Press release

India Tyre Market to Reach USD 27.6 Billion (CAGR 7.6%) by 2033 | Get Free Sample Report

According to IMARC Group's report titled "India Tyre Market Size, Share, Trends and Forecast by Vehicle Type, OEM and Replacement Segment, Domestic Production and Imports, Radial and Bias Tyres, Tube and Tubeless Tyres, Tyre Size, Price Segment, and Region, 2025-2033", The report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.Market Overview:

• The India tyre market remains robust, driven by rising vehicle ownership, expanding road infrastructure, and growing demand for replacements - positioning tyres as a key component in India's mobility and logistics ecosystem. According to IMARC Group, the market reached USD 13.4 Billion in 2024 and is expected to grow to USD 27.6 Billion by 2033, exhibiting a CAGR of 7.6% during 2025-2033.

• Demand is fueled by the rapid adoption of two-wheelers, passenger vehicles, and commercial vehicles. Replacement tyres form a major part of consumption, supported by a growing vehicle fleet and increased usage across urban and rural geographies. Changes in consumer preferences - such as a shift from bias to radial tyres, rising demand for tubeless tyres, and growing interest in sustainable, fuel-efficient tyre variants - are reshaping the market landscape.

Request Free Sample Report: https://www.imarcgroup.com/india-tyre-market/requestsample

Latest Developments & Government / Policy-Level Drivers:

• Strong growth prospects backed by rising automotive & commercial vehicle demand: Increasing vehicle sales, especially in two-wheelers and commercial segments, is boosting tyre replacement and OEM demand across India.

• Shift toward radial & tubeless tyres: Growing consumer awareness about fuel efficiency, safety, and durability is accelerating the shift from bias/tube tyres to radial and tubeless tyres - a structural shift in tyre demand.

• Expansion of commercial vehicle segment and infrastructure growth: Rising logistics, transportation, construction activities and better road connectivity are increasing demand for commercial vehicle tyres, pushing market growth.

• Domestic production dominance over imports: The majority of tyre demand continues to be met by domestic manufacturers - supporting local industry growth and reducing import dependence.

• Emerging demand for sustainable and EV-compatible tyres: With increasing interest in fuel efficiency, emissions reduction, and the gradually rising adoption of electric vehicles (EVs), demand for high-performance, eco-friendly, and specialty tyres is growing.

Analyst Commentary:

The India tyre market is at a promising inflection point. Sustained growth in vehicle ownership - across two-wheelers, passenger cars, and commercial vehicles - along with expanding road infrastructure and a shift toward better-performing radial/tubeless tyres, is setting a strong foundation. The growth of logistics, e-commerce, and transportation sectors further amplifies demand for replacement and commercial vehicle tyres. As sustainability and vehicle electrification begin to influence consumer behaviour, tyre manufacturers that invest in fuel-efficient, durable, and EV-compatible products stand to gain significantly over the coming decade.

Speak to Analyst or Any Inquiry, Before Buying the Report: https://www.imarcgroup.com/request?type=report&id=1261&flag=C

Key Trends:

• Radial & Tubeless Preference Gains Ground - Shift from bias/tube tyres toward radial and tubeless tyres due to superior durability, fuel efficiency, and safety.

• Two-Wheeler Tyres Leading the Volume Share - High penetration of two-wheelers in India ensures that two-wheeler tyres continue to dominate the market by volume.

• Rising Demand for Commercial Vehicle Tyres - Growth in logistics, e-commerce and infrastructure activity fuels demand for heavy-duty and commercial tyres.

• Domestic Production Strength & Import Substitution - Strong domestic manufacturing capacity satisfies major demand, supporting local industry over imports.

• Focus on Fuel Efficiency & Sustainability - Tyre manufacturers increasingly offer fuel-efficient and eco-friendly tyres to meet evolving consumer and regulatory expectations.

• Move Toward EV-Ready and Specialty Tyres - As EV adoption slowly rises, demand grows for tyres optimized for EV performance, load-bearing, and durability.

Growth Drivers:

• Expanding Vehicle Fleet & Ownership - Growth in both two-wheelers and four-wheelers, along with commercial vehicles, drives tyre demand.

• Infrastructure Development & Logistics Boom - Road-building, highway expansion, and rising logistics demand push commercial tyre consumption.

• Replacement Market Growth - Large existing vehicle population ensures steady replacement tyre demand over time.

• Consumer Shift to Better-quality Tyres (Radial & Tubeless) - Preference for safer, durable, fuel-efficient tyres supports market upgradation.

• Domestic Manufacturing Capacity & Policies Favoring Local Production - High domestic production meets demand, reducing reliance on imports and encouraging local industry growth.

• Emerging Demand for Eco-friendly and Specialty Tyres (EV-compatible, High-Performance) - Changing vehicle and environmental trends support diversification into advanced tyre segments.

• Growth of Aftermarket Channels & Tyre Retail Infrastructure - Expansion of tyre service centres, replacement networks and retail channels across urban and rural India improves accessibility and demand.

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-tyre-market

An In-Depth Analysis of Prominent Companies in the Industry by IMARC Group:

• Apollo Tyres Ltd

• Bridgestone India Private Limited

• CEAT Ltd

• Continental Tyres

• JK Tyre & Industries Ltd.

• MRF Tyres

• The Goodyear Tire & Rubber Company

• Yokohama India Pvt Ltd

Comprehensive Market Report Highlights & Segmentation Analysis:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India tyre market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Comprehensive Market Report Highlights & Segmentation Analysis:

Analysis by Vehicle Type:

• Two Wheelers

• Three Wheelers

• Passenger Cars

• Light Commercial Vehicles

• Medium and Heavy Commercial Vehicles

• Off the Road

The two-wheeler tyre segment holds the largest share in the India tyre market, driven by high demand, widespread usage, and a rapidly growing two-wheeler population.

Analysis by OEM and Replacement:

• OEM Tyres

• Replacement Tyres

The replacement tyre segment dominates the India tyre market, accounting for the largest share due to increasing vehicle ownership, wear and tear, and growing consumer demand.

Analysis by Domestic Production and Imports:

• Domestic Production

• Imports

Domestic tyre manufacturing holds a dominant position in the Indian tyre market, accounting for the majority share and driving growth across various vehicle segments nationwide.

Analysis by Radial and Bias Tyres:

• Bias Tyres

• Radial Tyres

Radial tyres hold a dominant position in the India tyre market, driven by their superior performance, durability, fuel efficiency, and increasing adoption across vehicle segments.

Analysis by Tube and Tubeless Tyres:

• Tube Tyres

• Tubeless Tyres

The tubeless tyre segment holds the largest market share in the India tyre industry, driven by growing consumer preference for enhanced safety, durability, and fuel efficiency.

Analysis by Tyre Size:

• Small

• Medium

• Large

The small tyre segment accounts for the largest market share in India, mainly due to strong demand for two-wheelers, entry-level cars, and compact commercial vehicles.

Analysis by Price Segment:

• Low

• Medium

• High

Regional Analysis:

• North India

• East India

• West and Central India

• South India

West and Central India dominate the Indian tyre market, driven by robust automotive manufacturing hubs, advanced infrastructure, high vehicle ownership, and strong regional demand for replacement tyres.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=1261&flag=E

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Other key areas covered in the report:

• COVID-19 Impact on the Market

• Porter's Five Forces Analysis

• Strategic Recommendations

• Market Dynamics

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

• Top Winning Strategies

• Recent Industry News

• Key Technological Trends & Development

Frequently Asked Questions:

Q1. What was the size of the India tyre market in 2024?

A1. The market was valued at USD 13.4 Billion in 2024.

Q2. What is the projected market value by 2033?

A2. The market is expected to reach USD 27.6 Billion by 2033.

Q3. What is the expected growth rate during 2025-2033?

A3. The market is projected to grow at a CAGR of 7.6% over 2025-2033.

Q4. Which tyre segment (vehicle type) dominates the India market?

A4. Two-wheeler tyres represent the largest vehicle-type segment in 2024, driven by high two-wheeler ownership across India.

Q5. What tyre types are leading - radial or bias; tubeless or tube?

A5. Radial tyres and tubeless tyres dominate, due to higher durability, fuel efficiency, safety and consumer preference shifts.

Q6. What factors are driving growth in the India tyre market?

A6. Growth is driven by expanding vehicle ownership, urbanization, infrastructure and logistics growth, rising demand for replacement tyres, shift to better-quality radial/tubeless tyres, and increasing need for commercial and specialty tyres.

Explore More Reports & Get Your Free Sample Now!

• India Alkaline Battery Market: https://www.imarcgroup.com/india-alkaline-battery-market/requestsample

• India Autonomous Mobile Robots Market: https://www.imarcgroup.com/india-autonomous-mobile-robots-market/requestsample

• India Metrology Services Market: https://www.imarcgroup.com/india-metrology-services-market/requestsample

• India Hair Oil Market: https://www.imarcgroup.com/india-hair-oil-market/requestsample

• India Subscriber Data Management Market: https://www.imarcgroup.com/india-subscriber-data-management-market/requestsample

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Updated Date: 03-Dec-2025

Author: Tarang Chauhan

Sources: IMARC Group

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Tyre Market to Reach USD 27.6 Billion (CAGR 7.6%) by 2033 | Get Free Sample Report here

News-ID: 4298354 • Views: …

More Releases from IMARC Group

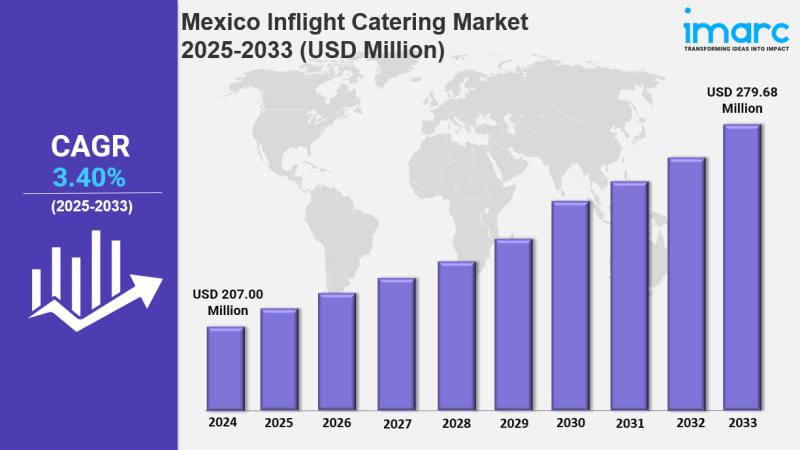

Mexico Inflight Catering Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Inflight Catering Market Size, Share, Trends and Forecast by Food Type, Flight Service Type, Aircraft Seating Class, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico inflight catering market size reached USD 207.00 Million in 2024. The market is…

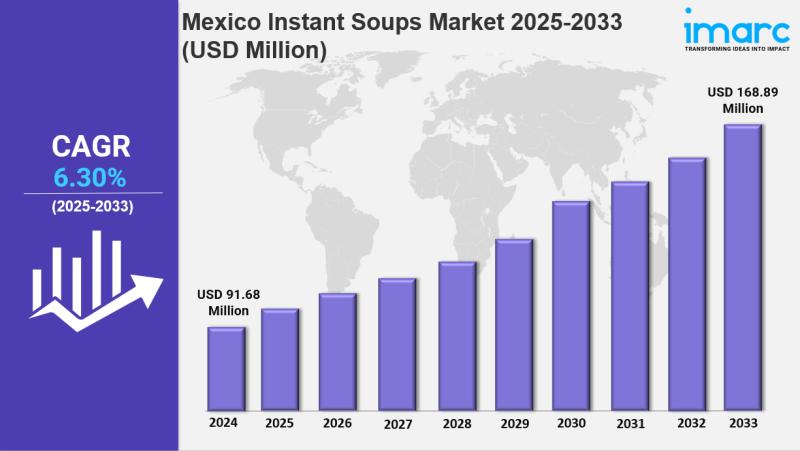

Mexico Instant Soups Market Size, Share, Latest Insights and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Instant Soups Market Size, Share, Trends and Forecast by Nature, Form, Source, Distribution Channel, End Use, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico instant soups market size reached USD 91.68 Million in 2024 and is projected to…

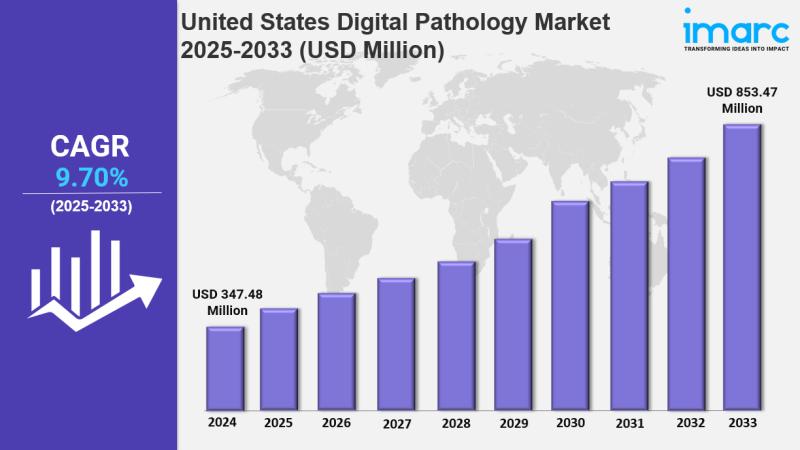

United States Digital Pathology Market : Trends, Drivers, and Growth Opportuniti …

IMARC Group has recently released a new research study titled "United States Digital Pathology Market Size, Share, Trends and Forecast by Product, Type, Delivery Model, Application, End User, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States digital pathology market size was valued at USD 347.48 Million in 2024…

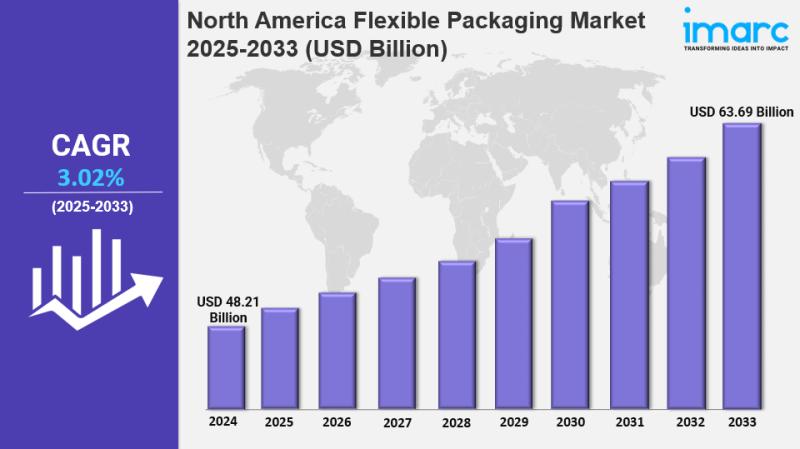

North America Flexible Packaging Market Share, Size, In-Depth Insights, Trends a …

IMARC Group has recently released a new research study titled "North America Flexible Packaging Market Size, Share, Trends and Forecast by Product Type, Raw Material, Printing Technology, Application, and Country, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The North America flexible packaging market was valued at USD 48.21 Billion in 2024 and is…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…