Press release

Oman Oil & Gas Downstream Market to Reach 2.8 Million bpd by 2030 | CAGR 1.1% | Key Players: PDO, Shell, Total, Oman LNG, Occidental Petroleum | Refining Leads with 40% Share | Driven by Capacity Expansion & Petrochemical Investments

Oman Oil and Gas Downstream Market OverviewThe Oman Oil and Gas Downstream Market reached 2.6 million barrels per day (bpd) in 2022 and is projected to rise to 2.8 million bpd by 2030, growing at a CAGR of 1.1% during the forecast period 2023-2030. Since the onset of commercial production, the downstream sector has been a major driver of Oman's economic development, contributing significantly to employment, industrial activity, and government revenue.

The oil and gas industry accounts for approximately 30% of Oman's GDP, with taxes and earnings from upstream and downstream operations traditionally funding around 70% of the national budget. In line with Oman Vision 2040, the government is actively pursuing economic diversification, using the oil and gas sector as a foundation while promoting the growth of non-oil activities, which are targeted to contribute 90% of GDP in the long term.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/oman-oil-and-gas-downstream-market?Juli

Recent Developments:

✅ November 2025: OQ signed strategic agreements with the Integrated Gas Company (IGC) to strengthen Oman's gas value chain and support downstream industries, including petrochemicals, natural gas logistics, and energy transition projects in Duqm, Sohar, and Sur.

✅ Late 2025: OQ Refineries and Petroleum Industries (OQ RPI) contracted Worley Ltd. for front-end engineering design of a decarbonization project at the Sohar refinery, aimed at improving energy efficiency and reducing emissions.

✅ 2025: Expansion and optimization at the Duqm Refinery and Petrochemical Industries Company (OQ8) reached full throughput capacity, enhancing operational efficiency and reliability in Oman's downstream segment.

✅ 2025: Refinery output increased, with higher production of motor fuels, diesel, LPG, and petrochemical products, reflecting strengthened downstream processing capabilities.

✅ 2025: Marsa LNG, a joint venture between TotalEnergies and OQ Exploration & Production, initiated construction of a new LNG plant and marine bunkering hub at Sohar Port to support cleaner fuel supply chains and expand Oman's LNG footprint.

Mergers & Acquisitions:

✅ October 2025: OQ acquired a majority stake in a local petrochemical logistics firm, strengthening its downstream supply chain and expanding its distribution network across Oman.

✅ August 2025: Occidental Petroleum completed the acquisition of additional shares in refining and storage assets in the Duqm industrial zone, increasing its capacity in the downstream segment.

✅ June 2025: TotalEnergies acquired a minority interest in Oman LNG's downstream operations, enabling strategic integration for LNG processing and export expansion.

✅ May 2025: OQ Refineries and Petroleum Industries (OQ RPI) entered a joint venture with a regional technology provider to enhance refinery efficiency and implement advanced digital monitoring systems.

Buy Now & Unlock 360° Market Intelligence:-https://www.datamintelligence.com/buy-now-page?report=oman-oil-and-gas-downstream-market?Juli

Key Players:

Royal Dutch Shell PLC | Petroleum Development Oman (PDO) | Kuwait Petroleum International | Total S.A. | Oman Oil Marketing Company SAOG | Oman LNG | Partex Oil and Gas (OrPIC) | BP Plc | Occidental Petroleum

Key Highlights:

• Petroleum Development Oman (PDO) - Holds the largest share at 35%, as the primary operator controlling most of Oman's upstream and downstream assets, including refining, petrochemicals, and distribution networks.

• Royal Dutch Shell PLC - Accounts for approximately 15%, contributing through integrated refining, distribution, and energy infrastructure projects in Oman.

• Total S.A. - Represents around 12%, driven by investments in LNG, refining, and petrochemical facilities, particularly in Duqm and Sohar industrial zones.

• Oman LNG - Holds roughly 10%, focusing on LNG processing, export terminals, and cleaner fuel supply chains.

• Occidental Petroleum - Captures about 8%, via ownership of downstream assets including refineries, storage facilities, and petrochemical plants.

• Kuwait Petroleum International - Accounts for 6%, supporting refining, marketing, and distribution partnerships in Oman.

• BP Plc - Holds 5%, leveraging international expertise in refining, trading, and distribution.

• Oman Oil Marketing Company SAOG - Represents 5%, focusing on fuel marketing, distribution, and retail infrastructure.

• Partex Oil and Gas (OrPIC) - Accounts for approximately 4%, managing integrated downstream operations including refining, petrochemicals, and storage facilities.

Market Segmentation:

➥By type, refining dominates the market with approximately 40% share, driven by continuous upgrades to refinery capacity in Sohar, Duqm, and Mina Al Fahal, as well as strong domestic and export demand. Petrochemicals account for around 25%, fueled by growing investment in value-added chemical production and regional export opportunities. Distribution contributes about 20%, reflecting the strategic logistics and supply chain operations that ensure efficient movement of oil and gas products across Oman and neighboring markets. Wholesale and retail marketing represent roughly 15%, focusing on fuel sales, retail networks, and end-user delivery channels for both industrial and consumer consumption.

➥By product, light products (including kerosene and diesel) hold approximately 25%, while gasoline (petrol) accounts for 20%, supporting both domestic and export markets. Liquefied Petroleum Gas (LPG) represents 15%, driven by industrial and residential energy demand. Medium products such as jet fuel and naphtha make up 10%, and heavy products (fuel oil and residuals) contribute around 8%. Other products, including petroleum coke, asphalt and tar, and paraffin wax, collectively account for 12%, supporting industrial applications, construction, and specialty markets.

➥By end-user, petrochemical and industrial manufacturers dominate with approximately 35%, reflecting the sector's reliance on feedstock from refineries and chemical plants. Utilities account for 20%, utilizing oil and gas products for power generation and industrial energy. Municipalities contribute around 15%, primarily for public infrastructure and energy needs. Commercial transportation holds 15%, driven by road freight and shipping fuels, while airlines account for 15%, fueled by increasing demand for aviation fuels and related jet fuel products.

Regional Insights:

The Oman Oil and Gas Downstream Market is primarily concentrated within Oman, accounting for approximately 90% of domestic market activity, driven by key refinery hubs in Sohar, Duqm, and Mina Al Fahal, and major petrochemical and LNG operations. These facilities form the backbone of Oman's domestic supply chain, supporting industrial, municipal, and commercial energy requirements while enabling strategic exports to the Gulf Cooperation Council (GCC) and broader Middle East region.

The GCC region (excluding Oman) represents around 7%, with downstream products from Oman exported to neighboring countries including UAE, Saudi Arabia, and Qatar, primarily in refined fuels, LPG, and petrochemical feedstocks. Strong regional demand for industrial energy and fuel distribution supports this cross-border trade.

The Rest of the World (RoW), including Asia-Pacific and Europe, accounts for the remaining 3%, primarily through LNG exports, specialty petroleum products, and petrochemicals. While the share is smaller, strategic partnerships, long-term contracts, and Oman's position as a reliable exporter of clean energy products contribute to steady market growth in international markets.

Speak to Our Analyst and Get Customization in the report as per your requirements:-https://www.datamintelligence.com/customize/oman-oil-and-gas-downstream-market?Juli

Market Dynamics:

Driver:

The growth of Oman's oil and gas downstream market is being propelled by the expansion of refinery capacity and ongoing investments in petrochemical infrastructure. Since the start of commercial production in 1967, oil has been a cornerstone of Oman's economy. While the sector was affected by the global oil price collapse in 2020, government support and strategic budgeting have revitalized downstream activities. In 2022, the Omani government allocated US$ 23.38 billion for the oil and gas industry, supporting expansion initiatives across refining, petrochemicals, and LNG operations. Notable developments include the Duqm refinery project, a 200,000 b/d facility facilitated by Ras Madrakah Petroleum Industry Co., Yanchang Petroleum International, and Genoil Inc., which is expected to increase overall refining capacity and reduce bottlenecks. These expansions are anticipated to strengthen Oman's downstream infrastructure and support both domestic consumption and regional exports during the forecast period.

Restraint:

Despite growth opportunities, the downstream market remains highly sensitive to global oil price fluctuations, which can significantly impact operational profitability and investment planning. Oman's economy relies heavily on oil revenues, with crude price assumptions guiding national budgeting-US$ 50/b for 2022 compared to US$ 45/b in 2021. Sudden or sharp variations in oil prices can affect margins for refining, petrochemical production, and downstream distribution, creating uncertainty for long-term investments. Companies operating in the downstream sector must navigate these market volatilities while maintaining operational efficiency and competitive pricing, which remains a key challenge for sustained growth.

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

☛ Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?Juli

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Oman Oil & Gas Downstream Market to Reach 2.8 Million bpd by 2030 | CAGR 1.1% | Key Players: PDO, Shell, Total, Oman LNG, Occidental Petroleum | Refining Leads with 40% Share | Driven by Capacity Expansion & Petrochemical Investments here

News-ID: 4339115 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Uranium Market to Reach US$ 13.59 billion by 2032, Led by Asia-Pacific's 38% Mar …

Leander, Texas and Tokyo, Japan - Jan.07.2026

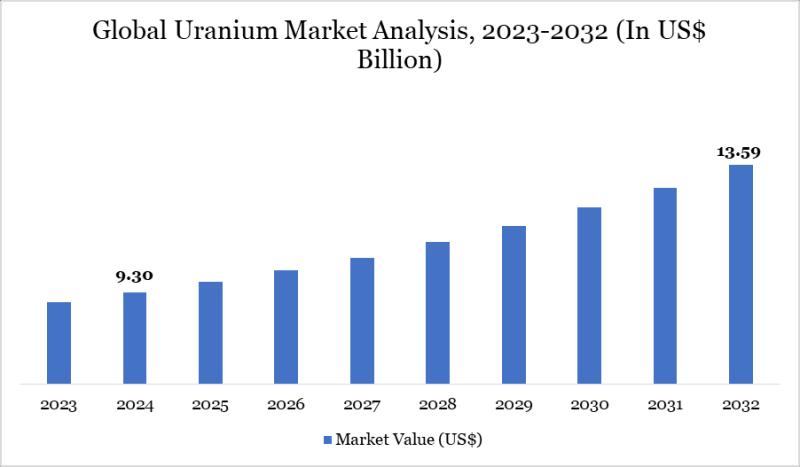

As per DataM Intelligence research insights, the Global Uranium Market was valued at US$ 9.30 billion in 2025 and is projected to reach US$ 13.59 billion by 2032, growing at a CAGR of 4.86% during the forecast period 2025-2032.

Download your exclusive sample report today: (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/uranium-market?praveen

United States: Recent Industry Developments

✅ In December 2025, U.S. nuclear energy companies expanded uranium mining and…

Triple Negative Breast Cancer (TNBC) Treatment Market to Reach USD 1.66billion b …

Triple Negative Breast Cancer Treatment Market Overview

The global Triple Negative Breast Cancer (TNBC) Treatment Market reached US$ 0.95 billion in 2023 and is projected to rise to US$ 1.00 billion in 2024, eventually reaching US$ 1.66 billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025-2033.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/triple-negative-breast-cancer-treatment-market?Juli

The market growth is being driven by…

United States Smart Coatings Market 2031 | Growth Drivers, Key Players & Investm …

Market Size and Growth

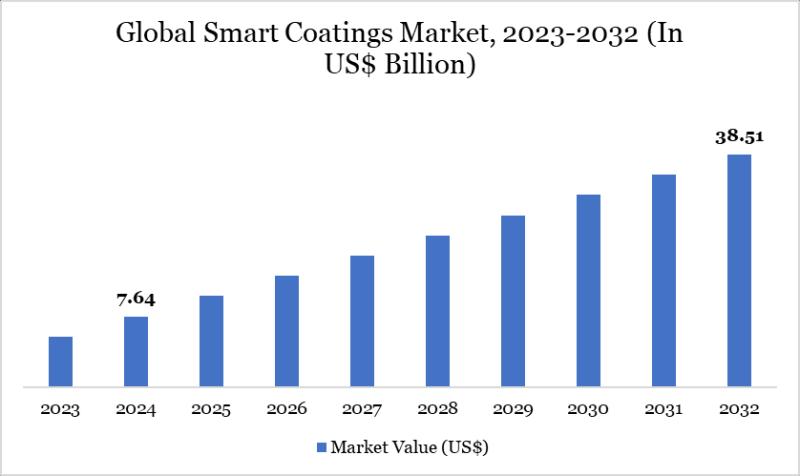

Global Smart Coatings market reached US$ 7.64 billion in 2024 and is expected to reach US$ 38.51 billion by 2032, growing with a CAGR of 22.41% during the forecast period 2025-2032.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/smart-coatings-market?sb

Key Development:

United States: Recent Smart Coatings Developments

✅ In December 2025, PPG's focus on next‐gen coating solutions for EV battery facilities, emphasizing protective…

Rail Digitalization Market expected to reach USD 118.8 billion by 2031 | Top Com …

Leander, Texas and Tokyo, Japan - Jan.07.2026

As per DataM Intelligence research insights, the Global Rail Digitalization Market was valued at USD 61.7 billion in 2024 and is projected to reach USD 118.8 billion by 2031, growing at a CAGR of 8.7% during the forecast period 2024-2031.

Download your exclusive sample report today: (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/rail-digitalization-market?praveen

United States: Recent Industry Developments

✅ In December 2025, U.S. rail operators expanded digital signaling, communication,…

More Releases for Oman

Oman PVC Pipes Market 2021 Analysis by Global Manufacturers - Muna Noor, Oman Za …

The Oman PVC Pipes Market Research Report 2021-2026

The “Oman PVC Pipes” Market report offers qualitative and quantitative insights and a detailed analysis of market size & growth rate for all possible segments in the market. The Global Oman PVC Pipes Industry presents a market overview, product details, classification, and market concentration. The report also provides an in-depth survey of key players in the market which is based on various competitive intelligence…

Mile Enters Oman

ODP & Mile Solutions Launch ‘Imdad” Platform for the logistics sector

‘Imdad’ - useful for real-time tracking of delivery of goods and commodities

Maqbool Al-Wahaibi: The unified logistic platform helps in providing delivery services which are growing in the Sultanate

Muscat: June 2020

Oman Data Park (ODP), the premier cloud services and information technology managed services provider, in partnership with Mile Solutions launched ‘Imdad’ logistic platform…

Pharmaceutical Market Size, Share| Growth With Top Players By 2025: PharmaProduc …

Analytical Research Cognizance present a comprehensive research report namely "Global Pharmaceutical Market Research Report 2020" which reveals an extensive analysis of global industry by delivering the detailed information about Emerging Trends, Customer's Expectations, Technological Improvements, Competitive Dynamics and Working Capital in the Market. This is an in-depth study of the market enlightening key forecast to 2025.

Summary

Pharmaceutical market research report provides the newest industry data and industry future trends, allowing you…

Oman Telecoms, Mobile and Broadband Market Growth, Analysis, Challenges and Indu …

WiseGuyReports.com “Oman - Telecoms, Mobile and Broadband - Statistics and Analyses” report has been added to its Research Database.

Scope of the Report:

Oman - Telecoms

Oman is demonstrating progress in both mobile and fixed telecomsOman has established a progressive mobile sector which has substantial coverage of both 3G and 4G LTE networks. While significant 5G developments are not expected until at least 2020; there have been trials already conducted.

Mobile broadband subscriptions are…

3rd Annual HR Oman Summit Opens in Muscat, Oman

Fleming Gulf's 3rd Annual HR Oman Summit was officially inaugurated on 27th Jan at Intercontinental Muscat, Oman by 'His Excellency AL Sayed Salim Musalam Ali Al-Busaidi, Under-Secretary Of Administrative Development Ministry Of Civil Service, Oman. Aptly themed 'Time For Change- Next Generation HR- Evolution 2.0', the summit hosted over 70 distinguished HR professionals from Oman and other Middle East countries who discussed crucial issues on how to seize new opportunities with value-added…

Oman Power Market Outlook to 2014

RNCOS has recently added a new Market Research Report titled, “Oman Power Market Outlook to 2014” to its report gallery. In Oman, the consumption of electricity is rapidly increasing. In the past few years, the power demand has almost doubled due to increased economic and industrial activities. According to our new research report on Oman power market, the electricity demand and supply mechanism is still balanced in the country, and…