Press release

Vanadium Prices, Trend, Chart, Index & Analysis Sep 2025

North America Vanadium Prices Movement Sep 2025:Vanadium Prices in USA:

During the third quarter of 2025, vanadium prices in the USA rose to 9766 USD/MT in September. The increase was supported by steady demand from the alloy, aerospace, and energy-storage industries, which boosted procurement activities. Market tightening stemmed from fluctuations in mining output and periodic disruptions at conversion facilities. Higher processing and upgrading costs for vanadium feedstock further contributed to the upward pricing trend.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/vanadium-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

APAC Vanadium Prices Movement Sep 2025:

Vanadium Prices in China:

During the third quarter of 2025, vanadium prices in China fell to 8491 USD/MT in September. The decline was driven by reduced consumption from steel and chemical manufacturers, who scaled back production and limited raw material intake. Supply remained sufficient due to continuous plant operations and reliable feedstock availability. Improved logistics improved distribution efficiency, encouraging buyers to postpone purchases amid softer market sentiment.

Vanadium Prices in India:

During the third quarter of 2025, vanadium prices in India settled at 12758 USD/MT in September, posting a slight decrease. Demand from specialty alloys, tool steel, and catalyst applications remained stable but not strong enough to support higher price levels. Domestic supply conditions were steady, aided by consistent conversion runs and adequate ore availability. Reduced freight bottlenecks and smoother import flows also contributed to a subdued pricing environment.

Regional Analysis: The price analysis can be extended to provide detailed Vanadium price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries.

Vanadium Prices in Canada:

During the third quarter of 2025, vanadium prices in Canada climbed to 11469 USD/MT in September. Stronger demand from advanced alloy producers and industrial steel manufacturers supported the upward trend. Supply tightened intermittently due to variable mining yields and fluctuating processing rates. Increasing export interest and higher feedstock-handling expenses further encouraged suppliers to raise price offers during the quarter.

Vanadium Prices in Netherlands:

During the third quarter of 2025, vanadium prices in the Netherlands declined to 13101 USD/MT in September. The downturn reflected weakened purchasing activity from the steel, catalyst, and chemical-processing industries. Stable availability of imported vanadium ensured comfortable supply across European trading centers. Enhanced maritime and inland transport efficiency also reduced logistical pressure, reinforcing the mild downward movement in prices.

Purchase Options: https://www.imarcgroup.com/checkout?id=23467&method=1925

• Biannual Updates: For 2 Deliverables, Billed Annually

• Quarterly Updates: For 4 Deliverables, Billed Annually

• Monthly Updates: For 12 Deliverables, Billed Annually

We Also Provide News and Historical Data of Vanadium

• Historical Data: Comprehensive historical pricing and market trends.

• Quarterly Analysis: Detailed insights into price fluctuations and market dynamics.

• Regional and Global Data: Coverage of key markets and their performance.

• Forecast Comparisons: Historical data paired with future market projections.

• Customizable Reports: Tailored analysis to meet specific business needs.

What is Vanadium?

Vanadium is a transition metal primarily used as an alloying element in steel, specialty alloys, and high-performance materials. Known for its exceptional strength, durability, and corrosion resistance, vanadium significantly enhances the hardness and heat resistance of steel. It is also essential in catalysts, aerospace components, chemical applications, and increasingly in next-generation energy-storage systems such as vanadium redox flow batteries (VRFBs). Major vanadium production comes from China, Russia, South Africa, and emerging mining operations in North America.

Factors Affecting Vanadium Prices

1. Steel Sector Demand

Most global vanadium consumption is linked to high-strength low-alloy (HSLA) steel production. Any rise or slowdown in construction, automotive, or infrastructure projects directly impacts vanadium pricing.

2. Mining Output & Ore Availability

Fluctuations in vanadium-bearing ore mining, especially from titanomagnetite deposits, influence global supply levels. Disruptions or low yields often lead to price volatility.

3. Energy-Storage Industry Growth

Growing adoption of VRFBs for grid storage boosts vanadium demand. Policy incentives and renewable-energy expansion add upward pressure to prices.

4. Feedstock & Processing Costs

Costs associated with extraction, upgrading, and conversion of vanadium slag or ore significantly influence market prices, especially in regions with high energy costs.

5. Trade Policies & Export Controls

Changes in export regulations, tariffs, or quotas-particularly from large producers like China and Russia-can alter global supply balance.

6. Logistics, Freight & Supply Chain Efficiency

Shipping constraints, port congestion, or rising freight expenses affect landed prices of vanadium products in major markets.

7. Currency Fluctuations

Exchange-rate volatility impacts import costs for countries dependent on foreign vanadium sources (e.g., India, Europe).

Vanadium Supply Overview (2025)

• China remains the world's largest vanadium producer, with consistent feeds from steel slag.

• South Africa and Russia maintain significant contributions but face periodic mining and geopolitical constraints.

• North America and Australia are expanding production through new mining and recovery projects.

• Secondary recovery from petroleum residues and spent catalysts adds supplementary supply.

• Supply in 2025 was marked by intermittent tightening due to variable mining yields and conversion-plant maintenance cycles.

Vanadium Prices & Index Trend (September 2025)

Price Trends:

By September 2025:

• The USA saw strong upward pricing driven by demand from aerospace, alloys, and battery-storage sectors.

• China recorded softer pricing as steel manufacturers reduced output, leaving supply sufficiently balanced.

• India observed mild easing due to stable demand and efficient imports.

• Canada experienced upward momentum due to improved alloy demand and higher operational costs.

• Europe (Netherlands) noted a decline as steel, chemical, and catalyst users scaled back purchases.

Index Movement:

• Vanadium price indices showed mixed performance, with Western markets trending upward and Asian markets trending downward.

• Energy-linked production costs pushed indices higher in the Americas, while muted steel demand softened numbers across East Asia.

Latest News & Market Developments (2025)

• Increasing global interest in vanadium redox flow batteries strengthened long-term demand projections.

• Several countries advanced new mining and recovery projects to reduce reliance on Chinese supply.

• Geopolitical tensions affected Russian exports, tightening European supply channels.

• Advances in aerospace material technologies increased usage of vanadium in titanium alloys.

• Improved logistics in Asia helped stabilize short-term supply, moderating price spikes.

Current Demand Scenario (Q3-Q4 2025)

Strong demand originates from:

• HSLA and specialty steel production

• Aerospace superalloys and turbine components

• Catalysts for chemical and petroleum refining

• Large-scale battery storage (VRFBs)

• Industrial tools, pipelines, structural components, and metal reinforcement

Demand remained healthy in North America and Europe, while Asian demand softened temporarily due to reduced steel output.

Future Demand Outlook (2025-2026)

• Adoption of renewable-energy storage systems will strongly support long-term vanadium demand.

• Rising construction and infrastructure development in emerging markets is expected to revive steel-sector consumption.

• Growth in aerospace manufacturing and defense applications will contribute to sustained demand.

• New mining and secondary recovery projects may ease global supply constraints by late 2026.

• Overall, vanadium demand is projected to show steady to strong growth, particularly in green-energy and high-performance alloy sectors.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=23467&flag=C

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, "Vanadium Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition," presents a detailed analysis of Vanadium price trend, offering key insights into global Vanadium market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Vanadium demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Vanadium Prices, Trend, Chart, Index & Analysis Sep 2025 here

News-ID: 4306605 • Views: …

More Releases from IMARC Group

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

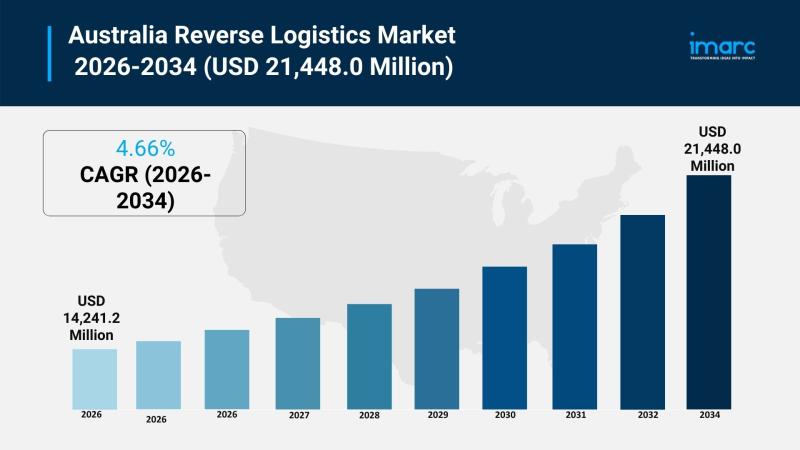

Australia Reverse Logistics Market Projected to Reach USD 21,448.0 Million by 20 …

Market Overview

The Australia reverse logistics market size reached USD 14,241.2 Million in 2025 and is projected to reach USD 21,448.0 Million by 2034, growing at a CAGR of 4.66% during 2026-2034. This expansion is driven by the rise in e-commerce platforms, environmental sustainability efforts, and the integration of advanced technologies in logistics operations. The market encompasses return types, services, end users, and regional segments across Australia. For more details, visit…

Global Hummus Market Report 2026-2034: Growth, Trends, Packaging, Channels & Reg …

The global hummus market size reached USD 4.7 Billion in 2025 and is anticipated to reach USD 9.1 Billion by 2034, reflecting a CAGR of 7.50% during the forecast period 2026-2034. This growth is driven by increasing lifestyle diseases, rising health-conscious consumers, and escalating demand for plant-based proteins. The popularity of hummus as a substitute for traditional condiments further supports market expansion.

Study Assumption Years

Base Year: 2025

Historical Period: 2020-2025

Forecast Period:…

More Releases for Vanadium

Emerging Trends Influencing The Growth Of The Vanadium Ore Market: Energizing Th …

The Vanadium Ore Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Vanadium Ore Market Size and Projected Growth Rate?

The size of the vanadium ore market has seen consistent growth over the past few years. From 2024 to 2025, the forecast predicts an…

Vanadium Pentoxide for Electrolyte of Vanadium Battery Market Expected to Rise: …

LOS ANGELES, United States: The global Vanadium Pentoxide for Electrolyte of Vanadium Battery market is comprehensively and accurately detailed in the report, taking into consideration various factors such as competition, regional growth, segmentation, and market size by value and volume. This is an excellent research study specially compiled to provide latest insights into critical aspects of the global Vanadium Pentoxide for Electrolyte of Vanadium Battery market. The report includes…

Vanadium Trioxide Market to Witness Stunning Growth with EVRAZ, Atlantic, Vanadi …

The latest study released on the Global Vanadium Trioxide Market by HTF MI evaluates market size, trend, and forecast to 2030. The Vanadium Trioxide market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players in…

Vanadium Pentoxide for Electrolyte of Vanadium Battery Market 2028: Industry Gro …

QY Research has recently published a new report, titled Global Vanadium Pentoxide for Electrolyte of Vanadium Battery Market Report, History and Forecast 2017-2028, Breakdown Data by Manufacturers, Key Regions, Types and Application. The report has been put together using primary and secondary research methodologies, which offer an accurate and precise understanding of the Vanadium Pentoxide for Electrolyte of Vanadium Battery market. Analysts have used a top-down and bottom-up approach to…

Vanadium Redox Battery (VRB) Market is Thriving Worldwide | Australian Vanadium, …

The Latest research study released by HTF MI “Global Vanadium Redox Battery (VRB) Market” with 100+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint and status (2022-2028). Understanding the segments helps in identifying the importance of different factors that aid the market growth. Some of the Major Companies covered…

Vanadium Market: Year 2020-2027 and its detail analysis by focusing on top key p …

The research report provides a big picture on "Vanadium market" 2027, on a global basis, offering a forecast and statistic in terms of revenue during the forecast period. This report covers detailed segmentation, complete R & D history, and explanatory analysis including the latest news. Furthermore, the study explains the future opportunities and a sketch of key players involved in the "Vanadium hike in terms of revenue.

Get sample PDF of…