Press release

Global Digital Payments Market is projected to reach the value of $1499.98 Billion by 2030.

In 2024, the Global Digital Payments marketplace was valued at $1.40 Billion and is projected to reach a market size of $ 11.43 billion by 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 730.01%.Request Sample @ https://virtuemarketresearch.com/report/digital-payments-market/request-sample

The world of digital payments is constantly changing, and many factors influence its growth. One major reason for its long-term expansion is the global shift toward cashless transactions. Governments and financial institutions are pushing for digital payment adoption because it is more efficient and secure than cash. Many countries are introducing policies that encourage businesses and individuals to use digital payment methods. Contactless payments, online banking, and mobile wallets are becoming more common, making transactions faster and easier. The increased use of smartphones and internet access has also contributed to this shift. As technology continues to improve, digital payments will likely become the dominant method of financial transactions worldwide.

The COVID-19 pandemic significantly impacted the digital payments market. During lockdowns, people avoided using cash due to concerns about virus transmission. Many businesses were forced to switch to online sales, leading to a surge in digital transactions. E-commerce platforms experienced rapid growth as customers preferred shopping from home. Governments also encouraged the use of digital payments to maintain economic activity while reducing physical contact. As a result, businesses invested in better digital payment infrastructure, making transactions more seamless. Even after the pandemic, the habit of using digital payments has remained strong, driving continued market growth.

A key short-term driver for digital payments is the rise of instant payment solutions. Consumers and businesses demand faster transactions, and financial institutions are responding by offering real-time payment options. Instant payments allow money to be transferred within seconds, eliminating long wait times associated with traditional banking methods. This has become particularly important for businesses that rely on quick transactions to maintain cash flow. Governments and regulatory bodies are also supporting these developments by creating frameworks that enable secure and efficient instant payments.

One major opportunity in the digital payments market lies in financial inclusion. Many people, especially in developing regions, do not have access to traditional banking services. Digital payments provide a way for them to participate in the financial system using mobile wallets and digital banking platforms. Companies are increasingly focusing on expanding their services to underserved populations, helping them access financial tools that were previously unavailable. By reaching these new customers, businesses can expand their user base and contribute to economic development in these regions.

A notable trend in the digital payments market is the increasing use of artificial intelligence (AI) and machine learning. AI is being used to enhance security, detect fraud, and improve customer experiences. Payment platforms are implementing AI-powered chatbots to assist users and resolve issues quickly. Machine learning algorithms analyze transaction patterns to identify suspicious activities and prevent fraud. As cyber threats continue to evolve, AI-driven security measures will become even more critical for ensuring safe digital transactions. Additionally, AI is helping businesses personalize their payment services, offering customized recommendations based on user behavior. This trend is expected to shape the future of digital payments, making transactions more secure and efficient.

Enquire Before Buying @ https://virtuemarketresearch.com/report/digital-payments-market/enquire

Segmentation Analysis:

The global Digital Payments Market segmentation includes:

By Type: Credit unions, Co-operative Banks, Consumer Bank.

The consumer bank segment is the largest in the digital payments market, driven by increasing revenue, cost efficiency, and digital transformation. These banks prioritize customer-centric services and are rapidly adopting digital payment solutions to enhance user experience.The fastest-growing segment is co-operative banks, as they are increasingly integrating digital payment solutions to expand their customer base and offer seamless financial services. Their shift from traditional branch-based services to digital platforms is accelerating their market growth.

By Region:

The largest segment in the digital payments market by region is North America, driven by the strong presence of major financial institutions, high consumer adoption of digital transactions, and continuous innovation in payment technologies. The region's well-established banking infrastructure and focus on customer retention further contribute to its dominance.The fastest-growing segment is Asia-Pacific, fueled by the increasing penetration of smartphones, government initiatives promoting digital transactions, and a rapidly expanding fintech ecosystem. Countries like China, India, and Japan are leading this growth with widespread adoption of mobile payments and financial inclusion programs.

Latest Industry Developments:

• Expansion of Embedded Finance Solutions: Companies in the digital payments market are increasingly integrating financial services into non-financial platforms through embedded finance. This trend enables businesses to offer seamless, in-app payment experiences, eliminating the need for traditional banking interfaces. The rise of partnerships between payment providers and e-commerce platforms, fintech firms, and social media apps is accelerating this transformation, creating new revenue streams and enhancing customer retention.

• Growth in Cross-Border Payment Innovations: The adoption of real-time cross-border payment solutions is gaining momentum, driven by the need for faster and more cost-effective international transactions. Companies are leveraging blockchain technology, AI-driven fraud detection, and digital currencies to enhance security and efficiency. Regulatory developments and collaborations between global financial institutions and fintech firms are further streamlining these transactions, reducing processing times, and expanding access to international markets.

• Personalization Through AI and Data Analytics: The use of artificial intelligence (AI) and advanced data analytics is becoming a key strategy in enhancing digital payment experiences. Companies are investing in AI-driven fraud prevention, predictive analytics for customer behavior, and personalized financial services to increase user engagement. Machine learning models are being integrated into payment platforms to provide customized recommendations, optimize transaction security, and improve the overall payment experience. This trend is fostering greater consumer trust and loyalty in digital transactions.

Buy Now @ https://virtuemarketresearch.com/checkout/digital-payments-market

About Us:

Virtue Market Research is a strategic management firm helping companies to tackle most of their strategic issues and make informed decisions for their future growth. We offer syndicated reports and consulting services. Our reports are designed to provide insights on the constant flux in the global demand-supply gap of markets.

103 Kumar Plaza,SRPF Road,

Ramtekadi,Pune,

Maharashtra - 411013

Virtue Market Research stands at the forefront of strategic analysis, empowering businesses to navigate complex market landscapes with precision and confidence. Specializing in both syndicated and bespoke consulting services, we offer in-depth insights into the ever-evolving interplay between global demand and supply dynamics. Leveraging our expertise, businesses can identify emerging opportunities, discern critical trends, and make decisions that pave the way for future success."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Digital Payments Market is projected to reach the value of $1499.98 Billion by 2030. here

News-ID: 4299859 • Views: …

More Releases from Virtue Market Research

The Global Vodka Seltzer Market is projected to reach a market size of USD 16.22 …

The Vodka Seltzer Market was valued at USD 9.4 billion in 2024 and is projected to reach a market size of USD 16.21 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.1%.

Request Sample @ https://virtuemarketresearch.com/report/vodka-seltzer-market/request-sample

The vodka seltzer market has grown from a niche beverage choice into a mainstream favorite, supported by shifting consumer lifestyles and evolving…

The Global Telehealth Services Market and is projected to reach a market size of …

The Global Telehealth Services Market was valued at USD 126.1 billion and is projected to reach a market size of USD 302.49 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.7%.

Request Sample @ https://virtuemarketresearch.com/report/telehealth-services-market/request-sample

The perennial shift towards patient-centric healthcare has been a pivotal long-term market driver for telehealth services. Over the years, the industry has witnessed…

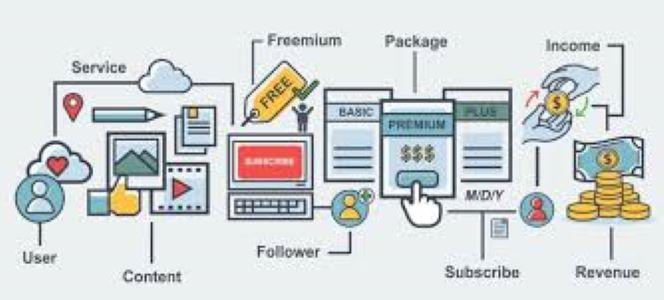

The Subscription Box/Subscription E-Commerce Market is projected to reach a mark …

The Subscription Box/Subscription E-Commerce Market is valued at USD 47.19 billion in 2024 and is projected to reach a market size of USD 97.73 billion by the end of 2030. Over the outlook period of 2025-2030, the market is anticipated to grow at a CAGR of 12.9%.

Request Sample @ https://virtuemarketresearch.com/report/subscription-e-commerce-market/request-sample

The subscription e-commerce market has grown into one of the most dynamic parts of the digital economy. It began as a…

The Global Aramid Fibre Reinforced Polymer Composites Market is projected to rea …

According to the report published by Virtue Market Research in Aramid Fibre Reinforced Polymer Composites Market was valued at USD 5.55 billion and is projected to reach a market size of USD 8.57 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/aramid-fibre-reinforced-polymer-composites-market/request-sample

The Aramid Fibre Reinforced Polymer Composites…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…