Press release

United States Fintech as a Service (Faas) Market to hit US$ 1,059.78 billion by 2032: Outlook in GCC & MENA Regions | Top Companies are Solid Financial Technologies, Inc, Synctera Inc, SAP Fioneer, TCS BaNCS, PayMate

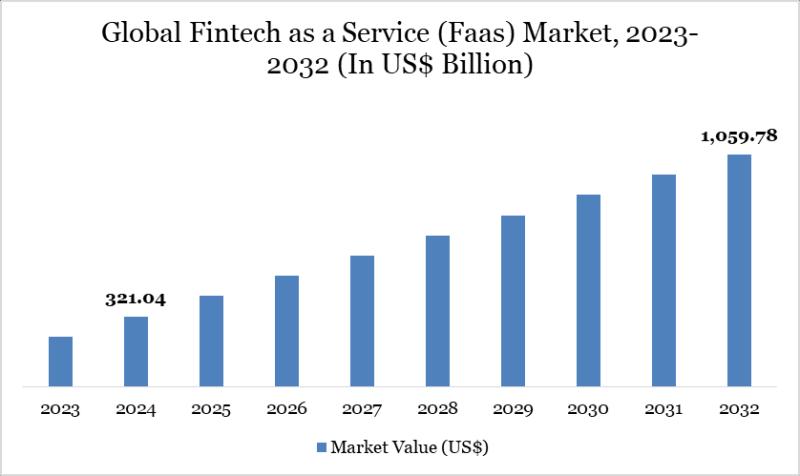

Fintech as a Service (Faas) Market reached US$ 321.04 billion in 2024 and is expected to reach US$ 1,059.78 billion by 2032, growing with a CAGR of 16.10% during the forecast period 2025-2032Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/fintech-as-a-service-market?kb

United States: Recent Industry Developments

✅ October 2025: Stripe launched an upgraded FaaS API suite enabling banks and fintech startups to integrate instant payments and embedded finance at scale.

✅ September 2025: PayPal expanded its Banking-as-a-Service (BaaS) capabilities to support crypto wallets, automated lending, and cross-border remittance APIs.

✅ August 2025: Visa partnered with multiple SaaS providers to deploy white-label FaaS platforms for SMEs and e-commerce businesses across the U.S.

Japan: Recent Industry Developments

✅ October 2025: SoftBank introduced a FaaS platform enabling financial institutions to launch digital lending and BNPL services through modular APIs.

✅ September 2025: Rakuten Bank accelerated adoption of FaaS solutions for embedded insurance, credit scoring, and digital payroll services.

✅ August 2025: Mitsubishi UFJ Financial Group (MUFG) collaborated with fintech startups to scale AI-powered FaaS offerings for real-time KYC, payments, and digital onboarding.

Key Players:

Finastra, Stripe, Inc, Rapyd Financial Network Ltd, foo.mobi, Solid Financial Technologies, Inc, Synctera Inc, SAP Fioneer, TCS BaNCS, PayMate, Backbase

Growth Forecast Projection:

The Global Fintech as a Service Market is anticipated to rise at a considerable rate during the forecast period, between 2025 and 2032. In 2024, the market is growing at a steady rate, and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Research Process:

Both primary and secondary data sources have been used in the global Fintech as a Service Market research report. During the research process, a wide range of industry-affecting factors are examined, including governmental regulations, market conditions, competitive levels, historical data, market situation, technological advancements, upcoming developments, in related businesses, as well as market volatility, prospects, potential barriers, and challenges.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=fintech-as-a-service-market?kb

Key Segmentation:

By Type: (Payments as a Service, Banking as a Service (BaaS), Lending as a Service, Insurance as a Service (InsurTech), Others)

By Deployment: (Cloud-Based, On-Premises, Hybrid)

By Technology: (API-based Services, Blockchain, AI & Machine Learning, Robotic Process Automation (RPA), Others)

By Application: (Banks & Financial Institutions, Insurance Companies, Fintech Startups, eCommerce & Retail Businesses, Telecom Companies, Government Agencies, Others)

Regional Analysis for Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Benefits of the Report:

Chapter 1: Sets the stage by outlining the report's coverage, summarizing key market segments by region, product type, and application. Presents a snapshot of market sizes, growth potential across segments, and anticipated industry evolution both short and long term.

Chapter 2: Highlights pivotal market insights and uncovers the most significant emerging trends driving change within the industry.

Chapter 3: Offers an in-depth look at the competitive landscape among Fintech as a Service producers, including revenue shares, strategic moves, and recent mergers and acquisitions.

Chapter 4: Presents comprehensive profiles of the market's key players, delving into details such as revenue, profit margins, product portfolios, and company milestones.

Chapters 5 & 6: Analyze Fintech as a Service revenue at both regional and country levels, providing quantitative breakdowns of market sizes, growth opportunities, and development prospects worldwide.

Chapter 7: Focuses on different market segments by type, examining their individual sizes and potential, guiding readers toward high-impact, untapped market areas.

Chapter 8: Explores segmentation by application, evaluating industry growth potential in various downstream markets and pinpointing promising sectors for expansion.

Chapter 9: Provides a thorough review of the industry's supply chain mapping out both upstream and downstream activities.

Chapter 10: Concludes with a summary of the report's key findings and highlights the most critical takeaways for industry stakeholders.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/fintech-as-a-service-market?kb

FAQ's

Q1: What is the current size of the Fintech as a Service Market?

A: The Fintech as a Service Market stood at US$ 321.04 billion in 2024 and is set to experience remarkable growth, reaching US$ 1,059.78 billion by 2032

Q2: How fast is the Fintech as a Service Market growing?

A: The Market is on an impressive growth trajectory, expected to expand at a CAGR of 16.10% from 2025 to 2032

Have any Enquiry of This Report @ https://www.datamintelligence.com/enquiry/fintech-as-a-service-market?kb

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Fintech as a Service (Faas) Market to hit US$ 1,059.78 billion by 2032: Outlook in GCC & MENA Regions | Top Companies are Solid Financial Technologies, Inc, Synctera Inc, SAP Fioneer, TCS BaNCS, PayMate here

News-ID: 4294480 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

Japan Data Center Cooling Market (2026-2033) | Top Companies 2026 - Vertiv Group …

Market Size and Growth

Japan's data center cooling market is expected to grow steadily over the coming years, driven by rising data center capacity, cloud adoption, and advanced cooling technology deployment.

Download Free Custom Research: https://www.datamintelligence.com/custom-research?kbdc

• ICT Leadership: Japan hosts major ICT players like Sony, Panasonic, Fujitsu, NEC, and Toshiba, driving the country's digital infrastructure growth.

• Cloud Adoption: PaaS and IaaS see rapid uptake due to low CAPEX and flexible, on-demand usage.

•…

Cardiac Arrhythmia Monitoring Devices Market (2026): North America Holds 38% Mar …

Market Size and Growth

Cardiac Arrhythmia Monitoring Devices market is estimated to grow at a CAGR of 5.65% during the forecast period 2024-2031.

United States: Recent Industry Developments

✅ February 2026: Abbott launched the next-gen continuous cardiac rhythm monitoring device with AI-enabled arrhythmia detection.

✅ January 2026: Medtronic expanded its remote cardiac monitoring services to improve patient follow-up and reduce hospital visits.

✅ December 2025: iRhythm Technologies received FDA clearance for enhanced Zio XT patch…

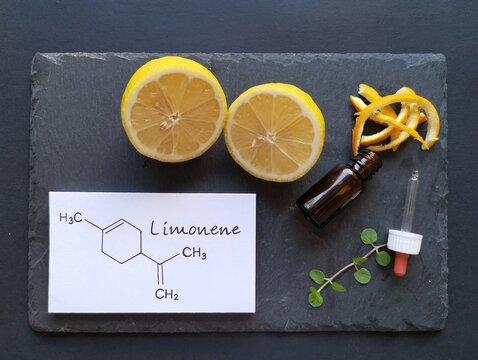

D-Limonene Industry Growth & Market Forecast (2026-2033) for Flavor, Fragrance & …

Market Size and Growth

D-Limonene Market is estimated to reach at a CAGR of 4.4% within the forecast period 2026-2033.

United States: Recent Industry Developments

✅ February 2026: U.S.-based citrus processors expanded D-Limonene extraction capacity to meet rising demand from bio-based solvent manufacturers.

✅ January 2026: Specialty chemical companies introduced high-purity D-Limonene grades for use in eco-friendly cleaning products and industrial degreasers.

✅ December 2025: Growth in natural flavor applications drove new supply agreements between…

Photorejuvenation Devices Market Report (2026) | Growth Analysis, Competitive La …

Market Size and Growth

Photorejuvenation market is growing at a CAGR of 7.2% during the forecast period (2024-2031).

United States: Recent Industry Developments

✅ February 2026: Cutera launched next-generation photorejuvenation systems with enhanced IPL technology for skin revitalization.

✅ January 2026: Cynosure introduced AI-assisted devices for precise photorejuvenation targeting hyperpigmentation and fine lines.

✅ December 2025: FDA approved new photorejuvenation lasers with reduced downtime and improved patient comfort.

Download Free Sample PDF Report (Get Higher Priority…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…