil Prices, Trends & Forecasts | Provided by Procurement Resource

RBD Palm Oil, a more refined variant of Palm Oil, mirrors its price trends closely. Asia, led by Indonesia, majorly exports RBD Palm Oil globally, shaping international price dynamics. In H1 2023, RBD Palm Oil witnessed mixed trends.

Request for Real-Time RBD Palm Oil Prices: https://www.procurementresource.com/resource-center/rbd-palm-oil-price-trends/pricerequest

Indonesia's export tariff easing, and freight adjustments impacted upstream costs, causing Q1 fluctuations, followed by controlled Q2 exports for domestic stability, resulting in minimal upward pressure.…

Saelig Introduces RBD 9103 USB Graphing Picoammeter

Saelig Company, Inc. announces the availability of the RBD 9103 USB Graphing Picoammeter, a compact, versatile, general-purpose picoammeter designed to accurately measure DC current from nanoamps to milliamps via its isolated BNC input. This rugged, portable, and affordable picocurrent sensor is available with high-speed and high-voltage options, optional bias, and 5kVDC float isolation. The 9103 USB Picoammeter measures bi-polar DC current and can be biased from an optional built-in fixed…

RBD Creative partners with Reproductive Genetic Innovations

Acknowledged in D Business' Faces of Detroit in 2015, RBD Creative, a local Plymouth marketing and design studio, is proud to announce a new partnership with Reproductive Genetic Innovations (RGI) of Northbrook, IL. RBD Creative specializes in health and wellness marketing solutions and has several notable clients including: University of Michigan Health System, University of Michigan School of Medicine, Lakes Urgent Care, Evangelical Homes of Michigan, Cryowellness USA, Michigan Reproductive…