Press release

Critical Minerals at Stake | Europe's Battery Recycling Market Emerges as a Strategic Shield for EV Expansion

Critical Minerals at Stake | Europe's Battery Recycling Market Emerges as a Strategic Shield for EV Expansion

The numbers tell the story: surging EV registration, expanding gigafactory footprints, tightening sustainability regulation, and rising geopolitical tension over raw materials. Battery recycling-once a niche downstream activity-has now become a core strategic pillar of Europe's clean-tech industrial strategy.

And the result? A market that is scaling faster than analysts expected, fueled by policy mandates, circular economy legislation, and the simple reality that Europe cannot meet its electrification goals without recycling every gram of lithium, nickel, and cobalt it can recover.

Get the Detailed Industry Analysis (including the Table of Contents, List of Figures, and List of Tables) - from the Battery Recycling Markett Research Report: https://marketgenics.co/reports/battery-recycling-market-88294

Europe's Market Crossroads | Why Battery Recycling Suddenly Matters

Europe's electrification push has collided with a mineral supply chain it doesn't control.

The EU imports:

87% of its lithium

100%+ of its natural graphite

98% of its rare earths

71% of its cobalt

Against this backdrop, recycling has shifted from being an environmental checkbox to a strategic defense mechanism-a way to reduce vulnerability to global supply shocks and assert industrial independence.

Add in the wave of EV retirements expected from 2028 onward, plus the early shred and process waste from Europe's gigafactories, and suddenly recycling becomes:

A supply chain stabilizer

A mineral source

A cost-buffer

A competitive advantage

Europe is not just recycling batteries-it's rewriting its industrial strategy around them.

Oversupply or Insurance Policy? Europe Says Both

Globally, gigafactory capacity is rising faster than battery demand. Europe itself will host more than 40 battery plants by 2030.

But unlike China or the US, Europe is not betting on oversupply alone. It's building recycling infrastructure in parallel-by design, not accident.

For European policymakers, recycling is:

A hedge against mineral shortages

An insurance policy against geopolitical risk

A compliance tool under EU's Battery Regulation

A circularity engine for end-of-life EVs

To Europe, battery recycling is not a backup plan-

it is Plan A.

The Policy Wave That Changed Everything

Europe's regulatory environment is the single biggest catalyst for the market's growth.

The EU Battery Regulation mandates:

Minimum recycled content in new batteries

Mandatory collection rates

Strict carbon footprint declarations

Localization of critical processing

Traceability from mine to recycling

By 2031, new batteries sold in the EU must contain:

16% recycled cobalt

6% recycled lithium

6% recycled nickel

This alone will create a structural pull for recycled materials-guaranteeing demand before supply even scales.

The Digital Inflection Point | AI-Led Sorting and Real-Time Traceability

Europe's recyclers are no longer just "processing waste"-they are becoming high-tech mineral recovery plants.

A new wave of technologies is transforming the sector:

AI-driven cell sorting to classify chemistries

Robotic disassembly lines for EV battery packs

Digital passports tracing every battery from birth

Hydrometallurgical extraction with higher yield

Solvent-based recovery improving purity levels

As Europe's recycling becomes more digital, more automated, and more traceable, the continent is positioning itself as the world's most transparent battery ecosystem.

To know more about the Battery Recycling Market - Download our Sample Report: https://marketgenics.co/download-report-sample/battery-recycling-market-88294

The Segmental Reveal | Where Europe's Recycling Market Is Growing Fastest

Like the CCUS markets, Europe's battery recycling market is not monolithic-it splits into dynamic, fast-moving segments.

End-of-Life EV Batteries

The fastest-growing stream, driven by:

Retired BEVs from early adoption years

Used imports reaching end-of-life

Fleet EV turnover

Manufacturing Shred

Gigafactory ramp-ups create 30-40% shred rates in early years.

This stream is now a primary revenue driver.

Portable Electronics

Still growing, but dwarfed by EV volumes.

However, offers high cobalt content-making it valuable.

Stationary Energy Storage

Expected to contribute significantly after 2030, especially as wind and solar storage systems retire.

Europe's Regional Dynamics | Where the Action Is

Germany

The undisputed leader-with automotive giants, gigafactories, and recycling startups building integrated ecosystems.

France

Aggressively scaling its hydrometallurgical infrastructure; strong policy support from the French state.

Nordics (Sweden, Finland)

The mineral powerhouse. With access to renewable energy, the region is becoming Europe's recycling chemistry hub.

UK

Though outside the EU, the UK is aligning closely with EU standards-building recycling capacity to support its EV shift.

Eastern Europe

Becoming the backbone of Europe's recycling manufacturing base, driven by cost advantages and proximity to OEMs.

The Geopolitics Beneath the Market

Lithium is the new oil. Nickel is the new steel.

And cobalt? It's the new geopolitical wildcard.

Europe's reliance on a small group of countries for these minerals has forced a fundamental rethinking of industrial strategy. Battery recycling is now:

A resource security tool

A diplomatic buffer

A competitive necessity

The EU sees recycling as its ticket to reducing exposure to global mineral volatility-and as a way to lead ethically in a world concerned about mining practices.

Is the Market Overhyped or Undervalued?

Most analysts still undervalue the speed at which:

Gigafactory shred will peak

EV retirements will surge

Mandatory recycled content will kick in

OEMs will vertically integrate recycling

Europe's battery recycling market is not simply "growing"-

it is becoming the backbone of its clean-energy future.

The next decade will determine whether Europe becomes:

A global leader in circular battery production

or

A region dependent on imported minerals

Right now, the momentum strongly favors the former.

Europe is entering a defining decade-one where batteries are no longer just components of electric vehicles or energy storage systems, but the very foundation of the region's industrial sovereignty. As EV adoption accelerates and dependence on critical minerals deepens, Europe is quietly building one of the world's most sophisticated battery recycling ecosystems.

The numbers tell the story: surging EV registration, expanding gigafactory footprints, tightening sustainability regulation, and rising geopolitical tension over raw materials. Battery recycling-once a niche downstream activity-has now become a core strategic pillar of Europe's clean-tech industrial strategy.

And the result? A market that is scaling faster than analysts expected, fueled by policy mandates, circular economy legislation, and the simple reality that Europe cannot meet its electrification goals without recycling every gram of lithium, nickel, and cobalt it can recover.

Europe's Market Crossroads | Why Battery Recycling Suddenly Matters

Europe's electrification push has collided with a mineral supply chain it doesn't control.

The EU imports:

87% of its lithium

100%+ of its natural graphite

98% of its rare earths

71% of its cobalt

Against this backdrop, recycling has shifted from being an environmental checkbox to a strategic defense mechanism-a way to reduce vulnerability to global supply shocks and assert industrial independence.

Add in the wave of EV retirements expected from 2028 onward, plus the early shred and process waste from Europe's gigafactories, and suddenly recycling becomes:

A supply chain stabilizer

A mineral source

A cost-buffer

A competitive advantage

Europe is not just recycling batteries-it's rewriting its industrial strategy around them.

Oversupply or Insurance Policy? Europe Says Both

Globally, gigafactory capacity is rising faster than battery demand. Europe itself will host more than 40 battery plants by 2030.

But unlike China or the US, Europe is not betting on oversupply alone. It's building recycling infrastructure in parallel-by design, not accident.

For European policymakers, recycling is:

A hedge against mineral shortages

An insurance policy against geopolitical risk

A compliance tool under EU's Battery Regulation

A circularity engine for end-of-life EVs

To Europe, battery recycling is not a backup plan-

it is Plan A.

Buy Now: https://marketgenics.co/buy/battery-recycling-market-88294

The Policy Wave That Changed Everything

Europe's regulatory environment is the single biggest catalyst for the market's growth.

The EU Battery Regulation mandates:

Minimum recycled content in new batteries

Mandatory collection rates

Strict carbon footprint declarations

Localization of critical processing

Traceability from mine to recycling

By 2031, new batteries sold in the EU must contain:

16% recycled cobalt

6% recycled lithium

6% recycled nickel

This alone will create a structural pull for recycled materials-guaranteeing demand before supply even scales.

The Digital Inflection Point | AI-Led Sorting and Real-Time Traceability

Europe's recyclers are no longer just "processing waste"-they are becoming high-tech mineral recovery plants.

A new wave of technologies is transforming the sector:

AI-driven cell sorting to classify chemistries

Robotic disassembly lines for EV battery packs

Digital passports tracing every battery from birth

Hydrometallurgical extraction with higher yield

Solvent-based recovery improving purity levels

As Europe's recycling becomes more digital, more automated, and more traceable, the continent is positioning itself as the world's most transparent battery ecosystem.

The Segmental Reveal | Where Europe's Recycling Market Is Growing Fastest

Like the CCUS markets, Europe's battery recycling market is not monolithic-it splits into dynamic, fast-moving segments.

End-of-Life EV Batteries

The fastest-growing stream, driven by:

Retired BEVs from early adoption years

Used imports reaching end-of-life

Fleet EV turnover

Manufacturing Shred

Gigafactory ramp-ups create 30-40% shred rates in early years.

This stream is now a primary revenue driver.

Portable Electronics

Still growing, but dwarfed by EV volumes.

However, offers high cobalt content-making it valuable.

Stationary Energy Storage

Expected to contribute significantly after 2030, especially as wind and solar storage systems retire.

Europe's Regional Dynamics | Where the Action Is

Germany

The undisputed leader-with automotive giants, gigafactories, and recycling startups building integrated ecosystems.

France

Aggressively scaling its hydrometallurgical infrastructure; strong policy support from the French state.

Nordics (Sweden, Finland)

The mineral powerhouse. With access to renewable energy, the region is becoming Europe's recycling chemistry hub.

UK

Though outside the EU, the UK is aligning closely with EU standards-building recycling capacity to support its EV shift.

Eastern Europe

Becoming the backbone of Europe's recycling manufacturing base, driven by cost advantages and proximity to OEMs.

The Geopolitics Beneath the Market

Lithium is the new oil. Nickel is the new steel.

And cobalt? It's the new geopolitical wildcard.

Europe's reliance on a small group of countries for these minerals has forced a fundamental rethinking of industrial strategy. Battery recycling is now:

A resource security tool

A diplomatic buffer

A competitive necessity

The EU sees recycling as its ticket to reducing exposure to global mineral volatility-and as a way to lead ethically in a world concerned about mining practices.

Is the Market Overhyped or Undervalued?

Most analysts still undervalue the speed at which:

Gigafactory shred will peak

EV retirements will surge

Mandatory recycled content will kick in

OEMs will vertically integrate recycling

Europe's battery recycling market is not simply "growing"-

it is becoming the backbone of its clean-energy future.

The next decade will determine whether Europe becomes:

A global leader in circular battery production

or

A region dependent on imported minerals

Right now, the momentum strongly favors the former.

Get the complete market breakdown - statistics, insights, and future outlook: https://marketgenics.co/press-releases/battery-recycling-market-88294

The Closing Line

Europe's battery recycling market is not just a waste-management story-it is a geopolitical strategy, a climate strategy, an industrial strategy, and an economic strategy converging at once.

The region has made one thing clear:

Every battery counts, every mineral counts, and every loop must close.

Mr. Debashish Roy

MarketGenics Research

800 N King Street, Suite 304 #4208, Wilmington, DE 19801, United States

USA: +1 (302) 303-2617

Email: sales@marketgenics.co

Website: https://marketgenics.co

MarketGenics is a global market research and management consulting company empowering decision makers across healthcare, technology, and policy domains. Our mission is to deliver granular market intelligence combined with strategic foresight to accelerate sustainable growth.

We support clients across strategy development, product innovation, healthcare infrastructure, and digital transformation.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Critical Minerals at Stake | Europe's Battery Recycling Market Emerges as a Strategic Shield for EV Expansion here

News-ID: 4299073 • Views: …

More Releases from MarketGenics Research

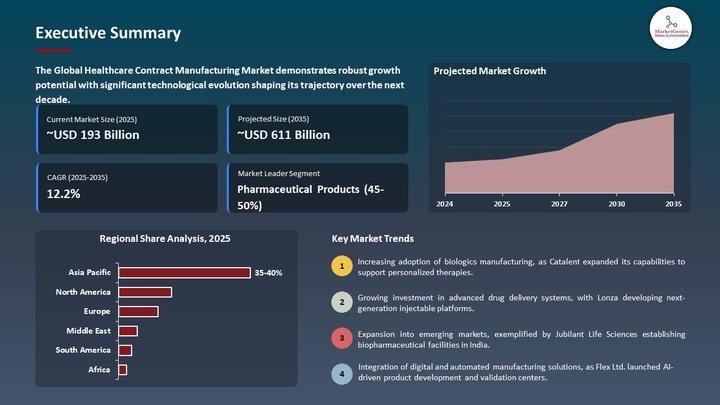

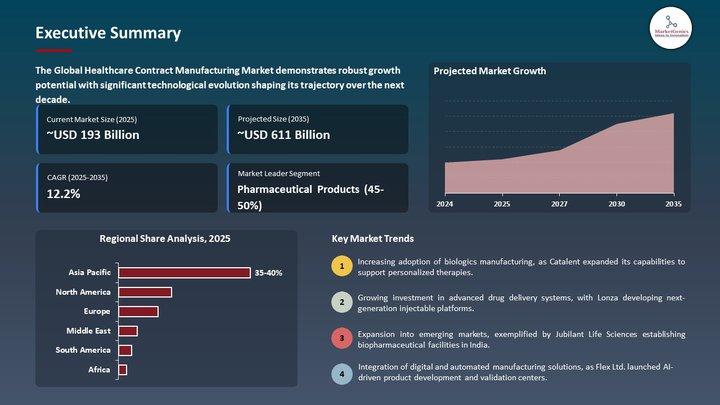

Healthcare Contract Manufacturing Market | Europe's Race for Quality-Centric Man …

Healthcare Contract Manufacturing Market | Europe's High-Precision Manufacturing Pivot Is Reshaping the Future of Therapeutics

The Healthcare Contract Manufacturing Market used to live in the operational shadows - a technical appendix to pharma strategy, an afterthought to medical device roadmaps.

That era is gone.

Europe's push for biologics scale-up, GMP modernization, sterile manufacturing compliance, and resilient supply chains has moved the Healthcare Contract Manufacturing Market from the backroom of operations into the center…

"Aerosol Cans Market in Europe: Sustainability, Aluminum Demand, and Regional Gr …

The world is moving fast on sustainability-biodegradable materials, reusable packaging, and recyclable metals are capturing headlines. Aerosol cans, often overlooked as simple packaging, have quietly evolved into a high-performance, environmentally-conscious solution across personal care, household, healthcare, and industrial sectors.

In 2025, the global Aerosol Cans Market reached USD 14.4 billion, and it is projected to expand to USD 24.0 billion by 2035, growing at a CAGR of 4.7%. For a sector…

Clinical Trial Supplies Market | Europe's New Era of Trial Logistics - Big Pharm …

Clinical Trial Supplies Market | Europe's Supply-Chain Transformation Reshaping the Future of Drug Development

The Clinical Trial Supplies Market used to live in the back rooms of pharma operations - cartons, kits, comparators, storage rooms and shipping labels.

That era is gone.

Europe's pivot toward precision medicine, biologics, decentralized studies, and multi-country regulatory complexity has pushed the Clinical Trial Supplies Market from a logistics afterthought into a strategic pillar of clinical success.

This shift…

Clinical Trial Supplies Market | Europe's Supply-Chain Reinvention - Cold-Chain …

The Clinical Trial Supplies Market used to be a logistics afterthought: labelled vials, dry ice shipments, and predictable pallet runs. That era is gone.

Europe's regulatory complexity, the explosion of biologics and cell & gene therapies, and the rise of decentralized clinical trials (DCTs) have moved the Clinical Trial Supplies Market from a vendor line-item into a strategic capability that determines trial speed, quality and cost. From cryogenic storage in Frankfurt…

More Releases for Europe

2019 Strategy Consulting Market Analysis | McKinsey, The Boston Consulting Group …

Strategy Consulting Market reports also offer important insights which help the industry experts, product managers, CEOs, and business executives to draft their policies on various parameters including expansion, acquisition, and new product launch as well as analyzing and understanding the market trends

Need for strategic planning in highly competitive environment and to develop business capabilities to meet & exceed the emerging requirements are the major drivers which help in surging…

Strategy Consulting Market 2025 | Analysis By Top Key Players: Booz & Co. , Rola …

Global Strategy Consulting Market 2019-2025, has been prepared based on an in-depth market analysis with inputs from industry experts. This report covers the market landscape and its growth prospects over the coming years. The report also includes a discussion of the key vendors operating in this market.

The key players covered in this study

McKinsey , The Boston Consulting Group , Bain & Company , Booz & Co. , Roland Berger Europe…

Digital Strategy Consulting Market is Thriving Worldwide with Deloitte, McKinsey …

A Digital Strategy is a form of strategic management and a business answer or response to a digital question, often best addressed as part of an overall business strategy. A digital strategy is often characterized by the application of new technologies to existing business activity and focus on the enablement of new digital capabilities to their business.

A new report as a Digital Strategy Consulting market that includes a comprehensive analysis…

Strategy Consulting Market 2019: By McKinsey, The Boston Consulting Group, Bain …

This report studies the global Strategy Consulting market, analyzes and researches the Strategy Consulting development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

• McKinsey

• The Boston Consulting Group

• Bain & Company

• Booz & Co.

• Roland Berger Europe

• Oliver Wyman Europe

• A.T. Kearney Europe

• Deloitte

• Accenture Europe

Get Sample Report@ https://www.reporthive.com/enquiry.php?id=1247388&req_type=smpl&utm_source=AB

Market segment by Type, the product can be split into

• Operations Consultants

• Business Strategy Consultants

• Investment Consultants

• Sales and…

Strategy Consulting Market Analysis 2018: McKinsey, The Boston Consulting Group, …

Orbis Research Present’s “Global Strategy Consulting Market” magnify the decision making potentiality and helps to create an effective counter strategies to gain competitive advantage.

The global Strategy Consulting status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Strategy Consulting development in United States, Europe and China.

In 2017, the global Strategy Consulting market size was million US$ and it is expected to reach million…

Influenza Vaccination Market Global Forecast 2018-25 Estimated with Top Key Play …

UpMarketResearch published an exclusive report on “Influenza Vaccination market” delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains 115 pages which highly exhibits on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability. This report focuses on the Influenza Vaccination market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This…