Press release

Iron Ore Prices Surge in Key Regions in 2025 - Get the Latest Price Index & Forecast Report

Iron Ore Price Index Analysis in North America: 2025 OverviewIron Ore Prices in United States of America:

Iron ore prices in the USA averaged USD 105/MT in the last quarter of 2025, supported by steady steel production and stable domestic mining operations. The Iron Ore Price Trend Report indicates balanced supply conditions despite moderate construction sector weakness. Reviewing the Iron Ore Historical Price Overview, U.S. pricing remains relatively consistent, reflecting long-term resilience in industrial demand and well-integrated steel value chains.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/iron-ore-price-trend/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

Iron Ore Price Index Analysis in APAC: 2025 Overview

Iron Ore Prices in China:

China recorded iron ore prices near USD 99/MT, shaped by fluctuating steel mill purchasing patterns and cautious production controls. The Iron Ore Price Trend Report highlights reduced demand from the real estate sector, which kept prices comparatively restrained. According to the Iron Ore Historical Price Overview, China continues to experience cyclical pricing shifts that closely mirror domestic manufacturing sentiment and environmental policy adjustments.

Regional Analysis: The price analysis can be extended to provide detailed Glyoxylic Acid price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries.

Iron Ore Price Index Analysis in Europe: Q2 2025 Overview

Iron Ore Prices in United Kingdom:

The United Kingdom reported iron ore prices of USD 108/MT in Q4 2025, supported by modest steel-sector recovery and stable import flows. Insights from the Iron Ore Price Trend Report show that energy-cost reductions helped improve mill operating margins. The Iron Ore Historical Price Overview indicates that UK prices tend to remain slightly elevated due to reliance on external suppliers and varying industrial consumption trends.

Regional Analysis: The price analysis can be extended to provide detailed Iron Ore price information for the following list of European countries.

Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries.

Iron Ore Price Index Analysis in North America: 2025 Overview

Iron Ore Prices in Canada:

Canada's iron ore prices averaged USD 95/MT, reflecting strong mining output and healthy export activity, particularly toward Asian markets. As noted in the Iron Ore Price Trend Report, favorable logistics and port operations contributed to smooth supply. The Iron Ore Historical Price Overview shows Canada's pricing trajectory remains competitive globally, supported by consistent production efficiency and high-grade ore quality.

Note: The analysis can be tailored to align with the customer's specific needs.

Iron Ore Price Index Analysis in Europe: 2025 Overview

Iron Ore Prices in France:

France recorded iron ore prices at USD 97/MT in the final quarter of 2025, moderately constrained by sluggish steel demand and ongoing industrial slowdown. The Iron Ore Price Trend Report points to reduced blast furnace operations as a key factor influencing pricing. According to the Iron Ore Historical Price Overview, France's iron ore market often mirrors wider EU trends driven by manufacturing output and energy market volatility.

Regional Analysis: The price analysis can be extended to provide detailed Iron Ore price information for the following list of European countries.

Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries.

Iron Ore Price Trend, Factors, Recent Developments, History, and Forecast - 2025

In Q3 2025, iron ore prices reached 105 USD/MT in the USA, 99 USD/MT in China, 108 USD/MT in the United Kingdom, 95 USD/MT in Canada, and 97 USD/MT in France. Prices showed mixed trends with gains in USA, China, and UK amid steel demand and supply tightness, while Canada and France eased on weaker exports and manufacturing slowdowns.

Key Influencing Factors

• Supply Constraints: High-grade ore shortages, mining regulations, and port delays tightened availability from major exporters.

• Demand Patterns: Steel production for infrastructure and construction supported pricing, offset by seasonal restocking caution.

• Production Costs: Freight hikes, logistics inflation, and energy expenses elevated landed costs globally.

• Export Dynamics: Trade tariffs and currency shifts influenced competitiveness in North America and Europe.

• Policy Shifts: Environmental rules and infrastructure spending boosted consumption in key regions.

• Geopolitical Factors: Tensions and weather disruptions added volatility to global supply chains.

Recent Developments

• USA prices rose moderately on sustained steel demand and tighter high-grade supplies amid rising transport costs.

• China gained from infrastructure resumption and mill restocking, despite port delays and shipping pressures.

• UK edged higher via construction and wind projects, pressured by import freight and exchange fluctuations.

• Canada declined on softer exports and stable domestic output, curbed by logistics burdens.

• France softened due to manufacturing weakness outweighing modest supply cost increases.

Historical Context

Q2 2025 featured levels like 98.67 USD/MT in Canada and 96.24 USD/MT in China from trade uncertainties and domestic sourcing shifts. Q1 showed volatility with UK at higher ranges amid policy changes; earlier quarters reflected weather impacts, tariffs, and steel cycles driving swings across regions.

Price Forecast

Global iron ore industry reached USD 327.60 Billion in 2024, projecting USD 418.03 Billion by 2034 at 2.75% CAGR. Steel growth, infrastructure investments, and supply tightening will sustain upward trends, with stabilization around USD 100/MT in 2026 amid automation efficiencies and export dynamics.

Speak To an Analyst: https://www.imarcgroup.com/request?type=report&id=38942&flag=C

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, Iron Ore Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition, presents a detailed analysis of Iron Ore price trend, offering key insights into global Iron Ore market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Iron Ore demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Iron Ore Prices Surge in Key Regions in 2025 - Get the Latest Price Index & Forecast Report here

News-ID: 4302511 • Views: …

More Releases from IMARC Group

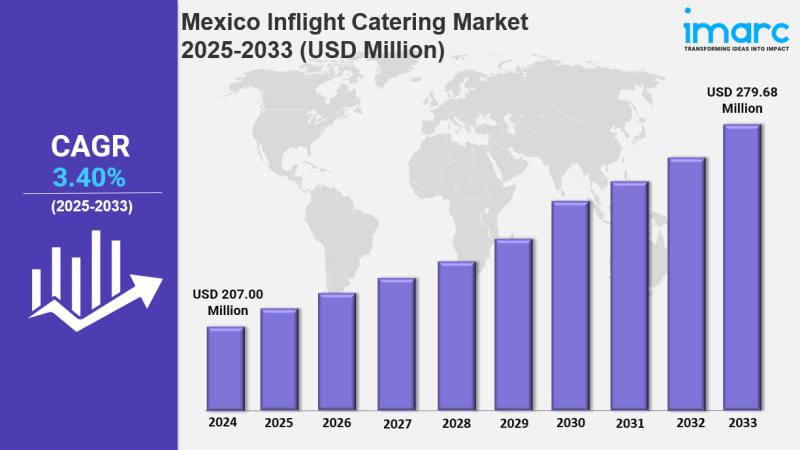

Mexico Inflight Catering Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Inflight Catering Market Size, Share, Trends and Forecast by Food Type, Flight Service Type, Aircraft Seating Class, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico inflight catering market size reached USD 207.00 Million in 2024. The market is…

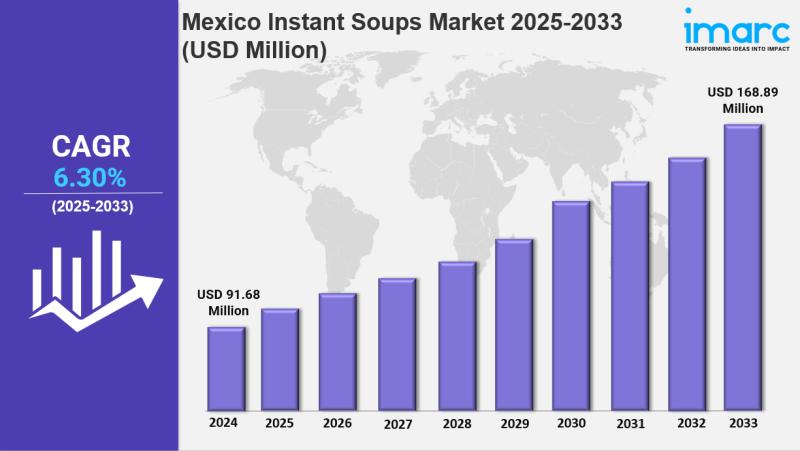

Mexico Instant Soups Market Size, Share, Latest Insights and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Instant Soups Market Size, Share, Trends and Forecast by Nature, Form, Source, Distribution Channel, End Use, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico instant soups market size reached USD 91.68 Million in 2024 and is projected to…

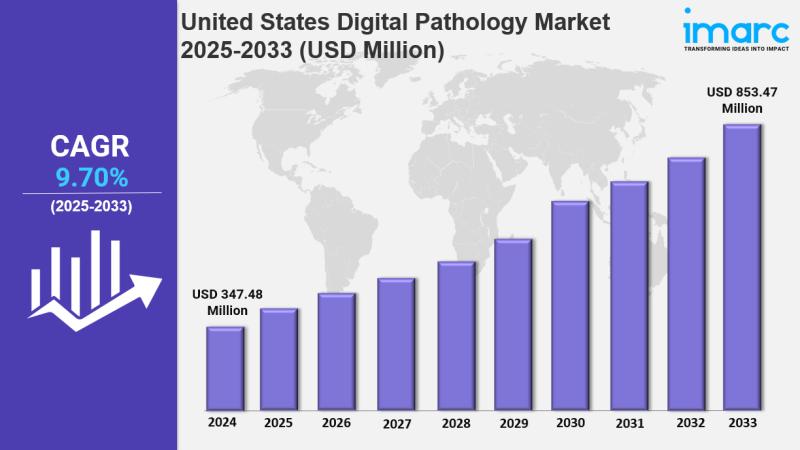

United States Digital Pathology Market : Trends, Drivers, and Growth Opportuniti …

IMARC Group has recently released a new research study titled "United States Digital Pathology Market Size, Share, Trends and Forecast by Product, Type, Delivery Model, Application, End User, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States digital pathology market size was valued at USD 347.48 Million in 2024…

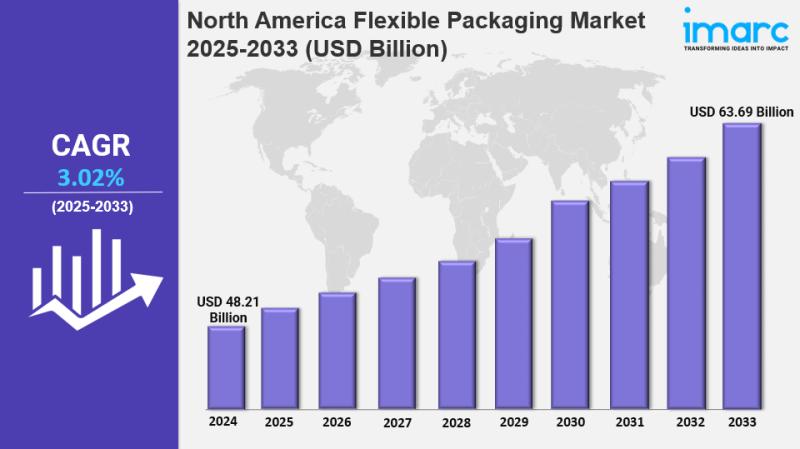

North America Flexible Packaging Market Share, Size, In-Depth Insights, Trends a …

IMARC Group has recently released a new research study titled "North America Flexible Packaging Market Size, Share, Trends and Forecast by Product Type, Raw Material, Printing Technology, Application, and Country, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The North America flexible packaging market was valued at USD 48.21 Billion in 2024 and is…

More Releases for Price

Bitcoin Price, XRP Price, and Dogecoin Price Analysis: Turn Volatility into Prof …

London, UK, 4th October 2025, ZEX PR WIRE, The price movements in the cryptocurrency market can be crazy. Bitcoin price (BTC price), XRP price, and Dogecoin price vary from day to day, which can make it complicated for traders. Some investors win, but many more lose, amid unpredictable volatility. But there's a more intelligent way and that is Hashf . Instead of contemplating charts, Hashf provides an opportunity for investors…

HOTEL PRICE KILLER - BEAT YOUR BEST PRICE!

Noble Travels Launches 'Hotel Price Killer' to Beat OTA Hotel Prices

New Delhi, India & Atlanta, USA - August 11, 2025 - Noble Travels, a trusted name in the travel industry for over 30 years, has launched a bold new service called Hotel Price Killer, promising to beat the best hotel prices offered by major online travel agencies (OTAs) and websites.

With offices in India and USA, Noble Travels proudly serves an…

Toluene Price Chart, Index, Price Trend and Forecast

Toluene TDI Grade Price Trend Analysis - EX-Kandla (India)

The pricing trend for Toluene Diisocyanate (TDI) grade at EX-Kandla in India reveals notable fluctuations over the past year, influenced by global supply-demand dynamics and domestic economic conditions. From October to December 2023, the average price of TDI declined from ₹93/KG in October to ₹80/KG in December. This downward trend continued into 2024, with October witnessing a significant drop to ₹73/KG, a…

Glutaraldehyde Price Trend, Price Chart 2025 and Forecast

North America Glutaraldehyde Prices Movement Q1:

Glutaraldehyde Prices in USA:

Glutaraldehyde prices in the USA dropped to 1826 USD/MT in March 2025, driven by oversupply and weak demand across manufacturing and healthcare. The price trend remained negative as inventories rose and procurement slowed sharply in February. The price index captured this decline, while the price chart reflected persistent downward pressure throughout the quarter.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/glutaraldehyde-pricing-report/requestsample

Note: The analysis can…

Butane Price Trend 2025, Update Price Index and Real Time Price Analysis

MEA Butane Prices Movement Q1 2025:

Butane Prices in Saudi Arabia:

In the first quarter of 2025, butane prices in Saudi Arabia reached 655 USD/MT in March. The pricing remained stable due to consistent domestic production and strong export activities. The country's refining capacity and access to natural gas feedstock supported price control, even as global energy markets saw fluctuations driven by seasonal demand and geopolitical developments impacting the Middle East.

Get the…

Tungsten Price Trend, Chart, Price Fluctuations and Forecast

North America Tungsten Prices Movement:

Tungsten Prices in USA:

In the last quarter, tungsten prices in the United States reached 86,200 USD/MT in December. The price increase was influenced by high demand from the aerospace and electronics industries. Factors such as production costs and raw material availability, alongside market fluctuations, also contributed to the pricing trend.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/tungsten-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific…