Press release

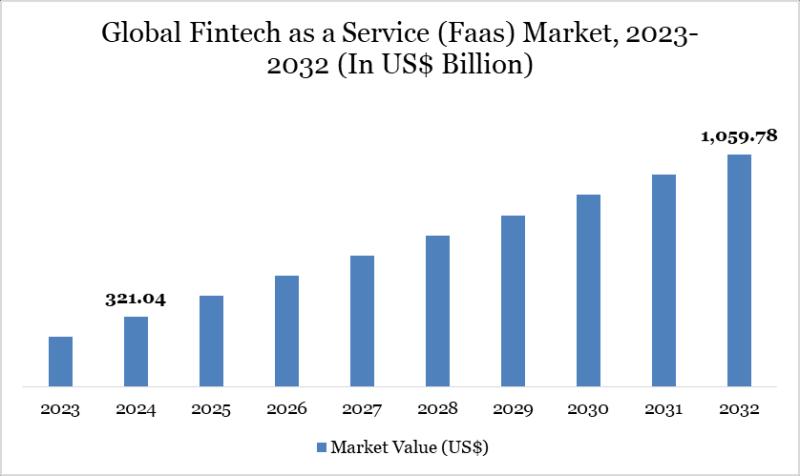

Fintech as a Service Market Set for Strong Growth to USD 1,059.78 Billion by 2032, Led by North America's 35% Global Market Share | DataM Intelligence

The Global Fintech as a Service (FaaS) Market reached USD 321.04 billion in 2024 and is expected to reach USD 1,059.78 billion by 2032, growing at a strong CAGR of 16.10% during the forecast period 2025-2032.Market growth is propelled by the rapid digitalization of financial services, rising adoption of API-driven banking, and increasing demand for scalable, plug-and-play fintech solutions. Businesses across banking, insurance, e-commerce, and lending are integrating FaaS platforms to accelerate product launches and reduce infrastructure costs. Additionally, advancements in embedded finance, rising fintech collaborations, and greater consumer preference for seamless digital experiences are further boosting market expansion.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/fintech-as-a-service-market?ram

United States: Key Industry Developments

✅ November 2025: Stripe launched an enhanced Fintech as a Service platform with AI-driven compliance tools, enabling seamless embedded finance integrations for US enterprises and boosting scalability for payment processing.

✅ October 2025: Plaid expanded its FaaS offerings with real-time data APIs tailored for US banks, supporting open banking mandates and accelerating fintech adoption amid regulatory shifts.

✅ September 2025: FIS introduced a cloud-native FaaS solution focused on regtech and AI analytics, targeting US financial institutions to reduce operational costs and enhance customer experiences.

Asia Pacific / Japan: Key Industry Developments

✅ November 2025: SBI Holdings rolled out a comprehensive FaaS ecosystem in Japan, integrating QR payments and blockchain for remittances, aligning with the nation's digital transformation goals.

✅ October 2025: Ant Group advanced its FaaS platform across Asia Pacific with cross-border payment rails, emphasizing SME digitalization in markets like India and China for rapid market penetration.

✅ September 2025: Rakuten launched AI-powered FaaS modules in Japan, focusing on insurance and wealth management to serve aging demographics and promote cashless ecosystems.

Key Merges and Acquisitions(2025):

✅ PayPal - expanded its merchant services in the Fintech as a Service ecosystem by partnering with Wix Advance in July 2025, enabling streamlined payment management and flexible options to boost conversions and customer experience.

✅ Mastercard - strengthened global money transfer capabilities through its July 2025 partnership with BMO, powering BMO's service with Mastercard Move to support transfers to nearly 70 locations across multiple regions.

✅ BlackRock - acquired Preqin in 2025 to enhance data-driven WealthTech offerings within Fintech as a Service platforms, capitalizing on scalable analytics for wealth management dominance.

Market Segmentation Analysis:

-By Type: Payments Leads with Strong Adoption

Payments as a Service holds the largest market share at 35%, driven by rapid uptake of digital wallets, real-time payments, and embedded finance solutions enabling seamless transactions.

Banking as a Service (BaaS) captures 25%, offering scalable infrastructure for digital banking, account issuance, and core financial operations without heavy in-house development.

Lending as a Service accounts for 20%, powering data-driven credit scoring and automated loan origination for faster access to capital.

Insurance as a Service (InsurTech) represents 15%, focusing on digital underwriting, claims processing, and personalized policies via API integrations.

Others, including RegTech and wealth management, make up 5%, addressing niche compliance and asset management needs.

-By Deployment: Cloud Dominates for Scalability

Cloud-Based deployment leads with 60% market share, providing flexible, cost-effective access to fintech capabilities with minimal upfront investment.

On-Premises holds 25%, preferred by institutions prioritizing data control and security in regulated environments.

Hybrid accounts for 15%, blending cloud agility with on-premises security for customized hybrid architectures.

-By Technology: API-Based Drives Integration

API-based Services command 40% share, enabling easy integration of fintech functionalities into existing platforms for quick market entry.

Blockchain takes 25%, enhancing secure, transparent transactions and smart contracts in payments and lending.

AI & Machine Learning holds 20%, powering fraud detection, personalization, and predictive analytics.

Robotic Process Automation (RPA) represents 10%, automating compliance and back-office tasks for efficiency.

Others contribute 5%, covering emerging tools like cybersecurity enhancements.

-By Application: Banks & Financial Institutions Lead Demand

Banks & Financial Institutions dominate with 30% share, leveraging FaaS for digital transformation and competitive edge in core services.

Insurance Companies follow at 25%, adopting for streamlined operations and customer-centric products.

Fintech Startups hold 20%, using FaaS to scale rapidly without building infrastructure.

eCommerce & Retail Businesses account for 15%, integrating payments and lending for seamless checkout experiences.

Telecom Companies take 5%, embedding financial services into billing platforms.

Government Agencies and Others share 5%, focusing on compliance and public sector innovations.

Purchase this report before year-end and unlock an exclusive 30% discount: https://www.datamintelligence.com/buy-now-page?report=fintech-as-a-service-market?ram (Purchase 2 or more Reports and get 50% Discount)

Growth Drivers:

-Rise of Embedded Finance: Non-financial companies integrate banking, payments, and lending into their platforms via FaaS APIs, boosting customer experiences and revenue streams across e-commerce, retail, and other sectors.

-Surge in Digital Payments: Increased adoption of mobile wallets, contactless tech, and e-commerce drives demand for seamless, secure payment processing solutions provided by FaaS platforms.

-Open Banking Regulations: Mandates like PSD2 in Europe and similar frameworks worldwide compel API sharing, spurring innovation, competition, and compliance through FaaS.

-AI and Blockchain Advancements: These technologies enhance fraud detection, credit scoring, security, and efficiency, making FaaS solutions more attractive for personalized financial services.

-Cloud Computing Scalability: Offers flexible, cost-effective infrastructure for rapid deployment of financial services without heavy in-house development.

Regional Insights:

-North America leads the Fintech as a Service (FaaS) market with the largest share, estimated at around 35% in recent years, driven by advanced digital infrastructure, a robust ecosystem of fintech innovators like Stripe and Plaid, and supportive regulations from bodies such as the OCC and CFPB. The U.S. alone contributes significantly, with its mature financial sector in hubs like New York and Silicon Valley fostering rapid adoption among startups, neobanks, and traditional banks. This dominance positions North America as the global hub for FaaS innovation and scalable financial solutions.

-Asia Pacific follows as the second-largest region by market share, though exact percentages vary across reports, fueled by explosive digital payment growth, high smartphone penetration, and expanding economies in China, India, and Southeast Asia. The region is projected to exhibit the fastest CAGR over the coming years due to increasing demand for accessible financial services among underserved populations and government initiatives promoting digital inclusion. Its rapid urbanization and tech-savvy consumers make it a critical growth engine for FaaS providers targeting payments and lending.

-Europe ranks third in FaaS market share, benefiting from strong regulatory frameworks like PSD2 that encourage open banking and API-driven services, alongside established financial centers in the UK, Germany, and France. The region's focus on data privacy via GDPR and cross-border payment systems supports steady adoption by fintech firms and incumbents alike. While trailing North America and Asia Pacific, Europe's emphasis on compliant, secure solutions ensures sustained expansion in areas like core banking and compliance tools.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/fintech-as-a-service-market?ram

Key Players:

Finastra | Stripe, Inc. | Rapyd Financial Network Ltd | foo.mobi | Solid Financial Technologies, Inc. | Synctera Inc. | SAP Fioneer | TCS BaNCS | PayMate | Backbase | among others.

Key Highlights (Top 5 Key Players) for Fintech as a Service Market:

-Finastra reported USD 1.2 billion in FusionFabric.cloud revenues from API-driven FaaS platforms, with open banking integrations growing 25% YoY in 2025.

-Stripe, Inc generated USD 18.5 billion in overall payments revenue, powering over 40% of FaaS-enabled digital wallets and embedded finance solutions globally.

-Rapyd Financial Network Ltd achieved USD 450 million in transaction volume through its cross-border FaaS APIs, expanding to 100+ countries with 35% client growth.

-SAP Fioneer delivered USD 800 million in cloud-based FaaS for banking and -payments, including AI-enhanced compliance tools adopted by 200+ financial institutions.

-Backbase recorded USD 250 million in modular FaaS platform revenues, supporting digital transformation for 150 banks with engagement banking suites up 30% YoY.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?ram

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech as a Service Market Set for Strong Growth to USD 1,059.78 Billion by 2032, Led by North America's 35% Global Market Share | DataM Intelligence here

News-ID: 4308830 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

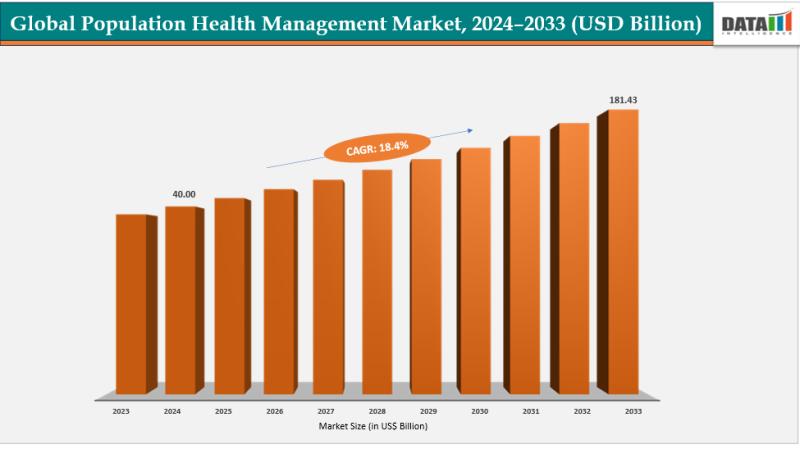

Population Health Management Market Set for Explosive Growth to USD 181.43 Billi …

The Global Population Health Management Market size reached USD 40.00 billion in 2024 and is expected to reach USD 181.43 billion by 2033, growing at a CAGR of 18.4% during the forecast period 2025-2033.

Market growth is driven by the rising prevalence of chronic diseases, increasing adoption of digital health solutions, and growing demand for value-based care models. Advancements in AI and predictive analytics, expanding healthcare IT infrastructure, surging investments in…

Organic Infant Formula Market Set to Grow to US$ 36,046 Million by 2032 at 6.3% …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Organic Infant Formula Market Size reached US$ 20,800 million in 2023, rose to US$ 22,110 million in 2024 and is projected to reach US$ 36,046 million by 2032, expanding at a CAGR of 6.3% from 2025 to 2032. The Organic Infant Formula Market is transforming early childhood nutrition by providing parents with certified organic, high-quality alternatives free from synthetic pesticides,…

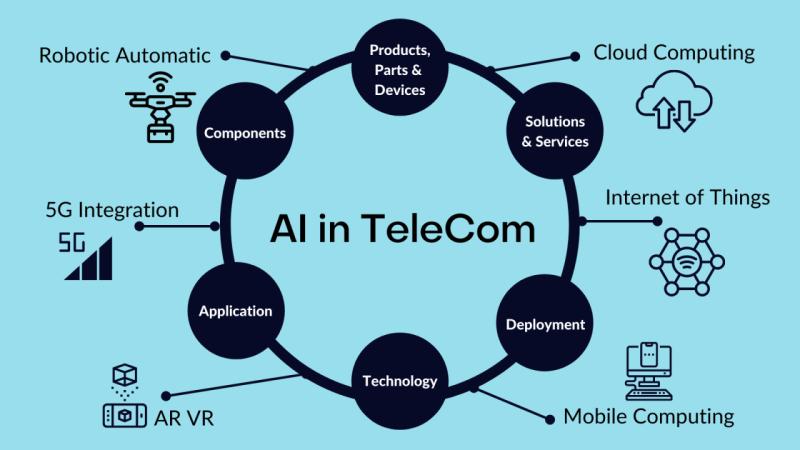

Future of Ai in telecommunication market. AI + Telecommunications Top Technologi …

The global AI in telecommunication market reached US$ 2.25 billion in 2023, with a rise to US$ 2.90 billion in 2024, and is expected to reach US$ 48.98 billion by 2033, growing at a CAGR of 36.9% during the forecast period 2025-2033.

AI in telecommunication market growth is driven by rising data traffic, demand for automated network optimization, predictive maintenance, improved customer experience, cost reduction, and rapid deployment of 5G and…

Bioresorbable Implants Market to Double, Reaching US$ 14.34 Billion by 2033 at 7 …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Bioresorbable Implants Market Size reached US$ 7.00 billion in 2024 and is projected to reach US$ 14.34 billion by 2033, expanding at a CAGR of 7.4% during the forecast period 2025-2033. The Bioresorbable Implants Market is transforming surgical outcomes by dissolving after fulfilling their role, leaving no permanent foreign body and lowering revision risks.

The shift from traditional metallic implants to…

More Releases for FaaS

Farming As A Service (FaaS) Market Size & Forecast to 2031

The Farming-as-a-Service (FaaS) market is rapidly gaining prominence as a key driver of agricultural innovation and efficiency around the world. This evolution of traditional farming into a modern, service-oriented ecosystem is enabling stakeholders - from small‐scale farmers to large agribusinesses - to adopt advanced technologies, improve productivity, and connect more effectively with markets. Recent industry activity underscores the growing importance of FaaS in reshaping how agriculture operates in a digitally…

Financial accounting advisory services (FAAS) Market Size And Global Industry Fo …

Digitalization, Regulatory Complexity, and Strategic Consulting Drive Market Momentum

Introduction

The global financial accounting advisory services (FAAS) market has emerged as a critical segment within the financial services industry, catering to evolving needs in corporate governance, compliance, digital finance transformation, and business restructuring. Organizations across sectors are increasingly relying on financial advisory firms to navigate the complexities of accounting regulations, enhance transparency, and ensure resilience in a volatile global economy. The Exactitude…

Fintech as a Service (FaaS) Market Size, Industry Share, Sales Revenue Analysis …

The Fintech as a Service (FaaS) Market is expected to experience substantial growth, with projections indicating a rise from USD 310.5 billion in 2023 to USD 676.9 billion by 2028, exhibiting a compound annual growth rate of 16.9%, during the forecast period.

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9388805

The growth of the FaaS market is driven by factors such as the emergence of cloud computing technology which will facilitate operational flexibility and scalability…

FAAS Market Regional Developments, Industry Future Demands and Competitive Lands …

The FAAS market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development prospects.…

India FaaS Market Size, Status, Top Players, Trends in Upcoming Years

The government of India has set up the Agricultural Technology Management Agency (ATMA) to strengthen research–extension–farmer linkages, improve the quality and type of technologies being distributed, offer an effective mechanism for management and coordination of activities of multiple agencies involved in technology validation/adaption and dispersion at the district level and below, and march toward shared ownership of the agricultural technology systems among prominent shareholders.

Get the Free Sample Pages: https://www.psmarketresearch.com/market-analysis/india-farming-as-a-service-faas-market/report-sample

The…

India FaaS Market Size, Share, Growth, Trends, Applications, and Industry Strate …

Factors such as the increasing implementation of government initiatives to support the farmers, such as the Pradhan Mantri Krishi Sinchayee Yojana (PMSY) and Soil Health Card Scheme, and improving internet connectivity in rural areas will fuel the Indian farming as a service (FaaS) market growth during the forecast period (2021–2030). Moreover, the rising efforts made by private companies to enhance the productivity and efficiency of the agriculture sector will also…