Press release

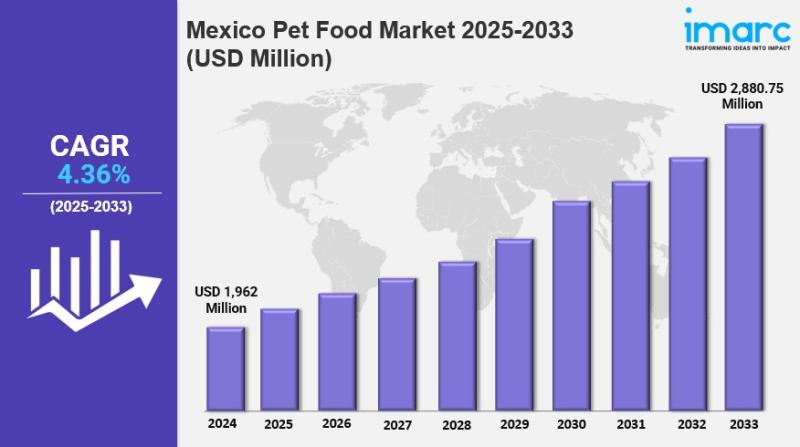

Mexico Pet Food Market 2025: Industry Size to Reach USD 2,880.75 Million by 2033, At a CAGR of 4.36%

IMARC Group has recently released a new research study titled "Mexico Pet Food Market Size, Share, Trends and Forecast by Pet Type, Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.Mexico Pet Food Market Overview

The Mexico pet food market size reached USD 1,962 Million in 2024 and is projected to reach USD 2,880.75 Million by 2033, growing at a CAGR of 4.36% during the forecast period 2025-2033. Growth is driven by increasing pet parentship, premium and nutritionally balanced product demand, strategic manufacturing expansions by key companies like Nestlé Purina, and expanding e-commerce and diversified retail channels. The market benefits from rising middle-class incomes and evolving preferences towards quality pet nutrition.

Study Assumption Years

● Base Year: 2024

● Historical Years: 2019-2024

● Forecast Period: 2025-2033

Mexico Pet Food Market Key Takeaways

● Current Market Size: USD 1,962 Million in 2024

● CAGR: 4.36%

● Forecast Period: 2025-2033

● The humanization of pets is fueling demand for

premium and nutritionally balanced pet foods, driven especially by millennials prioritizing sustainability and animal welfare.

● Strategic manufacturing expansions, including a CHF 200 million investment by Nestlé Purina in Mexico, enhance local production and supply chain efficiencies.

● E-commerce and specialty retail channels are growing rapidly, complementing traditional supermarkets, hypermarkets, and veterinary clinics.

● The cat population growth in urban Mexico is influencing product development and retail assortments.

● Middle-class income growth is enabling consumers to spend more on high-quality pet nutrition.

Sample Request Link: https://www.imarcgroup.com/mexico-pet-food-market/requestsample

Mexico Pet Food Market Growth Factors

The Mexico pet food market growth is primarily driven by increasing pet parentship and the humanization trend, where pets are viewed as family members deserving premium nutrition. This shift leads to higher demand for nutritionally balanced, premium pet food including natural ingredients and specialized formulations. The rising middle-class income across Mexico enables pet parents to spend more on premium pet care products, moving beyond traditional mass-market offerings.

Strategic manufacturing expansions and local production investments by multinational and domestic companies significantly augment market growth. Notably, in May 2024, Nestlé Purina invested CHF 200 million to expand its pet food plant in Silao, Mexico, the largest facility in Latin America, adding lines for wet and dry pet food. Mexico accounts for 45% of Purina's regional market, underscoring its strategic importance. These expansions reduce import dependency and logistics costs while increasing responsiveness to local preferences.

The retail landscape is also evolving, with growing e-commerce penetration and diversified retail channels such as specialty stores and online platforms complementing traditional supermarkets and vet clinics. E-commerce caters to digital-native consumers seeking convenience and variety. For example, Hartz Mountain launched its Delectables cat treat line in 2024 via Petco México, a specialty retailer known for introducing international innovations. This channel diversification allows segmented distribution strategies that enhance market coverage and meet varied consumer needs.

Buy Report Now: https://www.imarcgroup.com/checkout?id=43464&method=980

Mexico Pet Food Market Segmentation

Breakup by Pet Type:

● Dog Food: Includes various dog food products catered to Mexico's pet population.

● Cat Food: Encompasses the growing range of cat food

products, influenced by increasing cat ownership.

● Others: Other pet food categories present in the market.

Breakup by Product Type:

● Dry Pet Food: Includes pellet and kibble forms of pet food.

● Wet and Canned Pet Food: Moist and canned pet food products.

● Snacks and Treats: Pet snacks and treat items for dogs and cats.

Breakup by Pricing Type:

● Mass Products: Economical pet food options for broad consumers.

● Premium Products: Higher-priced, premium quality pet food formulations.

Breakup by Ingredient Type:

● Animal Derived: Pet foods formulated primarily with animal-sourced ingredients.

● Plant Derived: Products based mainly on plant-sourced ingredients.

Breakup by Distribution Channel:

● Supermarkets and Hypermarkets: Major retail chains distributing pet foods.

● Specialty Stores: Dedicated pet stores offering premium and varied selections.

● Online Stores: E-commerce platforms selling pet food.

● Others: Includes veterinary clinics, neighborhood stores, and other smaller retail outlets.

Regional Insights

Northern Mexico, Central Mexico, Southern Mexico, and Others comprise the key regions analyzed. The report does not specify which region is dominant nor includes specific market share or CAGR statistics per region. The regional segmentation allows understanding of varied demand patterns and supply dynamics across Mexico's geography.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=43464&flag=C

Recent Developments & News

● May 2025: Kimberly-Clark de México entered the pet food market with a dual-brand launch targeting value and premium segments, leveraging its strong wholesale and traditional retail presence.

● March 2025: ADM inaugurated its first wet pet food manufacturing plant in Yecapixtla, Morelos, following a USD 39 million investment. This facility aims to produce at least half of Mexico's wet food demand locally by the end of 2025.

Key Players

● Nestlé Purina

● Kimberly-Clark de México

● ADM

● Hartz Mountain

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mexico Pet Food Market 2025: Industry Size to Reach USD 2,880.75 Million by 2033, At a CAGR of 4.36% here

News-ID: 4302475 • Views: …

More Releases from IMARC Group

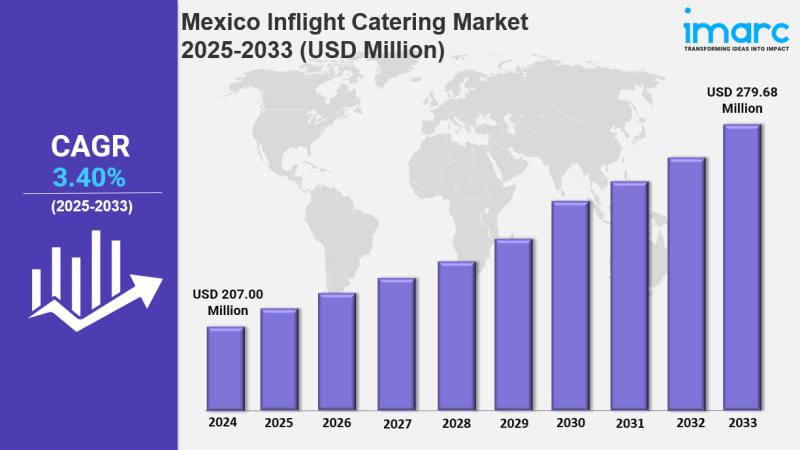

Mexico Inflight Catering Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Inflight Catering Market Size, Share, Trends and Forecast by Food Type, Flight Service Type, Aircraft Seating Class, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico inflight catering market size reached USD 207.00 Million in 2024. The market is…

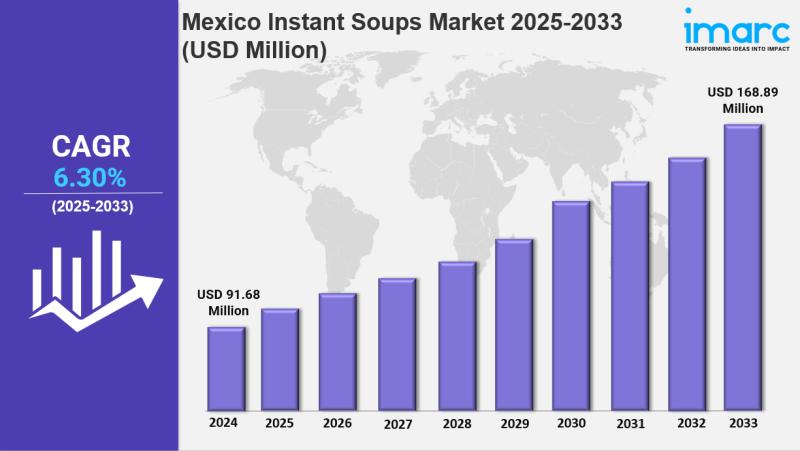

Mexico Instant Soups Market Size, Share, Latest Insights and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Instant Soups Market Size, Share, Trends and Forecast by Nature, Form, Source, Distribution Channel, End Use, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico instant soups market size reached USD 91.68 Million in 2024 and is projected to…

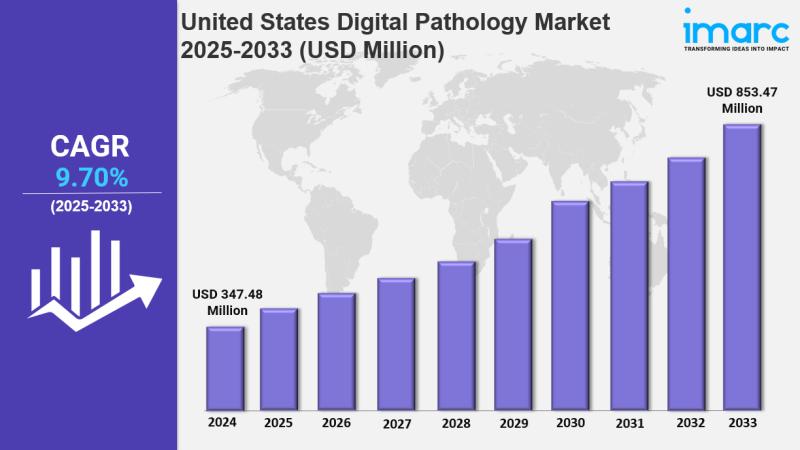

United States Digital Pathology Market : Trends, Drivers, and Growth Opportuniti …

IMARC Group has recently released a new research study titled "United States Digital Pathology Market Size, Share, Trends and Forecast by Product, Type, Delivery Model, Application, End User, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States digital pathology market size was valued at USD 347.48 Million in 2024…

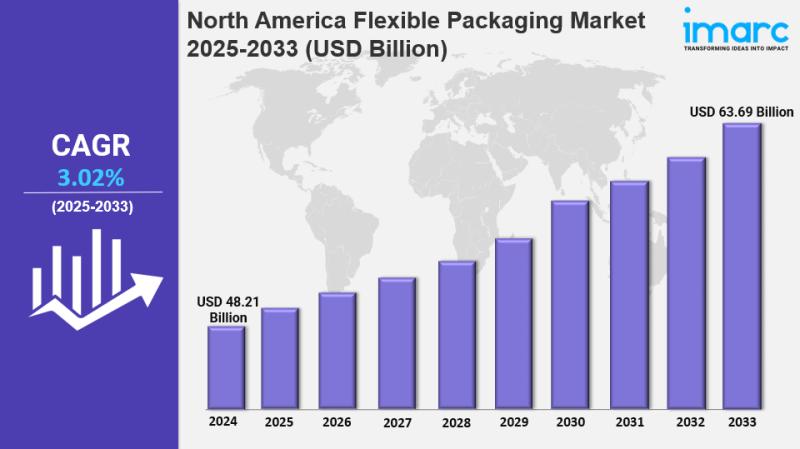

North America Flexible Packaging Market Share, Size, In-Depth Insights, Trends a …

IMARC Group has recently released a new research study titled "North America Flexible Packaging Market Size, Share, Trends and Forecast by Product Type, Raw Material, Printing Technology, Application, and Country, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The North America flexible packaging market was valued at USD 48.21 Billion in 2024 and is…

More Releases for Mexico

Human Resources Mexico Releases Employer Guide To Mexico 2026 Minimum Wage Compl …

Mexico's National Minimum Wage Commission (CONASAMI) has confirmed the new minimum wage levels that will take effect on January 1, 2026. The general daily minimum wage will increase to MXN [315.04], while the Northern Border Free Zone rate will rise to MXN [440.87] for 2026.

Image: https://www.globalnewslines.com/uploads/2025/12/d53f76670eba46736b7e94c6a16fb975.jpg

The adjustment reflects an estimated 13 percent increase for the general zone and about 5 percent for the Northern Border Free Zone compared to 2025.…

Mexico Relocation Guide Helps Thousands Successfully Move to Mexico with Compreh …

Mexico City, Mexico - March 27, 2025 - Since 2019, Mexico Relocation Guide has helped thousands of retirees, digital nomads, and families successfully move to Mexico with its Complete Mexico Relocation Guide-an all-in-one online resource designed to simplify the relocation process. This comprehensive guide provides up-to-date, step-by-step instructions on everything from obtaining residency visas to navigating healthcare, real estate, and taxes, ensuring a seamless transition to life in Mexico.

Image: https://www.globalnewslines.com/uploads/2025/03/c0f68758919db47341ba6f02f686214a.jpg

A…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by Market Insights Reports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by MarketInsightsReports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico Rooftop Solar…

The Mexico Online On-demand Home Services Market , Major Keyplayers - Aliada Inc …

Mexico Online On-demand Home Services Market 2021

Mexico online on-demand home services market offer a range of services within the comfort of home as well as save time and money. Additionally, these services help in bridging the gap between the real-world services and instant online services with improved efficiency. Recently, the demand for Mexico online on-demand home services marekt has started witnessing huge growth due to convenience and accessibility. The growing…

Mexico Agriculture Market, Mexico Agriculture Industry, Mexico Agriculture Grain …

Mexico Agriculture has been crucial sector of the country’s economy traditionally and politically even if it currently accounts for a really little share of Mexico’s GDP. Mexico is one in all the cradles of agriculture with the Mesoamericans emerging domesticated plants like maize, beans, tomatoes, squash, cotton, vanilla, avocados, cacao, number sorts of spices, and more. Domestic turkeys and Muscovy ducks were the solely domesticated fowl within the pre-Hispanic amount and little dogs…