Press release

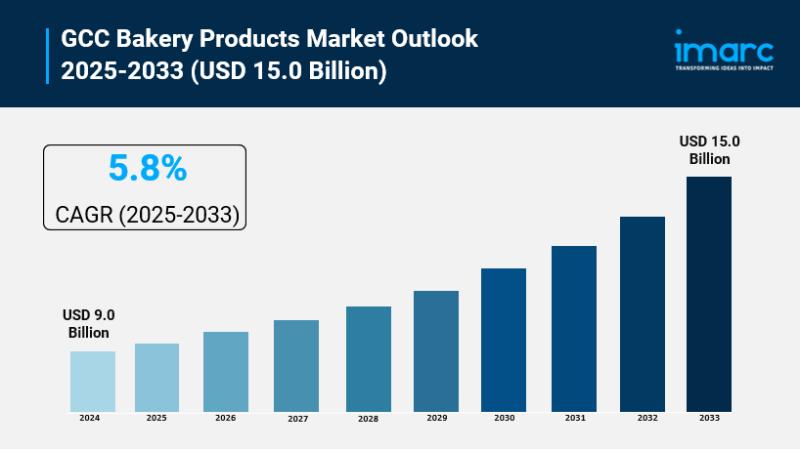

GCC Bakery Products Market Size to Hit USD 15.0 Billion by 2033 | With a 5.8% CAGR

GCC Bakery Products Market OverviewMarket Size in 2024: USD 9.0 Billion

Market Size in 2033: USD 15.0 Billion

Market Growth Rate 2025-2033: 5.8%

According to IMARC Group's latest research publication, "GCC Bakery Products Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the GCC bakery products market size was valued at USD 9.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.0 Billion by 2033, exhibiting a CAGR of 5.8% during 2025-2033.

How AI is Reshaping the Future of GCC Bakery Products Market

● Revolutionizing Production Efficiency: AI-driven automation and robotic systems are optimizing bakery production lines, reducing labor costs by 30% and improving consistency in product quality across GCC manufacturing facilities.

● Enhancing Supply Chain Intelligence: Machine learning algorithms are transforming ingredient sourcing and inventory management, with real-time data analytics enabling bakeries to reduce waste by 25% and improve demand forecasting accuracy.

● Personalizing Consumer Experience: AI-powered customer analytics are driving customized product development, helping GCC bakeries create region-specific flavors and nutritional profiles that match local preferences and dietary requirements.

● Optimizing Quality Control: Advanced computer vision systems are detecting defects and ensuring product consistency, with automated quality inspection reducing rejection rates by 40% in major GCC bakery operations.

● Streamlining Digital Commerce: AI-driven e-commerce platforms and mobile applications are revolutionizing bakery retail, enabling predictive ordering systems and personalized recommendations that boost online sales by 45%.

Download a sample copy of the Report: https://www.imarcgroup.com/gcc-bakery-products-market/requestsample

How Vision 2030 is Transforming GCC Bakery Products Market

Saudi Arabia's Vision 2030 is catalyzing a bakery renaissance across the GCC by channeling oil revenues into food security and economic diversification, subsidizing local wheat cultivation to slash imports by 30% and empowering SMEs like Sunbulah Group with low-cost land and equity funding to scale artisanal production of premium breads and pastries infused with regional flavors such as pistachio and dates. This initiative bolsters modern bakeries through enhanced subsidies and infrastructure, as evidenced by Almarai's SR405 million investment in frozen bakery expansion, capturing 41% of the GCC market share amid surging demand from quick-service restaurants and urban consumers. By fostering innovation in clean-label, organic variants and integrating digital tools for supply chain resilience, Vision 2030 not only elevates Saudi Arabia's dominance but also inspires UAE and Qatar to localize production, projecting the overall GCC bakery sector to reach USD 15.0 billion by 2033 with a 5.8% CAGR, driven by a young, expatriate-heavy population craving convenient yet culturally attuned snacking options.

GCC Bakery Products Market Trends & Drivers:

The GCC bakery products market is surging due to rapid urbanization and a diverse, expatriate-heavy population demanding convenient, on-the-go items like frozen pastries and ready-to-bake doughs, with Saudi Arabia leading as quick-service restaurant chains proliferate and disposable incomes rise, fueling premiumization toward artisanal breads and specialty biscuits. Health consciousness is reshaping preferences, with a spike in packaged sales from tourist inflows and Western trends, alongside innovations in gluten-free and vegan variants that align with low-calorie diets combating obesity, supported by e-commerce growth enabling more frequent online purchases for time-saving options.

Sustainability and localization efforts under regional agendas amplify these drivers, as integrated supply chains reduce waste and verify organic sourcing, while the expansion of artisanal patisseries offering diverse cakes, tarts, and macarons caters to festive occasions and corporate events, projecting steady growth through enhanced foodservice availability and multicultural flavor fusions like saffron-infused cookies.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=3798&method=940

GCC Bakery Products Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Product Type:

● Bread and Rolls

● Loaves

● Baguettes

● Rolls

● Burger Buns

● Sandwich Slices

● Ciabatta

● Frozen Bread

● Others

● Cakes & Pastries

● Cupcakes

● Dessert Cakes

● Sponge Cakes

● Pastries

● Biscuits

● Cookies

● Cream Biscuits

● Glucose Biscuits

● Marie Biscuits

● Non-Salt Cracker Biscuits

● Salt Cracker Biscuits

● Milk Biscuits

● Others

● Others

Breakup by Bakery Type:

● Artisanal Bakeries

● In-Store Bakeries

● Others

Breakup by Source:

● Whole Wheat Flour

● Multi-Grain Flour

● Others

Breakup by Form:

● Fresh

● Frozen

Breakup by Nature:

● Conventional

● Organic

Breakup by Distribution Channel:

● Convenience Stores

● Supermarkets and Hypermarkets

● Independent Retailers

● Online Stores

● Others

Breakup by Country:

● Saudi Arabia

● United Arab Emirates

● Qatar

● Oman

● Kuwait

● Bahrain

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in GCC Bakery Products Market

● January 2025: Demand for artisanal and freshly baked bread surged across the UAE and Saudi Arabia, driven by rising preference for clean-label bakery items and premium café culture growth in major cities.

● March 2025: Regional bakery chains introduced health-oriented product lines, including high-fiber, gluten-free, and protein-enriched baked goods, targeting consumers adopting balanced and fitness-driven diets.

● April 2025: GCC retailers expanded in-store bakery sections using automation and smart baking equipment to improve production efficiency, maintain freshness, and support rising demand for ready-to-eat bakery products.

● June 2025: Hospitality and food service sectors across Qatar, Oman, and Kuwait reported increased procurement of specialty pastries and gourmet bakery items, driven by tourism events, corporate catering, and premium dining trends.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release GCC Bakery Products Market Size to Hit USD 15.0 Billion by 2033 | With a 5.8% CAGR here

News-ID: 4301758 • Views: …

More Releases from IMARC Group

Industrial Enzymes Manufacturing Plant DPR 2026: Cost Structure, Production Proc …

Setting up an industrial enzymes manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of fermentation-based production technologies. These biological catalysts serve critical roles in detergents, food and beverages, animal feed, biofuels, pulp and paper, textiles, and wastewater treatment. Success requires careful site selection, efficient microbial fermentation processes, stringent quality assurance protocols, reliable raw material sourcing, and compliance with industrial and environmental regulations to ensure profitable and…

Fly Ash Bricks Manufacturing Plant DPR & Unit Setup Report 2026

Setting up a fly ash bricks manufacturing plant positions investors in one of the fastest-growing and most environmentally progressive segments of the construction materials value chain, backed by sustained global growth driven by the increased demand for environmentally friendly construction materials, the growing trend of sustainable construction, and increasing government support towards waste utilisation and green construction methods. As urbanization accelerates, infrastructure development intensifies, and regulatory frameworks increasingly mandate the…

ERW Steel Pipes Manufacturing Plant DPR 2026: Investment Cost, Demand Analysis & …

Setting up an ERW steel pipes manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. These high-strength, cost-effective pipes serve the oil and gas, construction, automotive, water transportation, and energy infrastructure sectors. Success requires careful site selection, advanced welding and precision manufacturing processes, stringent quality assurance protocols, reliable raw material sourcing, and compliance with industrial safety and environmental regulations to ensure profitable and sustainable…

Waste-to-Energy Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

Setting up a Waste-to-Energy Plant positions investors in one of the most stable and essential segments of the renewable energy and waste management value chain, backed by sustained global growth driven by rising municipal solid waste generation, sustainable waste management requirements, increasing demand for renewable energy sources, and the dual-benefit advantages of waste reduction with energy production. As urbanization accelerates, waste volumes escalate toward 3.40 billion tons globally by 2050,…

More Releases for GCC

RNTrust Announces GCC Cybersecurity Virtual Summit

Dubai, UAE - November 26, 2025 - RNTrust Group announces a high-level Cybersecurity Summit taking place in Dubai on Wednesday, December 10, 2025. Designed exclusively for cybersecurity leaders and professionals across the GCC region, the summit will serve as a premier platform to examine emerging cyber threats, strengthen regional security capabilities, and promote strategic cooperation among government entities, critical-infrastructure operators, and industry stakeholders.

Summit Overview

The summit, titled "GCC Cybersecurity Virtual Summit,"…

GCC Herbal Ingredients and Functional Beverages Market CAGR 5.5% from 2018 to 20 …

According to a new report published by Allied Market Research, titled, "GCC Herbal Ingredients and Functional Beverages Market By Functional Beverage and Herbal Ingredients: GCC Opportunity Analysis and Industry Forecast, 2018-2027," The herbal ingredients market was valued at $46.4 million in 2017 and is projected to reach $73.5 million by 2027, registering a CAGR of 4.9% from 2018 to 2027. The functional beverages market revenue was valued at $750.2 million…

GCC Artificial Intelligence Market

When any business seek to lead the market or make a mark in the market as a fresh emergent, market research report is always central. A comprehensive GCC Artificial Intelligence Market report encompasses a market data that provides a detailed analysis of the ABC industry and its impact based on applications and different geographical regions. The report gives current as well as upcoming technical and financial details of the industry…

GCC LED Lighting Market

According to the latest report by IMARC Group, titled "𝗚𝗖𝗖 𝗟𝗘𝗗 𝗟𝗶𝗴𝗵𝘁𝗶𝗻𝗴 𝗠𝗮𝗿𝗸𝗲𝘁: 𝗜𝗻𝗱𝘂𝘀𝘁𝗿𝘆 𝗧𝗿𝗲𝗻𝗱𝘀, 𝗦𝗵𝗮𝗿𝗲, 𝗦𝗶𝘇𝗲, 𝗚𝗿𝗼𝘄𝘁𝗵, 𝗢𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝗮𝗻𝗱 𝗙𝗼𝗿𝗲𝗰𝗮𝘀𝘁 𝟮𝟬𝟮𝟮-𝟮𝟬𝟮𝟳", the GCC LED lighting market size reached a value of US$ 689.2 Million in 2021. Looking forward, IMARC Group expects the market to reach US$ 1,452.1 Million by 2027, exhibiting a CAGR of 14.1% during 2022-2027..

𝗬𝗲𝗮𝗿 𝗖𝗼𝗻𝘀𝗶𝗱𝗲𝗿𝗲𝗱 𝘁𝗼 𝗘𝘀𝘁𝗶𝗺𝗮𝘁𝗲 𝘁𝗵𝗲 𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗶𝘇𝗲:

Base Year of the Analysis: 2021

Historical Period:…

GCC Contact Lens Market Size, Growth Opportunities, Statistics, Market Scope, Tr …

The GCC Contact Lens Market Report provides a thorough study of the competitive landscape, market participants, geographical regions, and application areas. In order to comprehend future demand and industry prognosis, the research includes a complete assessment of growth variables, market definitions, manufacturers, market potential, and influential trends. The research also contains a comprehensive analysis of the market, taking into account key growth-influencing elements.

The study gives a detailed breakdown of important…

GCC Digital Signage Market-(2017-2023)

Market Forecast By Components (Display Screens, Content Players and Software), By Display Screen Types (Single Screen, Video Wall or Multi Screen and Digital Signage Kiosk), By Display Screen Technologies (LED, OLED and QLED), By Display Screen Size (Below 40", 40"-55" and Above 55"), By End User Applications (Government & Transportation, Retail, Healthcare & Hospitality, Education, Entertainment, Banks & Financial Institutions and Commercial Offices & Buildings), By Countries (Saudi Arabia, Bahrain…