Press release

Accelerated Digital Transformation Fuels Expansion in the Creator Tax Software Market: Key Insights

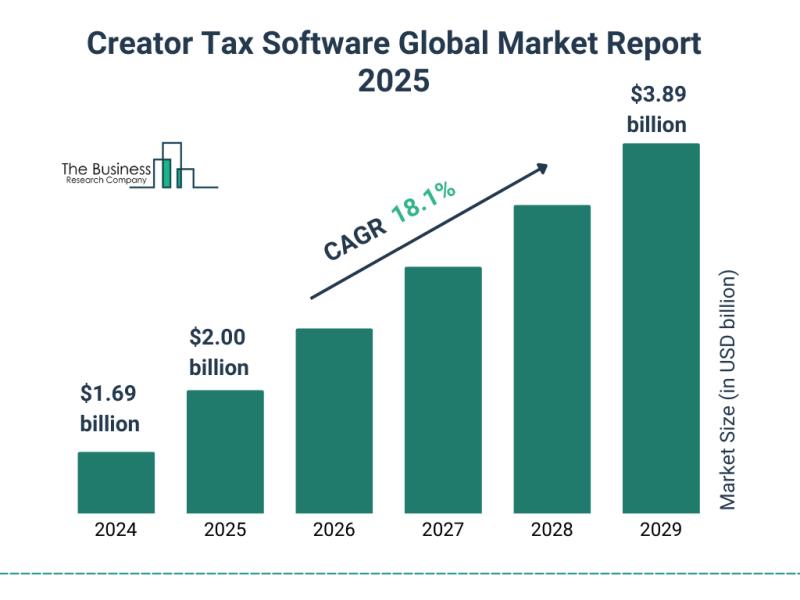

Projected size of the Creator Tax Software Market by 2025The creator tax software market has expanded rapidly in recent years, with its valuation expected to climb from $1.69 billion in 2024 to $2.00 billion in 2025, representing an 18.5% CAGR. This strong historical performance is supported by several core drivers, including greater adoption of digital tax-filing technologies, more stringent tax reporting expectations for independent earners, increasing volumes of creator income flowing through online platforms (alongside additional 1099 filings), growing awareness of the penalties associated with inaccurate tax compliance, and the rising number of international digital transactions.

Market size outlook for 2029

By 2029, the creator tax software market is forecast to reach $3.89 billion, supported by a compound annual growth rate of 18.1%. This momentum stems from the diversification of creator income streams across multiple digital ecosystems, stricter oversight of platform-reported financial activity, increasing financial literacy among creators, the growing popularity of subscription and tipping-based earnings, and stronger government efforts to address tax underreporting. Key developments likely to shape the market include advancements in natural language processing for conversational tax assistance, privacy-focused mechanisms for secure data transfer, deeper integration with marketplaces and payment processors via APIs, emerging uses of optical character recognition for scanning receipts, and the adoption of robotic process automation to streamline year-end filing tasks.

Access the full Creator Tax Software Market report here:

https://www.thebusinessresearchcompany.com/report/creator-tax-software-global-market-report

Drivers accelerating the Creator Tax Software Market

One of the most significant forces propelling market growth is the rising level of global internet access. Internet penetration-defined as the proportion of the population that can connect to and use the internet-continues to rise due to affordable smartphones and wider access to mobile data. As more individuals come online, creators benefit from dependable digital connectivity that enables real-time revenue monitoring, automated record collection, and immediate tax submission.

Rising internet accessibility supporting creator-focused tax tools

Greater internet availability ensures that creators can manage tax compliance from virtually anywhere, simplifying obligations that once required professional assistance or manual recordkeeping. Supporting this trend, the Government of Canada projects that high-speed internet coverage will expand from 93.5% in 2022 to 98% in 2026, ultimately reaching 100% by 2030. This steady expansion of digital infrastructure is a key catalyst behind the continued growth of the creator tax software market.

Download your free Creator Tax Software Market sample now:

https://www.thebusinessresearchcompany.com/sample.aspx?id=29397&type=smp

Innovations transforming the Creator Tax Software Market

Market leaders are increasingly investing in advanced systems-particularly fully automated tax compliance solutions-designed to simplify reporting obligations, minimize human errors, and ensure on-time tax submissions for creators. Full tax automation refers to a model in which the software independently performs calculations, tracks earnings, prepares documentation, and submits filings with minimal manual effort. This approach reduces compliance risks and ensures that creators stay aligned with relevant tax regulations.

Example of automation influencing creator tax compliance

An example of this innovation is the Sales Tax Solution for Creators introduced in August 2023 by Thinkific Labs Inc., a Canada-based provider of education-focused e-commerce platforms. Powered by Stripe, the system automates tax calculation, collection, reporting, and remittance for sales occurring across the United States and Canada. It greatly reduces administrative burdens by eliminating the need for creators to register individually with multiple tax authorities and enables immediate compliance for all sales conducted through Thinkific Payments.

Segment breakdown of the Creator Tax Software Market

The creator tax software market covered in this report is segmented -

By Component: Software, Services

By Deployment Mode: Cloud-Based, On-Premises

By Organization Size: Small and Medium Enterprises, Large Enterprises

By Application: Income Tax Filing, Expense Tracking, Invoicing, Compliance Management, Other Applications

By End-User: Freelancers, Influencers, Content Creators, Agencies, Other End-Users

Subsegments include:

- Software: Tax Preparation And Filing, Expense Tracking And Receipt Management, Income And Royalty Management, Accounting And Bookkeeping, Invoicing And Payments Integration, Compliance And Regulatory Updates

- Services: Tax Advisory And Planning, Tax Preparation And Submission, Bookkeeping And Payroll, Audit Support And Representation, Compliance Management, Data Migration And Onboarding, Implementation And Systems Integration, Training And Customer Support

Companies driving innovation in the Creator Tax Software Market

Major companies operating in the market include H&R Block Inc.; Taxfix GmbH; Collective Inc.; Relyon Softech Limited; Lili App Inc.; TaxAct Holdings Inc.; Zenwork Inc.; SAG Infotech Private Limited; Intuit Inc.; myITreturn (India) Private Limited; SPAN Enterprises LLC; Zenwork Inc.; ClearTax (India) Private Limited; Xolo OÜ; Quicko Technologies Private Limited; Keeper Tax Inc.; FlyFin AI Inc.; Block Inc.; Greatland Corporation; Advanced Micro Solutions Inc.

Regions presenting the strongest opportunities

North America remained the largest regional market in 2024. Other regions included in the creator tax software market assessment are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

Purchase your detailed Creator Tax Software Market report now:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=29397

This Report Supports:

Business Leaders & Investors - In identifying opportunities, risks, and strategic planning considerations.

Manufacturers & Suppliers - For assessing market dynamics and evolving customer needs.

Policy Makers & Regulators - In monitoring compliance trends and shaping tax frameworks.

Consultants & Analysts - To guide clients in market entry, growth strategy, and competitive positioning.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Accelerated Digital Transformation Fuels Expansion in the Creator Tax Software Market: Key Insights here

News-ID: 4303116 • Views: …

More Releases from The Business Research Company

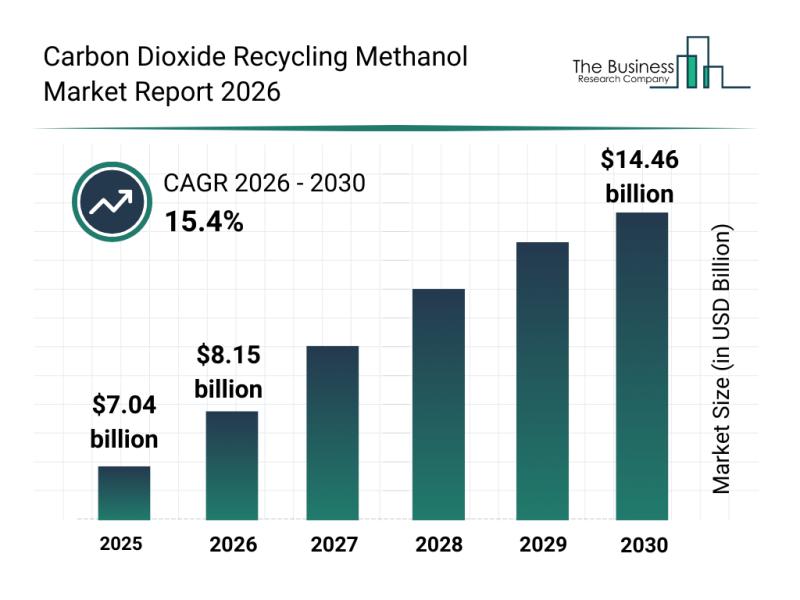

Top Players and Competitive Environment in the Carbon Dioxide Recycling Methanol …

The carbon dioxide recycling methanol market is poised for remarkable expansion as the world intensifies efforts toward sustainability and carbon neutrality. With increasing emphasis on reducing greenhouse gas emissions and boosting renewable energy sources, this market is set to play a pivotal role in the global transition to cleaner fuels and circular carbon economies. Here's a detailed look at its projected growth, influential players, emerging trends, and segmentation.

Forecasted Market Growth…

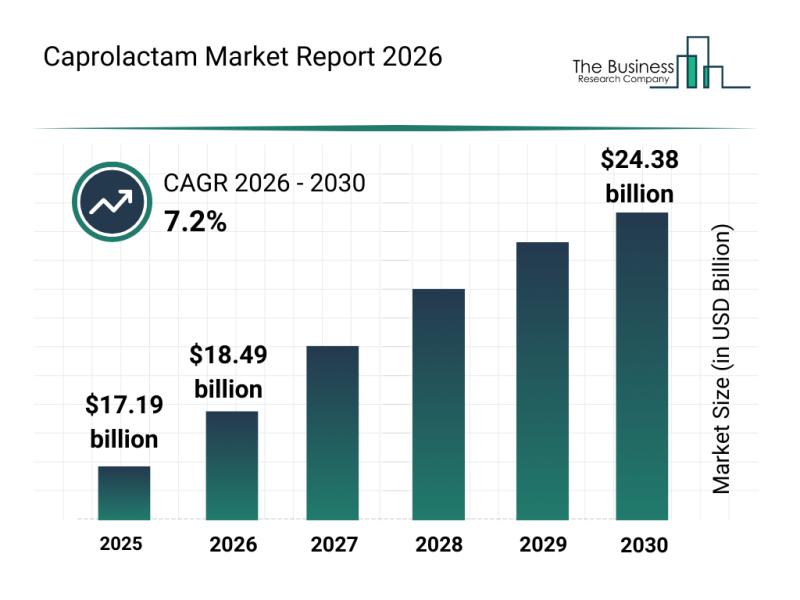

Emerging Sub-Segments Transforming the Caprolactam Market Landscape

The caprolactam market is set for significant expansion in the coming years, driven by evolving industrial needs and sustainability initiatives. This report delves into the anticipated growth, key players, emerging trends, and detailed market segmentation to offer a comprehensive view of the sector's future trajectory.

Caprolactam Market Size Forecast Through 2030

The caprolactam market is projected to reach a value of $24.38 billion by 2030, growing at a compound annual…

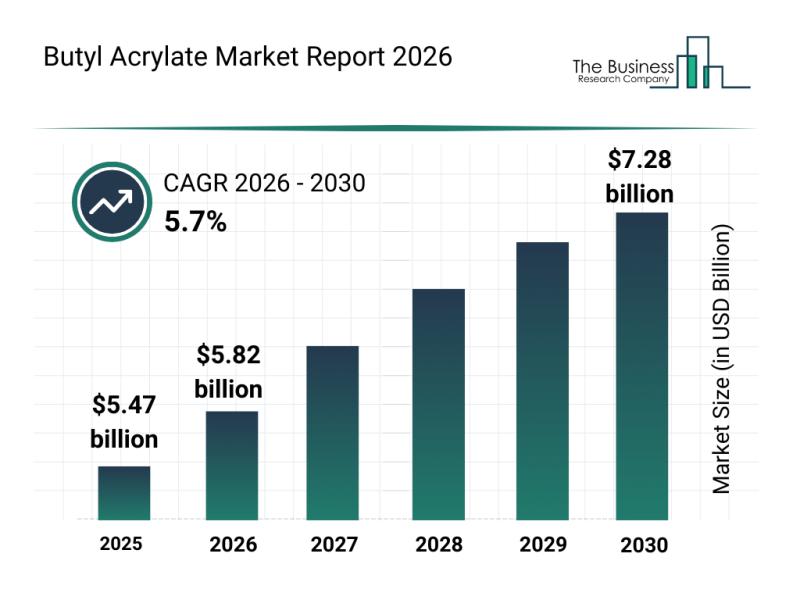

Emerging Growth Patterns Driving Expansion in the Butyl Acrylate Market

The butyl acrylate market is gaining considerable attention as industries increasingly seek versatile chemical compounds to enhance their products. With its broad utility across coatings, adhesives, and textiles, the market is set for significant growth in the coming years. Let's explore the current market size, the main players, key trends, and segment insights shaping this industry.

Projected Market Size and Growth in Butyl Acrylate

The butyl acrylate market is poised…

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Bo …

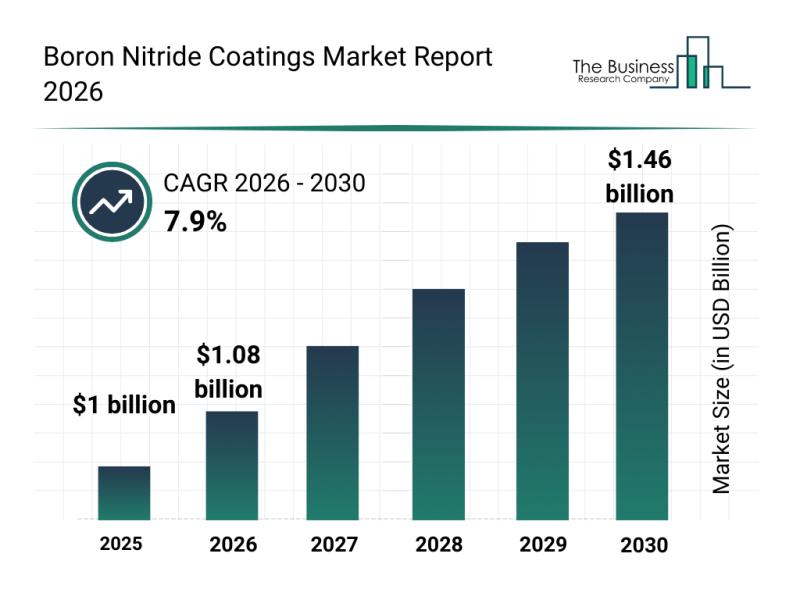

Boron nitride coatings are gaining increased attention due to their versatile applications and enhanced protective qualities. As industries like automotive, aerospace, and electronics evolve, the demand for advanced coating solutions that can withstand extreme conditions is rising. This overview explores the current market size, key players, important trends, and dominant segments shaping the boron nitride coatings market.

Strong Market Growth Expected for Boron Nitride Coatings by 2030

The boron nitride…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…