Press release

Inside the USD 3,173 Million Surge: Why Electrophoretic Paint Is Reshaping the Future of Automotive Manufacturing

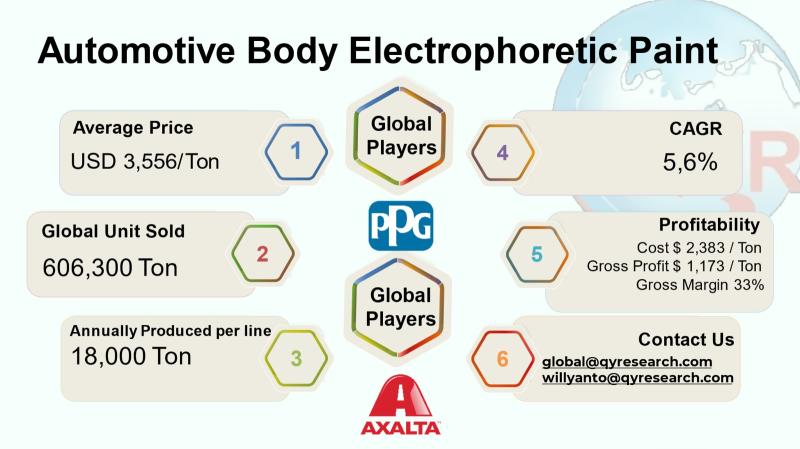

Automotive body electrophoretic paint is the cathodic/anodic electrodeposition coating applied to car bodies and large structural automotive parts to provide uniform, high-quality corrosion protection as the first (and often the largest) protective layer in the OEM paint stack. The technology is valued by vehicle makers because it delivers complete coverage of complex geometries, high transfer efficiency, and a controlled, thin film that dramatically improves long-term substrate life and downstream finishing consistency. The sector sits at the intersection of specialty chemistry (electrodepositable resins, pigments and additives), large-scale automated wet-line manufacturing equipment (pretreatment, dip tanks, rinse, curing ovens) and heavy downstream integration with OEM assembly lines.The global 2024 automotive-body electrophoretic paint market size is USD 2,156 million with a forecast CAGR of 5.6% to 2031, reaching market size USD 3,173 million by 2031. With an average selling price of USD 3,556 per ton, the implied global volume in 2024 is approximately 606,300 ton of electrophoretic paint sold in 2024. A factory gross margin is at 33% which implies a factory gross profit on the order of USD 1,173 per ton and cost of goods sold at USD 2,383 per ton. A COGS breakdown is raw materials, energy & utilities, labor & direct operators, pretreatment chemicals & waste treatment, maintenance & spare parts, packaging & logistics, overhead & depreciation. A single line full machine production capacity is around 18,000 ton. Downstream demand is concentrated in automotive OEM, components & module followed by EV battery & parts, and heavy machinery.

Latest Trends and Technological Developments

The e-coat and wider automotive coatings sector has seen several notable industry developments: on May 2024, PPG announced a major USD 300 million investment to expand manufacturing capacity in North America to serve increasing automotive and OEM demand, underscoring global supplier investment in regional manufacturing resilience. On March 2025, Electronic Coating Technologies listed new trade show participation and product showcases emphasizing advanced coating and encapsulation solutions for electronics and related markets, reflecting cross-industry technology sharing that benefits e-coat chemistries and process controls. More recently, on November 2025, the announced merger plan between AkzoNobel and Axalta (a major industrial and automotive coatings player) was reported by Reuters, a development that could materially reshape scale and R&D priorities across automotive coatings including electrophoretic segments. In parallel, suppliers such as PPG have publicized new electrocoat formulations and system platforms in 2025 designed for enhanced corrosion protection and EV-specific requirements (battery pack interfaces, thermal/ dielectric demands). These items illustrate both consolidation and continued capital/investment activity across the supplier base.

Ford Motor Company purchases large volumes of cathodic epoxy electrophoretic paint from Axalta Coating Systems for its F-Series truck production lines. This procurement is part of a long-term supply agreement, where Ford secures the advanced e-coat at a negotiated price. This bulk purchasing is critical for ensuring consistent, high-quality corrosion protection for hundreds of thousands of truck bodies annually, forming the essential first layer in their multi-stage painting process.

The electrophoretic paint from Axalta is applied at Toyota's manufacturing plant in Georgetown, Kentucky, for the production of the Toyota Camry. In this automated process, each vehicle body is immersed in a massive e-coat bath, where an electrical charge bonds the paint primer evenly to every inch of the metal frame and body panels. For a single vehicle, the material cost of the electrophoretic paint applied is roughly $25 per unit. This investment is fundamental to providing the vehicle's renowned long-term rust resistance and durability, forming an impermeable protective layer that can last the lifetime of the car.

Asia Pacific is the single largest regional market for automotive electrophoretic paint by both value and volume, driven by the scale of vehicle assembly across China, Japan, South Korea, India, and Southeast Asia, integrated supply chains, and aggressive capacity build by global and regional chemical suppliers. China is both a major consumer and a significant domestic manufacturing base for electrophoretic chemistries and line equipment: numerous Chinese formulators and equipment builders supply cathodic electrodeposition paints and turnkey e-coat lines at competitive capital costs, supporting local OEMs and the rapidly expanding NEV (new energy vehicle) segment. Indias vehicle production expansion and local content policies are increasing domestic e-coat demand while Japan and Korea sustain high-specification premium segments that prioritize advanced formulation performance. Across Asia, customers are increasingly demanding low-VOC, improved throw/edge coverage, and formulations certified to OEM-specific corrosion test protocols. Local raw-material sourcing, water-treatment regulation compliance, and energy pricing are principal drivers of regional operating costs. Sources tracking regional demand and equipment supply note modular line growth and many equipment suppliers promoting energy-reduction packages to lower running costs.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5489926

Automotive Body Electrophoretic Paint Companies by Type:

Epoxy

Modified Epoxy

Automotive Body Electrophoretic Paint Companies by Product Category:

Two-Component

Single-Component

Automotive Body Electrophoretic Paint Companies by Market Segment:

ICE Vehicle

Electric Vehicle

Automotive Body Electrophoretic Paint Companies by Features:

High Corrosion Resistance Coatings

High Throwing Power Formulations

Fast Curing E Coat Systems

Ultra Low VOC

Others

Automotive Body Electrophoretic Paint Companies by Structure:

Thick Film Systems

Thin Film Systems

Single Layer E Coat Structures

Multi Layer E Coat Structures

Others

Automotive Body Electrophoretic Paint Companies by Application:

Passenger Cars

Commercial Vehicles

Global Top 10 Key Companies in the Automotive Body Electrophoretic Paint Companies Market

PPG Industries

BASF

Axalta

Nippon Paint

Kansai Paint

Xiangjiang Kansai

KCC Corporation

Kinlita

Haolisen

Daoqum

Regional Insights

Within ASEAN, the automotive e-coat demand footprint is concentrated in Indonesia, Thailand, Malaysia and Vietnam where vehicle assembly and component manufacturing clusters have strengthened. Indonesia is a notable growth area because of increasing domestic assembly volumes, government incentives to expand local content and a growing light-vehicle market. Major international coatings companies operate through regional affiliates or partnerships (for example Nippon Paint and Asian Paints have strong local presence in Indonesia) and local specialty manufacturers and mid-size chemical companies supply niche industrial coatings and pre-treatment chemistries. Indonesian manufacturers are also investing modestly in finishing capabilities to serve both OEMs and the aftermarket; however, high capital cost of full e-coat lines means many local facilities rely on regional supply or subcontracted electrocoating from regional job shops. The ASEAN picture is therefore a mix of captive OEM lines (for larger assemblers) and outsourced finishing for smaller manufacturers.

The electrophoretic paint industry faces a persistent set of challenges: volatility in raw-material prices (resins, specialty monomers and corrosion inhibitors) squeezes supplier margins and can force price renegotiations with OEMs; environmental and water-treatment regulations require increasingly sophisticated pretreatment and effluent systems which increase capital and OPEX; the energy intensity of large e-coat dip tanks and ovens makes producers sensitive to electricity price swings and grid reliability; consolidation among global suppliers shifts bargaining power and may create uneven competition for regional formulators; and technical demand from EV manufacturers (for thermal or dielectric interfacing) requires reformulation and validation investment. In ASEAN specifically, limited availability of high-specification job shops and the high up-front capital needed for full-line installations slow local conversion to in-house e-coat capability for smaller OEMs and tier-suppliers.

Suppliers should emphasize formulation R&D that targets improved throwing power, lower solids-to-coverage cost, and compliance with stricter effluent rules, while investing in process controls and modular, energy-saving line components to reduce operating cost. OEMs will prefer suppliers with multi-region manufacturing footprints and tight security of supply; nearshoring or regional supply agreements reduce logistics risk and inventory costs. Investors should watch consolidation moves among global majors (which reshape pricing power and R&D scale), equipment suppliers that offer energy-reduction retrofits (because these can deliver fast operational payback), and regional capacity additions in China and ASEAN that change local supply dynamics. Strategic value can also come from companies owning both chemistry and line-engineering capabilities (vertical solutions for OEMs). Recent capital investments by PPG and M&A headlines among major players are leading indicators of the strategic priorities capacity resilience, scale and synergy capture.

Product Models

Automotive Body Electrophoretic Paint refers to electrically deposited coatings designed to form a protective, corrosion-resistant layer on automotive body shells. These coatings are typically waterborne and rely on resin chemistries.

Epoxy e-coats provide strong adhesion and corrosion resistance. Notable products include:

Powercron 6000CX PPG Industries: A high-corrosion-resistant epoxy e-coat widely used in OEM automotive body applications for excellent throwpower and durability.

Cathoguard 525 Axalta Coating Systems: A next-generation epoxy electrophoretic coating engineered for improved edge protection and uniform deposition.

Electrocoat 3700 BASF: A durable epoxy e-coat offering strong adhesion and high-performance rust protection suitable for car body shells.

Ecodur 3000 Nippon Paint Automotive: An advanced epoxy-based e-coat providing consistent film formation and robust anti-corrosion properties.

Kansai E-Coat E8500 Kansai Paint: A widely adopted epoxy electrophoretic coating designed for high-efficiency deposition and excellent salt-spray resistance.

Modified epoxy systems being the most widely used due to their durability and cost-effectiveness. Notable products include:

Powercron 9000AE PPG Industries: A modified epoxy e-coat with enhanced flexibility and chip resistance while maintaining corrosion protection.

Electrocoat 5100M BASF: A modified epoxy offering better impact resistance and reduced bake energy requirements for OEM production lines.

Ecodur FX-4000 Nippon Paint Automotive: A modified epoxy system designed for superior film smoothness and improved UV stability compared to standard epoxies.

Kansai Hybrid E-Coat HX9000 Kansai Paint: A modified epoxy resin system engineered to boost flexibility and edge corrosion performance.

Electropaint Hybrid H-2000 KCC Corporation: A modified epoxy solution offering better elasticity and resistance to stone chipping.

Automotive body electrophoretic paint is a mature but still evolving industrial specialty where incremental formulation improvements, stricter environmental controls, and capital investment in energy-efficient lines determine competitive advantage. Asia Pacific and within it China and ASEAN markets such as Indonesia will continue accounting for the majority of global tonnage because of vehicle assembly location and NEV growth. Supplier consolidation, OEM requirements for secure regional supply, and the constant pressure to reduce COGS while delivering improved corrosion performance will keep technical R&D and line-level process optimization at the center of strategic activity for the next five to ten years.

Investor Analysis

What investors should take from this report is a quantified view of the electrophoretic paint addressable market (user baseline USD 2,156 million in 2024; implied ~606,300 tonnes at USD 3,556/ton) and the structural forces shaping margins (raw material exposure, energy and water treatment, and capital intensity of lines). How investors can use this information is to prioritize targets: (1) upstream specialty resin and additive companies that supply cathodic resins (exposure to raw-material pricing and patent-protected chemistries); (2) equipment and systems integrators that provide line upgrades and energy-saving retrofits (recurring service revenues and good payback profiles); and (3) geographically strategic suppliers with multi-region footprint or strong local partnerships in Asia and ASEAN, which provide lower supply-risk to OEMs. Why this matter is that the e-coat market generates steady, OEM-contracted demand with long qualification cycles successful investments capture durable revenue streams once OEM approvals and line integrations are complete. Finally, watching consolidation in the large public majors (M&A, capacity reallocation) is critical because it changes bargaining power and potential upside for niche suppliers or equipment vendors.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5489926

5 Reasons to Buy This Report

Understand the market baseline and volume conversion to size supply and opportunity.

Regional intelligence for Asia and ASEAN identifying where capacity additions and OEM demand are concentrated.

Factory economics model (COGS breakdown, gross-profit per ton and margin profiling) enabling operational and valuation sensitivity analysis.

Strategic supplier and equipment insights: which technology investments (energy reduction, modular lines, pretreatment) drive fast payback.

Latest industry news and consolidation signals that affect competitive structure and M&A risk/opportunity.

5 Key Questions Answered

What was the 2024 market value and implied tonnage for automotive body electrophoretic paint?

What is the typical selling price per ton and what factory gross margin is realistic for suppliers?

How is the COGS typically broken down by category and which cost levers most affect margins?

Which regions (Asia / ASEAN / Indonesia) will drive the next wave of demand and why?

Which industry players and equipment suppliers are strategically positioned to benefit from market growth and ongoing consolidation?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Automotive Body Electrophoretic Paint Market Research Report 2025

https://www.qyresearch.com/reports/5489926/automotive-body-electrophoretic-paint

Automotive Body Electrophoretic Paint - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5489949/automotive-body-electrophoretic-paint

Global Automotive Body Electrophoretic Paint Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5489924/automotive-body-electrophoretic-paint

Global Automotive Body Electrophoretic Paint Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5489923/automotive-body-electrophoretic-paint

Global Electrophoretic Paint Market Research Report 2025

https://www.qyresearch.com/reports/4193105/electrophoretic-paint

Global Epoxy Electrophoretic Paint Market Research Report 2025

https://www.qyresearch.com/reports/5445589/epoxy-electrophoretic-paint

Global Cathodic Electrophoretic Paint Market Research Report 2025

https://www.qyresearch.com/reports/5376173/cathodic-electrophoretic-paint

Global Lead Free Electrophoretic Paint Market Research Report 2025

https://www.qyresearch.com/reports/5445661/lead-free-electrophoretic-paint

Global Automobile Electrophoretic Paint Market Research Report 2025

https://www.qyresearch.com/reports/3865487/automobile-electrophoretic-paint

Global Automotive Parts Electrophoretic Paint Market Research Report 2025

https://www.qyresearch.com/reports/5489927/automotive-parts-electrophoretic-paint

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Inside the USD 3,173 Million Surge: Why Electrophoretic Paint Is Reshaping the Future of Automotive Manufacturing here

News-ID: 4287770 • Views: …

More Releases from QY Research

Top 30 Indonesian Rubber Public Companies - Q3 2025 Revenue & Performance

1) Overall companies' performance (Q3 2025 snapshot)

PT Gajah Tunggal Tbk

PT Multistrada Arah Sarana Tbk

PT Goodyear Indonesia Tbk

PT King Tire Indonesia

PT Indo Kordsa Tbk

PT Kirana Megatara Tbk

PT Bumi Serpong Damai Tbk

PT Adaro Energy Tbk

PT ACE Hardware Indonesia Tbk

PT Suryaraya Rubberindo Tbk

PT Dharma Polimetal Tbk

PT Selamat Sempurna Tbk

PT Indospring Tbk

PT Autopedia Sukses Lestari Tbk

PT Nipress Tbk

PT Prima Alloy Steel Universal Tbk

PT Anugerah Spareparts Sejahtera Tbk

PT Bintang Oto…

Smart Vacuum Grippers Reshape Industrial Handling Market Through 2032

Rubber suction cups are flexible vacuum-based gripping components used for temporary adhesion and handling across consumer, industrial, and automation applications

Widely applied in packaging lines, glass handling, automotive assembly, electronics pick-and-place, medical devices, and household accessories

Manufactured primarily from silicone rubber, EPDM, nitrile (NBR), natural rubber, and thermoplastic elastomers

Industry characterized by high-volume standardized parts combined with customized industrial vacuum grippers for robotics and smart factories

Demand closely linked to automation penetration, e-commerce packaging…

Renewable Plastic Packaging 2025: ASEAN Growth and 28% Margins Driving the Next …

Renewable plastic packaging refers to packaging materials produced from bio-based, compostable, or renewable feedstocks such as PLA, PHA, starch blends, bio-PE, and bio-PET.

Derived from corn, sugarcane, cassava, cellulose, and plant oils, replacing fossil-fuel plastics to reduce carbon footprint and landfill load.

Applications include:

Food & beverage flexible packs

Retail carry bags

Personal care bottles

E-commerce mailers

Agricultural films

Adoption driven by:

Government plastic taxes & EPR mandates

ESG commitments from FMCG brands

Consumer preference for biodegradable/low-carbon materials

Retailers banning single-use fossil…

From Plastic-Free to Premium: The Future of the Global Facial Wipes Industry

Facial wipes are disposable non-woven textile products pre-saturated with cleansing or skincare solutions used for makeup removal, hygiene, moisturizing, and antibacterial purposes

Widely adopted across personal care, travel, baby care, sports, hospital, and on-the-go convenience segments

Increasing penetration driven by busy lifestyles, urbanization, higher disposable income, and rising skincare awareness

Core buyers include mass retail, convenience stores, e-commerce, beauty chains, pharmacies, and hospitality sectors

Industry Explanation and Global Overview

Combines nonwoven fabric manufacturing (spunlace, airlaid)…

More Releases for Paint

SKSHU Paint: Life Enjoyment Wall Repair Paint

Image: https://www.abnewswire.com/uploads/6c917f12026802adfd22d2c0dd8f5805.png

This product is a fast-drying waterborne aerosol paint composed of waterborne acrylic resin, pigments and fillers. Odorless and environment-friendly, it has the advantages of easy application, good atomization, high spray rate, high film richness, excellent adhesion and strong hiding power.

Product Introduction

This product is a fast-drying waterborne aerosol paint composed of waterborne acrylic resin, pigments and fillers. Odorless and environment-friendly, it has the advantages of easy application, good atomization, high…

How to Solve the Paint Selection Problem? Understanding the Mystery of Latex Pai …

Introduction

Before starting this paint exploration journey, let's first think about why the choice of paint is so important. A warm and comfortable home, a smooth, brightly colored wall, not only can bring us visual enjoyment, but also create a unique atmosphere and mood. The coating, as a wall coat, its quality, performance and environmental protection directly affect our quality of life and health.

1. Definition and component analysis

Latex paint:

Definition: Latex paint…

Water Based Enamel Paint Market is Booming Worldwide | Intercoastal Paint, Nippo …

The latest study released on the Global Water Based Enamel Paint Market by AMA Research evaluates market size, trend, and forecast to 2027. The Water Based Enamel Paint market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Global Refinish Paint for Automotive Market By Key Players: Akzo Nobel, BASF, 3M …

Qyresearchreports include new market research report Global Refinish Paint for Automotive Market Professional Survey Report 2018 to its huge collection of research reports.

This report studies the global Refinish Paint for Automotive market status and forecast, categorizes the global Refinish Paint for Automotive market size (value & volume) by manufacturers, type, application, and region. This report focuses on the top manufacturers in North America, Europe, Japan, China, India, Southeast Asia and…

Road Marking Paint Market Report 2018: Segmentation by Product (Thermoplastic Ma …

Global Road Marking Paint market research report provides company profile for Ennis Flint, Hempel, Geveko Markings, PPG Industries, Asian Paints PPG, SealMaster, 3M, Sherwin-Williams, Swarco AG, Nippon Paint and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018…

China Paint and Coatings Market Research Report 2017 - PPG, Akzo Nobel, Kansai P …

This report studies Paint and Coatings in China market, focuses on the top players in China market, with capacity, production, price, revenue and market share for each manufacturer, covering

PPG

Akzo Nobel

Kansai Paint

Nippon Paint

BASF

Axalta (formerly DuPont)

Chugoku Marine Paint

Valspar

Sherwin-Williams

Hempel

Market Segment by Regions (provinces), covering

South China

East China

Southwest China

Northeast China

North China

Central China

Northwest China

Split by product Type, with production, revenue, price, market share and growth rate of each type, can be divided into

Waterborne Coatings

High-solids Coatings

Powder Coatings

Others

Split…