Press release

Saudi Arabia Office Real Estate Market Size Projected to Reach USD 37,573.8 Million by 2034 | CAGR is 6.75%

Saudi Arabia Office Real Estate Market OverviewMarket Size in 2025: USD 20,874.6 Million

Market Forecast in 2034: USD 37,573.8 Million

Market Growth Rate 2026-2034: 6.75%

According to IMARC Group's latest research publication, "Saudi Arabia Office Real Estate Market Report by Property Type (High-rise Commercial Buildings, Business Parks, Mixed-use Developments, Coworking Spaces), Rental Model (Traditional Long-term Leases, Flexible Lease Arrangements, Coworking/Shared Office Spaces), Classification (Class A, Class B, Class C), and Region 2026-2034", the Saudi Arabia office real estate market size reached USD 20,874.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 37,573.8 Million by 2034, exhibiting a growth rate (CAGR) of 6.75% during 2026-2034.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-office-real-estate-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Office Real Estate Market

● AI analytics give investors sharp insights into tenant habits and occupancy, powering smarter choices in Riyadh's tight market where Grade A spaces hit 98% occupancy.

● PropTech boom under REGA's push uses AI for energy savings and green buildings, aligning with Vision 2030's sustainability drive and boosting GDP by over 7% digitally.

● ROSHN leverages AI for 3D modeling and fast construction, cutting timelines while mega-projects like NEOM assemble offices via digital twins for efficiency.

● Smart building systems with IoT optimize operations in KSA offices, slashing costs and drawing tenants to tech-savvy spots amid Riyadh rents at SAR 2,700/sq m.

● AI tools automate leasing and predict demand in Saudi's USD 0.86 billion PropTech market, helping SMEs snag flexible spaces in Vision 2030 accelerators.

How Vision 2030 is Transforming Saudi Arabia Office Real Estate Industry?

Vision 2030 is reshaping Saudi Arabia's office real estate market by driving economic diversification, nurturing new business sectors, and attracting multinational companies. Government-led initiatives to expand financial services, technology, and creative industries are increasing demand for modern, flexible office spaces. Major developments such as economic zones and smart city projects are fostering high-quality commercial infrastructure. Additionally, workplace digitalization, sustainability priorities, and hybrid work trends are influencing design preferences, prompting developers to deliver innovative, energy-efficient, and adaptable office environments.

Saudi Arabia Office Real Estate Market Trends & Drivers:

Saudi Arabia's office real estate market is booming thanks to Vision 2030's Regional Headquarters (RHQ) program, which has lured over 350 multinational firms like Amazon and Microsoft to set up shop with 30-year zero-tax perks and mandates for at least 15 senior staff per license. This corporate rush is tightening supply in premium spots, pushing Riyadh's Grade A rents to a record SAR 2,700 per square meter amid 98% occupancy rates, while Jeddah sees steady climbs to SAR 1,280. Mega-projects like the USD 50 billion New Murabba in Riyadh and Jeddah Central are spawning fresh business districts aligned with Expo 2030 and the 2034 FIFA World Cup, drawing tenants who need top-notch connectivity and talent pools nearby. These moves aren't just filling desks-they're reshaping skylines and locking in long-term leases that keep rents firm even as hybrid work evolves.

A big shift comes from the surge in demand for Grade A offices packed with smart tech, sustainability features, and wellness perks, as firms chase LEED Platinum certifications like those in King Abdullah Financial District (KAFD), where 94 towers lead the pack. Riyadh grabs 51.1% of national demand, with Grade A spaces holding 47.9% market share and rents up 23% year-on-year, while developers retrofit older Grade B buildings to compete or risk them turning into something else entirely. The Saudi Building Code 2024 ramps up energy rules, widening the gap between high-end towers like Forbes International Tower aiming for Zero Carbon status and the rest. Tenants love the IoT systems and clean energy splits between hydrogen and solar, making these spaces magnets for ESG-focused global players expanding under diversification goals.

Flexible workspaces and coworking spots are exploding as SMEs hit 1.24 million and Vision 2030 licenses 273 accelerators-triple the pre-2020 count-with hubs like Jada30 backing 245 enterprises and 60,000 users. Hybrid work habits have companies ditching rigid leases for collaborative setups that cut costs and boost teamwork, fueling a coworking market valued at USD 0.6 billion. Riyadh adds 326,600 sq m of leasable area to match this, with 888,600 sq m more in the pipeline, while Jeddah's Gate project readies 230,000 sq m through 2028. Financial services, tech, and consulting firms lead leasing, with credit growth to USD 827.2 billion and fintechs thriving under sandbox rules, turning these spots into real business launchpads.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=13995&method=1315

Saudi Arabia Office Real Estate Industry Segmentation:

The report has segmented the market into the following categories:

Property Type Insights:

● High-rise Commercial Buildings

● Business Parks

● Mixed-use Developments

● Coworking Spaces

Rental Model Insights:

● Traditional Long-term Leases

● Flexible Lease Arrangements

● Coworking/Shared Office Spaces

Classification Insights:

● Class A

● Class B

● Class C

Regional Insights:

● Northern And Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Office Real Estate Market

● December 2025: Knight Frank reports Riyadh leads GCC with soaring Grade-A rents as occupiers snap up ESG-compliant prime offices amid undersupply.

● November 2025: Riyadh office rents surge 15% with 98% occupancy, fueled by 34 new RHQ licenses totaling 634, drawing multinationals to premium spaces.

● September 2025: Five-year Riyadh rent freeze stabilizes costs alongside white land tax reforms, spurring development on 411 million sqm of idle land.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Office Real Estate Market Size Projected to Reach USD 37,573.8 Million by 2034 | CAGR is 6.75% here

News-ID: 4306675 • Views: …

More Releases from IMARC Group

Acetone Price Trend Rises in Q1 2026 on Steady Industrial Demand

The global Acetone Prices continues to reflect dynamic shifts influenced by feedstock costs, downstream demand, and regional supply adjustments. The latest Acetone price index indicates moderate volatility across major producing regions in 2025, with early 2026 trends pointing toward cautious stabilization. Businesses tracking the Acetone price trend analysis & Acetone price forecast are closely monitoring crude-linked raw material movements and industrial demand recovery.

Acetone Current Price Movements:

Recent Acetone Prices have displayed…

India Diamond Market: Size, Share, Trends, Key Players, Opportunity Analysis & F …

The latest report by IMARC Group, 'India Diamond Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034', provides a comprehensive industry analysis. It delivers deep insights into the Indian diamond ecosystem, highlighting growth drivers, competitive landscapes, and emerging segment trends for the 2026-2034 forecast period.

What is the India Diamond Market Size, Share, Trends, and Growth Forecast (2026-2034)?

According to the latest analysis by IMARC Group, the India diamond…

India Electric Three-wheeler Market Overview, Trends, Growth Drivers, Top Player …

India Electric Three-wheeler Market: Overview

According to IMARC Group's report titled "India Electric Three-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Drive Type, Motor Type, Power Output, Voltage Capacity, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The India electric three-wheeler market size was valued at USD 1,174.1 Million in 2024. The market is projected to…

India Coffee Market Size, Share, Trends, Industry Analysis, Growth, Opportunity …

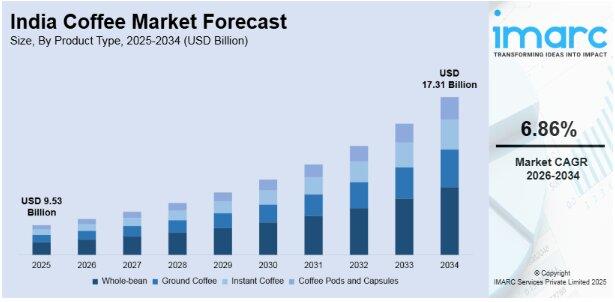

The latest report by IMARC Group, 'India Coffee Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034', provides a comprehensive industry analysis. It delivers deep insights into the ecosystem, highlighting growth drivers, competitive landscapes, and emerging segment trends for the 2026-2034 forecast period.

What is the India Coffee Market Size, Share, Trends, and Growth Forecast (2026-2034)?

According to the latest analysis by IMARC Group, the coffee market…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…