Press release

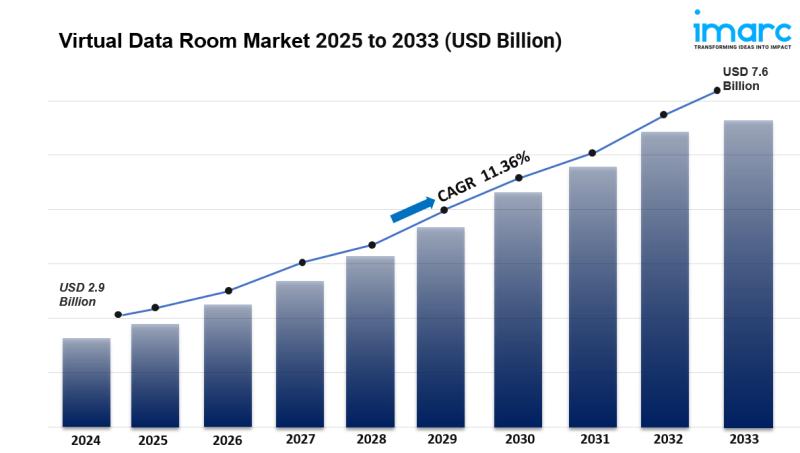

Virtual Data Room Market is Projected to Grow USD 7.6 Billion by 2033 | At CAGR 11.36%

Overview of the Virtual Data Room Market:The Virtual Data Room Market Share has gained significant traction in recent years, primarily driven by the increasing need for secure data storage and sharing solutions across industries such as finance, legal, and real estate. The Virtual Data Room (VDR) market continues to expand as organizations prioritize data security, compliance, and efficiency in handling confidential information. VDRs provide a secure online repository for sensitive documents, facilitating due diligence, mergers and acquisitions, and other transactions that demand confidentiality and regulatory compliance.

The global virtual data room market size was valued at USD 2.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.6 Billion by 2033, exhibiting a CAGR of 11.36% during 2025-2033. North America currently dominates the market, holding a significant market share of over 41.2% in 2024. Some of the primary factors driving the virtual data room market are the increasing acceptance of cloud-based solutions, a rising number of m-banking apps, and the growing inclination for online shopping.

Request For A Sample Copy Of This Report: https://www.imarcgroup.com/virtual-data-room-market/requestsample

Key Trends

1. Growing Demand for Secure Data Management:

o As cyber threats rise, organizations are prioritizing secure data management solutions, leading to increased adoption of VDRs.

2. Shift to Cloud-Based Solutions:

o The transition to cloud technology allows for more flexible, scalable, and cost-effective VDR solutions, making them more accessible to businesses of all sizes.

3. Increased Use in M&A Activity:

o The VDR market is significantly influenced by mergers and acquisitions, with companies relying on these platforms for secure document sharing during transactions.

4. Regulatory Compliance:

o Heightened regulatory requirements across industries drive the need for VDRs that can ensure compliance with data protection laws and regulations.

5. Integration with Other Technologies:

o VDRs are increasingly integrating with other technologies such as AI and machine learning to enhance functionality, including automated document sorting and advanced analytics.

Market Dynamics

1. Drivers:

o Rising Cybersecurity Concerns: Organizations are increasingly aware of the risks associated with data breaches, driving demand for secure VDRs.

o Globalization of Business: As businesses expand globally, the need for secure, cross-border data sharing solutions is growing.

o Cost Efficiency: VDRs often provide a more cost-effective solution compared to traditional physical data rooms, especially for large transactions.

2. Challenges:

o Market Competition: The VDR market is becoming saturated with numerous providers, making it challenging for new entrants to differentiate themselves.

o User Resistance: Some organizations may be hesitant to adopt VDRs due to concerns over usability or the transition from traditional methods.

3. Opportunities:

o Emerging Markets: There is significant potential for growth in emerging markets where digital transformation is accelerating.

o Custom Solutions: Offering tailored VDR solutions to meet specific industry needs can help companies capture niche markets.

Segmental Analysis:

Analysis by Component:

• Solution

• Services

Solutions dominate the market with a 75.0% share in 2024, providing the core platform and features that organizations rely on for secure data management. Cloud-based VDR solutions are particularly popular because they offer scalability, comprehensive security, and subscription-based pricing that eliminates upfront infrastructure costs. These platforms include advanced features like AI integration, mobile optimization, and compliance certifications that appeal to organizations of all sizes.

Analysis by Deployment Type:

• Cloud-based

• On-premises

On-premises solutions continue to hold significant market share, particularly among organizations with the strictest data security and compliance requirements. Banking and healthcare sectors, where regulatory mandates often require data to remain within physical infrastructure, favor on-premises deployments. These organizations prioritize complete control over their sensitive data and are willing to invest in the infrastructure necessary to maintain that control. However, the market is gradually shifting toward cloud-based solutions as security concerns are addressed and the benefits of accessibility, scalability, and lower total cost of ownership become more compelling. Hybrid solutions that combine on-premises security with cloud flexibility are gaining traction as organizations seek the best of both approaches.

Analysis by Enterprise Size:

• Large Enterprises

• Small and Medium Enterprises

Large enterprises command approximately 65.7% of the market share in 2024, driven by their complex data management needs, high-volume transactions, and stringent security requirements. These organizations regularly engage in mergers and acquisitions, major financing rounds, and extensive regulatory compliance activities-all scenarios where virtual data rooms prove indispensable. However, small and medium enterprises are increasingly recognizing the value proposition. In India alone, the number of MSMEs is projected to grow from 6.3 crore to around 7.5 crore at a CAGR of 2.5%, and many of these businesses are adopting VDRs as they scale operations and enter new markets. The subscription-based pricing model makes enterprise-grade security accessible to smaller organizations that previously couldn't justify the investment.

Analysis by Business Function:

• Marketing and Sales

• Legal

• Finance

• Workforce Management

Finance leads the market as the primary business function utilizing virtual data rooms. The finance sector's constant involvement in high-stakes transactions, regulatory reporting, and sensitive document management makes VDRs essential infrastructure. Legal departments follow closely, using VDRs for litigation support, contract management, and due diligence processes. Marketing and sales teams increasingly leverage VDRs for secure sharing of strategic plans, customer data, and competitive intelligence. Workforce management applications include secure onboarding documentation, employee records management, and confidential HR processes.

Analysis by Vertical:

• BFSI

• Retail and E-Commerce

• Government

• Healthcare and Life Sciences

• IT and Telecommunications

• Others

Banking, Financial Services, and Insurance leads with approximately 34.0% market share in 2024, reflecting the sector's critical need for secure data management. There were 784 foreign bank branches in the European Union during 2021, demonstrating the sector's global reach and corresponding need for secure cross-border data sharing. Healthcare and life sciences organizations use VDRs to manage clinical trial data, regulatory submissions, and patient information while maintaining HIPAA compliance. Retail and e-commerce companies, with Latin America alone boasting over 300 Million digital buyers, leverage VDRs for supply chain management, supplier contracts, and secure customer data handling. The IT and telecommunications sector, with expenditure on information and communications technology across the Middle East, Turkey, and Africa reaching USD 238 Billion in 2024 (up 4.5% over 2023), increasingly relies on VDRs for contract management and confidential project documentation.

Request Customization: https://www.imarcgroup.com/request?type=report&id=3828&flag=E

Analysis of Virtual Data Room Market by Regions

• North America

• Asia Pacific

• Europe

• Latin America

• Middle East and Africa

North America dominates with a 41.2% market share, powered by advanced technological infrastructure, strong regulatory frameworks, and mature financial and legal industries. The United States alone accounts for 84.50% of the North American market, with 98% of U.S. organizations having adopted cloud technology for business operations. This widespread cloud adoption creates a natural pathway for VDR implementation across sectors.

Asia Pacific represents the fastest-growing region, driven by rapid digital transformation, increasing M&A activity, and expanding financial services sectors. Countries like India and China are experiencing explosive growth in their SME populations, many of which are adopting digital tools including virtual data rooms as they scale.

Europe maintains strong adoption rates, particularly in financial centers like London, Frankfurt, and Paris. The region's stringent data protection regulations (GDPR and others) actually drive VDR adoption as companies seek compliant solutions for cross-border data sharing.

Latin America's market is expanding as the region's e-commerce and financial sectors modernize. The growing base of digital buyers and increasing foreign investment drive demand for secure transaction platforms.

The Middle East and Africa region is experiencing rapid growth, particularly in the IT and telecommunications sector. Government initiatives promoting digital transformation and smart city projects are creating new opportunities for VDR providers.

Leading Players of Virtual Data Room Market:

According to IMARC Group's latest analysis, prominent companies shaping the global virtual data room landscape include:

• Ansarada Pty Ltd.

• Brainloop AG (Diligent Corporation)

• CapLinked

• Citrix Systems Inc.

• Datasite Global Corporation

• DealRoom Inc.

• EthosData

• Firmex Inc

• FORDATA sp. z o.o.

• iDeals Solutions Group

• Intralinks Holdings Inc. (SS&C Technologies)

• SecureDocs Inc.

• ShareVault (Pandesa Corporation)

• SmartRoom (BMC Group)

These leading providers are expanding their footprint through strategic partnerships, enhanced AI capabilities, and industry-specific solutions. They're investing heavily in advanced security features, user experience improvements, and mobile accessibility to meet growing demand across financial services, legal, healthcare, and corporate sectors.

Key Developments in Virtual Data Room Market:

• September 2024: IDBI Bank announced that it would grant access to approved bidders for the bank's virtual data room, following the Reserve Bank of India's approval in July. This represents the first strategic disinvestment of a bank with substantial government ownership, targeting completion in FY2024. The move demonstrates how major financial institutions are leveraging VDR technology for complex, high-stakes transactions involving multiple stakeholders and regulatory oversight.

• Recent Development: IBM and Cohesity partnered to address enterprises' increasing needs for data resilience and security in hybrid cloud environments. IBM introduced the IBM Storage Defender service, incorporating Cohesity's data protection as an essential component. IBM Storage Defender combines data management, protection, and cyber resilience capabilities from both companies, designed to help with event monitoring and AI across multiple storage platforms through a single interface. The solution protects enterprise data layers from threats including human errors, ransomware, and sabotage.

• Recent Development: Oracle launched the European Union Sovereign Cloud to support European data privacy and sovereignty requirements. The EU Sovereign Cloud provides Oracle Cloud Infrastructure with identical service level agreements and competitive pricing as Oracle's commercial cloud regions. Located entirely within the EU and separate from Oracle's other cloud regions, it offers customers enhanced control over their data-a critical consideration for organizations evaluating virtual data room solutions within strict European regulatory frameworks.

• Recent Development: CallCabinet introduced an advanced version of its AI-driven Conversation Analytics, featuring enhanced generative AI integration, an optimized interface, and greater customization options. This update empowers businesses to tailor analytics to their strategic goals, boosting efficiency and fostering cross-departmental engagement with intuitive data insights. While not a VDR provider directly, this development illustrates the broader trend of AI integration across enterprise data management tools.

• Recent Development: Amelia showcased the newest version of its Conversational AI platform at Enterprise Connect 2024. This version utilizes generative AI and deterministic capabilities, allowing organizations to implement virtual agents for customer care applications. The technology demonstrates how AI is being integrated across enterprise platforms, including virtual data rooms, to enhance user experience and operational efficiency.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=3828&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Virtual Data Room Market is Projected to Grow USD 7.6 Billion by 2033 | At CAGR 11.36% here

News-ID: 4286831 • Views: …

More Releases from IMARC Group

Natural Gas Price Index: Current Prices, Regional Trends & Forecast

The Natural Gas Price Index has experienced notable fluctuations in recent months due to supply-demand shifts, geopolitical factors, and seasonal energy consumption. Understanding the price of Natural Gas is vital for traders, industrial users, and investors seeking insights into market trends. This report provides a detailed overview of Natural Gas Prices, including historical data, price trends, forecasts for 2026, and regional variations. Whether you are analyzing the Natural Gas price…

Natural Gas Price Index: Current Prices, Regional Trends & Forecast

The Natural Gas Price Index has experienced notable fluctuations in recent months due to supply-demand shifts, geopolitical factors, and seasonal energy consumption. Understanding the price of Natural Gas is vital for traders, industrial users, and investors seeking insights into market trends. This report provides a detailed overview of Natural Gas Prices, including historical data, price trends, forecasts for 2026, and regional variations. Whether you are analyzing the Natural Gas price…

Natural Gas Price Index: Current Prices, Regional Trends & Forecast

The Natural Gas Price Index has experienced notable fluctuations in recent months due to supply-demand shifts, geopolitical factors, and seasonal energy consumption. Understanding the price of Natural Gas is vital for traders, industrial users, and investors seeking insights into market trends. This report provides a detailed overview of Natural Gas Prices, including historical data, price trends, forecasts for 2026, and regional variations. Whether you are analyzing the Natural Gas price…

Natural Gas Price Index: Current Prices, Regional Trends & Forecast

The Natural Gas Price Index has experienced notable fluctuations in recent months due to supply-demand shifts, geopolitical factors, and seasonal energy consumption. Understanding the price of Natural Gas is vital for traders, industrial users, and investors seeking insights into market trends. This report provides a detailed overview of Natural Gas Prices, including historical data, price trends, forecasts for 2026, and regional variations. Whether you are analyzing the Natural Gas price…

More Releases for VDR

Global Simplified Voyage Data Recorders VDR Market Size by Application, Type, an …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to Market Research Intellect, the global Simplified Voyage Data Recorders VDR market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The market for simplified voyage data recorders (VDR) is expanding gradually as a result of stricter marine safety laws and the increased…

Voyage Data Recorders (VDR) Market Size 2024 to 2031.

Market Overview and Report Coverage

A Voyage Data Recorder (VDR) is a vital piece of equipment on board a vessel that records crucial data for accident investigation and analysis. The VDR market is expected to grow at a CAGR of 1.60% during the forecasted period, driven by the increasing emphasis on maritime safety and regulations.

The current outlook for the VDR market is positive, with advancements in technology leading to…

Virtual Data Room (VDR) Market by Industry Top Players 2023 to 2029

The Virtual Data Room (VDR) market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status…

Voyage Data Recorders (VDR) Market: Competitive Dynamics & Global Outlook 2024

Market Research Report Store offers a latest published report on Voyage Data Recorders (VDR) Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

According to this study, over the next five years the Voyage Data Recorders (VDR) market will register a xx% CAGR in terms of revenue, the global market size will reach US$ xx million by 2024, from US$ 1470.1…

Voyage Data Recorders (VDR) Market 2017 Emerging Trends

The major players in global Voyage Data Recorders (VDR) market include Furuno, Kelvin Hughes, Consilium, Interschalt Maritime Systems, JRC, Danelec Marine, Raytheon Anschutz, SELMA, Kongsberg Maritime, Chongqing Hi-Sea Group, Netwave Systems, Transas Marine International, SAM Electronics, Maretron, GEM Elettronica.

Geographically, this report is segmented into several key Regions, with production, consumption, revenue, market share and growth rate of Voyage Data Recorders (VDR) in these regions, from 2012 to 2022 (forecast) ,…

Voyage Data Recorders (VDR) Market 2017 - Japan Radio Co, Furuno

Marketreports.biz, recently published a detailed market research study focused on the "Voyage Data Recorders (VDR) Market" across the global, regional and country level. The report provides 360° analysis of "Voyage Data Recorders (VDR) Market" from view of manufacturers, regions, product types and end industries. The research report analyses and provides the historical data along with current performance of the global Voyage Data Recorders (VDR) industry, and estimates the future…