Press release

Cancer Biomarker Testing Market to Reach US$ 96.53 Billion by 2033, Driven by Precision Oncology & North America Leading with 42% Share | DataM Intelligence

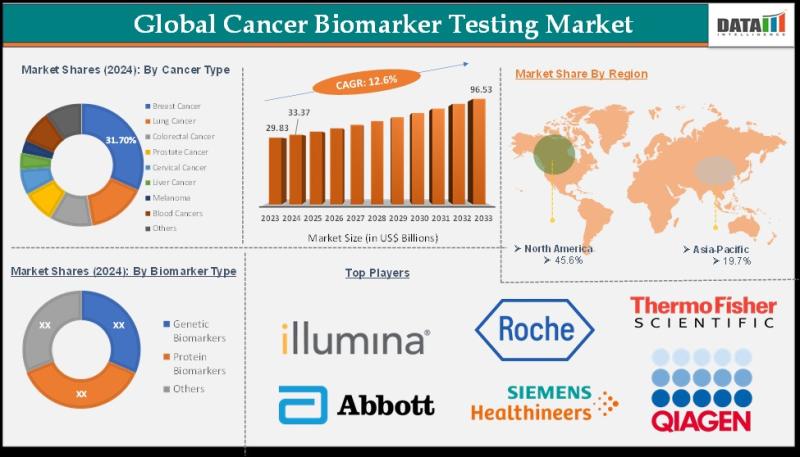

The Global Cancer Biomarker Testing Market was valued at US$ 29.83 billion in 2023, expanded to US$ 33.37 billion in 2024, and is projected to reach US$ 96.53 billion by 2033, registering a strong CAGR of 12.6% during 2025-2033. Growth is driven by rising cancer incidence worldwide, increasing adoption of precision oncology, and rapid advancements in biomarker-based diagnostic technologies.The market continues to strengthen its position as healthcare systems shift toward early detection, personalized treatment pathways, and companion diagnostics. Expanded use of genomic profiling, liquid biopsies, protein biomarkers, and multi-omics testing is enabling more accurate tumor characterization and therapy selection, improving patient outcomes and supporting robust long-term market expansion.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID): https://www.datamintelligence.com/download-sample/cancer-biomarker-testing-market?sai-v

The cancer biomarker testing market refers to the industry that provides diagnostic tests used to detect biological markers in blood or tissue to support cancer diagnosis, prognosis, and treatment decisions.

Key Developments

United States

✅ October 2025: U.S. diagnostic labs expanded use of advanced companion diagnostic platforms for PD-L1, MSI-H, and TMB biomarker analysis to support the growing demand for precision oncology.

✅ August 2025: Leading cancer centers accelerated adoption of liquid biopsy-based biomarker testing, integrating ctDNA assays for early mutation detection and therapy monitoring.

✅ May 2025: Multiple oncology networks implemented AI-powered biomarker interpretation software to reduce diagnostic variability and improve decision support across multi-omic cancer testing.

✅ March 2025: The FDA authorized updated next-generation sequencing (NGS) biomarker panels, allowing broader use of multi-gene cancer profiling across U.S. hospitals.

Japan

✅ September 2025: Major Japanese hospitals deployed AI-enhanced pathology biomarker systems to increase accuracy in tumor classification and molecular-level diagnostics.

✅ June 2025: Research institutions and biotech firms in Japan jointly advanced development of next-generation protein biomarkers focused on lung and pancreatic cancer detection.

✅ February 2025: Regional health programs expanded access to blood-based cancer biomarker testing for early detection, strengthening nationwide screening initiatives.

Mergers & Acquisitions

United States

✅ July 2025: A U.S. diagnostics company strengthened its oncology portfolio by acquiring a biomarker analytics startup specializing in AI-driven mutation profiling.

Japan

✅ April 2025: A Japanese precision diagnostics firm formed a strategic collaboration with a domestic pharmaceutical company to co-develop high-specificity biomarkers for targeted cancer therapies.

✅ January 2025: A leading Japanese medical technology provider entered a partnership with a U.S. molecular diagnostics firm to expand biomarker assay distribution for clinical cancer testing.

Key Players:

Illumina, Inc. | F. Hoffmann-La Roche Ltd | Thermo Fisher Scientific Inc. | Abbott | QIAGEN | Siemens Healthineers AG | Bio-Rad Laboratories, Inc. | Agilent Technologies | BioMérieux | Foundation Medicine, Inc.

Key Highlights :

• Illumina, Inc. - Holds 16.8% share of the global cancer biomarker testing market, driven by advanced NGS platforms, genomic sequencing solutions, and precision oncology diagnostics.

• F. Hoffmann-La Roche Ltd - Accounts for 14.5% share, supported by leading companion diagnostic tests, liquid biopsy technologies, and personalized medicine initiatives.

• Thermo Fisher Scientific Inc. - Holds 12.9% share, propelled by PCR-based assays, next-generation sequencing kits, and integrated biomarker testing solutions.

• QIAGEN - 10.7% share, driven by strong adoption of molecular diagnostic kits, sample preparation technologies, and oncology-focused biomarker panels.

• Abbott - Holds 9.3% share, supported by immunoassay-based cancer biomarkers, laboratory automation, and high-throughput diagnostic systems.

• Siemens Healthineers AG - 8.6% share, backed by diagnostic imaging integration, biomarker testing platforms, and laboratory information systems.

• Bio-Rad Laboratories, Inc. - 6.8% share, driven by protein assays, molecular testing kits, and quality-control solutions for oncology diagnostics.

• Agilent Technologies - 5.7% share, supported by analytical instrumentation and molecular diagnostics tools for biomarker discovery and validation.

• BioMérieux - 4.9% share, contributing through immunoassay-based testing and molecular diagnostics platforms focused on oncology biomarkers.

• Foundation Medicine, Inc. - 3.9% share, driven by comprehensive genomic profiling, NGS-based oncology tests, and precision medicine solutions.

Purchase this report before year-end and unlock an exclusive 30% discount: https://www.datamintelligence.com/buy-now-page?report=cancer-biomarker-testing-market?sai-v

(Purchase 2 or more reports and get 50% discount.)

Market Drivers

• Increasing global cancer incidence and rising awareness of early diagnosis are driving demand for biomarker-based testing.

• Growing adoption of precision medicine and personalized oncology treatment approaches is boosting the use of molecular, protein, and genetic biomarkers.

• Expansion of advanced diagnostic technologies such as next-generation sequencing (NGS), liquid biopsy, and immunohistochemistry (IHC) platforms is supporting accurate, rapid, and minimally invasive testing.

• Strong government and private funding for cancer research, clinical trials, and biomarker discovery programs is facilitating market growth.

• Rising demand for companion diagnostics to guide targeted therapy selection and monitor therapeutic response is accelerating adoption.

Industry Developments

• October 2025 (US): Diagnostic companies launched liquid biopsy panels capable of detecting multiple cancer biomarkers from a single blood sample, improving early detection.

• August 2025 (Germany): Biotechnology firms introduced advanced NGS-based tumor profiling kits for precision oncology applications.

• June 2025 (Japan): Laboratories adopted multiplex immunoassays for simultaneous detection of protein and genetic biomarkers to optimize treatment selection.

• April 2025 (UK): Key players partnered with hospitals to implement AI-driven biomarker interpretation software, enhancing diagnostic accuracy and workflow efficiency.

Regional Insights

• North America - US$ 5.6 billion (42% share): Growth is driven by "high cancer prevalence, strong adoption of precision diagnostics, extensive clinical research, and robust reimbursement frameworks for biomarker testing."

• Europe - US$ 4.1 billion (31% share): Expansion is supported by "advanced diagnostic infrastructure, rising use of companion diagnostics, and strong regulatory support for molecular testing in oncology."

• Asia-Pacific - US$ 2.5 billion (19% share): Growth is fueled by "rapidly increasing cancer incidence, rising investments in molecular diagnostics, and expansion of hospital-based diagnostic centers in major countries."

• Latin America - US$ 0.6 billion (5% share): Demand is increasing due to "improving laboratory infrastructure, growing awareness of personalized medicine, and gradual adoption of advanced biomarker testing solutions."

• Middle East & Africa - US$ 0.3 billion (3% share): Growth is driven by "emerging diagnostic centers, increasing cancer detection initiatives, and government support for modern oncology testing technologies."

Key Segments

By Test Type

Genetic biomarker testing leads the market due to its ability to identify mutations, hereditary risks, and personalized treatment targets. Protein biomarker testing is growing steadily for early detection, prognosis, and therapy monitoring. Circulating tumor DNA (ctDNA) testing is expanding rapidly as a minimally invasive method for cancer detection and monitoring treatment response. Polymerase Chain Reaction (PCR) remains widely used for high-sensitivity detection of specific genetic sequences and mutations. Next-Generation Sequencing (NGS) is gaining momentum for comprehensive genomic profiling and precision medicine applications. Other test types include microarrays, epigenetic assays, and emerging diagnostic platforms.

By Product Type

Instruments - PCR machines, NGS platforms, mass spectrometers, ctDNA detection devices, and other diagnostic equipment form the backbone of cancer testing laboratories and research facilities.

Kits & Reagents - Include consumables, assay kits, probes, and reagents required for performing tests efficiently and accurately, driving recurring demand in clinical and research settings.

By Cancer Type

Lung cancer dominates due to its high incidence and the need for early detection and personalized therapy monitoring. Prostate and breast cancer segments follow, driven by screening programs and targeted therapy adoption. Leukemia testing is expanding in response to advances in molecular diagnostics for hematological malignancies. Other cancer types include colorectal, ovarian, pancreatic, and rare cancers, where biomarker testing enables precision treatment approaches.

By Application

Drug discovery and development is a key application as molecular and biomarker testing helps identify novel therapeutic targets and monitor clinical trial efficacy. Disease screening drives early detection programs, particularly in high-risk populations. Treatment planning relies on molecular diagnostic results to guide personalized therapies and monitor response. Other applications include prognosis prediction, monitoring minimal residual disease, and research into emerging therapeutic approaches.

Speak to our analyst and get customization in the report as per your requirements: https://www.datamintelligence.com/customize/cancer-biomarker-testing-market?sai-v

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cancer Biomarker Testing Market to Reach US$ 96.53 Billion by 2033, Driven by Precision Oncology & North America Leading with 42% Share | DataM Intelligence here

News-ID: 4284891 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

United States Power Transistor Market (2026-2033)., North America's Hold 32% Mar …

Market Size and Growth

Global power transistor market grows with rising demand in EVs, industrial electronics, and renewable energy (2026-2033)

United States: Recent Industry Developments

✅ February 2026: Infineon Technologies (U.S. operations) introduced next-generation silicon carbide (SiC) power transistors for EV and renewable energy applications.

✅ January 2026: ON Semiconductor launched high-efficiency gallium nitride (GaN) power transistors for data centers and industrial automation.

✅ December 2025: Texas Instruments released new automotive-grade MOSFETs to enhance power…

United States International Express Delivery Market (2026-2033)., North America …

Market Size and Growth

Market expansion outlook: The International Express Delivery Market was hit huge Growth (2026-2033)

United States: Recent Industry Developments

✅ February 2026: FedEx expanded its global express delivery network, introducing faster cross-border services for e-commerce shipments.

✅ January 2026: UPS launched AI-enabled route optimization to improve delivery speed and reduce operational costs.

✅ December 2025: DHL implemented sustainable delivery solutions using electric cargo vehicles for urban international shipments.

Downlaod Free Custom Research: https://www.datamintelligence.com/custom-research?kb=ied

Japan:…

United States Fibrin Sealants Market Witness high Growth (2026-2033)., North Ame …

Market Size and Growth

Fibrin Sealants Market to hit at a high CAGR during the forecast period (2026-2033)

United States: Recent Industry Developments

✅ February 2026: Baxter International launched a next-generation fibrin sealant with enhanced adhesive strength for surgical applications.

✅ January 2026: Medtronic expanded distribution of its fibrin sealant portfolio to support minimally invasive and robotic surgeries.

✅ December 2025: Integra LifeSciences introduced a fast-acting fibrin sealant optimized for wound closure in cardiovascular procedures.

Download…

United States Commercial Juicer Market (2026-2033) | Global Market Growth Projec …

Market Size and Growth

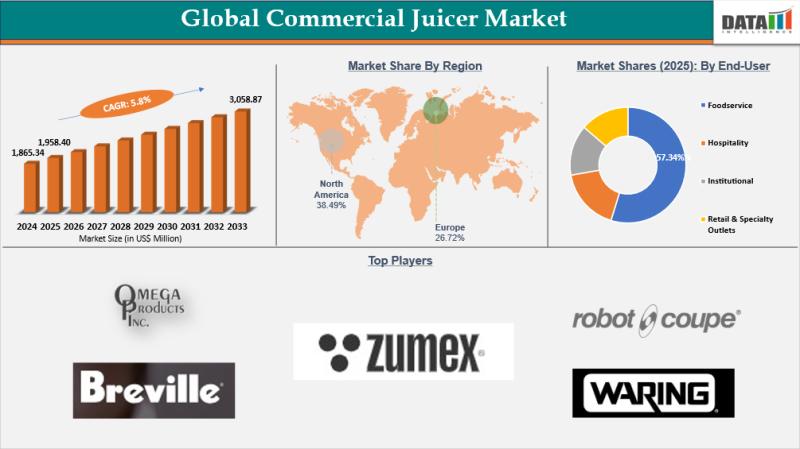

commercial juicer market reached US$ 1,865.34 Million in 2024, rising to US$ 1,958.40 Million in 2025 and is expected to reach US$ 3,058.87 Million by 2033, growing at a strong CAGR of 5.8% during the forecast period from 2026 to 2033.

demand is driven by investments in modern processing technologies, such as the US$ 6.3 million funding provided by the government to Greenhouse Juice Company in Mississauga, Canada.

United…

More Releases for NGS

Next Generation Sequencing (NGS) : - Key Industry Dynamics

The Next Generation Sequencing (NGS) market size is projected to reach US$ 34.75 billion by 2031 from US$ 10.00 billion in 2023. The market is expected to register a CAGR of 16.8% during 2023-2031. Increased throughput and reduced costs is likely to remain key trends in the market.

Next-generation sequencing (NGS) carries a shift in genomics research, offering unmatched capabilities for analyzing DNA and RNA molecules in a high-throughput and cost-effective…

Next-Generation Sequencing (NGS) Services Next-Generation Sequencing (NGS) Servi …

Global Next-Generation Sequencing (NGS) Services Market Report encompasses market data, such as trends, consumer behavior, and competitive analysis in a way that allows businesses to identify opportunities in the market. The objective of the market research is understood very clearly by DBMR team before the creation of report commences. Intense research takes place to accurately analyze market dynamics and consumer behaviour included in the report.

Global Next-Generation Sequencing (NGS) Services Market,…

Complete PDF Guide to NGS Sample Preparation

The NGS sample preparations determine components in the samples, such as blood, urine, and others, in animals.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐏𝐃𝐅 @ https://www.theinsightpartners.com/sample/TIPRE00006573?utm_source=OpenPR&utm_medium=10379

The type of analyzers includes urine analyzers, blood gas & electrolyte analyzers, glucometers, and others used by medical labs, hospitals, and people at home.

Top Companies Analysis -

Agilent Technologies, Inc.

Becton, Dickinson and Company

Beckman Coulter

F. Hoffmann-La Roche AG

Illumina, Inc.

…

NGS Sample Preparation Market - Preparing for Precision: NGS Sample Preparation …

Newark, New Castle, USA: The "NGS Sample Preparation Market" provides a value chain analysis of revenue for the anticipated period from 2023 to 2031. The report will include a full and comprehensive analysis of the business operations of all market leaders in this industry, as well as their in-depth market research, historical market development, and information about their market competitors.

NGS Sample Preparation Market: https://www.growthplusreports.com/report/ngs-sample-preparation-market/8504

This latest report researches the industry structure,…

NGS Library Preparation Market - Sequencing Solutions, Redefined: Innovations in …

Newark, New Castle, USA - new report, titled NGS Library Preparation Market The report has been put together using primary and secondary research methodologies, which offer an accurate and precise understanding of the NGS Library Preparation market. Analysts have used a top-down and bottom-up approach to evaluate the segments and provide a fair assessment of their impact on the global NGS Library Preparation market. The report offers an overview of…

Next Generation Sequencing (NGS) Data Analysis Market Research Report 2020Next G …

The Next Generation Sequencing (NGS) Data Analysis Market report helps identify the biggest opportunities in Next Generation Sequencing (NGS) Data Analysis industry space and offers accurate latent demand forecasting that empowers quantitative decision making among Next Generation Sequencing (NGS) Data Analysis market players and new entrants. Investors will gain a clear insight on the dominant players in Next Generation Sequencing (NGS) Data Analysis industry and their future forecasts. Furthermore, readers…