Press release

Lithium Carbonate Production Plant Setup: Cost, Process, and Market Outlook

Setting up a lithium carbonate production plant involves selecting a suitable manufacturing method such as extraction from lithium-bearing brines through solar evaporation and chemical precipitation, or processing of hard rock spodumene ore through roasting and acid leaching followed by purification and carbonation, securing raw material supply from brine operations or spodumene mining, installing evaporation ponds or roasting kilns, precipitation reactors, filtration and washing systems, drying equipment, and comprehensive quality control facilities, and ensuring compliance with environmental regulations, mining permits, and battery-grade purity specifications.IMARC Group's report, titled "Lithium Carbonate Production Cost Analysis 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," provides a complete roadmap for setting up a lithium carbonate production plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc.

Request for a Sample Report: https://www.imarcgroup.com/lithium-carbonate-manufacturing-plant-project-report/requestsample

What is Lithium Carbonate?

Lithium carbonate is an inorganic chemical compound with the formula Li2CO3, commonly used as a key raw material in the lithium industry. It appears as a white, odorless, crystalline powder that is highly stable and slightly soluble in water. Lithium carbonate plays a crucial role in producing lithium‐ion batteries, which power electric vehicles, smartphones, laptops, and energy storage systems. It is also used in pharmaceuticals for treating bipolar disorder, and in ceramics and glass manufacturing to enhance strength and thermal resistance. With rapid technological advancements, lithium carbonate has become essential in clean energy applications and the global shift toward sustainability.

What is driving Lithium Carbonate Production?

Lithium carbonate production is primarily driven by the rapid growth of the electric vehicle (EV) industry, which heavily relies on lithium‐ion batteries for long-range performance and efficient energy storage. Increasing adoption of renewable energy systems - including solar and wind power - demands advanced battery storage technologies, boosting lithium consumption worldwide. Government policies promoting decarbonization, sustainability, and reduction of fossil fuel dependency further accelerate lithium carbonate demand. Additionally, continuous expansion of consumer electronics such as smartphones, tablets, and wearable devices adds significant pressure on the lithium supply chain. Technological innovations in battery chemistry and recycling, along with rising investments in mining and processing facilities, are enabling increased production capacities. Furthermore, growing demand from aerospace, medical devices, and glass and ceramics industries contributes to market expansion. As countries pursue electrification and greener infrastructure, lithium carbonate remains a strategic material shaping future energy and transportation solutions.

Buy Now: https://www.imarcgroup.com/checkout?id=10048&method=2142

Key Insights for setting up a Lithium Carbonate Production Plant

Detailed Process Flow

• Product Overview

• Unit Operations Involved

• Mass Balance and Raw Material Requirements

• Quality Assurance Criteria

• Technical Tests

Project Details, Requirements and Costs Involved:

• Land, Location and Site Development

• Plant Layout

• Machinery Requirements and Costs

• Raw Material Requirements and Costs

• Packaging Requirements and Costs

• Transportation Requirements and Costs

• Utility Requirements and Costs

• Human Resource Requirements and Costs

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Project Economics:

• Capital Investments

• Operating Costs

• Expenditure Projections

• Revenue Projections

• Taxation and Depreciation

• Profit Projections

• Financial Analysis

Profitability Analysis:

• Total Income

• Total Expenditure

• Gross Profit

• Gross Margin

• Net Profit

• Net Margin

Key Cost Components

• Land and Site Development: For brine operations-extensive evaporation pond construction in arid climates (1,000+ hectares), processing facility foundations; For hard rock-crushing plant infrastructure, roasting kiln foundations, acid plant integration, tailings management facilities.

• Machinery and Equipment: Brine Route: Pumping systems, evaporation pond infrastructure, precipitation reactors, filtration systems, centrifuges, spray dryers, micronization equipment, DLE systems (emerging); Hard Rock Route: Crushing and grinding mills, rotary kilns for spodumene roasting (1,050-1,100°C), acid leaching tanks, solvent extraction units, precipitation vessels, calcination furnaces, quality control laboratories (ICP-MS, XRF).

• Construction and Civil Work: Evaporation pond construction and lining, chemical-resistant processing facilities, high-temperature equipment foundations, tailings dams (hard rock), water management infrastructure, utilities installation.

• Environmental Compliance: Water management and recycling systems, brine discharge treatment, tailings management facilities, air emission controls for roasting operations, dust suppression systems, environmental monitoring programs, and regulatory permits.

• Technology Licensing or R&D: DLE technology licensing, proprietary purification processes, battery-grade quality enhancement methods, spodumene beneficiation technologies, or in-house process optimization programs.

Economic Trends Influencing Lithium Carbonate Plant Setup Costs 2025

• Electric Vehicle Revolution: Explosive EV adoption globally (projected 30-40% of new car sales by 2030) drives unprecedented lithium demand growth, justifying massive capital investments despite high setup costs.

• Resource Availability and Competition: Limited high-grade lithium resources (brine deposits in South America's "Lithium Triangle," hard rock in Australia, emerging resources in Africa and North America) create intense competition for quality reserves.

• Technology Transition to DLE: Direct lithium extraction technologies promise faster production (weeks vs. 12-18 months for evaporation), reduced water usage, and smaller land footprint-but require higher CAPEX and are still scaling commercially.

• Battery-Grade Purity Requirements: Stringent specifications for battery applications (>99.5% purity, low heavy metals, controlled particle size) necessitate advanced purification infrastructure beyond traditional industrial-grade production.

• Energy Cost Impact: Hard rock processing (energy-intensive roasting at 1,050°C) makes facilities highly sensitive to electricity and natural gas prices, favoring locations with renewable energy access.

• Supply Chain Bottlenecks: Shortage of qualified engineering contractors, specialized equipment (roasting kilns, DLE systems), and experienced personnel creates project delays and cost escalations in this rapidly expanding sector.

• Price Volatility: Lithium carbonate prices ranging from $15,000-80,000/ton over recent years create financial modeling challenges and risk assessment complexity for long-term investments.

Request for Customized Report: https://www.imarcgroup.com/request?type=report&id=10048&flag=E

Challenges and Considerations for Investors

• Exceptional Capital Investment: Lithium carbonate plants rank among the most capital-intensive chemical facilities-brine operations requiring $300-800 million, hard rock plants $500 million-1.5 billion+ depending on capacity and integration level.

• Long Development Timeline: Brine operations require 3-5 years from exploration to production (including 12-18 months evaporation), hard rock projects 4-6 years-creating extended periods before revenue generation.

• Resource Risk and Reserve Uncertainty: Geological uncertainty in brine composition, lithium concentration variability, and hard rock ore grade consistency affect production planning and economics.

• Extreme Price Volatility: Lithium carbonate market experiences boom-bust cycles with prices fluctuating 5-6x, creating revenue uncertainty despite long-term growth trajectory.

• Environmental and Social License: Water usage in arid regions, tailings management, indigenous land rights, and community impacts create permitting challenges and operational restrictions.

• Quality Specification Evolution: Battery chemistry evolution (LFP, NMC, solid-state) may alter lithium compound specifications and demand patterns, requiring production flexibility.

• Geopolitical Considerations: Resource nationalism, export restrictions, strategic mineral designations, and supply chain security concerns affect investment risk and market access.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lithium Carbonate Production Plant Setup: Cost, Process, and Market Outlook here

News-ID: 4304456 • Views: …

More Releases from IMARC Group

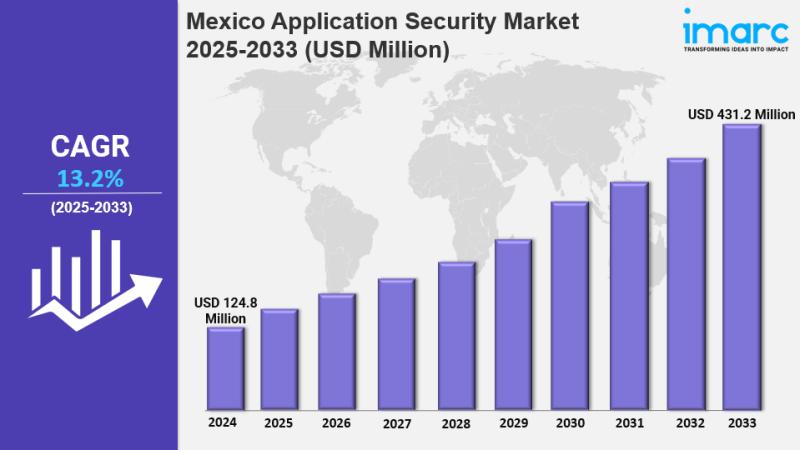

Mexico Application Security Market Size, Share, Industry Trends, Growth Factors …

IMARC Group has recently released a new research study titled "Mexico Application Security Market Size, Share, Trends and Forecast by Component, Type, Testing Type, Deployment Mode, Organization Size, Industry Vertical, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico application security market was valued at USD 124.8 Million in 2024 and…

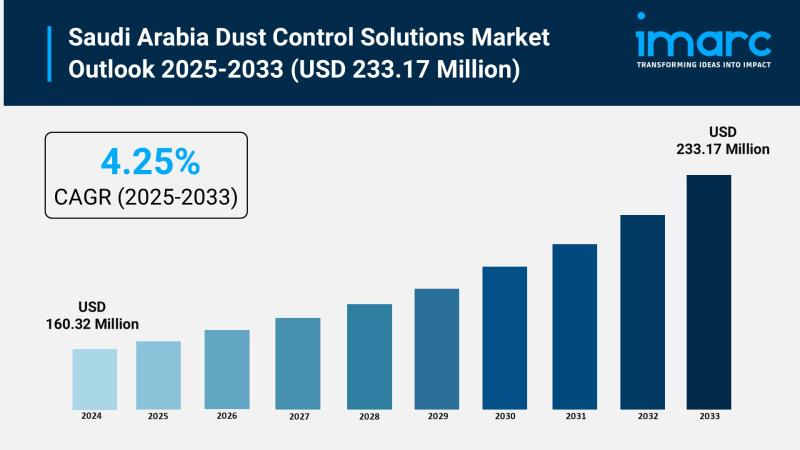

Saudi Arabia Dust Control Solutions Market Size to Surpass USD 233.17 Million by …

Saudi Arabia Dust Control Solutions Market Overview

Market Size in 2024: USD 160.32 Million

Market Size in 2033: USD 233.17 Million

Market Growth Rate 2025-2033: 4.25%

According to IMARC Group's latest research publication, "Saudi Arabia Dust Control Solutions Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia dust control solutions market size reached USD 160.32 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 233.17 Million…

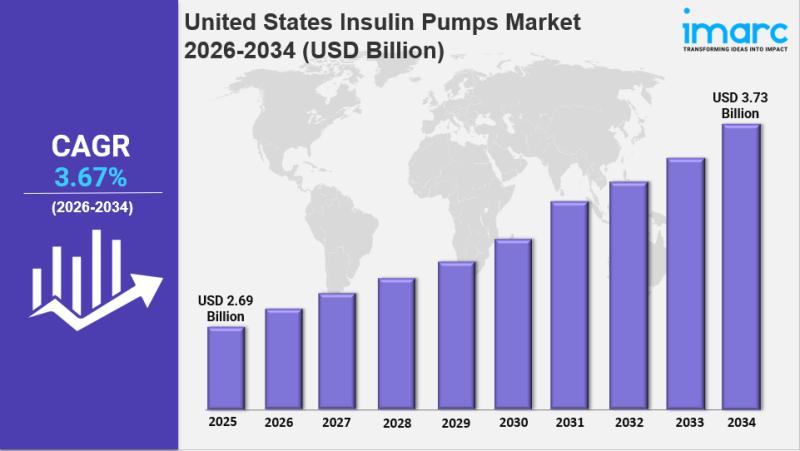

United States Insulin Pumps Market Size, Trends, Growth and Forecast 2026-2034

IMARC Group has recently released a new research study titled "United States Insulin Pumps Market Report by Product Type (Insulin Pumps, Insulin Pump Supplies and Accessories), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Sales, Diabetes Clinics/ Centers, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States insulin pumps…

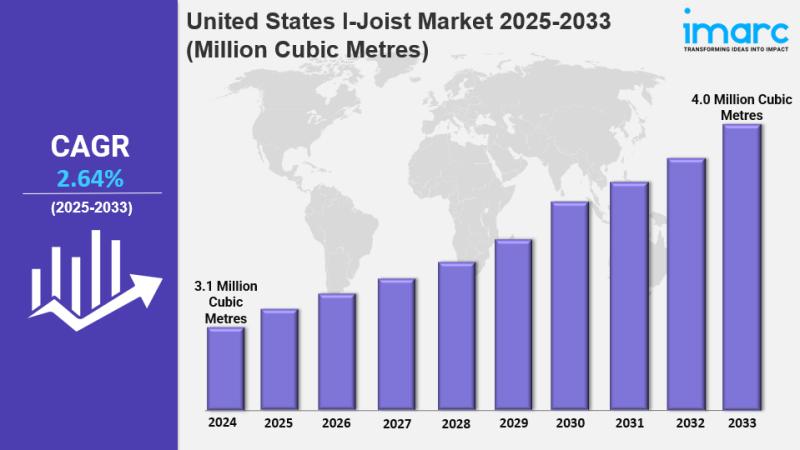

United States I-Joist Market Share, Size, In-Depth Insights, Trends and Forecast …

IMARC Group has recently released a new research study titled "United States I-Joist Market Report by Sector (Residential, Commercial), New Construction and Replacement (New Construction, Replacement), Application (Floors, Roofs, and Others), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States I-Joist market size reached 3.1 Million Cubic Metres in 2024.…

More Releases for Cost

Steel Production Cost - Process Economics, Raw Materials, and Cost Drivers

Steel is the backbone of modern industry, and its production cost is one of the most closely tracked indicators across construction, infrastructure, automotive, and manufacturing sectors. Unlike niche chemicals or APIs, steel economics are driven by scale, energy intensity, and raw material volatility.

Here's the thing: steel production cost isn't just about iron ore prices. It's a layered equation involving coking coal, electricity, labor, emissions compliance, logistics, and technology choice. A…

Egg Powder Manufacturing Plant Setup Cost | Cost Involved, Machinery Cost and In …

IMARC Group's report titled "Egg Powder Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing an egg powder manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to…

Glucose Manufacturing Plant Cost Report 2024: Requirements and Cost Involved

IMARC Group's report titled "Glucose Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" provides a comprehensive guide for establishing a glucose manufacturing plant. The report covers various aspects, ranging from a broad market overview to intricate details like unit operations, raw material and utility requirements, infrastructure necessities, machinery requirements, manpower needs, packaging and transportation requirements, and more.

In addition to the operational…

Fatty Alcohol Production Cost Analysis: Plant Cost, Price Trends, Raw Materials …

Syndicated Analytics' latest report titled "Fatty Alcohol Production Cost Analysis 2023-2028: Capital Investment, Manufacturing Process, Operating Cost, Raw Materials, Industry Trends and Revenue Statistics" includes all the essential aspects that are required to understand and venture into the fatty alcohol industry. This report is based on the latest economic data, and it presents comprehensive and detailed insights regarding the primary process flow, raw material requirements, reactions involved, utility costs, operating costs, capital…

Corn Production Cost Analysis Report: Manufacturing Process, Raw Materials Requi …

The latest report titled "Corn Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Corn. Read More: https://www.procurementresource.com/production-cost-report-store/corn

Report Features - Details

Product Name - Corn Production

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost, Auxiliary Equipment…

Crude Oil Production Cost Analysis Report: Manufacturing Process, Raw Materials …

The latest report titled "Crude Oil Production Cost Report" by Procurement Resource, a global procurement research and consulting firm, provides an in-depth cost analysis of the production process of the Crude Oil. Read More: https://www.procurementresource.com/production-cost-report-store/crude-oil

Report Features - Details

Product Name - Crude Oil

Segments Covered

Manufacturing Process: Process Flow, Material Flow, Material Balance

Raw Material and Product/s Specifications: Raw Material Consumption, Product and Co-Product Generation, Capital Investment

Land and Site Cost: Offsites/Civil Works, Equipment Cost,…