Press release

Booming Construction Activity Drives Growth of the Creator Tax 1099 Automation Market by 2025

How Big Will the Creator Tax 1099 Automation Market Grow by 2025?The market focused on automating the filing of 1099 forms for content creators has experienced swift expansion lately; specifically, its valuation is projected to increase from $0.94 billion in 2024 to $1.11 billion the following year, reflecting a consistent compound annual growth rate of 17.9%. This historical upward trajectory is fueled by several factors, including the proliferation of digital marketplaces and platforms catering to creators, the escalating frequency of modest payments disbursed to freelancers, the greater imperative for precise tax documentation, enhanced payer cognizance regarding regulatory requirements, and the heightened financial repercussions associated with submitting flawed information returns.

What Is the Forecasted Global Size of the Creator Tax 1099 Automation Market by 2029?

Anticipation is high for substantial expansion within the market segment dedicated to automating the issuance of 1099 forms for content creators, projecting its valuation to reach $2.13 billion by 2029, driven by a compound annual growth rate of 17.5 percent over the coming years. This projected surge is fueled by several key factors, including a greater frequency of international agreements with independent contractors, the growing tendency for enterprises to favor contract workers over direct hires, payers leaning towards consolidated systems for handling compliance mandates, the increasing popularity of immediate payment solutions for freelancers, and stricter adherence being demanded regarding backup withholding regulations. Furthermore, significant technological shifts characterizing this period involve the implementation of artificial intelligence capabilities for identifying unusual patterns, the utilization of machine learning algorithms for accurately matching payees and assessing associated risks, the deployment of optical character recognition technology to facilitate the capture of form data and extraction processes, the incorporation of robotic process automation to streamline routine filing duties, and the employment of natural language processing tools to enhance support functions and document analysis.

Access the full Creator Tax 1099 Automation Market report here:

https://www.thebusinessresearchcompany.com/report/creator-tax-1099-automation-global-market-report

Which Major Drivers Are Fueling the Expansion of the Creator Tax 1099 Automation Market?

Anticipation surrounds the creator tax 1099 automation market's expansion, heavily influenced by the broader uptake of digital platforms, which are understood as internet-based systems or applications facilitating user content creation, sharing, and the exchange of goods or services. This surge in digital platform usage stems from a persistent need for heightened operational efficiency, as organizations increasingly integrate technology to simplify workflows, cut down on manual labor, and boost overall output. Creator Tax 1099 Automation significantly improves these digital environments through streamlined tax reporting, automated creation of requisite forms, validation of Taxpayer Identification Numbers, and electronic filing capabilities, all serving to lessen hands-on work and curb mistakes related to regulatory adherence. To illustrate this trend, projections from the International Trade Administration, a US governmental body, suggested that by August 2025, the population of e-commerce users in Germany would climb from 47.68 million in 2025 to reach 51.77 million by the year 2029, thereby confirming that the expanding utilization of digital platforms is a key contributor to the progress observed in the creator tax 1099 automation sector.

Download your free Creator Tax 1099 Automation Market sample now:

https://www.thebusinessresearchcompany.com/sample.aspx?id=29396&type=smp

Which Emerging Trends Are Shaping the Future of the Creator Tax 1099 Automation Market?

Leading enterprises within the sphere of creator tax 1099 automation are channeling their efforts into formulating sophisticated, artificial intelligence-powered tools, exemplified by automated workflow mechanisms, with the aim of increasing operational throughput, elevating precision, and diminishing the need for hands-on adherence activities. These automated workflow systems constitute software engineered to optimize and carry out business procedures autonomously, thereby cutting down on tasks performed by humans while simultaneously boosting both efficiency and correctness. To illustrate, in the month of September in the year 2025, a software firm situated in the United States named Qount introduced an intelligent 1099 workflow platform driven by AI. This application has been conceived to handle the complete cycle of 1099 submissions automatically, spanning from bringing in and verifying data all the way through the preparation of necessary documentation and electronic submission. It leverages artificial intelligence capabilities to manage necessary modifications and unforeseen issues with intelligence, substantially mitigating the potential for mistakes and the imposition of fines by the Internal Revenue Service (IRS). A key component of this functionality encompasses built-in features for verifying and matching taxpayer identification numbers (TINs), which allows for reporting and adherence to be executed smoothly without requiring much hands-on involvement.

What Are the Major Segment Categories Within the Creator Tax 1099 Automation Market?

The creator tax 1099 automation market covered in this report is segmented -

1) By Component: Software, Services

2) By Deployment Mode: Cloud-Based, On-Premises

3) By Organization Size: Small And Medium Enterprises, Large Enterprises

4) By End-User: Content Creators, Influencer Agencies, Digital Platforms, Freelancers, Other End-Users

Subsegments:

1) By Software: Form Generation Software, Electronic Filing Platforms, Taxpayer Identification Number Validation Tools, Application Programming Interface Connectors, Compliance Rules Engines, Document Management And Optical Character Recognition, Analytics And Reporting Dashboards, Payments And Withholding Management Software

2) By Services: Implementation And Integration Services, Managed Filing Services, Consulting And Advisory Services, Training And Enablement Services, Support And Maintenance Services, Data Migration Services, Outsourced Form Preparation Services, Compliance Monitoring And Update Services

Who Are the Top Market Leaders Defining Growth and Innovation in the Creator Tax 1099 Automation Market?

Major companies operating in the creator tax 1099 automation market are Intuit Inc.; ADP Inc.; Stripe Inc.; Paychex Inc.; BILL Holdings Inc.; Gusto Inc.; Sovos Compliance LLC; Tipalti Inc.; FreshBooks Cloud Accounting Inc.; C&S Technologies Inc.; Payoneer Global Inc.; Greatland Corporation; Patriot Software LLC; Zenwork Inc.; SPAN Enterprises LLC; Zenwork Inc.; Keeper Tax Inc.; FlyFin AI Inc.; Square Inc.; Greatland Corporation

What Are the Top-Performing Regional Markets in the Creator Tax 1099 Automation Industry?

North America was the largest region in the creator tax 1099 automation market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the creator tax 1099 automation market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase your detailed Creator Tax 1099 Automation Market report now:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=29396

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Booming Construction Activity Drives Growth of the Creator Tax 1099 Automation Market by 2025 here

News-ID: 4303028 • Views: …

More Releases from The Business Research Company

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Sa …

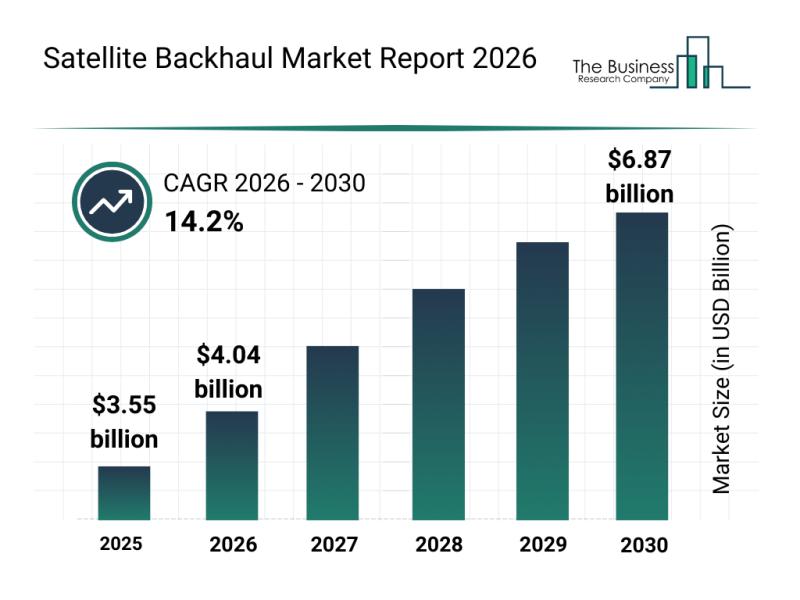

The satellite backhaul market is poised for significant expansion as advancements in connectivity and communication technologies accelerate. With the rapid development of 5G networks and an increasing need for reliable communication in remote and challenging environments, this sector is attracting substantial attention from industry leaders and investors alike. Let's explore the current market size, key players, emerging trends, and the segmentation driving growth through 2030.

Anticipated Growth in the Satellite Backhaul…

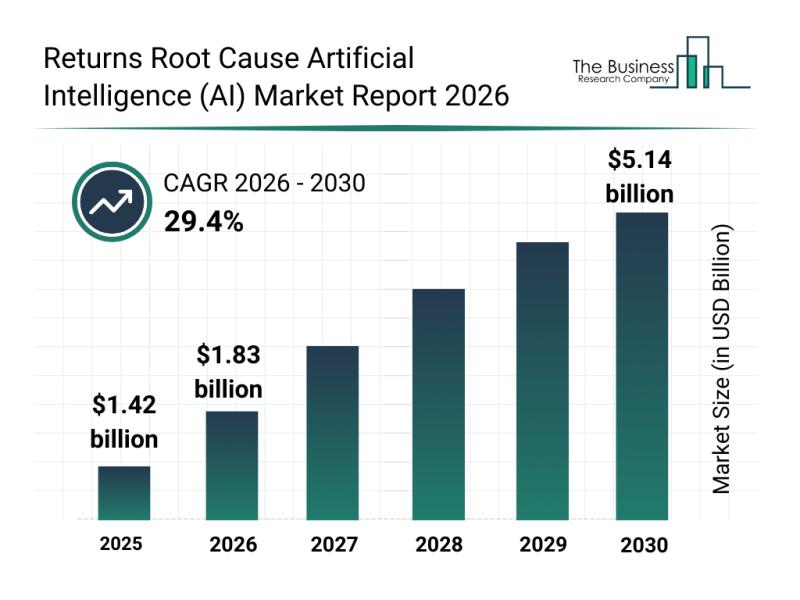

Leading Companies Fueling Innovation and Growth in the Returns Root Cause Artifi …

The use of artificial intelligence (AI) to analyze the root causes of product returns is rapidly transforming retail and supply chain management. This emerging market is poised for significant expansion as AI solutions become more integrated into operational workflows, helping businesses optimize efficiency and customer satisfaction. Let's explore the market's size, key players, future trends, and segmentation to understand where this sector is headed.

Forecasted Growth Trajectory of the Returns Root…

Analysis of Segments and Major Growth Areas in the Supermirrors Market

The supermirrors market is positioned for significant growth as advancements in various high-tech fields continue to drive demand. With increasing applications across industries such as quantum computing and medical imaging, the market is set to expand steadily over the next several years. Let's explore the market's projected valuation, key players, and major segment classifications to better understand the future outlook for supermirrors.

Projected Market Valuation and Growth Factors in the Supermirrors…

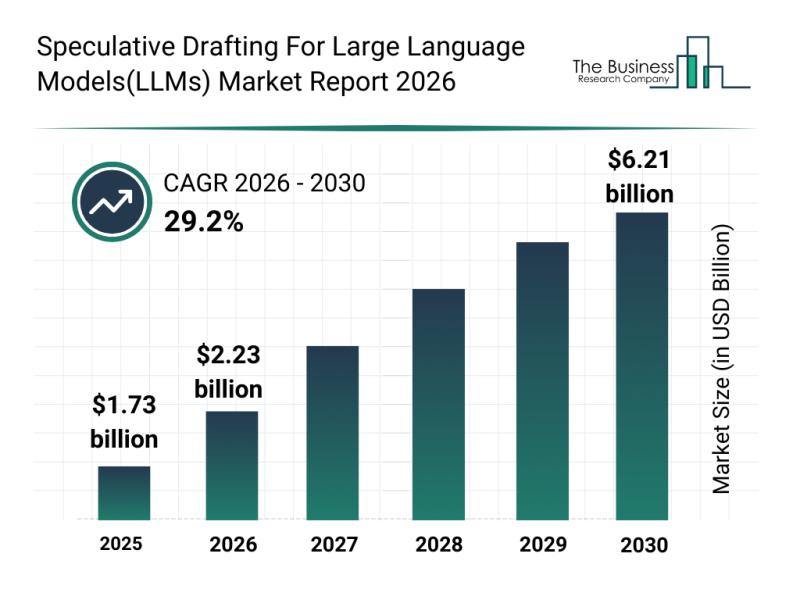

Emerging Growth Factors Fueling the Expansion of the Speculative Drafting Market …

The speculative drafting market for large language models (LLMs) is rapidly evolving and poised for remarkable growth in the coming years. With businesses increasingly adopting AI-driven solutions, this sector is set to transform how organizations approach automated drafting tasks. Let's explore the market's projected size, key players, principal segments, and emerging trends shaping its future.

Projected Market Growth and Size of the Speculative Drafting for Large Language Models Market

The…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…