Press release

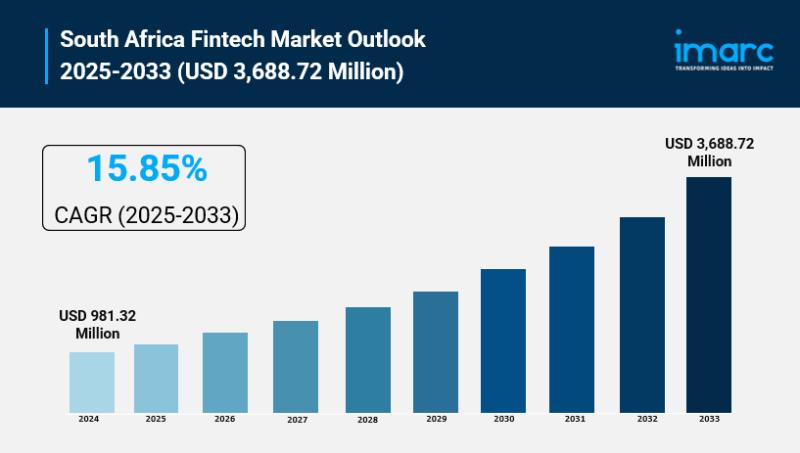

South Africa Fintech Market Set to Surge to USD 3,688.72 Million by 2033 at a 15.85% CAGR

South Africa Fintech Market OverviewMarket Size in 2024: USD 981.32 Million

Market Size in 2033: USD 3,688.72 Million

Market Growth Rate 2025-2033: 15.85%

According to IMARC Group's latest research publication, "South Africa Fintech Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa fintech market size reached USD 981.32 Million in 2024. The market is projected to reach USD 3,688.72 Million by 2033, exhibiting a growth rate (CAGR) of 15.85% during 2025-2033.

How AI is Reshaping the Future of South Africa Fintech Market

● AI-driven digital payment systems are accelerating the adoption of cashless transactions, enhancing security and user convenience across urban and rural areas.

● Automated underwriting through AI enables faster loan approvals on digital lending platforms, reaching underserved individuals and SMEs efficiently.

● AI integration in open banking enhances personalized financial services by analyzing customer data securely with regulatory compliance.

● AI-powered fraud detection and risk assessment tools improve trust and reduce operational losses for fintech firms and financial institutions.

● AI-enabled chatbots and virtual assistants improve customer service and operational efficiency by handling queries and transactions 24/7.

● Companies like Street Wallet leverage AI to develop innovative payment solutions that do not require smartphones or bank accounts, expanding digital inclusion.

Grab a sample PDF of this report: https://www.imarcgroup.com/south-africa-fintech-market/requestsample

Market Growth Factors

The South African fintech market is experiencing a surge in mobile money and digital payments, driven by widespread smartphone penetration exceeding 67% and a tech-savvy younger demographic comprising nearly 60% of users, which has propelled transaction volumes to record highs in 2025. This trend is fueled by innovative platforms like digital wallets and contactless solutions, enabling seamless remittances and peer-to-peer transfers that cater to the informal economy, which accounts for about 30% of GDP. As a result, fintech firms are bridging urban-rural divides, with projections indicating the digital payments segment will grow at over 16% annually through 2030, enhancing everyday commerce and reducing reliance on cash.

Artificial intelligence and open banking are reshaping credit access and personalized financial services in South Africa, where AI-driven models now assess alternative data for lending to the 15% unbanked population, boosting inclusion for SMEs that form over 90% of businesses. Regulatory advancements, including open finance frameworks, have spurred bank-fintech partnerships, allowing embedded finance in non-financial apps for real-time data sharing and tailored products like robo-advisory and BNPL options. This convergence is accelerating market expansion, with the lending sector expected to rise by 28% in value by 2025, fostering economic empowerment amid supportive policies from innovation sandboxes.

The rise of virtual assets and blockchain is positioning South Africa as a crypto hub in Africa, with imminent large-scale retail adoption supported by evolving regulations in nations like Mauritius and Nigeria that align with global standards, drawing venture capital and cross-border investments. Drivers include blockchain's role in secure, low-cost DeFi platforms that address high remittance fees, alongside a thriving startup ecosystem valued at over USD 9 billion in 2025, attracting international players through stable infrastructure. This trend not only diversifies investment options but also enhances cybersecurity via biometric tools and RegTech, projecting the digital assets market to reach USD 373 million in total AUM this year, underscoring fintech's pivotal role in sustainable growth.

Access the Latest 2026 Data & Forecasts: https://www.imarcgroup.com/checkout?id=41872&method=1590

Market Segmentation

Deployment Mode Insights:

● On-Premises

● Cloud-Based

Technology Insights:

● Application Programming Interface

● Artificial Intelligence

● Blockchain

● Robotic Process Automation

● Data Analytics

● Others

Application Insights:

● Payment and Fund Transfer

● Loans

● Insurance and Personal Finance

● Wealth Management

● Others

End User Insights:

● Banking

● Insurance

● Securities

● Others

Regional Insights:

● Gauteng

● KwaZulu-Natal

● Western Cape

● Mpumalanga

● Eastern Cape

● Others

Recent Development & News

● August 2025: South African fintech startup Street Wallet secured $350,000 in funding to expand its digital payment solutions for informal traders and service providers, enabling cashless payments without smartphones or bank accounts via unique QR codes.

● August 2025: Apis Partners and Crossfin Holdings exited their investment in South African fintech iKhokha following its acquisition by Nedbank. This maintains iKhokha's brand and leadership while bolstering SME financial inclusion through increased collaboration between fintech's and banks.

● August 2025: Official data reflected a growing adoption of digital transactions across South Africa, signalling strong market expansion driven by technological advancements and supportive regulations fostering inclusive financial services.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release South Africa Fintech Market Set to Surge to USD 3,688.72 Million by 2033 at a 15.85% CAGR here

News-ID: 4304321 • Views: …

More Releases from IMARC Group

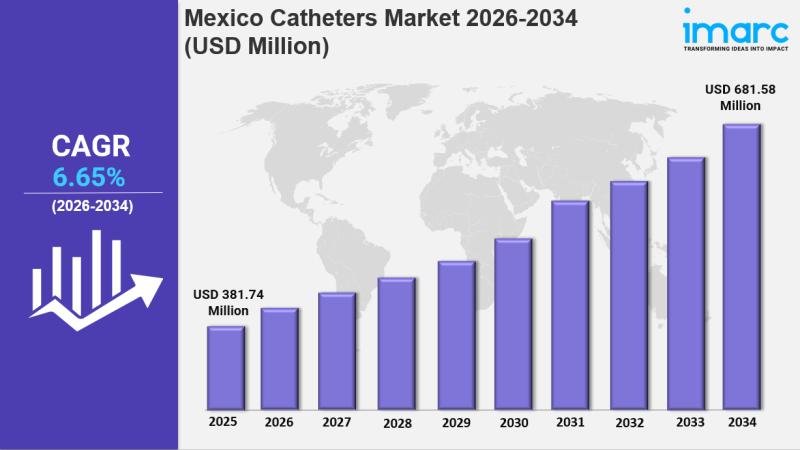

Mexico Catheters Market Size, Growth, Latest Trends and Forecast 2026-2034

IMARC Group has recently released a new research study titled "Mexico Catheters Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico catheters market size was valued at USD 381.74 Million in 2025 and is projected to reach USD 681.58…

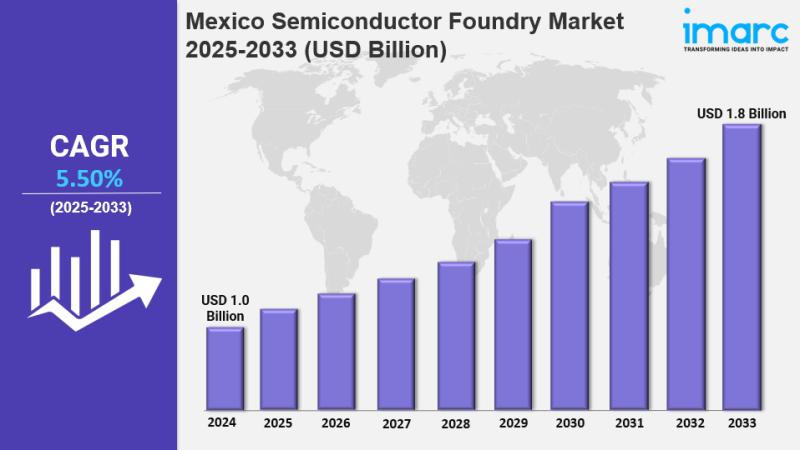

Mexico Semiconductor Foundry Market Size, Share, Latest Insights and Forecast 20 …

IMARC Group has recently released a new research study titled "Mexico Semiconductor Foundry Market Size, Share, Trends and Forecast by Technology Node, Foundry Type, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico semiconductor foundry market size reached USD 1.0 Billion in 2024. It is projected to grow to USD…

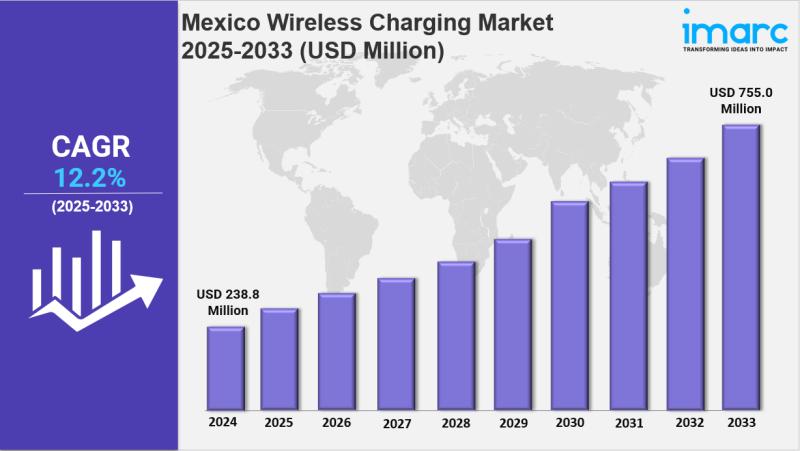

Mexico Wireless Charging Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Wireless Charging Market Size, Share, Trends and Forecast by Technology, Transmission Range, Application, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico wireless charging market size reached USD 238.8 Million in 2024. It is expected to reach USD 755.0…

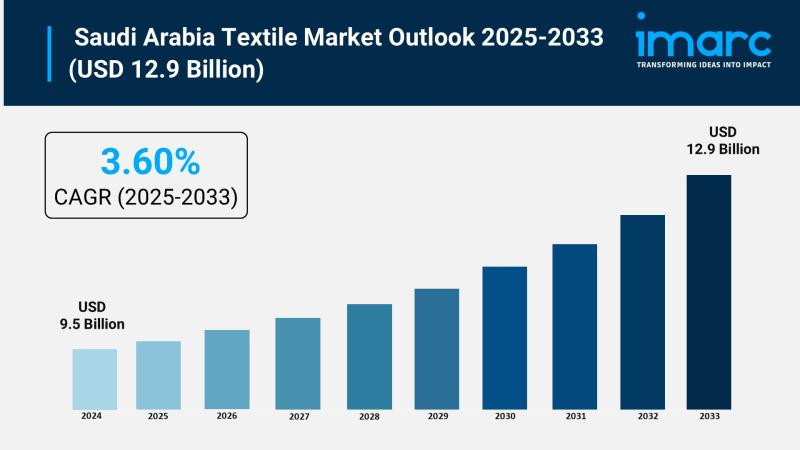

Saudi Arabia Textile Market Is Expected to Reach USD 12.9 Billion by 2033, Grow …

Saudi Arabia Textile Market Overview

Market Size in 2024: USD 9.5 Billion

Market Size in 2033: USD 12.9 Billion

Market Growth Rate 2025-2033: 3.60%

According to IMARC Group's latest research publication, "Saudi Arabia Textile Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia textile market size was valued at USD 9.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.9 Billion by 2033, exhibiting a…

More Releases for Africa

ONShine Africa Awareness Expands Through ONSAFX and Develop Africa Partnership

ONSA FX, a forex broker licensed by South Africa's Financial Sector Conduct Authority (FSCA), is extending its social impact through a strategic partnership with Develop Africa, under the umbrella of its social responsibility platform, ONShine Africa. This collaboration focuses on delivering critical educational support to children across Africa and reinforcing ONSA FX's commitment to sustainable development through long-term, values-based initiatives.

Develop Africa is a respected nonprofit organization founded in 2006 with…

Zetu Africa: Designing a Sustainable Future for Education Across Africa

In the heart of Kampala, Uganda, lies a bustling hub of creativity and purpose: Zetu Africa [https://www.zetuafrica.org/]. This award-winning design company has garnered acclaim not only for its stunning products but also for its unwavering commitment to social and environmental impact. At the core of Zetu's ethos is the belief that design can be a powerful force for positive change, and this belief is reflected in everything they do.

Image: https://www.abnewswire.com/uploads/83a984ca8ea183848376ae0ab0fea376.jpg

The…

Buildexpo Africa – Largest building and construction exhibition returns to Eas …

Buildexpo Africa is the only show with the widest range of the latest technology in building material, mining machines, construction machinery and heavy equipment. At the latest edition of Buildexpo, East Africa's largest building and construction fair, we bring you exhibitors from over 40 countries who are the finest in infrastructure development.

Find what suits you best from about 14.3 million business prospects during the three-day event, with over 10,000 products,…

South Africa Agriculture Market, South Africa Agriculture Industry, South Africa …

The South Africa has a market-oriented agricultural economy, which is much diversified and includes the production of all the key grains (except rice), deciduous, oilseeds, and subtropical fruits, sugar, wine, citrus, and most vegetables. Livestock production includes sheep, cattle, dairy, and a well-developed poultry & egg industry. Value-added activities in the agriculture sector include processing & preserving of fruit and vegetables, crushing of oilseeds, chocolate, slaughtering, processing & preserving of…

Wellness Tourism Market 2019 Future Growth with Worldwide Players: Africawellnes …

Wellness Tourism Market 2019 Industry Research Report provides a detailed Global Wellness Tourism Industry overview along with the analysis of industry’s favorable growth opportunities, the advent of flexible packaging is likely to dampen the market’s growth to an extent. Nevertheless, the increasing number of manufacturers, high demand for management applications, growth of residential & commercial sector and superior strength & corrosion resistance property.

Get Sample Copy of this Report -https://www.orianresearch.com/request-sample/904685

Market Overview:…

Vizocom Selects iSAT Africa as Its Africa C-band Partner

Vizocom, a leading global provider of satellite services, announced today that it has signed a partnership agreement with iSAT Africa to cooperate in providing satellite services and solutions.

Sharjah, UAE, March 02, 2016 -- Vizocom, a leading global provider of satellite services, announced today that it has signed a partnership agreement with iSAT Africa to cooperate in providing satellite services and solutions such as data solutions including C-band VSAT services and…