Press release

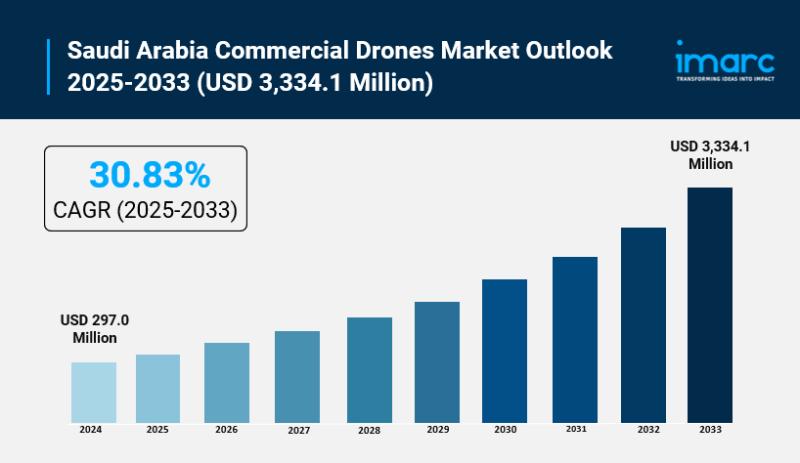

Saudi Arabia Commercial Drones Market Projected to Reach USD 3,334.1 Million by 2033 At CAGR 30.83%

Saudi Arabia Commercial Drones Market OverviewMarket Size in 2024: USD 297.0 Million

Market Size in 2033: USD 3,334.1 Million

Market Growth Rate 2025-2033: 30.83%

According to IMARC Group's latest research publication, "Saudi Arabia Trade Finance Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia commercial drones market size reached USD 297.0 Million in 2024. Looking forward, the market is expected to reach USD 3,334.1 Million by 2033, exhibiting a growth rate (CAGR) of 30.83% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-commercial-drones-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Commercial Drones Market

● AI-driven drones enhance oil pipeline inspections in Saudi Arabia, reducing inspection times by 50% and boosting operational safety significantly.

● The government's drone regulation framework encourages autonomous AI-based drone flights, making commercial drone use safer and more scalable.

● Saudi Aramco's AI-powered drones contribute to discovering new resources and monitoring environmental compliance, improving efficiency drastically.

● AI-enabled drones optimize agricultural monitoring by analyzing crop health faster and more accurately than traditional methods.

● Urban drone delivery projects leveraging AI have cut last-mile delivery times by 40%, greatly enhancing logistics efficiency in congested cities.

How Vision 2030 is Transforming The Saudi Arabia Commercial Drones Industry?

Commercial drones are growing in appeal in Saudi Arabia due to Vision 2030. The trend for smart technologies and automation in smart cities, precision agriculture, industrial inspections, transportation, logistics, and other applications is further growing with the government initiatives in Saudi Arabia for the adoption of drone solutions. These regulatory initiatives will result in safer and more organized operations, accelerate innovation and private sector investment, and in conjunction with the growing demand for efficiency, data analysis, and remote monitoring will cement commercial drones as key enablers of the Kingdom's modernization agenda.

Saudi Arabia Commercial Drones Market Trends & Drivers:

Saudi Arabia's commercial drone market is being driven by Vision 2030 ambition, newly established supportive regulations and use cases across the energy, logistics and construction industries. Smart cities, digital infrastructure, and wider automation have been key elements of Vision 2030 and are twisted into the Saudi mega-projects such as NEOM, Red Sea, and urban development. GACA has combined Part 107 style regulations with other rules, such as new Advisory Circulars on BVLOS, flights at night, and operations over people, and a national investment initiative to make it easier for companies to fly drones legally and at scale. This combination of regulatory clarity and investment is encouraging investors and operators to roll out commercial drone fleets across multiple sectors.

Another massive driver has been the rapid spread of drones through existing heavy industries such as oil and gas, utilities and large infrastructure where they are clearly lowering costs and improving safety in ways that are very hard to ignore. Saudi Aramco, for example, is often cited as a reference case in providing non‐destructive inspections of tanks, stacks and confined space. Their internal programs have achieved 50-60 per cent reduction in inspection costs vs customary methods, and have removed the need for hazardous work at height. Other partnerships include Aramco and Terra Drone, and Terra Drone Arabia and FAHSS. The collaborations focus on scaling up inspection of industrial plants, boiler stacks, flare stacks, pipelines, and transmission towers, among others. Organizations and sites such as construction and mines across many Kingdom projects are also using drones for inspection, mapping, and surveillance.

Drones are also changing the way Saudi Arabia thinks about logistics, agriculture, and smart-city services, creating new opportunities in the Kingdom. GACA has been approving drone delivery and the Kingdom has undertaken its first pilot drone deliveries with the support of the government. The plan is to expand the service to some other major cities across the Kingdom, as demand for e‐commerce deliveries continues to grow. The 2025 regulations for registering drones and issuing pilot licenses are meant for the launch of drone delivery and other advanced services such as surveying, mapping, public-safety operations, precision agriculture, remote construction monitoring, and security surveillance. These applications are becoming commonplace as the use of drones to operate in remote and dangerous locations becomes an everyday business solution.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=20856&method=1315

Saudi Arabia Commercial Drones Industry Segmentation:

The report has segmented the market into the following categories:

System Insights:

● Hardware

● Airframe

● Propulsion System

● Payloads

● Others

● Software

Product Insights:

● Fixed Wing

● Rotary Blade

● Hybrid

Mode of Operation Insights:

● Remotely Operated

● Semi-Autonomous

● Autonomous

Weight Insights:

● 2 Kg

● 2 Kg-25 Kg

● 25 Kg-150 Kg

Application Insights:

● Filming and Photography

● Inspection and Maintenance

● Mapping and Surveying

● Precision Agriculture

● Surveillance and Monitoring

● Others

End User Insights:

● Agriculture

● Delivery and Logistics

● Energy

● Media and Entertainment

● Real Estate and Construction

● Security and Law Enforcement

● Others

Regional Insights:

● Northwest

● Northeast

● Central

● South

● Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Commercial Drones Market

● November 2025: Saudi Aramco deploys AI-enabled drones for pipeline inspections, reducing downtime by 30% and enhancing safety protocols across remote locations.

● October 2025: Saudi government launches drone delivery corridor pilots, enabling autonomous urban logistics with real-time AI traffic management systems.

● September 2025: Terra Drone partners with Riyadh municipality to implement AI-powered aerial surveys, accelerating construction monitoring and urban planning efficiency.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Commercial Drones Market Projected to Reach USD 3,334.1 Million by 2033 At CAGR 30.83% here

News-ID: 4282450 • Views: …

More Releases from IMARC Group

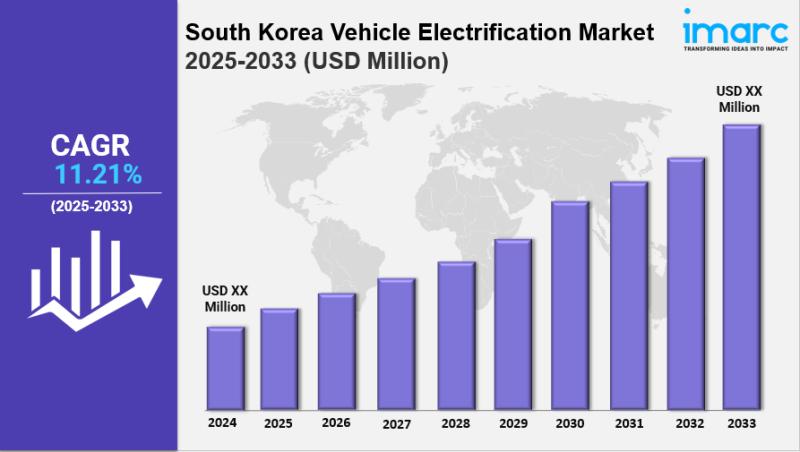

South Korea Vehicle Electrification Market Size, Growth, Key Players, Latest Tre …

IMARC Group has recently released a new research study titled "South Korea Vehicle Electrification Market Report by Product Type (Starter Motor, Alternator, Electric Car Motors, Electric Water Pump, Electric Oil Pump, Electric Vacuum Pump, Electric Fuel Pump, Electric Power Steering, Actuators, Start/Stop System), Vehicle Type (Internal Combustion Engine (ICE) and Micro-Hybrid Vehicle, Plug-in Hybrid Electric Vehicle (PHEV) and Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV)), Sales Channel (Original Equipment…

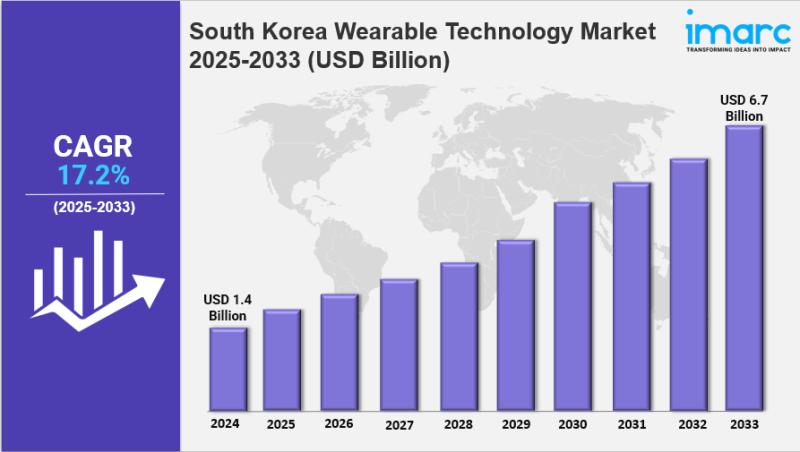

South Korea Wearable Technology Market Size, Share, Industry Overview, Trends an …

IMARC Group has recently released a new research study titled "South Korea Wearable Technology Market Report by Product (Wrist-Wear, Eye-Wear and Head-Wear, Foot-Wear, Neck-Wear, Body-Wear, and Others), Application (Consumer Electronics, Healthcare, Enterprise and Industrial Application, and Others), and Region 2025-2033" This report offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wearable Technology Market Overview

The…

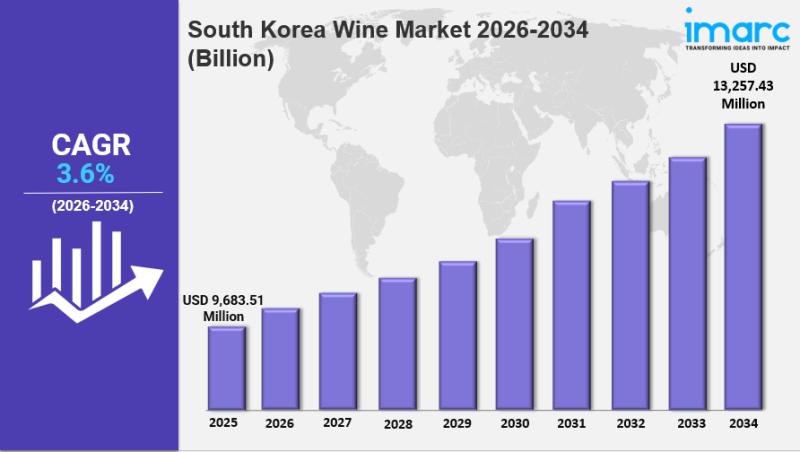

South Korea Wine Market Size, Share, Industry Overview, Trends and Forecast 2026 …

IMARC Group has recently released a new research study titled "South Korea Wine Market Size, Share, Trends and Forecast by Product Type, Color, Distribution Channel, and Region, 2026-2034", which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wine Market Report Overview

The South Korea wine market size was valued at USD 9,683.51 Million in 2025.…

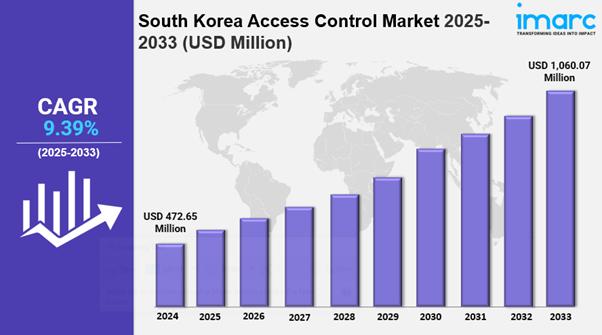

South Korea Access Control Market Size, Share, Industry Overview, Trends and For …

IMARC Group has recently released a new research study titled "South Korea access control market Size, Share, Trends and Forecast by Component, Deployment Mode, SMS Traffic, Application, End User, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Access Control Market Overview

The South Korea access control market size was valued at USD…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…