Press release

Buy Now Pay Later Market Estimated to Grow at 23.8% CAGR by 2032 | Persistence Market Research

Overview of the MarketThe global Buy Now Pay Later (BNPL) market is experiencing unprecedented momentum as digital payment adoption accelerates across both developed and emerging economies. The market, valued at US$44.7 billion in 2025, is projected to skyrocket to US$196.0 billion by 2032, expanding at a remarkable CAGR of 23.8% during the forecast period. Growing comfort with online shopping and flexible payment options continues to push BNPL solutions into the mainstream.

Consumers today demand simplified, instant, and interest-free payment alternatives that alleviate upfront costs, making BNPL one of the fastest-adopted fintech innovations. The booming e-commerce ecosystem is the leading demand catalyst, as retailers increasingly embed BNPL solutions at checkout to improve cart conversion. The online retail segment remains the dominant contributor to BNPL transactions, while North America leads the global market due to advanced digital infrastructure, the presence of key players, and strong consumer trust in alternative financing models.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/35349

Key Highlights from the Report

The Buy Now Pay Later market is projected to reach US$196.0 billion by 2032.

Rising e-commerce adoption continues to be the primary demand driver.

BNPL is gaining traction due to its ease of use and interest-free payment structures.

North America remains the leading geographic market for BNPL services.

Online retail applications accounted for the largest market share in 2024-2025.

Increasing partnerships between BNPL providers and global retailers is fueling growth.

Market Segmentation Analysis

The Buy Now Pay Later market segmentation spans product type, business model, sales channel, end user, and industry verticals. Within product type, pay-in-four installment solutions dominate the global landscape due to their simplicity, zero-interest payment structure, and instant approval mechanisms. Subscription-based BNPL models are also gaining popularity as more consumers seek budget-friendly options for recurring services like entertainment, fashion rental, and electronics upgrades.

Based on end user, the market primarily serves millennials and Gen Z, as these digitally savvy groups increasingly prefer flexible financing. Enterprises have also begun adopting BNPL solutions for B2B payments, especially in sectors like retail procurement and IT equipment leasing. By sales channel, the online segment continues its dominance, supported by seamless integration capabilities through APIs and embedded finance models that enhance merchant conversion rates.

Regional Insights

North America remains the largest regional market, driven by early BNPL adoption, advanced digital payment ecosystems, and the presence of major players such as Affirm, PayPal, and Afterpay. Consumers in the region have shown strong acceptance of short-term credit options, making BNPL a preferred alternative to traditional credit cards.

Asia Pacific, meanwhile, is the fastest-growing region, supported by massive e-commerce penetration, rising smartphone adoption, and the entry of regional fintechs offering hyper-local BNPL models. Markets such as India, Indonesia, and Vietnam are witnessing explosive demand due to a young population and limited access to traditional credit.

Secure Your Full Report - Proceed to Checkout: https://www.persistencemarketresearch.com/checkout/35349

Market Drivers

A key market driver for BNPL growth is the surging demand for hassle-free and flexible payment solutions. The shift in consumer behavior toward interest-free micro-financing has revolutionized both online and offline retail experiences. Moreover, embedded finance integrations allow instant approvals, enhancing checkout convenience and increasing retailer conversion rates.

Another driver is the expanding e-commerce landscape, where BNPL is positioned as an essential tool for abandoned cart reduction. Partnerships between BNPL firms and online marketplaces have strengthened the consumer journey, offering payment flexibility across fashion, electronics, healthcare, and travel industries.

Market Restraints

Despite strong adoption, the market faces challenges related to regulatory scrutiny, as governments globally aim to protect consumers from overspending and hidden financial risk. Stricter compliance requirements may increase operational costs for BNPL providers. Additionally, growing concerns over consumer creditworthiness and rising delinquency rates pose a risk to sustainable growth.

The highly competitive landscape also presents restraints, with numerous fintechs and banks entering the BNPL space. Price competition and merchant fee reductions may pressure profit margins for leading providers, affecting long-term viability.

Market Opportunities

Emerging markets offer vast opportunities for BNPL expansion due to the low penetration of traditional credit and increasing digital payment adoption. Fintech partnerships with banks, credit bureaus, and merchants will pave new avenues for growth. The rise of B2B BNPL is another promising opportunity, allowing small businesses to access working capital and flexible payment schedules.

Technological advancements, including AI-driven credit assessment, biometric KYC, and predictive analytics, will enhance risk management and customer onboarding. The integration of BNPL into travel, healthcare, and automotive sectors further widens the opportunity landscape for players.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/35349

Reasons to Buy the Report

✔ Gain detailed insights into current and future BNPL market trends.

✔ Understand regional dynamics and emerging high-growth markets.

✔ Identify key growth drivers, restraints, and strategic opportunities.

✔ Access competitive intelligence and analysis of leading market players.

✔ Support business planning with reliable forecasts for 2025-2032.

Frequently Asked Questions (FAQs)

How big is the Buy Now Pay Later Market?

Who are the key players in the global market for Buy Now Pay Later?

What is the projected growth rate of the Buy Now Pay Later Market?

What is the market forecast for Buy Now Pay Later solutions for 2032?

Which region is estimated to dominate the BNPL industry through the forecast period?

Company Insights

Affirm Holdings Inc.

Klarna Bank AB

Afterpay (Block Inc.)

PayPal Holdings Inc.

Zip Co.

Sezzle Inc.

Splitit Payments Ltd.

Laybuy Group Holdings

LatitudePay

Perpay Inc.

Recent Developments

In 2024, Klarna expanded its AI-based credit decisioning model to improve risk assessment and enhance approval accuracy across new markets.

Affirm partnered with major global retailers to integrate BNPL options for high-ticket purchases across electronics and home appliances categories.

Related Reports:

Power Supply Unit (PSU) Market https://www.persistencemarketresearch.com/market-research/power-supply-unit-psu-market.asp

Digital Textile Printing Market https://www.persistencemarketresearch.com/market-research/digital-textile-printing-equipment-market.asp

Wearable Biosensors Market https://www.persistencemarketresearch.com/market-research/wearable-biosensors-market.asp

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street,

London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Buy Now Pay Later Market Estimated to Grow at 23.8% CAGR by 2032 | Persistence Market Research here

News-ID: 4282161 • Views: …

More Releases from Persistence Market Research

India Aluminum Beverage Can Market Size to Reach US$ 0.8 Bn by 2032 - Persistenc …

The India aluminum beverage can market is undergoing a significant transformation, driven by changing consumer lifestyles, rising urbanization, and a noticeable shift toward sustainable and convenient packaging formats. Aluminum beverage cans are increasingly preferred across carbonated soft drinks, energy drinks, sports beverages, alcoholic drinks, and ready-to-drink juices due to their lightweight structure, portability, fast chilling properties, and superior recyclability. In India, where on-the-go consumption is accelerating rapidly, aluminum cans are…

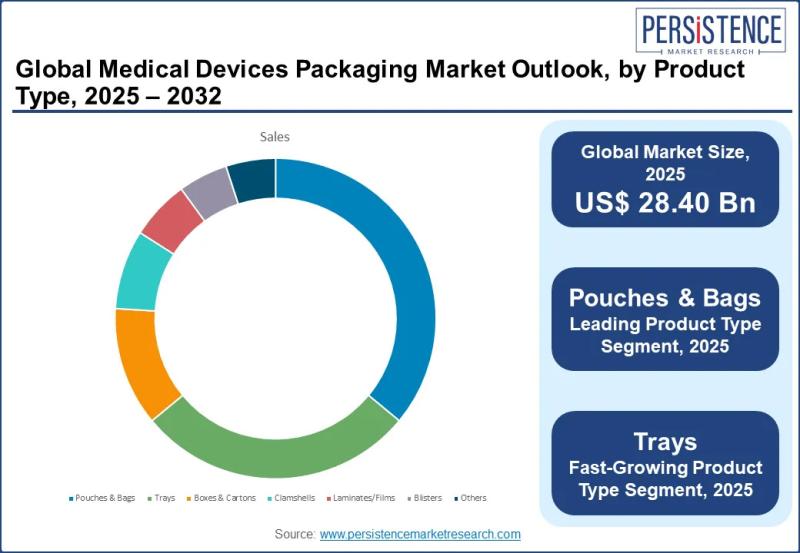

Medical Devices Packaging Market Size to Reach US$ 41.57 Billion by 2032 - Persi …

The medical devices packaging market plays a vital role within the global healthcare ecosystem, acting as a protective and regulatory bridge between manufacturers and end users. Medical device packaging refers to specialized materials and formats designed to safeguard medical instruments, implants, diagnostic tools, and consumables throughout storage, transportation, and clinical use. These packaging solutions are engineered to maintain sterility, prevent contamination, ensure ease of handling, and comply with strict regulatory…

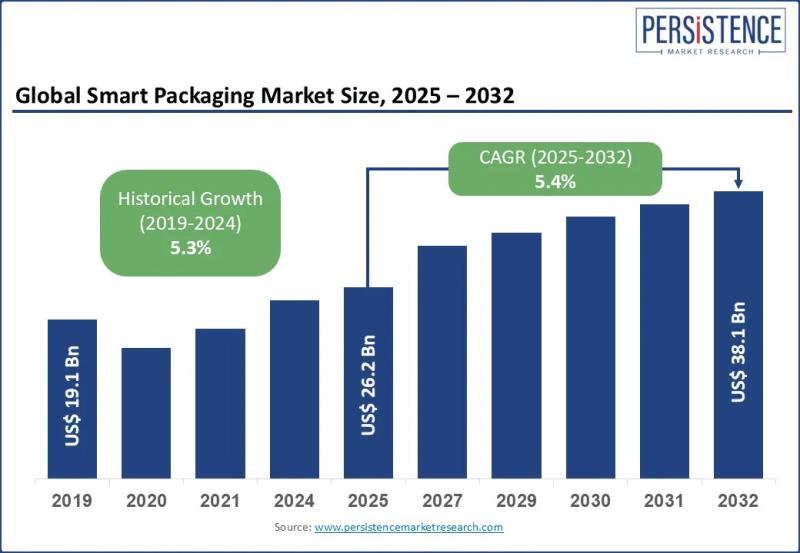

Smart Packaging Market Size Valued at US$ 26.2 Bn in 2025, Projected to Reach US …

The smart packaging market is rapidly transforming the global packaging landscape by integrating advanced technologies with traditional packaging materials to deliver enhanced functionality, traceability, and consumer engagement. Smart packaging refers to packaging systems embedded with features such as sensors indicators QR codes RFID tags and data tracking mechanisms that monitor product condition authenticity and movement across the supply chain. These solutions are increasingly adopted as businesses shift from passive containment…

Football Equipment Market Set for Strong Global Growth Through 2032

The global football equipment market continues to display resilient growth driven by rising participation in football across all age groups, expanding commercial opportunities, and technological advancements in sports gear. The industry is expected to grow from an estimated US$ 18.7 billion in 2025 to approximately US$ 24.1 billion by 2032, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

➤ Download Your Free Sample & Explore Key…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…