Press release

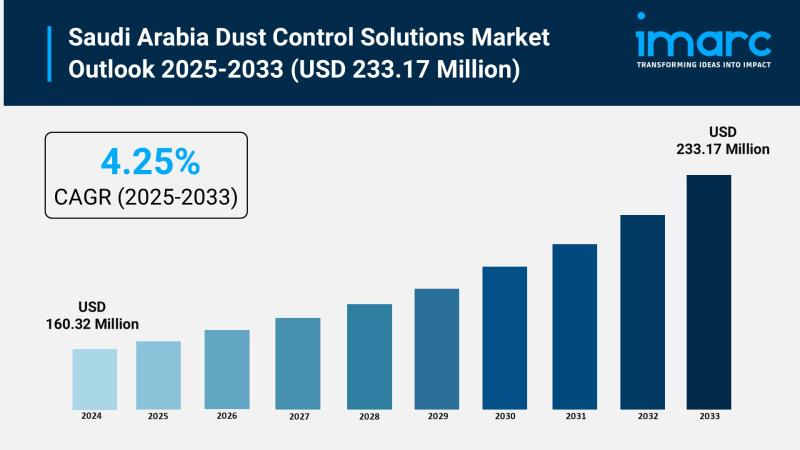

Saudi Arabia Dust Control Solutions Market Size to Surpass USD 233.17 Million by 2033, at a CAGR of 4.25%

Saudi Arabia Dust Control Solutions Market OverviewMarket Size in 2024: USD 160.32 Million

Market Size in 2033: USD 233.17 Million

Market Growth Rate 2025-2033: 4.25%

According to IMARC Group's latest research publication, "Saudi Arabia Dust Control Solutions Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia dust control solutions market size reached USD 160.32 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 233.17 Million by 2033, exhibiting a CAGR of 4.25% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Dust Control Solutions Market

● AI-powered sensors and IoT-enabled systems enable real-time dust monitoring and automated response mechanisms, optimizing suppression system activation across construction sites and mining operations in Saudi Arabia.

● Machine learning algorithms analyze weather patterns, dust storm trajectories, and environmental conditions to predict dust events, allowing proactive deployment of control measures in industrial facilities throughout the Kingdom.

● AI-driven smart misting and dosing systems automatically adjust spray intensity and chemical concentration based on real-time particulate matter (PM) readings, reducing water and chemical consumption while maximizing dust suppression efficiency.

● Predictive analytics optimize maintenance schedules for dust collection systems and filters, minimizing equipment downtime and extending operational lifespan in Saudi Arabia's harsh desert environment.

● Computer vision and AI-powered monitoring systems detect dust emissions at their source, enabling immediate corrective actions and ensuring compliance with Saudi environmental regulations while protecting worker health.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-dust-control-solutions-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Dust Control Solutions Industry

Saudi Arabia's Vision 2030 is reshaping the dust control solutions industry by emphasizing environmental sustainability, worker health, and safer industrial practices. Stricter regulations and mega-projects such as NEOM, the Red Sea Project, and Qiddiya are driving demand for advanced, eco-friendly, and water-efficient dust suppression technologies. Overall, Vision 2030 positions dust control as a key requirement for sustainable infrastructure development and responsible industrial growth across the Kingdom.

Saudi Arabia Dust Control Solutions Market Trends & Drivers:

Saudi Arabia's dust control solutions market is experiencing steady growth, driven by the Kingdom's ambitious construction boom and mega-project developments under Vision 2030. Major initiatives including NEOM, the Red Sea Project, Qiddiya, and extensive urban development across Riyadh, Jeddah, and Dammam generate unprecedented demand for sophisticated dust suppression systems. The construction sector's embrace of environmentally sustainable practices, mandated by government regulations, promotes adoption of bio-based suppressants and water-efficient technologies that preserve the Kingdom's limited desalination capacity. Advanced chemical formulations, including polymer emulsions and hygroscopic agents, enable extended moisture retention on haul roads and construction sites, significantly reducing water consumption-a critical consideration in Saudi Arabia's arid climate.

The mining sector's expansion contributes substantially to market growth, with Saudi Arabia actively developing its mineral resources including phosphate, bauxite, gold, and copper deposits. Mining operations require comprehensive dust control solutions to protect worker health, meet environmental compliance standards, and maintain operational efficiency. The industry increasingly adopts IoT-enabled smart misting systems that automatically adjust based on real-time particulate matter monitoring, reducing chemical and water usage while ensuring effective dust suppression. Rising awareness of occupational health hazards associated with silica dust and other airborne particulates drives mining companies to invest in advanced dust collection systems, including wet scrubbers, electrostatic precipitators, and baghouse filters.

Saudi Arabia Dust Control Solutions Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

● Wet

● Wet Scrubbers

● Wet Electrostatic Precipitators (WEPS)

● Dry

● Bag Dust Collectors

● Cyclone Dust Collectors

● Electrostatic Dust Collectors

● Vacuum Dust Collectors

● Others

Application Insights:

● Construction

● Mining

● Oil and Gas

● Chemical

● Food and Beverage

● Others

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

● Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=35226&method=1315

Recent News and Developments in Saudi Arabia Dust Control Solutions Market

● December 2025: Saudi Arabia's UNCCD COP16 Presidency launched an international initiative for sand and dust storm monitoring, enhancing global early warning systems. This effort builds on the World Meteorological Organization's (WMO) existing capacity, including the Sand and Dust Storm Warning Advisory and Assessment System (SDS-WAS) based in Jeddah. The initiative aims to improve monitoring in countries lacking resources, with Saudi Arabia committing USD 10 Million over five years to expand global dust storm prediction capabilities and support affected nations.

● January 2024: Researchers from UNSW Sydney proposed advanced cooling technologies and reflective materials to reduce temperatures in Riyadh by up to 4.5°C, addressing extreme heat and dust storms common in the capital city. This strategy aims to combat environmental challenges posed by climate change and rapid urban expansion while enhancing environmental sustainability and quality of life through innovative urban planning solutions.

● July 2024: The executive director of the Sand and Dust Storm Warning Regional Center highlighted a significant decline in dust storms in Saudi Arabia, attributing it to the Kingdom's environmental efforts under Vision 2030. This includes the Saudi Green Initiative, which targets planting 50 Billion trees, and regional collaborations on dust storm mitigation, demonstrating the positive impact of comprehensive environmental management strategies.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Dust Control Solutions Market Size to Surpass USD 233.17 Million by 2033, at a CAGR of 4.25% here

News-ID: 4331782 • Views: …

More Releases from IMARC Group

Charcoal Production Plant DPR & Unit Setup 2026: Demand Analysis and Project Cos …

Setting up a charcoal production plant involves strategic planning, substantial capital investment, and comprehensive understanding of production technologies. This essential biomass fuel serves cooking, heating, metallurgical, and industrial applications. Success requires careful site selection, efficient carbonization processes, proper kiln systems, reliable wood and biomass sourcing, and compliance with environmental and forestry regulations to ensure profitable and sustainable operations.

IMARC Group's report, "Charcoal Production Plant Project Report 2026: Industry Trends, Plant Setup,…

Grease Manufacturing Plant DPR 2026: CapEx/OpEx Analysis with Profitability Fore …

Setting up a grease manufacturing plant involves strategic planning, substantial capital investment, and comprehensive understanding of production technologies. This essential lubricant serves automotive, industrial machinery, and heavy equipment applications. Success requires careful site selection, efficient blending and mixing processes, quality control systems, reliable raw material sourcing from base oil and thickener suppliers, and compliance with environmental and safety regulations to ensure profitable and sustainable operations.

IMARC Group's report, "Grease Production Plant…

Tequila Manufacturing Plant Cost 2026: CapEx, OpEx & ROI Analysis

Setting up a Tequila Manufacturing Plant positions investors in one of the most stable and essential segments of the premium spirits and alcoholic beverages value chain, backed by sustained global growth driven by rising international demand for authentic agave-based spirits, increasing consumer preference for premium and super-premium heritage-driven beverages, expanding consumption across hospitality, retail, and export channels, and the dual-benefit advantages of strong brand loyalty combined with high-margin product differentiation.…

Prefabricated Building and Structural Steel Manufacturing Plant Cost Analysis Re …

Setting up a prefabricated building and structural steel manufacturing plant positions investors within one of the most dynamic and infrastructure-driven segments of the global construction and industrial manufacturing sector, supported by accelerating urbanization, expanding industrial corridors, and rising demand for fast-track, cost-efficient building solutions across residential, commercial, and industrial projects.

Prefabricated structures and structural steel components play a critical role in modern construction by enabling reduced project timelines, improved quality…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…