Press release

U.S. Dermal Fillers Market Set to Surpass USD 3.4 Billion by 2034, Driven by Rapid Adoption of Minimally Invasive Aesthetic Procedures

The U.S. dermal fillers market is witnessing robust expansion, fueled by rising consumer interest in aesthetic enhancement and non-surgical cosmetic procedures. The industry was valued at US$ 1.4 billion in 2023 and is projected to reach more than US$ 3.4 billion by 2034, advancing at a consistent CAGR of 8.4% from 2024 to 2034. This growth is underpinned by technological advancements in filler materials, increasing demand for anti-aging treatments, and a surge in cosmetic procedures among both young and aging populations.Examine key highlights and takeaways from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86063

Market Overview: Dermal fillers-also known as soft-tissue fillers-are medical device implants designed to restore facial volume, smooth wrinkles, and enhance facial contours. These injectables are widely used for lip augmentation, cheek enhancement, chin correction, under-eye hollow treatment, and overall facial rejuvenation. As collagen degradation accelerates with age, dermal fillers offer a non-surgical pathway to counter skin laxity, volume loss, and fine lines.

More than 55% of U.S. dermal filler recipients are aged 40 years and above, highlighting the connection between aging demographics and market opportunity. Additionally, the rise of personalized aesthetic procedures and next-generation fillers capable of stimulating collagen production is contributing to long-lasting results and increasing patient satisfaction.

Key Market Growth Drivers

1. Rising Preference for Minimally Invasive Procedures

More consumers now favor injectable cosmetic solutions over surgical procedures due to:

• Faster recovery time

• Lower cost

• Reduced complications

• Natural, customizable results

The American Society of Plastic Surgeons (ASPS) recorded 26.2 million cosmetic procedures in 2022, reflecting a nearly 19% increase since 2019. Lip augmentation alone accounted for over 1.3 million procedures.

2. Increasing Introduction of Advanced Filler Products

Continuous innovations in formulation, longevity, and safety are propelling market demand.

In 2023, Galderma received FDA approval for Restylane Eyelight, targeting under-eye hollows. Similarly, Allergan Aesthetics continues to expand its JUVÉDERM portfolio with region-specific indications.

3. Growing Aesthetic Awareness and Social Media Influence

Celebrity endorsements, influencer content, and the rise of medical aesthetic education on social platforms have normalized cosmetic enhancements among younger adults.

4. Expanding MedSpa Industry

MedSpas have become the fastest-growing distribution channel for dermal fillers, offering:

• Specialized aesthetic practitioners

• Enhanced patient experience

• Tailored treatment plans

• Easy accessibility

Market Challenges & Opportunities

Challenges

• Risk of adverse reactions, swelling, allergic responses, and migration

• Stringent FDA regulations for product approval

• Lack of standardization in injector skillsets across non-medical settings

• High cost of premium fillers, limiting adoption in low-income groups

Opportunities

• Growing adoption of multi-tasking dermal fillers that combine collagen stimulation with volume restoration

• Rising demand among men, who now make up a growing share of MedSpa clientele

• Potential expansion of AI-driven facial mapping for precision-based filler injections

• Increased focus on natural-results technology, including hybrid fillers and medium-density HA innovations

Analysis of Key Players - Key Player Strategies

The U.S. dermal fillers landscape is fragmented but highly competitive, dominated by major players including:

Galderma S.A

Revance Therapeutics, Inc.

AbbVie, Inc. (Allergan Aesthetics)

Merz Pharma GmbH & Co. KGaA (Merz North America, Inc.)

Suneva Medical, Inc.

Prollenium Medical Technologies Inc.

Teoxane SA

Other Players

Key Strategies Adopted:

1. Product Innovation & FDA Approvals

Companies consistently introduce novel filler technologies emphasizing durability, safety, and natural facial movement.

2. Strategic Collaborations & Financing Partnerships

Galderma's partnership with PatientFi, for example, enables flexible monthly financing for aesthetic procedures.

3. Dermatologist & Injector Training Programs

Brands are investing heavily in practitioner education to promote correct injection techniques and improve treatment outcomes.

4. Marketing Through Influencers and Celebrities

Aesthetic brands increasingly leverage social media campaigns to expand consumer reach.

5. Portfolio Expansion into Multiple Facial Areas

Fillers are now formulated for cheeks, lips, temples, jawlines, and under-eye regions, supporting cross-category adoption.

Recent Developments

• In March 2024, Allergan Aesthetics announced that JUVÉDERM VOLUMA XC had received full FDA approval in the U.S., to be injected in the temple region to treat moderate to severe temple hollowing in people aged 21 and above. In the U.S., the approval of the esthetic injectable makes it the first and only hyaluronic acid (HA) dermal filler that has been FDA-approved for the treatment of moderate to severe temple hollowing. It has been tested for up to 13 months with optimal treatment.

• In November 2023, Galderma entered into an agreement with PatientFi. The agreement allows patients to access a convenient monthly membership for custom treatment plans with Galderma's portfolio of esthetic products.

• In April 2023, Galderma received U.S. FDA approval for Sculptra, which is intended to correct fine lines and wrinkles in the cheek. It is the first FDA-approved PPLA-SCA collagen stimulator that improves natural collagen production to enhance skin quality.

Investment Landscape and ROI Outlook

Investments in the U.S. dermal fillers market continue to rise, driven by:

• Expanding MedSpa chains

• Growing private equity interest in aesthetic dermatology

• Increased R&D funding for bio-engineered fillers

• Significant long-term ROI potential for manufacturers and service providers

ROI Outlook

• Manufacturers benefit from recurring revenue due to repeat treatments every 6-18 months.

• MedSpas report 20-30% annual growth due to strong consumer demand for injectables.

• Investors entering multi-clinic MedSpa networks see high profitability, with fillers contributing 35-45% of total revenue.

Buy this Premium Research Report for actionable insights and key takeaways -

https://www.transparencymarketresearch.com/checkout.php?rep_id=86063<ype=S

Market Segmentations

By Product

• Biodegradable Fillers (dominant)

• Non-biodegradable Fillers

By Material

• Hyaluronic Acid (largest share)

• Calcium Hydroxylapatite

• Poly-L-lactic Acid

• PMMA

• Others

By Application

• Facial Line Correction (leading segment)

• Facial Volume Enhancement

• Scar Treatment

• Others

By Gender

• Female (majority share)

• Male (fastest-growing segment)

By End-user

• MedSpas (fastest expanding channel)

• Dermatology Clinics

• Hospitals

• Others

By Region

• South Region (largest share)

- Growth led by Texas, Florida, Georgia

• West Region

- Dominated by California, strong celebrity influence

• Northeast Region

- High disposable income in NY, NJ, MA, PA

• Midwest Region

- Growing MedSpa penetration in IL, OH, MI

Why Buy This Report?

• Provides in-depth market analysis with accurate forecasts to 2034

• Includes regional breakdowns, product trends, and competitive benchmarking

• Covers regulatory insights and FDA approval pathways

• Offers investment feasibility assessments and ROI outlook

• Delivers extensive company profiles, strategies, and innovation pipelines

• Contains segment-wise market projections, Porter's Five Forces, value chain mapping, and industry dynamics

Frequently Asked Questions

1. What is the current market size of the U.S. dermal fillers market?

The market was valued at US$ 1.4 billion in 2023.

2. What are the main drivers of market growth?

Key drivers include rising demand for minimally invasive procedures, technological advancements in fillers, and growing aesthetic awareness.

3. Which material segment dominates the U.S. dermal fillers market?

Hyaluronic acid (HA) leads due to safety, affordability, and natural-feeling results.

4. Which region leads the market?

The South Region holds the largest share, driven by high aesthetic procedure volumes.

5. Who are the major companies in the U.S. dermal fillers industry?

Major players include Galderma, Allergan Aesthetics (AbbVie), Revance Therapeutics, Merz Pharma, and others.

Explore Latest Research Reports by Transparency Market Research:

Digital Pathology Market: https://www.transparencymarketresearch.com/digital-pathology-systems.html

Oncology Information System (OIS) Market: https://www.transparencymarketresearch.com/oncology-information-system-market.html

Cystatin C Assay Market: https://www.transparencymarketresearch.com/cystatin-c-assay-market.html

Mesotherapy Market: https://www.transparencymarketresearch.com/mesotherapy-market.html

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact Us:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Dermal Fillers Market Set to Surpass USD 3.4 Billion by 2034, Driven by Rapid Adoption of Minimally Invasive Aesthetic Procedures here

News-ID: 4291867 • Views: …

More Releases from Transparency Market Research

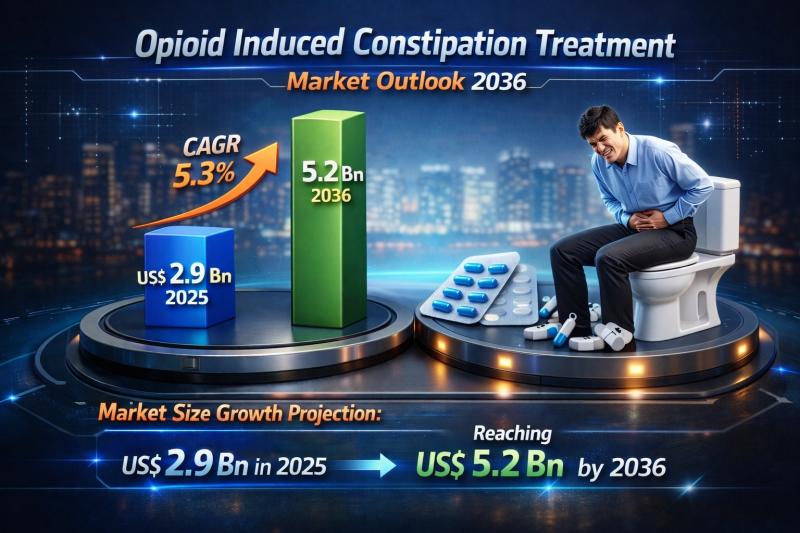

Global Opioid Induced Constipation Treatment Market Set to Reach USD 5.2 Billion …

The global opioid induced constipation (OIC) treatment market is witnessing steady and sustained growth as healthcare systems worldwide place increasing emphasis on comprehensive pain management and supportive care. Valued at US$ 2.9 billion in 2025, the market is projected to reach US$ 5.2 billion by 2036, expanding at a compound annual growth rate (CAGR) of 5.3% from 2026 to 2036. Growth is primarily fueled by the rising prevalence of chronic…

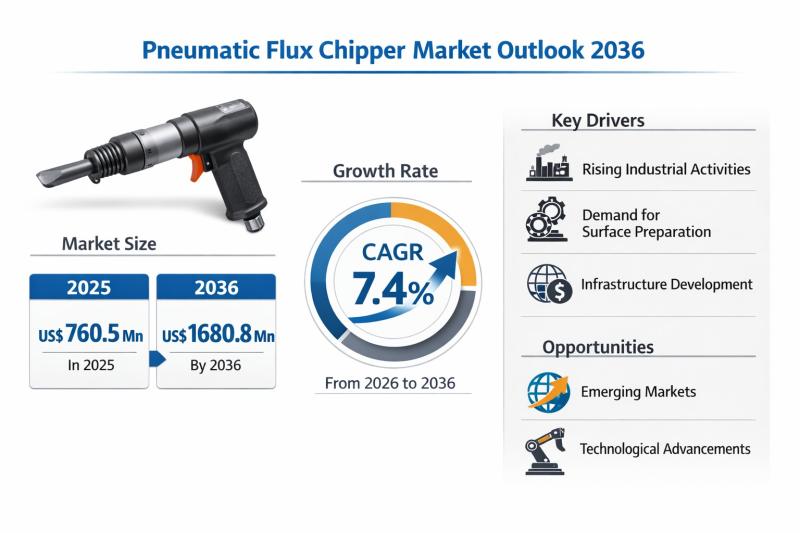

Pneumatic Flux Chipper Market Expanding at 7.4% CAGR Through 2036 - By Product T …

The global Pneumatic Flux Chipper Market is set to witness sustained and resilient growth over the next decade, underpinned by expanding heavy manufacturing activities, rising welding and fabrication demand, and continuous investments in industrial infrastructure across emerging and developed economies. According to the latest industry analysis, the market was valued at US$ 760.5 Mn in 2025 and is projected to reach US$ 1,680.8 Mn by 2036, expanding at a compound…

AI in Automotive Market Outlook 2036: Global Industry to Surge from US$ 19.8 Bil …

The AI in automotive market is entering a phase of exponential expansion, supported by rapid digitization of vehicles, growing safety mandates, and consumer demand for intelligent mobility. The global market was valued at US$ 19.8 Bn in 2025 and is projected to reach US$ 244.4 Bn by 2036, registering a remarkable CAGR of 27% from 2026 to 2036.

This growth trajectory reflects the transition of automobiles from mechanically driven products to…

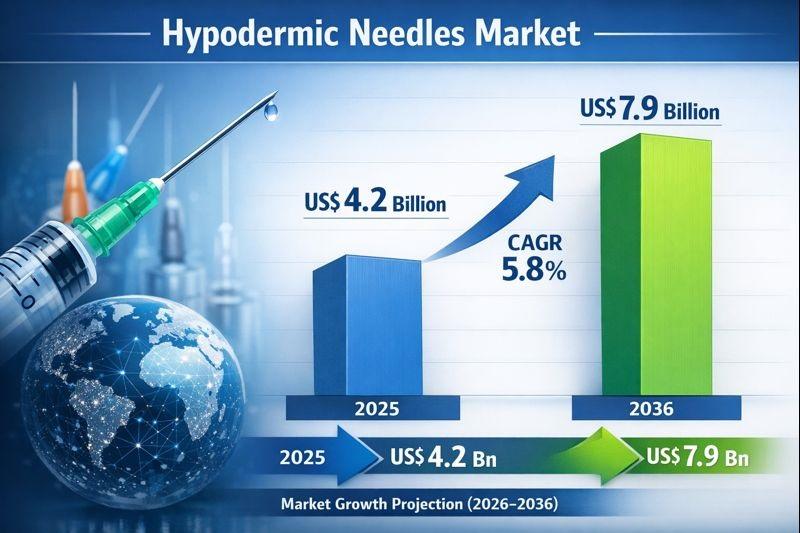

Hypodermic Needles Market to Reach US$ 7.9 Billion by 2036 on Rising Injectable …

The global hypodermic needles market was valued at approximately US$ 4.2 billion in 2025 and is projected to reach around US$ 7.9 billion by 2036, expanding at a CAGR of nearly 5.8% from 2026 to 2036, driven by the rising prevalence of diabetes, cancer, and chronic diseases, growing demand for injectable drugs and biologics, and the expansion of global vaccination and immunization programs; increasing adoption of safety-engineered and disposable needles,…

More Releases for Filler

Thermoplastic Filler Market Size Analysis by Application, Type, and Region: Fore …

USA, New Jersey- According to Market Research Intellect, the global Thermoplastic Filler market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The Thermoplastic Filler Market is experiencing steady growth, driven by increasing demand across industries such as automotive, construction, and packaging. These fillers are widely used…

FITI Announces October Botox & Filler Training

Miami, FL - Florida International Training Institute (FITI) [https://fitischools.edu/fiti-health-and-aesthetics/] is thrilled to announce its upcoming aesthetic education courses for October 2024, offering specialized training in Botox injections and dermal fillers. These highly anticipated sessions provide healthcare professionals with hands-on experience in advanced techniques, ensuring they stay ahead in the cosmetic medicine field.

October 2024 Course Schedule:

*

Friday, Oct 18, 2024, 8:00 AM - Beginner Botox Training. Sold Out.

*

Saturday, Oct 19,…

October Filler & Botox Training for Physicians

Miami, FL - Florida International Training Institute (FITI) is excited to announce our next Advanced Filler & Botox Training for Licensed Physicians [https://training.fitihealthaesthetic.com/] on October 18, 2024. Following the success of our sold-out September session, this highly sought-after continuing education course offers a unique opportunity for medical professionals to enhance their expertise in the rapidly growing field of cosmetic medicine.

About the Course

This advanced training program is designed exclusively for licensed…

Two-Dosage Filler Liquid Thermal Gap Filler market: Promising Regions for Compan …

"The Two-Dosage Filler Liquid Thermal Gap Filler global market is thoroughly researched in this report, noting important aspects like market competition, global and regional growth, market segmentation and market structure. The report author analysts have estimated the size of the global market in terms of value and volume using the latest research tools and techniques. The report also includes estimates for market share, revenue, production, consumption, gross profit margin, CAGR,…

AMA Beffi Dew Filler | JNL

JNL Co., Ltd. is a beauty device manufacturer that specializes in medical beauty devices, fillers, and functional cosmetics. Representing the level of the industry in Korea, JNL's excellence in beauty device technology is widely promoted across the world through the export of beauty devices, exporting its superb products with Cosmeceutical, Beffi Dew AMA Filler, and Home Care Devices.

JNL AMA Beffi Dew Filler

Beffi Dew Filler is an injection with hyaluronic acid…

Beffi Dew Filler Beauty, Star AMA FILLER Bringing You Natural Beauty | JNL

JNL Co., Ltd. is a beauty device manufacturer that specializes in medical beauty devices, fillers, and functional cosmetics. JNL is exporting its superb products with Beffi Dew AMA Filler and home care devices to over 61 countries worldwide.

Beffi Dew Beauty AMA Filler

This is not only a product of a popular line within the Beffi Dew Filler Product Line, but also this is a product with high viscosity that has…