Press release

Thermo Compression Bonding Market to Reach CAGR 11,2% by 2031 Top 10 Company Globally

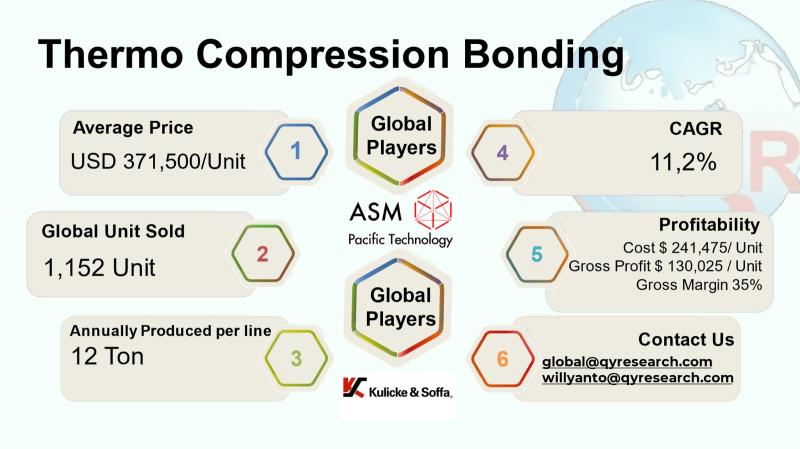

Thermo Compression Bonding (TCB) sits at the intersection of advanced packaging and high-precision manufacturing, enabling reliable, high-density interconnects for semiconductor and microsystem devices. TCBs unique combination of controlled heat and pressure makes it a preferred technology for flip-chip, panel-level, and 2.5D/3D stacking applications where mechanical and electrical integrity are critical. Demand for TCB is driven by miniaturization, higher I/O density, and the push for advanced packaging solutions across high-performance computing, mobile, automotive and sensing markets.The global thermo compression bonding market in 2024 is USD 428 million with a projected compound annual growth rate of 11.2% through 2031, reaching market sixe USD 830 million by 2031. With an average selling price of USD 371,500 per unit, the implied total units sold globally in 2024 is approximately 1,152 units. A factory gross margin is 35%, with cost of goods sold is approximately USD 241,475 and factory gross profit per unit is about USD 130,025. A COGS breakdown is Materials & components, Precision mechanical parts, Labor, Overhead & utilities, Testing & QA. A single life full machine production capacity is around 12 unit per line per year. Downstream demand is concentrated in advanced semiconductor packaging and back-end services (advanced packaging / OSAT and IDM back-end, OSAT & contract packaging , MEMS/sensors & specialty electronics and other industrial uses). These operational and margin figures reflect typical industry norms, supplier disclosures and the premium nature of precision semiconductor capital equipment.

Latest Trends and Technological Developments

Thermo-compression bonding is increasingly framed as a growth engine within the advanced-packaging equipment set as vendors and consortia accelerate development of panel-level and hybrid bonding platforms; technology reports and industry analysts highlight that TCB and hybrid bonding are major contributors to back-end equipment expansion (Yole Group insight, July 2025). Major equipment vendors are expanding R&D and qualification sites to accelerate customer validation and shorten time-to-market for next-generation TCB toolsets; for example, Kulicke & Soffa announced TCB adoption milestones and expanded R&D activity in 2024 with follow-through in 2025 for facility commissioning. Consortium and platform plays are also notable: large equipment suppliers (ASMPT among them) have publicly joined multi-partner consortia to develop next-generation panel-level packaging platforms where TCB expertise is an integral capability (ASMPT JOINT3 participation announcement, 2025). Product-level innovation continues: equipment makers and die-bonder specialists are publishing higher-force, lower-thermal-mass designs and ultra-low volume tunnels to reduce oxygen and contamination risks while increasing throughput and yield for sensitive devices (recent equipment design papers and vendor product notes, 20242025).

Intel Corporation, a leading semiconductor designer and manufacturer, purchases high-precision Thermo Compression Bonding (TCB) equipment from companies like Besi (Netherlands) and ASMPT (Singapore) to bridge the performance gap in their advanced packaging processes. A single, state-of-the-art TCB bonding chamber module from these suppliers can cost between hundred thousand dollars to low million dollar per unit, depending on its level of integration, accuracy, and throughput. This significant investment is driven by the critical need to directly attach high-performance compute dies, such as CPUs and GPUs, to silicon interposers or organic substrates with thousands of fine-pitch copper microbumps, a process essential for creating next-generation 3D integrated circuits like Intel's Foveros and EMIB technologies.

The advanced TCB process is installed and used on the production lines of Taiwan Semiconductor Manufacturing Company (TSMC) for their Chip-on-Wafer-on-Substrate (CoWoS) advanced packaging platform. In this application, TCB is used to precisely bond high-bandwidth memory (HBM) stacks from companies like SK Hynix and Samsung onto a silicon interposer alongside a logic chip (e.g., an NVIDIA GPU). The value of the TCB process in this specific assembly is immense; it is a critical enabling step for a single CoWoS package that can amount to a final product value of several thousand dollars per unit, with the bonding process itself contributing a significant portion of the manufacturing cost due to its complexity, time, and equipment investment.

Asia (Greater China, Taiwan, Japan, South Korea, and Southeast Asia) is the dominant demand center for TCB because of the regions concentration of advanced packaging houses, foundries, OSATs (outsourced semiconductor assembly and test), and consumer electronics manufacturing. Taiwan, South Korea and China host the largest clusters of high-volume OSATs and panel/wafer-level packaging operations; Japan remains strong on precision equipment R&D and supplier ecosystems, while Southeast Asia (notably Malaysia, the Philippines and Vietnam) is growing as a capacity and test/assembly base. Vendors and analyst coverage consistently identify Asia Pacific as the fastest growing region for TCB adoption due to proximity to major IDM/OSAT customers and localized qualification cycles

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5486309

Thermo Compression Bonding by Type:

Semi-Automatic

Fully Automatic

Thermo Compression Bonding by Product Category:

W2W

D2W

Thermo Compression Bonding by Market Segment:

Standard Grade

High Precision Grade

Thermo Compression Bonding by Material:

Copper Bonding Films

Gold to Gold Bonding Materials

Nickel and Aluminum Substrates

Polymer Based Bonding Films

Others

Thermo Compression Bonding by Technology:

Direct Metal to Metal Bonding

Thermo Compression Flip Chip Bonding

Hybrid Bonding

Solder Based Thermal Compression Bonding

Others

Thermo Compression Bonding by Application:

3D IC

Advanced Packaging

MEMS

Others

Global Top 10 Key Companies in the Thermo Compression Bonding Market

ASMPT

SBT Ultrasonic Technology

Besi

Tresky

Shibuya

Kulicke and Soffa Industries

Ito Group

Amada Weld Tech

MRSI Systems

Panasonic Connect

Regional Insights

Within ASEAN, Malaysia and the Philippines are current hotspots for OSAT operations and thus early TCB demand for back-end services; Vietnam and Thailand show rising interest as regional supply chains diversify. Indonesias role is emerging: while the country today has fewer advanced packaging lines compared with Malaysia or the Philippines, government incentives and investments aimed at electronics manufacturing and automotive electrification are drawing attention from suppliers and integrators, creating a near-term opportunity for selective OSAT expansion and equipment qualification in Indonesia. Local content requirements, logistics, and skilled-labor availability are shaping timelines and the mix of automation vendors chosen by ASEAN customers. Regional OEMs and contract manufacturers often source TCB tools from established Asia suppliers to accelerate qualification and minimize cross-jurisdictional logistics overhead.

The industry faces several structural challenges: (1) High unit price and capital intensity slow adoption among lower-volume packagers; (2) Tight tolerance and process control requirements increase machine qualification cycles and customer on-boarding cost; (3) Rapid emergence of alternative bonding techniques (hybrid bonding, direct copper bonding, advanced thermosonic variants) creates technology substitution risk; (4) Supply chain constraints for precision subcomponents and electronic modules can lengthen lead times; and (5) Skilled process engineers and metrology capabilities are in short supply in emerging production jurisdictions, which can delay yield ramp and reduce short-term market uptake. These challenges are visible in vendor commentary and equipment qualification timelines reported by leading suppliers.

Manufacturers should prioritize three actions: invest in modular, low-volume internal chambers and high-throughput thermal heads to win panel and wafer customers; partner with OSAT/IDM pilots to shorten qualification cycles; and regionalize spare-parts and service footprints in Asia and ASEAN to reduce downtime risk for customers. For equipment OEMs, offering flexible finance/leasing and rapid upgrade paths increases addressable customers among mid-tier packagers. For investors and OSAT customers, favor vendors with demonstrable multivendor integrations (hybrid workflows) and those participating in consortia that set next-gen process standards these firms are positioned to capture the longer tail of advanced packaging adoption. Recent vendor announcements and consortium participation support these strategic moves.

Product Models

Thermo‐compression bonding (TCB) is a critical semiconductor assembly technique that joins components using simultaneous heat and mechanical pressure, creating strong, conductive, and reliable bonds without relying on flux.

Semi-Automatic Thermo-Compression Bonding In this mode, certain operations like loading/unloading parts, positioning, or pressure application may require manual intervention or operator assistance. Notable products include:

TCW-125C ITO Group (Pulse Heat / ACF Bonder): This semi-automatic ACF thermocompression bonder from ITO features a heater tool, CCD camera imaging, and flexible force control, making it ideal for lab-scale bonding of LCDs or flexible circuits.

T-3000-FC3 Tresky AG: A multifunction die-bonding platform that supports thermo-compression bonding via a vertical Z-drive, offering up to 500 N bond force with high precision in a semi-automatic/manual workflow.

Semi-Automatic Flip-Chip Bonder (hybrid mode) HiSOL: While their M-400 is fully automatic, similar HiSOL platforms may be operated in a semi-automatic alignment + pulse-heater mode for prototyping.

Manual / Semi-Auto Thermo-Compression Tester Tresky / custom setups: In addition to production bonder, Treskys systems can be configured for semi-automatic testing and research, giving flexibility for process development.

Low-Volume ACF Bonder with Manual Load Amada Weld Tech: Amada Miyachi (Amada Weld Tech) offers heat-seal and micro-bonding equipment, including pulse-heated thermocompression machines that may be used in semi-automatic fashion

Fully Automatic Thermo-Compression Bonding: These systems handle all major steps in a continuous, automated workflow. Notable products include:

FIREBIRD TCB Series ASMPT: A fully automatic thermo-compression bonder designed for 2D, 2.5D, and 3D heterogeneous integration. Offers inert environment, precise tip tilt, and wide force range (0.1300 N).

APTURA TCB Platform Kulicke & Soffa (K&S): K&Ss next-gen fluxless TCB platform supports high-throughput, fully automated chip-to-substrate and chip-to-wafer bonding with advanced analytics.

Fluxless TCB Bonder Kulicke & Soffa: K&S has shipped fully automatic fluxless TCB systems for chiplet assembly, eliminating the need for traditional flux and improving reliability.

WBB-2000 Kaijo Corporation: A fully automatic thermo-sonic wafer-level bonder (uses both heat and ultrasonic) that supports up to 12-inch wafers with very high throughput.

9800 TC^next Besi: Besis latest automatic thermo-compression bonding system engineered for advanced packaging, delivering high precision and production stability.

Thermo Compression Bonding is a specialized, high-value segment of the semiconductor back-end equipment market. With increasing adoption of advanced packaging, the TCB market is positioned for above-average growth as suppliers innovate on throughput, thermal control, and contamination management. Asia, led by Taiwan, Korea, China and Japan, will remain the growth center while ASEAN countries (including emerging activity in Indonesia) will grow as secondary capacity nodes. Vendors that can reduce qualification friction, regionalize service, and provide flexible financing are best placed to capture the next phase of adoption.

Investor Analysis

This report consolidates market size, per-unit economics, competitive landscape and technology trends needed to evaluate equipment OEMs, OSAT customers, and targeted M&A opportunities in TCB and adjacent bonders. Investors can use the per-unit COGS and margin profile to model EBITDA contribution per incremental machine sale, estimate payback periods for tool placements in OSATs, and stress-test scenarios where hybrid bonding erodes or augments TCB demand. The combination of high per-unit selling prices, limited annual unit volumes, and concentration of demand in Asia creates an environment where a handful of vendors can deliver outsized margins and strong installed-base service revenue an attractive profile for strategic buyers and private equity investors seeking capital-light recurring revenue via service and spares. In addition, vendor participation in technology consortia and panel-level initiatives signals which companies are best positioned for long-term contract wins and standard-setting roles.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5486309

5 Reasons to Buy This Report

Consolidated, regionally focused market sizing and unit economics for TCB equipment tailored to Asia and ASEAN.

Vendor and technology-trend timeline with recent news citations to validate near-term growth drivers.

Per-unit COGS and gross-margin modeling inputs usable for capex and ROI analysis.

Strategic supplier and customer recommendations (manufacturing footprint, service, financing) to accelerate market entry.

Top-player profiling to support vendor due diligence, partnership scouting or acquisition targeting.

5 Key Questions Answered

What is the 2024 market size and implied unit volume for TCB equipment, and how does that translate to OEM revenue opportunity?

Which technology trends and vendor initiatives are most likely to drive TCB adoption in advanced packaging?

How is demand split geographically within Asia and across ASEAN, including the role of Indonesia?

What are realistic per-unit COGS, gross profit and component breakdowns for TCB machines?

Which vendors and strategic moves should investors watch to capture long-term upside or hedge technology substitution risk?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Thermo Compression Bonding Market Research Report 2025

https://www.qyresearch.com/reports/5486309/thermo-compression-bonding

Global Thermo Compression Bonding Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5486308/thermo-compression-bonding

Thermo Compression Bonding - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5486310/thermo-compression-bonding

Global Thermo Compression Bonding Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5486311/thermo-compression-bonding

Global Thermo Compression Bonder Market Research Report 2025

https://www.qyresearch.com/reports/3470926/thermo-compression-bonder

Global Manual Thermo Compression Bonder Market Research Report 2025

https://www.qyresearch.com/reports/4089179/manual-thermo-compression-bonder

Global Automatic Thermo Compression Bonder Market Research Report 2025

https://www.qyresearch.com/reports/4089180/automatic-thermo-compression-bonder

Global High-accuracy Thermo-compression (TC) Bonder Market Research Report 2025

https://www.qyresearch.com/reports/3720180/high-accuracy-thermo-compression--tc--bonder

Global Thermo Compression Forming Market Research Report 2025

https://www.qyresearch.com/reports/4645584/thermo-compression-forming

Global Compression Bonded Magnets Market Research Report 2025

https://www.qyresearch.com/reports/4193262/compression-bonded-magnets

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Thermo Compression Bonding Market to Reach CAGR 11,2% by 2031 Top 10 Company Globally here

News-ID: 4285466 • Views: …

More Releases from QY Research

Global and U.S. Digital Stimulus Isolators Market Report, Published by QY Resear …

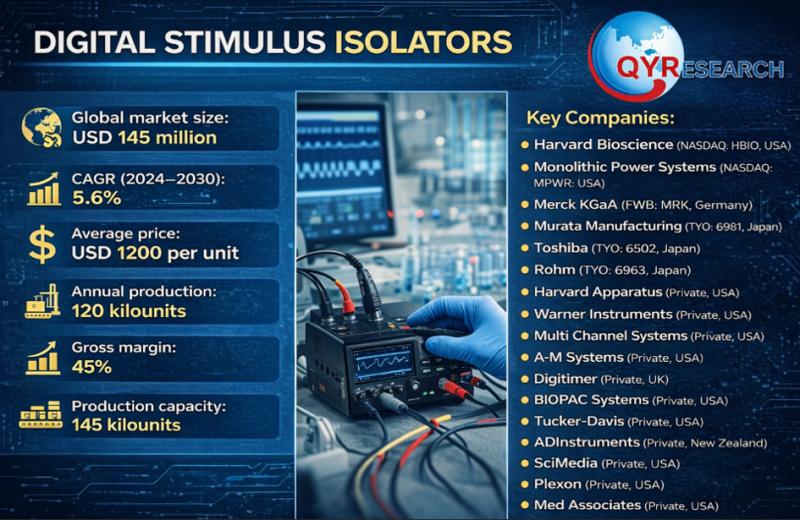

QY Research has released a comprehensive new market report on Digital Stimulus Isolators, precision electronic instruments designed to deliver electrically isolated, digitally controlled stimulation signals to biological tissues, neural circuits, and excitable cells. By providing accurate pulse timing, amplitude control, and complete galvanic isolation between stimulation and control electronics, digital stimulus isolators are essential in neuroscience research, electrophysiology, cardiac studies, and biomedical engineering. As experimental protocols become more complex and…

Global and U.S. Automotive Test Lights Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Automotive Test Lights, are handheld diagnostic tools used to check the presence of electrical current in a vehicle's circuits. They are commonly used to quickly determine whether a wire, fuse, switch, or component is receiving power. Typically, an automotive test light consists of a probe, a wire with an alligator clip, and a small bulb or LED that illuminates when…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA) Tile & ceramic producer (IDX).

PT Cahayaputra Asa Keramik Tbk (CAKK) Ceramic tiles (IDX).

PT Intikeramik Alamasri Industri Tbk (IKAI) Porcelain & tiles (IDX).

PT Keramika Indonesia Assosiasi Tbk (KIAS) Ceramic manufacturer (IDX).

PT Mulia Industrindo Tbk (MLIA) Ceramic tiles (via subsidiaries) and glass (IDX).

PT Asahimas Flat Glass Tbk (AMFG) Glass &…

Healthier Sweetening Solutions: A Strategic Look at the Organic Powdered Sugar I …

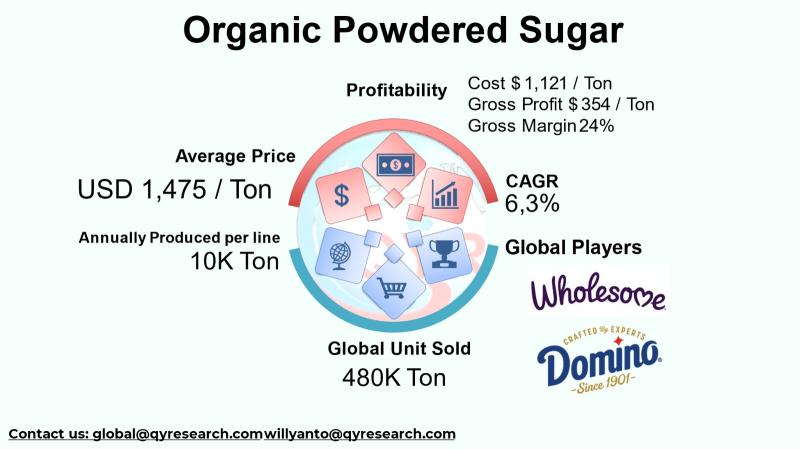

The global organic powdered sugar industry represents a specialized segment within the broader sweeteners and organic ingredient market, catering to increasing consumer demand for clean-label, sustainable, and health-oriented food products. As shoppers and food manufacturers alike seek alternatives to conventionally produced sugar, organic powdered sugar has emerged as a preferred input for bakery, confectionery, beverage, and specialty food applications. Its positioning as an ingredient free from synthetic pesticides and additives…

More Releases for TCB

The Future of Corporate Cards: How TCB Pay is Shaping the Industry

As corporate spending evolves, TCB Pay is introducing a more efficient and secure approach to corporate card programs. Designed to meet the needs of today's businesses, TCB Pay's solutions provide greater control, improved visibility, and simplified management of company expenses.

Businesses are increasingly looking for ways to improve internal processes while maintaining oversight of employees and departmental spending. In response, TCB Pay has developed a corporate card program that addresses these…

Global TCB Bonder Industry Growth Gate, Manufacturers, Types, Competition Landsc …

Global Info Research announces the release of the report "Global TCB Bonder Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" . The report is a detailed and comprehensive analysis presented by region and country, type and application. As the market is constantly changing, the report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company…

TCB Pay Expands to ACH Payments: The Flexible Alternative to Credit Cards

TCB Pay, a leading provider of corporate cards and payment solutions, is thrilled to announce the expansion of its services to include Automated Clearing House (ACH) payments. This new service cements TCB Pay's position as an innovator in payment technology, delivering greater flexibility, security, and efficiency for businesses managing their transactions.

ACH: The Ideal Alternative to Credit Card Payments

At TCB Pay, our ACH processing solution provides a versatile alternative for businesses…

TCB Pay launches innovative Corporate Card Program to simplify business expenses

TCB Pay, a leading fintech innovator, is proud to announce the launch of its new corporate card program, TCB Pay Issuing, designed to streamline expense management and enhance financial control for businesses of all sizes. This groundbreaking product aims to simplify corporate spending, offering a suite of features tailored to meet the needs of modern enterprises.

"We're thrilled to introduce TCB Pay Issuing, a corporate card program built to address the…

TCB Bonder Market, Size, Revenue, Insights, Overview, Outlook, Analysis | Valuat …

The global market for TCB Bonder was estimated to be worth US$ 90 million in 2023 and is forecast to a readjusted size of US$ 234.6 million by 2030 with a CAGR of 14.5% during the forecast period 2024-2030

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-33I8685/Global_TCB_Bonder_Market_Outlook_2022

Global TCB Bonder key players include ASMPT(Amicra), K&S, BESI, Shibaura, Hamni and SET. Global top five manufacturers hold a share about 88%.

Asia-Pacific is the largest market, with a share…

Global TCB Bonder Market Analysis By Major Manufacturers and Competitive landsca …

TCB Bonder report published by QYResearch reveals that COVID-19 and Russia-Ukraine War impacted the market dually in 2022. Global TCB Bonder market is projected to reach US$ 234.6 million in 2029, increasing from US$ 90 million in 2022, with the CAGR of 14.5% during the period of 2023 to 2029. Demand from IDMs and OSAT are the major drivers for the industry.

Global TCB Bonder Market: Driven factors and Restrictions factors

The…