Press release

United States Supply Chain Finance Market to Reach USD 4.0 Billion by 2030 at 13% CAGR | Key Players: Citibank, J.P. Morgan, HSBC, Standard Chartered, Wells Fargo | Asia-Pacific Leads with 40% Share

Supply Chain Finance Market OverviewThe global supply chain finance (SCF) market reached USD 1.5 billion in 2022 and is projected to reach USD 4.0 billion by 2030, expanding at a CAGR of 13.0% during the forecast period 2024-2031. The market is being driven by the increasing adoption of technology-based SCF solutions, which are transforming traditional financing methods and enabling businesses to optimize liquidity, streamline payments, and improve working capital management across fragmented supply chains.

The market growth is fueled by the availability of diverse financing options from banks, non-banking financial companies (NBFCs), and private players, offering businesses greater flexibility in invoice financing. As companies increasingly recognize SCF as a strategic tool for financial efficiency, adoption rates are rising globally. Recent trends indicate that supply chain finance fund volumes surged by 38% between 2020 and 2021, reaching USD 1.8 trillion, while funds in use grew 41%, totaling USD 713 billion, reflecting the expanding importance of SCF for business operations.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/supply-chain-finance-market?Juli

Recent Developments:

✅ October 2025: Oracle launched new cloud-based Trade and Supply Chain Finance services for banks, automating receivables/payables financing and cross-border trade workflows.

✅ September 2025: Several SCF providers integrated AI-driven risk analytics modules to improve supplier credit assessment, reduce default risk, and accelerate financing decisions.

✅ August 2025: Deep-tier financing programs expanded globally, extending supply chain finance to Tier‐2 and Tier‐3 suppliers to enhance liquidity across extended supply chains.

✅ July 2025: Digital-first SCF platforms combining fintech, embedded finance, and cloud-based workflows gained traction, improving financing speed and accessibility for SMEs.

✅ May 2025: In India, KredX advanced its Trade Receivables Discounting System (TReDS), allowing SMEs to auction receivables and access working capital more efficiently.

✅ March 2025: Supply chain finance deals increasingly tied to ESG and sustainability metrics, offering preferential terms to suppliers meeting environmental and social performance targets.

Mergers & Acquisitions:

✅ 2025: A major consolidation wave saw a large banking/financial‐services group acquire an AI‐driven supply‐chain finance platform adding advanced risk‐analytics, invoice‐financing and receivables‐discounting capabilities to its balance‐sheet offering, thereby expanding SCF access for SMEs and mid‐sized companies.

✅ 2024: A fintech‐led SCF software provider was acquired by a global enterprise‐resource planning (ERP) firm to embed supply‐chain financing capabilities directly into ERP workflows, improving end‐to‐end working‐capital management for corporate clients.

✅ 2024: A regional trade‐financing firm acquired a smaller NBFC‐based invoice‐factoring company to strengthen its SCF delivery network and expand outreach to tier‐2 and tier‐3 suppliers in emerging markets.

✅ 2023: A leading working‐capital solutions platform merged with a payments & trade‐finance fintech, creating a broader SCF ecosystem combining invoice discounting, dynamic discounting, payables financing, and cross‐border trade finance enhancing flexibility for buyers and suppliers globally.

✅ 2022-2025 (Trend): The SCF market has witnessed increasing consolidation, with banks, fintechs, NBFCs, and technology‐platform providers merging or acquiring complementary firms. This consolidation aims to offer end‐to‐end SCF ecosystems combining financing, risk analytics, digital onboarding, and supply‐chain services increasing scalability and reducing fragmentation.

Key Players:

• Citibank - Holds approximately 14% market share, leveraging its global banking network, trade finance expertise, and digital SCF platforms to provide invoice discounting, payables financing, and working capital solutions to multinational corporations.

• J.P. Morgan Chase - Holds around 13% share, supported by advanced supply chain financing solutions, dynamic discounting, and integrated risk management services for corporate clients worldwide.

• HSBC - Represents roughly 12% share, offering a comprehensive suite of SCF solutions, including receivables financing, cross-border trade finance, and cloud-based digital platforms to improve cash flow efficiency.

• Standard Chartered - Holds about 10% share, specializing in trade finance, supplier financing programs, and digital supply chain solutions across emerging and developed markets.

• Wells Fargo - Accounts for approximately 9% share, providing end-to-end working capital solutions, including payables finance, receivables discounting, and SCF advisory services for mid-sized enterprises and large corporates.

• Banco Santander - Represents nearly 8% share, focusing on invoice financing, supplier financing networks, and digital trade platforms tailored to European and Latin American markets.

• BNP Paribas - Holds around 7% share, offering a range of supply chain finance programs, risk assessment tools, and cloud-enabled trade finance solutions to corporate clients globally.

• Deutsche Bank - Accounts for 6% share, providing integrated SCF services, including dynamic discounting, trade finance, and liquidity management solutions for multinational companies.

• Oracle - Holds 5% share, supported by its cloud-based SCF software solutions, enabling automation of payables, receivables, and supplier financing workflows for corporates.

• Taulia - Represents 4% share, specializing in cloud-enabled supply chain finance, dynamic discounting, early payment programs, and integration with ERP systems to optimize cash flow for buyers and suppliers.

Speak to Our Analyst and Get Customization in the Report as per Your Requirements: https://www.datamintelligence.com/customize/supply-chain-finance-market?Juli

Market Segmentation:

➥By Provider: The Banks segment dominates with approximately 60% share, driven by their established networks, extensive financing capabilities, and integrated digital SCF platforms. Trade Finance Houses account for around 25%, leveraging specialized expertise in global trade, risk mitigation, and structured financing solutions. The remaining 15% is contributed by Other Providers, including fintech firms and alternative financing platforms offering flexible, technology-enabled SCF solutions.

➥By Offering: Letter of Credit (LC) remains the leading offering with a 30% share, widely used for securing international trade transactions. Export and Import Bills account for 25%, facilitating seamless cross-border payment settlements. Performance Bonds represent 15%, ensuring contractual obligations are met, while Shipping Guarantees hold around 10%, assisting in logistics and cargo release. The remaining 20% is contributed by Other Offerings, including dynamic discounting, supplier financing, and receivables factoring solutions.

➥By Application: Domestic Supply Chain Finance dominates with 55% share, reflecting growing demand for working capital optimization and invoice financing within local supply chains. International SCF accounts for 45%, driven by cross-border trade, import/export financing, and multinational corporate supply chain requirements.

➥By End-User: Large Enterprises hold the largest share at 65%, leveraging SCF solutions to manage extensive supply networks, optimize cash flow, and reduce working capital constraints. Small and Medium-sized Enterprises (SMEs) contribute 35%, increasingly adopting SCF platforms to access flexible financing, mitigate payment delays, and support business growth.

Regional Insights:

Asia-Pacific dominates the global supply chain finance market, accounting for approximately 40% of the total market share (USD 1.6 billion in 2024). The region's leadership is driven by rapid industrialization, strong government support for trade digitization, and the expansion of e-commerce and manufacturing sectors. China remains the largest contributor, supported by favorable regulations, large-scale adoption of factoring and invoice financing, and digital innovations through platforms like the Commercial Factoring Expertise Committee (CFEC). India, Japan, and Singapore are also key markets, leveraging fintech-driven SCF solutions and blockchain-based trade finance systems to enhance liquidity across fragmented supply chains.

Europe holds around 27% share (USD 1.1 billion in 2024), supported by established banking networks, regulatory frameworks like Supply Chain Finance European Regulation (SCFER), and the growing integration of ESG-linked financing programs. The UK, Germany, and France lead regional adoption, with major banks and fintechs partnering to digitize supplier onboarding and accelerate invoice processing. The focus on sustainability and ethical sourcing is driving adoption of green SCF solutions, rewarding suppliers meeting environmental and social compliance standards.

North America represents approximately 22% of the market (USD 0.9 billion in 2024), propelled by strong adoption of technology-enabled working capital platforms and early-payment programs. The U.S. dominates due to the presence of leading financial institutions such as Citibank, JPMorgan Chase, and Wells Fargo, along with fintech collaborations that offer AI-powered liquidity forecasting and blockchain-based trade solutions. The increasing pressure on corporations to strengthen supplier relationships post-pandemic has further accelerated SCF program adoption.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=supply-chain-finance-market?Juli

Industry Developments:

• Rise of Fintech-Driven Platforms: Fintech innovation is transforming the SCF landscape with AI-powered platforms, blockchain-enabled financing, and real-time risk analytics. These technologies streamline supplier onboarding, enhance transparency, and reduce credit assessment times from weeks to hours.

• Expansion of Deep-Tier Financing: The focus has shifted beyond Tier-1 suppliers, with deep-tier financing models extending liquidity to Tier-2 and Tier-3 suppliers. This expansion is helping stabilize global supply chains by supporting small and medium-sized vendors with faster access to capital.

• Integration of ESG and Sustainable Finance: Banks and corporates are increasingly linking supply chain finance programs with sustainability metrics. ESG-linked SCF programs reward environmentally responsible and socially compliant suppliers with preferential financing terms.

• Blockchain Adoption for End-to-End Traceability: Blockchain is being used to create tamper-proof transaction records, enhancing trust between buyers, suppliers, and financiers. This ensures transparency in invoice validation and reduces fraud risks across complex, multi-tier supply networks.

• AI-Enabled Risk and Credit Scoring: Artificial intelligence and machine learning tools are enabling real-time risk profiling and credit scoring of suppliers. These systems help financiers make more accurate lending decisions and reduce exposure to defaults or delayed payments.

• Cloud-Based and API-Integrated SCF Solutions: The industry is witnessing a transition from traditional banking platforms to cloud-based, API-integrated ecosystems that connect buyers, suppliers, and lenders seamlessly, improving scalability and interoperability.

• Increased Collaboration Between Banks and Fintechs: Strategic partnerships between major banks and fintech startups are becoming common, combining the financial strength of traditional institutions with the agility and innovation of digital SCF providers.

• Growing Focus on SME Financing Inclusion: Governments and international organizations are promoting SCF programs to bridge the funding gap for SMEs, particularly in developing economies. Initiatives such as digital invoice discounting platforms and trade receivable exchanges are expanding access to affordable financing.

• Regulatory Standardization and Compliance Digitization: Policymakers worldwide are promoting digital trade documentation, e-invoicing, and standardized SCF frameworks to enhance transparency and cross-border interoperability.

• Integration with ERP and Procurement Systems: Leading corporates are embedding SCF modules directly into enterprise resource planning (ERP) and procurement systems, automating payment cycles, improving cash flow visibility, and optimizing working capital efficiency.

Market Dynamics:

The global supply chain finance (SCF) market is experiencing rapid expansion, driven by technological innovation, the need for liquidity optimization, and the increasing complexity of global supply chains. Businesses are increasingly adopting SCF solutions to improve working capital, strengthen supplier relationships, and ensure operational resilience amid economic uncertainty and fluctuating trade conditions.

Drivers

The primary growth driver for the SCF market is the rising demand for working capital optimization among corporations facing tight liquidity and elongated payment cycles. Digital transformation across supply chains is further boosting adoption, with AI, blockchain, and cloud-based platforms enhancing transparency, automating invoicing, and reducing transaction times. Moreover, the post-pandemic focus on supply chain resilience and supplier diversification has prompted enterprises to deploy SCF programs to stabilize cash flow across multi-tier supplier networks.

Regulatory and policy support is also catalyzing market growth. Governments and international trade organizations are promoting digital trade documentation, e-invoicing, and fintech-led financing initiatives to enhance financial inclusion, particularly for SMEs. In addition, the growing integration of ESG-linked supply chain finance where suppliers demonstrating sustainable practices receive preferential financing rates is reinforcing the alignment between financial growth and environmental responsibility.

Restraints

Despite strong growth potential, the market faces several challenges. High implementation costs, particularly for small enterprises, and limited digital infrastructure in developing economies can impede widespread adoption. Many SMEs still rely on traditional trade finance instruments due to a lack of awareness or access to digital SCF platforms. Additionally, data security concerns and complex regulatory compliance requirements across regions remain significant barriers. Interoperability challenges between banks, fintech systems, and enterprise resource planning (ERP) platforms can also slow integration and scalability.

Opportunities

Emerging markets represent a substantial opportunity for expansion, as governments and financial institutions increasingly promote digital trade ecosystems to empower small and mid-sized businesses. The rise of deep-tier supply chain financing extending liquidity beyond Tier-1 to Tier-2 and Tier-3 suppliers presents new growth avenues, particularly in Asia-Pacific and Latin America.

Furthermore, the integration of AI-driven risk analytics, IoT-enabled visibility tools, and blockchain-backed traceability is expected to revolutionize the SCF ecosystem, improving transparency, risk management, and transaction speed. The increasing collaboration between banks, fintechs, and non-banking financial companies (NBFCs) will continue to drive innovation, offering more flexible and accessible financing models.

In the long term, as sustainability and digital transformation become core business priorities, the supply chain finance market is poised to evolve into a cornerstone of modern trade ecosystems, providing resilience, efficiency, and equitable access to capital across global supply networks.

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

☛ Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?Juli

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Supply Chain Finance Market to Reach USD 4.0 Billion by 2030 at 13% CAGR | Key Players: Citibank, J.P. Morgan, HSBC, Standard Chartered, Wells Fargo | Asia-Pacific Leads with 40% Share here

News-ID: 4307756 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

US Property Management Robotics Market to Reach US$ 8,674.98 million by 2032 | S …

US Property Management Robotics Market Overview

The US property management robotics market reached US$ 4,418.12 million in 2024 and is projected to grow to US$ 8,674.98 million by 2032, registering a CAGR of 8.80% during the forecast period 2025-2032. The market is witnessing strong adoption as commercial real estate (CRE) operators increasingly integrate robotics for facility upkeep, cleaning, security, HVAC monitoring, and delivery services, enhancing operational efficiency and tenant experience.

Get a…

Oman Oil & Gas Downstream Market to Reach 2.8 Million bpd by 2030 | CAGR 1.1% | …

Oman Oil and Gas Downstream Market Overview

The Oman Oil and Gas Downstream Market reached 2.6 million barrels per day (bpd) in 2022 and is projected to rise to 2.8 million bpd by 2030, growing at a CAGR of 1.1% during the forecast period 2023-2030. Since the onset of commercial production, the downstream sector has been a major driver of Oman's economic development, contributing significantly to employment, industrial activity, and government…

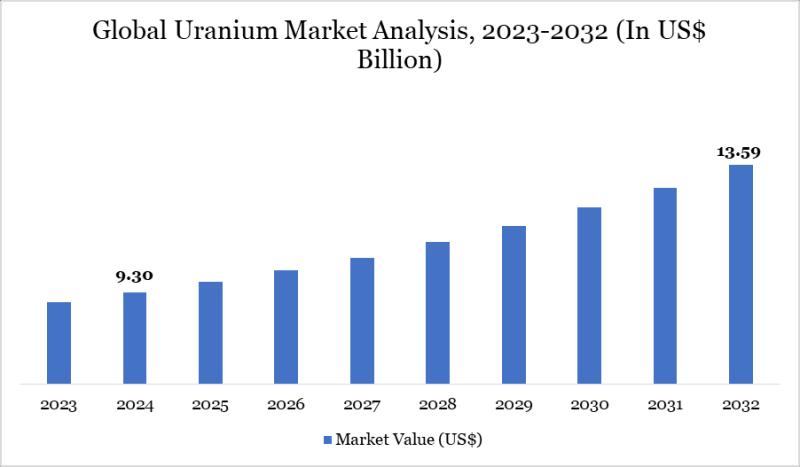

Uranium Market to Reach US$ 13.59 billion by 2032, Led by Asia-Pacific's 38% Mar …

Leander, Texas and Tokyo, Japan - Jan.07.2026

As per DataM Intelligence research insights, the Global Uranium Market was valued at US$ 9.30 billion in 2025 and is projected to reach US$ 13.59 billion by 2032, growing at a CAGR of 4.86% during the forecast period 2025-2032.

Download your exclusive sample report today: (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/uranium-market?praveen

United States: Recent Industry Developments

✅ In December 2025, U.S. nuclear energy companies expanded uranium mining and…

Triple Negative Breast Cancer (TNBC) Treatment Market to Reach USD 1.66billion b …

Triple Negative Breast Cancer Treatment Market Overview

The global Triple Negative Breast Cancer (TNBC) Treatment Market reached US$ 0.95 billion in 2023 and is projected to rise to US$ 1.00 billion in 2024, eventually reaching US$ 1.66 billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025-2033.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/triple-negative-breast-cancer-treatment-market?Juli

The market growth is being driven by…

More Releases for SCF

Digital Supply Chain Finance (SCF) Solution Market Growth Opportunities in the G …

The global market for Digital Supply Chain Finance (SCF) Solution was estimated to be worth US$ 13650 million in 2024 and is forecast to a readjusted size of US$ 28940 million by 2031 with a CAGR of 11.5% during the forecast period 2025-2031.

A 2025 latest Report by QYResearch offers on -"Digital Supply Chain Finance (SCF) Solution - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" provides…

Stem Cell Factor(SCF) Market Size, Trends, Growth Analysis, and Forecast | Val …

Stem Cell Factor(SCF) Market Size

The global Stem Cell Factor(SCF) market was valued at US$ 12900 million in 2023 and is anticipated to reach US$ million by 2030, witnessing a CAGR of 11.4% during the forecast period 2024-2030.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-10V18247/Global_Stem_Cell_Factor_SCF_Market_Research_Report_2024

The major global manufacturers of Stem Cell Factor(SCF) include PeproTech, Prospec, Proteintech, NeoScientific, STEMCELL Technologies, MP Biomedicals, AJINOMOTO, Enzo, FUJIFILM Irvine Scientific, SigmaAldrich, etc. In 2023, the world's top three vendors…

Dangerous Goods Container Market Size: 2022, Growth Strategic Assessment, Develo …

The Global "Dangerous Goods Container Market" report provides a comprehensive overview of the emerging market trends, drivers, and constraints. This report evaluates historical data on the Dangerous Goods Container market growth and compares it with current market situations. This report provides data to the customers that are of historical & statistical significance and informative. It helps to enable readers to have a detailed analysis of the development of the market.…

Slow Release Fertilizers Market 2018 Global Growth Analysis & Forecast to 2025 | …

UpMarketResearch offers a latest published report on “Global Slow Release Fertilizers Market Analysis and Forecast 2018-2023” delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability.

Get Free Exclusive PDF Sample Copy of This Report: https://www.upmarketresearch.com/home/requested_sample/5703

Slow Release Fertilizers Industry research report delivers a…

Global Control Release Fertilizers Market Size and Forecast 2025: Hanfeng, Prill …

Qyresearchreports include new market research report Global Control Release Fertilizers Market Professional Survey Report 2018 to its huge collection of research reports.

This report studies Control Release Fertilizers in Global market, especially in North America, China, Europe, Southeast Asia, Japan and India, with production, revenue, consumption, import and export in these regions, from 2013 to 2018, and forecast to 2025.

The global Control Release Fertilizers market is broadly shed light upon in…

Global Slow Release Fertilizers Market Insights, Forecast to 2025 : Hanfeng, Pri …

Researchmoz added Most up-to-date research on "Global Slow Release Fertilizers Market Insights, Forecast to 2025" to its huge collection of research reports.

This report researches the worldwide Slow Release Fertilizers market size (value, capacity, production and consumption) in key regions like North America, Europe, Asia Pacific (China, Japan) and other regions.

This study categorizes the global Slow Release Fertilizers breakdown data by manufacturers, region, type and application, also analyzes the market status,…