Press release

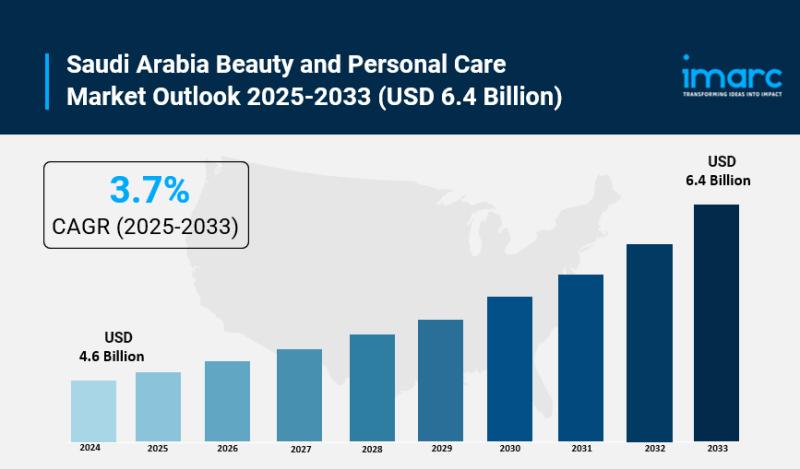

Saudi Arabia Beauty and Personal Care Market Size to Hit USD 6.4 Billion by 2033 | With a 3.7% CAGR

Saudi Arabia Beauty and Personal Care Market OverviewMarket Size in 2024: USD 4.6 Billion

Market Size in 2033: USD 6.4 Billion

Market Growth Rate 2025-2033: 3.7%

According to IMARC Group's latest research publication, "Saudi Arabia Beauty and Personal Care Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia beauty and personal care market size was valued at USD 4.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.4 Billion by 2033, exhibiting a CAGR of 3.7% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Beauty and Personal Care Market

● AI-powered personalization engines analyze skin profiles and beauty preferences, delivering customized product recommendations that enhance consumer satisfaction across Saudi Arabia's diverse demographic.

● Machine learning algorithms revolutionize virtual try-on experiences for cosmetics, enabling digital makeup testing through mobile applications and reducing product return rates significantly.

● AI-driven chatbots transform customer service in beauty retail, providing instant product guidance and skincare consultations across online platforms serving Saudi consumers.

● Predictive analytics optimize inventory management for beauty retailers, forecasting demand patterns and ensuring popular products remain available across physical and digital channels.

● Smart beauty devices integrated with AI technology analyze skin conditions and track skincare routines, empowering Saudi consumers with data-driven beauty decisions.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-beauty-personal-care-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Beauty and Personal Care Industry

Saudi Arabia's Vision 2030 is revolutionizing the beauty and personal care industry by driving economic diversification, cultural transformation, and entrepreneurial innovation across the Kingdom. The initiative has catalyzed significant changes in women's workforce participation and public engagement, directly expanding the consumer base for cosmetics, skincare, and grooming products. With rising disposable incomes fueled by the non-oil sector's growth, Saudi consumers are increasingly investing in premium, luxury, and natural beauty products that align with international standards. Vision 2030's emphasis on tourism development through mega-projects like NEOM and The Red Sea Project is boosting demand for hospitality-related beauty services and retail infrastructure. Government support through regulatory reforms, including streamlined product registration systems and halal certification frameworks established by entities like the Public Investment Fund's Halal Products Development Company, positions Saudi Arabia as a regional hub for compliant beauty manufacturing. The initiative's focus on digital transformation has accelerated e-commerce penetration, with beauty brands leveraging social media and online platforms to reach tech-savvy consumers. Ultimately, Vision 2030 elevates the beauty and personal care sector as a key pillar of economic growth, fostering innovation, empowering entrepreneurs, and establishing Saudi Arabia as a competitive force in the global beauty market.

Saudi Arabia Beauty and Personal Care Market Trends & Drivers:

Saudi Arabia's beauty and personal care market is experiencing robust growth, driven by the Kingdom's predominantly young and digitally connected population with a significant proportion under the age of 30. With internet penetration standing at nearly complete coverage and social media users accounting for a substantial portion of the total population, digital platforms have become primary channels for beauty discovery and purchasing decisions. Influencers and online beauty communities significantly shape consumer preferences, fueling interest in innovative products, global trends, and premium formulations. The rapid expansion of e-commerce platforms, beauty subscription services, and omnichannel retail strategies has made both international and local beauty brands more accessible than ever, transforming the shopping experience and driving market accessibility.

Economic diversification under Vision 2030 has led to a noticeable rise in disposable income, particularly among the middle and upper-middle classes, enabling consumers to invest in high-quality, luxury, and premium beauty products. Women's increasing participation in the workforce and public life is directly contributing to heightened demand for cosmetics, skincare, and grooming products as professional lifestyles require enhanced personal care routines. Cultural shifts regarding beauty standards and self-expression have expanded acceptance of cosmetics and grooming across all demographics, with the male grooming segment experiencing notable growth. Changing social norms and greater public visibility are reshaping beauty consumption patterns, pushing for more diversity in product offerings and targeting different consumer segments with specialized formulations.

Saudi Arabia Beauty and Personal Care Market Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

● Personal Care

● Cosmetics and Make-Up

Category Insights:

● Premium Products

● Mass Products

Distribution Channel Insights:

● Specialist Retailers

● Hypermarkets/Supermarkets

● Online Retailing

● Others

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Purchase the 2026 Comprehensive Updated data: https://www.imarcgroup.com/checkout?id=16463&method=1315

Recent News and Developments in Saudi Arabia Beauty and Personal Care Market

June 2025: Beautyworld Saudi Arabia concluded its successful fifth edition, gathering hundreds of exhibitors from numerous countries and attracting thousands of visitors, establishing itself as the largest beauty and wellness trade fair in the Middle East region.

May 2025: International beauty brands continued their aggressive expansion across Saudi Arabia's major metropolitan areas, opening flagship boutiques and specialty concept stores in premium shopping destinations to capture the Kingdom's growing luxury cosmetics segment.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Beauty and Personal Care Market Size to Hit USD 6.4 Billion by 2033 | With a 3.7% CAGR here

News-ID: 4297922 • Views: …

More Releases from IMARC Group

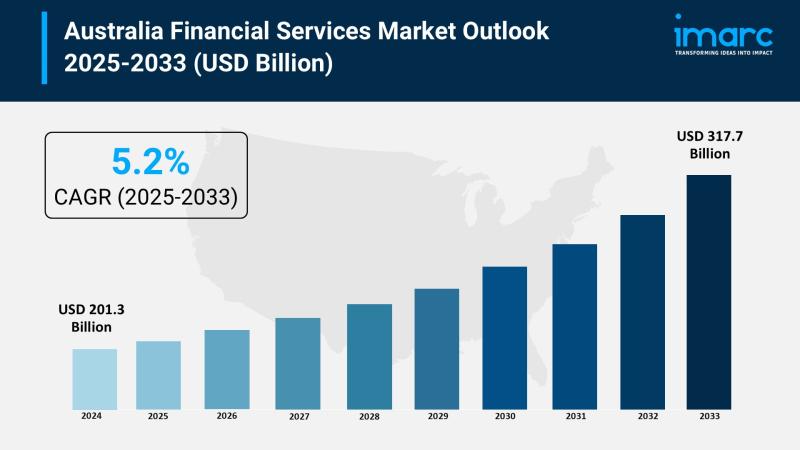

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

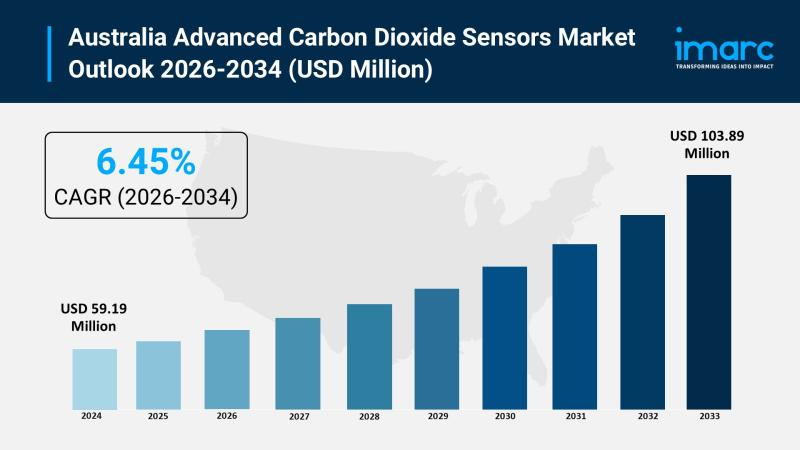

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

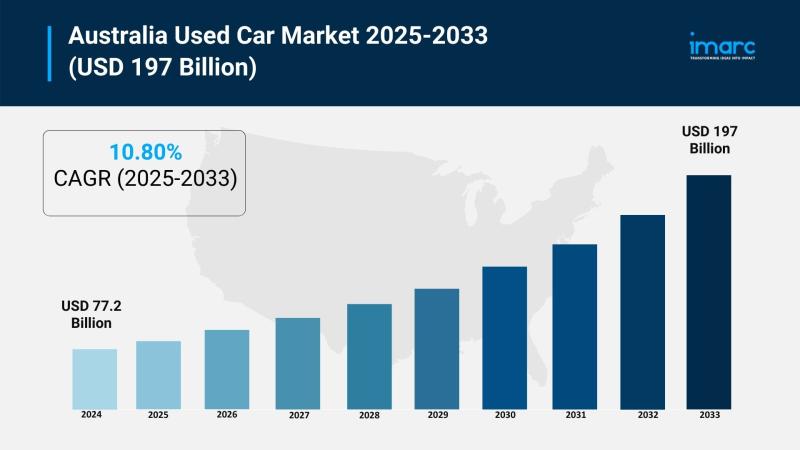

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

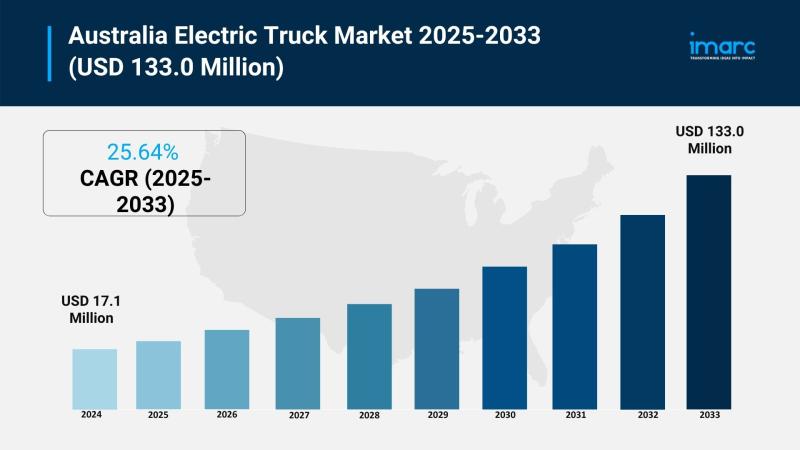

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…