Press release

TCB Pay launches innovative Corporate Card Program to simplify business expenses

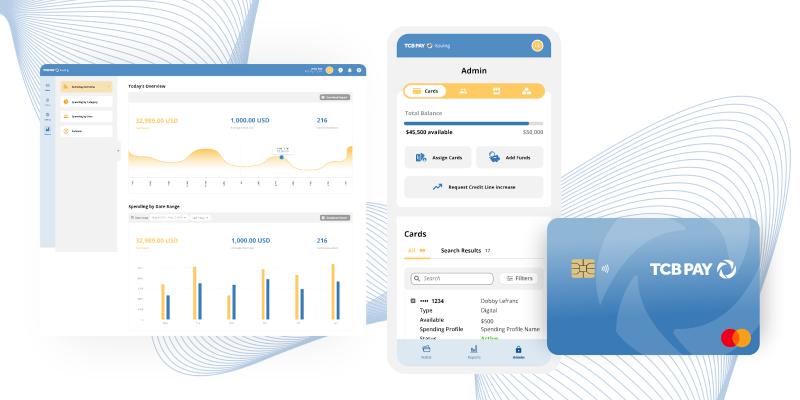

TCB Pay, a leading fintech innovator, is proud to announce the launch of its new corporate card program, TCB Pay Issuing, designed to streamline expense management and enhance financial control for businesses of all sizes. This groundbreaking product aims to simplify corporate spending, offering a suite of features tailored to meet the needs of modern enterprises."We're thrilled to introduce TCB Pay Issuing, a corporate card program built to address the unique challenges of business expense management," said Benjamin Haguel, CEO of TCB Pay. "Our card offers a blend of powerful features and user-friendly tools that will transform the way companies handle their finances, enabling them to focus more on growth and less on administrative burdens."

Key Features and Benefits

TCB Pay Issuing provides companies with the flexibility to optimize their business operations. Our intuitive platform offers an array of benefits designed to enhance financial efficiency and oversight:

- Unlimited digital and physical cards at no cost,

- Multi-level user access through different levels of permission,

- Customizable spending limits,

- Real-time tracking of purchases,

- Ability to block and activate cards instantly,

- Advanced reporting tools for detailed expense analysis.

We offer various programs to suit your financial strategy:

- Prepaid (debit): Enjoy the convenience of prepaid cards with almost unlimited spending capacity.

- Postpaid (credit): Take advantage of postpaid cards with generous spending limits for greater financial flexibility.

Empowering Businesses

TCB Pay Issuing is designed to support businesses in managing their expenditures more efficiently, reducing administrative tasks, and providing valuable insights into spending patterns. "Our TCB Pay corporate card offers unparalleled control and convenience. Engineered with cutting-edge security protocols and streamlined integration capabilities, it ensures swift and secure transactions, near real-time reporting, and active monitoring empowering businesses to navigate the dynamic marketplace with confidence." said Subhajyoti Moulick, CTO of TCB Pay. By utilizing these features, companies can improve their financial health and operational efficiency.

Early Success Story

Founded in 2014, TCB Pay is dedicated to providing innovative financial solutions that empower businesses to thrive. With a commitment to leveraging cutting-edge technology, TCB Pay offers a range of products designed to streamline financial processes and enhance business performance.

Check out our TCB Pay Issuing video: https://www.youtube.com/watch?v=luP7B9GRnuc

For more information, visit www.tcbpay.com/issuing

Laurie Evina

Chief of Marketing at TCB Pay

Phone: 866-444-8585

Email: laurie@tcbpay.com

Website: tcbpay.com/issuing

At TCB Pay, we're all about making payments easy, convenient, and secure for everyone. From online transactions to in-store purchases, we've got the tools and technology to help you take your business to the next level.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release TCB Pay launches innovative Corporate Card Program to simplify business expenses here

News-ID: 3741989 • Views: …

More Releases for Issuing

"Refreshing Fujian" Returns to New York's Times Square, Issuing a Global Invitat …

As the Lunar New Year approaches, the "mountain-sea gallery" from China's southeastern coast once again illuminates the world's crossroads. On February 11 (U.S. local time), Fujian's cultural and tourism brand "Refreshing Fujian" appeared on the No. 20 screen of New York's Times Square. A 15-second promotional video themed "Visit Refreshing Fujian, Celebrate a Fujian-style Chinese New Year" is presenting a visual and cultural feast to the world.

Image: https://www.globalnewslines.com/uploads/2026/02/bcbe4bc7bf3fe60947e98f77a531ecaa.jpg

The video captures…

Modern Card Issuing Platforms Market Is Booming Worldwide | Major Giants Marqeta …

HTF MI just released the Global Modern Card Issuing Platforms Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Key Players in This Report Include:

Marqeta, Stripe Issuing, Galileo,…

Modern Card Issuing Platforms Market Size by Application, Type, Geographic Scope …

USA, New Jersey- According to Market Research Intellect, the global Modern Card Issuing Platforms market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The modern card issuing platforms market is experiencing rapid expansion, driven by the growing adoption of digital payments and fintech innovations. Businesses are…

Financely Expands Securitization as a Service Platform After Issuing Over $400 M …

Image: https://lh7-rt.googleusercontent.com/docsz/AD_4nXc7P026F7bSklFbwHaYvmX_ftvRbACrAXlzh5iGm2wNo0aQL3QFBPNHtbNUp7fcO5eZ5cFYEELavK3VrFhaAN93WFMfrNLPPpkI3GsQXJKtoO6bhcSErkfPAImzkj4zMcXr7IA?key=Bv1ODsd0fZ_omQMpLuuJS2Zx

After effectively issuing over $400 million in notes last year, Financely, a rising leader in the structured finance sector, announces the extension of its Securitizing as a Service platform. Scaling its capacity to arrange and distribute trade finance, project finance, business acquisition, venture loans, and distressed asset notes has enabled the company to transform access to capital for both businesses and investors alike.

A Securitization Platform for Borrowers and Investors

Built…

Modern Card Issuing Platforms Market Report Unravelling the Growth Factors, Indu …

Modern card issuing platforms have revolutionized the financial landscape, offering seamless and efficient solutions for issuing and managing payment cards. These platforms leverage advanced technology to streamline the card issuance process, enabling businesses to quickly create and distribute customized cards tailored to their specific needs. With features such as real-time card activation, instant virtual card issuance, and robust security measures, these platforms provide unparalleled convenience and security to both businesses…

Modern Card Issuing Platforms Market Recent Trends, In-depth Analysis, Size and …

The Modern Card Issuing Platforms Market Trends Overview 2024-2031:

A new Report by Worldwide Market Reports, titled "Modern Card Issuing Platforms Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2031," offers a comprehensive analysis of the industry, which comprises insights on the Modern Card Issuing Platforms market analysis. The report also includes competitor and regional analysis, and contemporary advancements in the market.

This report has a complete table of contents, figures,…