Press release

Urea Price Analysis and Regional Trend Nov 2025

Northeast Asia Urea Prices Movement Nov 2025In Northeast Asia, urea prices in November 2025 settled at USD 0.23/kg, reflecting a slight 0.4% decline. Weak agricultural demand, steady production rates, and competitive exports from China kept prices subdued. Buyers showed cautious purchasing behaviour as stable feedstock and energy costs contributed to a balanced but soft market environment.

Regional Analysis: The price analysis can be expanded to include detailed Urea price data for a wide range of Northeast Asia countries such as China, Japan, South Korea, North Korea, Mongolia & Taiwan.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/urea-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

Africa Urea Prices Movement Nov 2025

In Africa, urea prices slipped to USD 0.48/kg in November 2025, marking a 3.5% decrease. Reduced fertilizer demand, ample regional inventories, and weaker international buying interest pressured prices downward. Improved domestic production and favorable logistics further contributed to the decline, keeping the market well-supplied throughout the month.

Regional Analysis: The price analysis can be expanded to include detailed Urea price data for a wide range of Africa countries such as Nigeria, South Africa, Egypt, Kenya, Morocco, Algeria, Ghana, Ethiopia, Tanzania, Uganda, Angola, Tunisia, Sudan, Cameroon, Ivory Coast, Senegal, Libya, Democratic Republic of the Congo, Zambia & Zimbabwe

Europe Urea Prices Movement Nov 2025

In Europe, urea prices climbed to USD 0.46/kg in November 2025, recording a 6.3% increase. The rise was driven by stronger seasonal fertilizer demand, tighter supply due to lower imports, and higher natural gas costs impacting production economics. Market sentiment improved as buyers secured volumes ahead of winter application needs.

Regional Analysis: The price analysis can be expanded to include detailed Urea price data for a wide range of European countries, such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Middle East Urea Prices Movement Nov 2025

In the Middle East, urea prices fell to USD 0.56/kg in November 2025, registering a 4.7% decline. Strong production output, reduced export inquiries from key markets, and softer global fertilizer demand weighed on prices. Competitive offers from major producers kept market sentiment bearish despite stable feedstock availability.

Regional Analysis: The price analysis can be expanded to include detailed Urea price data for a wide range of Middle East countries such as Saudi Arabia, United Arab Emirates (UAE), Qatar, Kuwait, Bahrain, Oman, Yemen, Iran, Iraq, Syria, Jordan, Lebanon, Israel, Palestine, Turkey & Egypt

Purchase Options: https://www.imarcgroup.com/checkout?id=22470&method=1925

• Biannual Updates: For 2 Deliverables, Billed Annually

• Quarterly Updates: For 4 Deliverables, Billed Annually

• Monthly Updates: For 12 Deliverables, Billed Annually

We Also Provide News and Historical Data of Urea:

• Historical Data: Comprehensive historical pricing and market trends.

• Quarterly Analysis: Detailed insights into price fluctuations and market dynamics.

• Regional and Global Data: Coverage of key markets and their performance.

• Forecast Comparisons: Historical data paired with future market projections.

• Customizable Reports: Tailored analysis to meet specific business needs.

What is Urea?

Urea is a nitrogen-rich chemical compound widely used as a fertilizer and industrial raw material. Produced by reacting ammonia with carbon dioxide, it contains 46% nitrogen, making it one of the most efficient and globally consumed nitrogen fertilizers. Urea is also used in resins, diesel exhaust fluid (DEF), adhesives, and plastics.

Factors Affecting Urea Prices

1. Natural Gas Prices

Natural gas is the primary feedstock for ammonia, which is used to produce urea. Any fluctuations in gas costs directly impact production expenses and global urea pricing.

2. Agricultural Demand Cycles

Fertilizer consumption varies seasonally. Peak planting seasons typically push prices up, while off-season demand softens market values.

3. Global Supply Levels

Capacity utilization, production outages, and export restrictions in major producing nations like China, the Middle East, and India influence global supply and pricing.

4. International Trade Policies

Export tariffs, quotas, and government interventions-including India's import tenders-play a large role in setting global price direction.

5. Freight & Logistics Costs

Shipping rates, port congestion, and vessel availability affect delivered prices across global markets.

6. Currency Exchange Rates

Urea is traded internationally; fluctuations in USD and regional currencies impact competitiveness and price trends.

7. Demand from Industrial Sectors

Beyond fertilizers, industries such as chemicals, plastics, and automotive (DEF/AdBlue) influence overall urea consumption.

Urea Supply and Prices - November 2025 Overview

Global urea supply conditions in November 2025 were mixed across regions:

• Northeast Asia showed steady production and weak export demand, keeping prices slightly lower.

• Africa recorded sufficient supply and reduced agricultural purchasing, putting downward pressure on prices.

• Europe saw firmer pricing as winter demand, reduced imports, and high natural gas costs tightened availability.

• Middle East producers maintained high output, but softer global orders and competitive export offers led to declining prices.

Urea Price Index - November 2025

The global Urea Price Index for November 2025 reflected:

• Declines in Asia and the Middle East, driven by steady production and weak demand.

• Soft index movement in Africa, consistent with reduced fertilizer off-take.

• A notable upward shift in Europe, supported by higher energy costs and stronger seasonal demand.

The index displayed moderate divergence across regions due to differing supply and energy dynamics.

Latest Urea Market News (Nov 2025)

1. China Maintains Export Controls

China continued managing fertilizer exports to safeguard domestic supply, resulting in occasional tightness for Asian buyers.

2. European Producers Face High Energy Costs

Rising natural gas prices limited production economics, prompting higher urea prices in Europe.

3. Weaker Demand from India

India's fertilizer imports slowed as adequate stocks and government procurement patterns reduced immediate buying interest.

4. Middle Eastern Producers Increase Spot Offers

Producers in Saudi Arabia and Qatar boosted spot cargo availability due to weaker demand from key Asian markets.

Urea Market Trend - November 2025

Market trends in November 2025 highlighted:

• Downward pressure in Asian and Middle Eastern markets due to abundant supply and lower agricultural demand.

• Upward movement in Europe, driven by rising input costs and stronger seasonal consumption.

• Muted industrial demand, especially in DEF and resins, kept overall sentiment balanced.

Current Demand for Urea (Nov 2025)

Current demand remained stable to moderate across sectors:

• Agriculture: The largest consumer, though demand eased in many countries post-planting season.

• Industrial sectors: Resins, melamine, adhesives, and plastics maintained steady but non-peak consumption.

• Automotive: DEF/AdBlue usage provided consistent demand, particularly in regions with strict emission standards.

Future Demand Outlook

Future demand for urea is expected to grow steadily due to:

1. Increasing Global Food Production Needs

Rising population and expanding agricultural activity will support long-term fertilizer demand.

2. Expansion of Industrial Applications

Demand in formaldehyde resins, melamine, and chemical intermediates is likely to rise.

3. Growth in Automotive Emission Control (DEF/AdBlue)

Stricter emission norms worldwide are expected to boost urea usage in diesel vehicles.

4. Stable Production in the Middle East

Low-cost producers will continue influencing global pricing and supply balance.

5. Improved Agricultural Policies

Subsidies, support programs, and efficient fertilizer distribution systems may enhance consumption in developing nations.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22470&flag=C

How IMARC Pricing Database Can Help

The latest IMARC Group study, "Urea Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition," presents a detailed analysis of Urea price trend, offering key insights into global Urea market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Urea demand, illustrating how consumer behavior and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Urea Price Analysis and Regional Trend Nov 2025 here

News-ID: 4298648 • Views: …

More Releases from IMARC Group

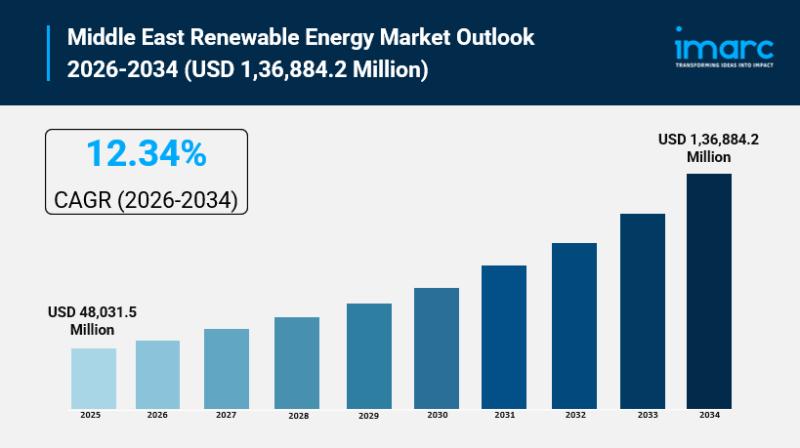

Middle East Renewable Energy Market Size to Hit USD 1,36,884.2 Million by 2034 | …

Middle East Renewable Energy Market Overview

Market Size in 2025: USD 48,031.5 Million

Market Size in 2034: USD 1,36,884.2 Million

Market Growth Rate 2026-2034: 12.34%

According to IMARC Group's latest research publication, "Middle East Renewable Energy Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East renewable energy market size was valued at USD 48,031.5 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,36,884.2 Million by…

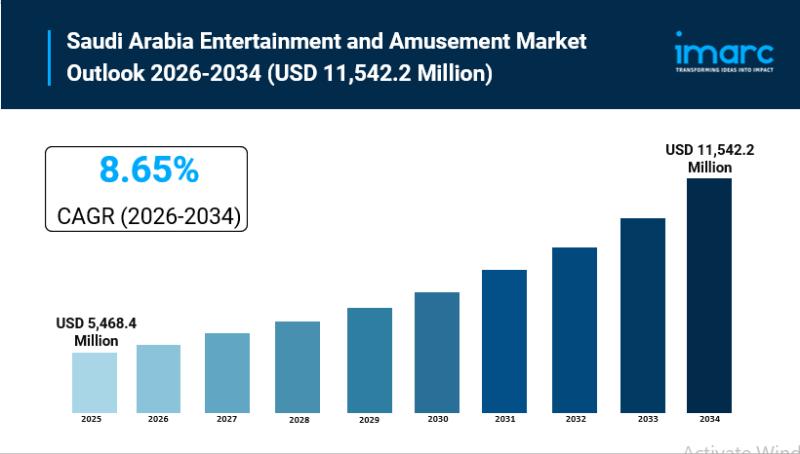

Saudi Arabia Entertainment and Amusement Market Size to Reach USD 11,542.2 Milli …

Saudi Arabia Entertainment and Amusement Market Overview

Market Size in 2025: USD 5,468.4 Million

Market Size in 2034: USD 11,542.2 Million

Market Growth Rate 2026-2034: 8.65%

According to IMARC Group's latest research publication, "Saudi Arabia Entertainment and Amusement Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Saudi Arabia entertainment and amusement market size reached USD 5,468.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 11,542.2 Million…

Philippines Wound Care Market 2026 | Worth USD 175.8 Million by 2034 | At a CAGR …

Market Overview

The Philippines wound care market size reached USD 111.4 Million in 2025. Looking forward, the market is expected to reach USD 175.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.20% during 2026-2034. The market is expanding due to rising awareness of advanced treatments, greater healthcare access, and demand for innovative products such as hydrocolloid dressings and antimicrobial solutions. Growing hospital investments, home healthcare adoption, and focus on…

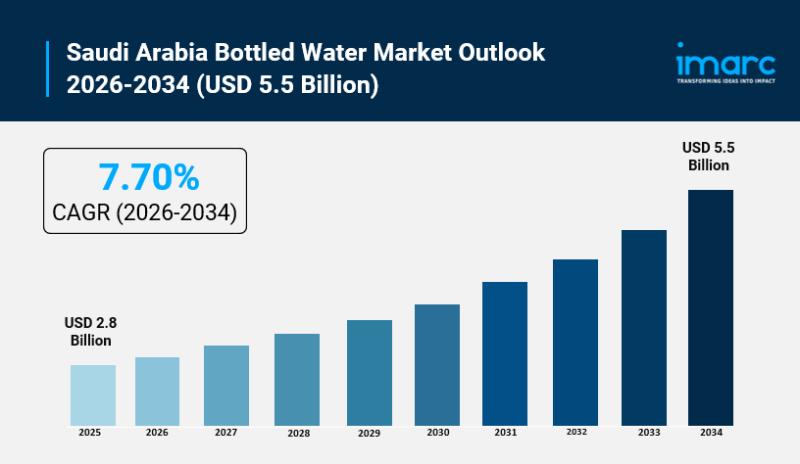

Saudi Arabia Bottled Water Market Size to Surpass USD 5.5 Billion by 2034 at a C …

Saudi Arabia Bottled Water Market Overview

Market Size in 2025: USD 2.8 Billion

Market Size in 2034: USD 5.5 Billion

Market Growth Rate 2026-2034: 7.70%

According to IMARC Group's latest research publication, "Saudi Arabia Bottled Water Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia bottled water market size was valued at USD 2.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 5.5 Billion by…

More Releases for Urea

Urea Formaldehyde Market Size Report 2025

"Global Urea Formaldehyde Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" is published by Global Info Research. It covers the key influencing factors of the Urea Formaldehyde market, including Urea Formaldehyde market share, price analysis, competitive landscape, market dynamics, consumer behavior, and technological impact, etc.At the same time, comprehensive data analysis is conducted by national and regional sales, corporate competition rankings, product types and applications. This report…

Global Marine Urea Solution Market Size by Application, Type, and Geography: For …

According to Market Research Intellect, the global Marine Urea Solution market under the Aerospace and Defense category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

The market for marine urea solutions is expanding significantly due to stricter environmental rules that aim to lower…

Urea market: Market Indicators Showing Positive Outlook

The new report published by The Business Research Company, titled Urea Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033, delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.

As per the report, the urea market size has grown steadily in recent years. It will grow from $47.64 billion in 2023…

Granular Urea Market: Cultivating Growth and Fertility with Premium Granular Ure …

The Worldwide "Granular Urea Market" 2023 Research Report presents a professional and complete analysis of the Global Granular Urea Market in the current situation. This report includes development plans and policies along with Granular Urea manufacturing processes and price structures. the reports 2023 research report offers an analytical view of the industry by studying different factors like Granular Urea Market growth, consumption volume, Size, revenue, share, trends, and Granular Urea…

Urea Market: Asia-Pacific to Lead Urea Market Growth with Rapid Industrializatio …

[100+ Pages Report] | Global "Urea Market" research report provides Innovative Insights on the Strategies adopted by Major Global in the worldwide industry. This valuable information offers businesses and investors a clear understanding of the market's Competitive Landscape, Growth Potential, and Impending Opportunities. The modern report highlights Latest Mergers, Achievements, Revenue Offshoring, R & D, Development Plans, Progression Growth, and Collaborations.

The global urea market size was valued at USD 107.28…

Polymer Sulphur Coated Urea Accounts for Over 90% of the Sales of Global Sulphur …

The impact of the COVID-19 outbreak has compelled several manufacturers and industries to rethink their operations to gradually recover from the losses incurred for years to come. The organic chemicals industry suffered a huge setback due to halted production and a limited supply of raw materials.

The report offers actionable and valuable market insights of Polymer Sulphur Coated Urea. The latest report by Fact.MR provides details on the present scenario of the…