Press release

United States Mobile Payments Market Insights | North America leads with 40% share driven by high smartphone penetration and advanced banking infrastructure

Leander, Texas and Tokyo, Japan - Dec.09.2025As per DataM intelligence research report" Mobile Payments market is estimated to reach at a high CAGR during the forecast period 2024-2031." Digital commerce and contactless transactions are driving robust expansion in mobile payment solutions.

Download your exclusive sample report today: (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/mobile-payments-market?Prasad

United States: Recent Industry Developments

✅ In November 2025, Apple launched "Tap to Pay" on iPhone for enterprise customers in the U.S. The feature allows retail staff to accept payments anywhere in the store without a terminal. It transforms the retail checkout experience.

✅ In October 2025, Venmo introduced a "Teen Account" with parental controls and a debit card. The product allows parents to monitor spending while teaching financial literacy. It captures the next generation of mobile payment users.

✅ In September 2025, The Federal Reserve's "FedNow" instant payment system gained adoption by major U.S. banks. The system enables real-time bill payments and peer-to-peer transfers. It modernizes the U.S. payment infrastructure to match global standards.

✅ In August 2025, PayPal expanded its stablecoin (PYUSD) for use in mobile checkout. The integration allows users to pay with crypto at millions of online merchants. It bridges the gap between digital assets and everyday commerce.

Japan: Recent Industry Developments

✅ In December 2025, PayPay announced it reached 65 million registered users in Japan. The dominance of the QR code app has fundamentally shifted Japan away from cash. It cements PayPay as the "super app" for Japanese payments.

✅ In November 2025, JR East updated its Mobile Suica app to support cloud-based ticketing. The update allows users to transfer passes between devices seamlessly. It improves the convenience of Japan's most popular transit payment card.

✅ In October 2025, The Japanese government began issuing digital salary payments to mobile wallets. The deregulation allows companies to pay employees directly into apps like PayPay or Rakuten Pay. It accelerates the cashless transition of the Japanese economy.

✅ In September 2025, Rakuten Pay integrated "Tap to Pay" for Android users. The feature allows payment by tapping the phone without opening the app. It competes with felica-based payments for speed and convenience.

Mobile Payments Market: Drivers

The mobile payments market continues to expand as consumers favor convenience, contactless transactions, and integrated digital wallets for retail, transit, and peer-to-peer transfers. NFC, QR code, tokenization, and in-app payment solutions provide diverse pathways with strong security measures like biometric authentication. Merchant adoption of POS upgrades, embedded payment APIs, and buy-now-pay-later options supports seamless omnichannel commerce. Regulatory focus on consumer protection, transaction security, and interoperability shapes provider strategies and market trust.

Fintech innovation, bank-fintech partnerships, and merchant incentive programs drive rapid user adoption and transaction volumes, while enhancements in cross-border payment rails and digital ID schemes broaden use cases. E-commerce, contactless retail, and super-apps in many regions continue to push mobile payments into everyday financial behavior. With ongoing investment in UX, security, and inclusivity, mobile payments remain a cornerstone of digital financial transformation.

Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/mobile-payments-market?Prasad

Mobile Payments Market: Major Players

Google, Alibaba Group Holdings Limited, Amazon.com Inc, Apple Inc, American Express Company, M Pesa, Money Gram International, PayPal Holdings Inc, Samsung Electronics Co. Ltd, Visa Inc and WeChat, among others.

Segment Covered in the Mobile Payments Market:

By Technology

The market is segmented into Near Field Communication (NFC) 30%, direct mobile billing 20%, mobile web payment 15%, SMS 10%, interactive voice response system 10%, and mobile app 15%, with NFC dominating due to convenience, security, and wide adoption in contactless payments. Mobile apps are growing rapidly with digital banking and e-commerce expansion. SMS and IVR are used in regions with lower smartphone penetration. Technological advancements and increasing smartphone adoption drive market growth across all types.

By Payment Type

Payment types include B2C 50%, B2B 30%, and B2G 20%, with B2C dominating due to retail, e-commerce, and mobile wallet adoption. B2B payments are growing with corporate and supply chain digitization. B2G adoption is emerging in public services and government collections. Increasing digital transactions and mobile penetration drive adoption across all payment types.

By Location Outlook

Location outlook includes remote payment 60% and proximity payment 40%, with remote payments dominating due to online shopping, mobile banking, and e-commerce growth. Proximity payments are growing with NFC-enabled terminals in retail and transportation. Both models are supported by digital infrastructure improvements. Expanding mobile payment networks accelerate adoption in urban and semi-urban regions.

By End-User

End-users include BFSI 30%, healthcare 15%, retail & e-commerce 25%, IT & telecom 10%, media & entertainment 10%, and transportation 10%, with BFSI and retail leading adoption due to mobile banking, digital wallets, and contactless payment solutions. Healthcare and transportation are growing with telemedicine and smart transit solutions. IT & telecom and media sectors support specialized mobile payment solutions. Broad end-user adoption supports overall market growth.

Regional Analysis

North America - 40% Share

North America leads with 40% share driven by high smartphone penetration, advanced banking infrastructure, and digital wallet adoption in the U.S. and Canada. NFC and mobile apps dominate technology. B2C and remote payments are key. BFSI and retail sectors lead adoption. Regulatory support and fintech innovation drive market growth.

Europe - 25% Share

Europe holds 25% share due to widespread digital payment adoption, e-commerce growth, and contactless technology use in Germany, UK, France, and Italy. NFC and mobile apps dominate. B2C and B2B payments lead. Remote payments are preferred. Retail, BFSI, and transportation sectors drive growth with fintech solutions and regulatory backing.

Asia Pacific - 20% Share

Asia Pacific accounts for 20% share driven by rapid smartphone adoption, mobile wallet growth, and government initiatives in China, India, Japan, and Australia. NFC and mobile apps dominate. B2C and remote payments lead. Retail, BFSI, and healthcare sectors drive adoption. Digital infrastructure expansion supports market growth.

Latin America - 7% Share

Latin America holds 7% share due to increasing smartphone penetration, fintech adoption, and e-commerce growth in Brazil, Mexico, and Argentina. NFC and direct mobile billing dominate. B2C and remote payments are key. BFSI and retail lead adoption. Urbanization and digital infrastructure support market expansion.

Middle East - 5% Share

The Middle East records 5% share driven by mobile wallet adoption, fintech growth, and urban population in UAE, Saudi Arabia, and Qatar. NFC and mobile apps dominate. B2C and remote payments are key. BFSI and retail sectors lead. Government initiatives and smart city projects support market growth.

Africa - 3% Share

Africa holds 3% share due to increasing mobile phone penetration, digital payment awareness, and fintech solutions in South Africa, Nigeria, and Egypt. NFC and direct mobile billing dominate. B2C and remote payments are key. BFSI and retail lead adoption. Fintech growth and mobile banking adoption support gradual market expansion.

Purchase this report before year-end and unlock an exclusive 30% discount:

https://www.datamintelligence.com/buy-now-page?report=mobile-payments-market

(Purchase 2 or more Repots and get 50% Discount)

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?Prasad

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Mobile Payments Market Insights | North America leads with 40% share driven by high smartphone penetration and advanced banking infrastructure here

News-ID: 4307318 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Type II Collagen Market is set to reach US$ 2.14 billion by 2032, North America …

Type II Collagen Market reached US$ 1.31 billion in 2024 and is expected to reach US$ 2.14 billion by 2032, growing at a CAGR of 6.30% during the forecast period 2025-2032.

Type II Collagen is a specialized structural protein supporting joint cartilage integrity, mobility, and shock absorption, widely used in nutraceuticals and therapies targeting arthritis management and joint health.

DataM Intelligence unveils its latest report on the " Type II Collagen Market…

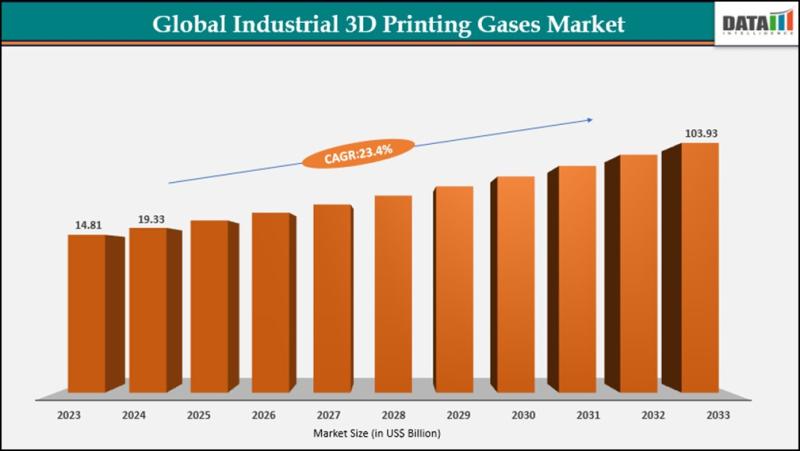

Industrial 3D Printing Gases Market to Reach US$ 103.93 Billion by 2032 at 23.4% …

The industrial 3D printing gases market reached US$ 19.33 billion in 2024 and is expected to reach US$ 103.93 billion by 2032, growing at a CAGR of 23.4% during the forecast period 2025-2032. The market is expanding rapidly alongside the accelerating adoption of additive manufacturing technologies across industrial applications that demand high precision, consistency, and material integrity.

Growth is driven by the critical role of specialty gases such as nitrogen, argon,…

Starter Cultures Market Set for Steady Growth at 5.5% CAGR Through 2031, Led by …

The starter cultures market is forecasted to reach at a CAGR of 5.5% during the forecast period (2024-2031).

Market growth is driven by rising demand for fermented dairy products like yogurt and cheese, increasing consumer preference for probiotic-enriched foods, and expanding applications in plant-based and non-dairy alternatives. Advancements in microbial strain engineering, growing food industry investments in natural preservation technologies, surging popularity of artisanal and functional foods, and supportive regulations for…

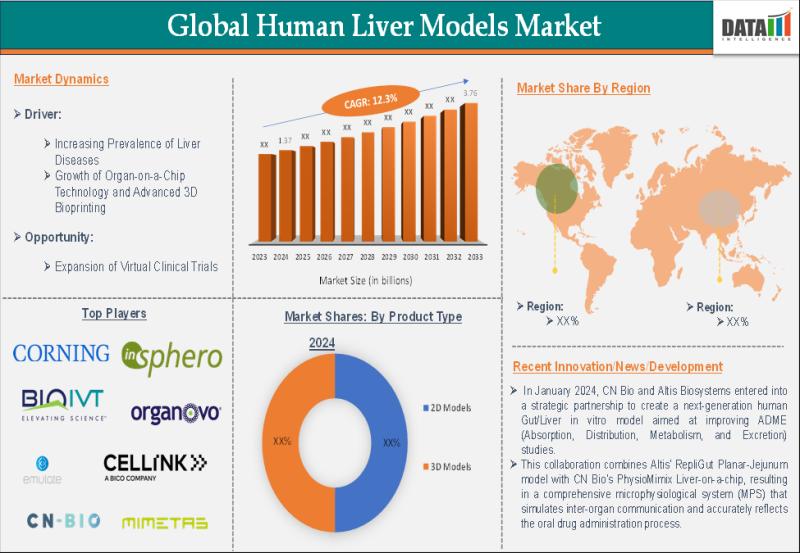

Human Liver Models Market to Reach US$ 3.76 Billion by 2033 at 12.3% CAGR, Drive …

According to DataM Intelligence, the global Human Liver Models market reached US$ 1.37 billion in 2024 and is expected to reach US$ 3.76 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2025-2033, driven by increasing demand for accurate in vitro liver models in ADME studies, toxicology testing, and drug discovery, shift from 2D to advanced 3D and organ-on-chip systems, growing regulatory pressure to reduce animal…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…