Press release

Indonesia Oil And Gas Market Size, Share, Growth, Analysis and Industry Outlook 2025-2033

Indonesia Oil And Gas Market OverviewThe Indonesia oil and gas market size was valued at USD 747.20 Million in 2024. The market is projected to reach USD 863.47 Million by 2033, exhibiting a CAGR of 1.54% during the forecast period 2025-2033. Kalimantan currently dominates, driven by growing domestic energy demand, aging production fields, and natural gas development. Government initiatives and infrastructure expansion also shape the market landscape.

Indonesia Oil And Gas Market Study Assumption Years

• Base Year : 2024

• Historical Year/Period : 2019-2024

Indonesia Oil And Gas Market Key Takeaways

• Current Market Size : USD 747.20 Million

• CAGR : 1.54%

• Forecast Period : 2025-2033

• The market is driven by rising domestic energy demand fueled by population growth and industrial expansion.

• Government incentives, improved contract terms, and exploration in frontier areas attract new investments.

• Infrastructure upgrades and downstream expansion increase energy security.

• A shift toward cleaner fuels and regulatory reforms influence the competitive landscape.

• Kalimantan dominates the market with the largest share due to mature fields and established production facilities.

Request Free Sample Report: https://www.imarcgroup.com/indonesia-oil-gas-market/requestsample

Indonesia Oil And Gas Market Growth Factors

Domestic demand, spurred by population and industrialization growth, as well as government policy to reduce energy imports, drive the oil and gas sector in Indonesia. This in turn increases upstream activity, by opening up new areas for exploration and production and through regulatory changes that help attract new foreign investments. This results in a growing exploitation of conventional and non-conventional resources.

Infrastructure investment has increased, with new pipelines and oil refineries prioritized as investments to increase the efficiency of supply and reduce dependence on imports to further the nation towards energy independence. One refinery under construction has a capacity of 500,000 barrels per day and an estimated cost of USD 12.5 billion.

Market growth is expected from the move to natural gas as a cleaner energy source, liquefied natural gas investment, gas-based generation and government support for improving contracts and EOR. Development of natural gas with regulatory improvement and diversification of supply is seen as a means to secure supply and achieve cleaner energy goals in the region.

Indonesia Oil And Gas Market Trends

Natural gas is included in Indonesia's long-term energy plan. Environmental legislation and market pressure on coal and oil, as well as large liquified natural gas (LNG) and pipeline projects all support natural gas as a cleaner alternative to be used in generation and for industry. For increasing domestic gas supply, Bukit Asam plans to build a USD 3.1 billion coal-to-synthetic natural gas plant.

People explored frontier areas such as eastern Indonesia then explored deep water regions like the Arafura Sea and Papua. The government changed fiscal terms, simplified the licensing process, made existing seismic data available for use, and encouraged foreign investors in joining ventures with Indonesian firms. Gaps in infrastructure remain, but incentives are planned to reduce risk.

Governments impose domestic supply obligations which prioritize the domestic market. For example, under the Domestic Market Obligation (DMO) the production-sharing contracts must allocate for domestic supplies. This may have led to LNG exports adjusting and contracts renewing, providing energy security for industries, power plants, and households.

Most of the investment and projects in Indonesia's oil and gas sector occur in the upstream sector; the government is targeting less red tape and better utilization of marginal fields. Large company players such as Pertamina, Eni, and BP have increased investment in conventional and non-conventional exploration.

Buy the Full Report for Complete Data, Trends, and Opportunities: https://www.imarcgroup.com/checkout?id=14256&method=1200

Indonesia Oil And Gas Market Segmentation

Analysis by Sector:

• Upstream: Focuses on exploration, drilling, and production activities. It accounts for the largest investment share, driven by government incentives and the need to boost declining output.

• Midstream: Involves the transportation, storage, and processing of oil and gas, supported by expanding infrastructure to improve supply efficiency.

• Downstream: Covers refining, distribution, and sales of petroleum products, with ongoing expansions aimed at energy security.

Regional Insights

• Java

• Sumatra

• Kalimantan

• Sulawesi

• Others

Kalimantan holds the largest market share within Indonesia's oil and gas sector, owing to mature fields, ongoing exploration, large gas reserves, established processing facilities, and strategic access to export routes. The region's stable output and government support contribute to its dominance. The overall market is projected to grow at a CAGR of 1.54% from 2025 to 2033.

Indonesia Oil And Gas Market Key Players

• BP p.l.c.

• Chevron Corporation

• China National Offshore Oil Corporation

• ExxonMobil Corporation

• Petroliam Nasional Berhad (PETRONAS)

• PT Pertamina (Persero)

• PT. Connusa Energindo

• PT. Perusahaan Gas Negara Tbk

• Shell plc

Indonesia Oil And Gas Market Recent Developments & News

• In May 2025, Eni began gas production from the Merakes East field offshore Indonesia, contributing up to 100 MMSCFD or 18,000 boepd. The field supports domestic supply and LNG exports.

• May 2025 saw the inauguration of two offshore projects in the South Natuna Sea by Medco E&P Natuna, aiming to produce 20,000 barrels daily.

• JAPEX acquired a 50% stake in EMP Gebang in North Sumatra in May 2025 to develop the Secanggang field.

• TotalEnergies planned to acquire a 25% stake in Bobara oil and gas block alongside Pertamina Hulu Energi.

• Pertamina East Natuna started oil and gas exploration in the North Natuna Sea in March 2025, aiming to begin drilling in 2026.

• In December 2024, the Ministry of Energy launched auctions for six new blocks with 48 Gboe reserves and signed contracts with Harbour Energy and Mubadala Energy.

Indonesia Oil And Gas Market Key Highlights of the Report

• Comprehensive analysis of Indonesia's oil and gas market forecast from 2025 to 2033.

• Historical market trends from 2019 to 2024 detailed.

• Assessment of industry catalysts, challenges, and segment-wise market evaluation.

• Detailed competitive landscape analysis including major companies.

• Porter's Five Forces analysis included to evaluate market competitiveness.

• Coverage of sectoral segmentation: Upstream, Midstream, Downstream.

Get Your Customized Market Report Instantly: https://www.imarcgroup.com/request?type=report&id=14256&flag=E

Customization Note: If you require any specific information not covered within this report's scope, we will provide it as part of the customization.

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel: (D) +91 120 433 0800

United States: +1-201971-6302

IMARC Group is a global management consulting firm that helps ambitious changemakers create a lasting impact.

The company offers comprehensive market assessment, feasibility studies, incorporation support, regulatory assistance, branding and strategy services, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Indonesia Oil And Gas Market Size, Share, Growth, Analysis and Industry Outlook 2025-2033 here

News-ID: 4279373 • Views: …

More Releases from IMARC Group

Vegetable Oil Processing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a vegetable oil processing plant positions investors in one of the most stable and essential segments of the food and agro-processing value chain, backed by sustained global growth driven by rising population, increasing consumption of edible oils, growth in packaged food demand, and expanding applications across food, personal care, and industrial sectors. As urbanization accelerates, consumer lifestyles shift toward convenience and packaged foods, and regulatory frameworks increasingly support…

Trinitrotoluene Production Plant DPR & Unit Setup 2026: Demand Analysis and Proj …

Setting up a trinitrotoluene production plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This critical explosive compound serves military and defense, mining and quarrying, construction and demolition, and industrial explosives manufacturing applications. Success requires careful site selection, efficient nitration processes, stringent safety protocols for handling hazardous materials, reliable raw material sourcing, and compliance with industrial safety regulations to ensure profitable and sustainable operations.

Market Overview…

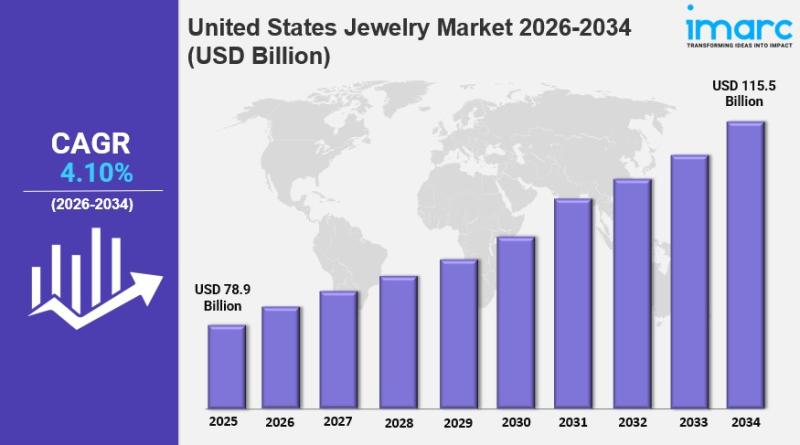

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

More Releases for Indonesia

Indonesia Facility Management Market Size, Trends 2031 By Key Players- Sodexo, I …

Indonesia Facility Management Market Growth Factors

Market conditions reflect evolving infrastructure and service expectations. Urbanization accelerates demand as commercial buildings, transport hubs, and mixed use developments require integrated services. Regulatory compliance strengthens outsourcing through safety standards, sustainability mandates, and reporting requirements. Technology integration improves efficiency using sensors, analytics, and automated maintenance scheduling. Current challenges include skilled labor shortages, fragmented vendor ecosystems, and cost sensitivity among clients. Market scope for 2026 includes…

Indonesia Oil and Gas Market Size, Share Projections 2031 by Key Manufacturer- P …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Oil and Gas Market size was valued at USD 281.50 Billion in 2024 and is projected to reach USD 499.94 Billion by 2032, growing at a CAGR of 7.66% during the forecast period 2026-2032.

What is the current outlook and growth potential of the Indonesia Oil and Gas Market?

The Indonesia Oil and Gas Market is showing signs of gradual…

Indonesia Amino Acid Fertilizer Market Anticipated for Positive Growth by 2031 | …

Indonesia Amino Acid Fertilizer Market Research Report By DataM Intelligence: A comprehensive analysis of current and emerging trends provides clarity on the dynamics of the Indonesia Amino Acid Fertilizer market. The report employs Porter's Five Forces model to assess key factors such as the influence of suppliers and customers, risks posed by different entities, competitive intensity, and the potential of emerging entrepreneurs, offering valuable insights. Additionally, the report presents research…

Overview of Indonesia MICE Market | SHIFTinc, Venuerific Indonesia, Werkudara Gr …

Astute Analytica, a leading provider of market research and analysis, released its highly anticipated Market Analysis Report on the Indonesia MICE Market. This comprehensive report aims to equip businesses with invaluable insights and data, enabling them to make informed decisions and stay one step ahead of the competition.

Access the Comprehensive PDF Market Research Analysis Report Here: https://www.astuteanalytica.com/request-sample/indonesia-mice-market

Indonesia MICE Market was valued at US$ 2,095.95 million in 2022 and is…

Clinical Laboratory Market in Indonesia, Clinical Laboratory Industry in Indones …

"Increase in healthcare expenditure from the Indonesian government has driven the growth of clinical laboratory market in Indonesia."

Increase in Healthcare Awareness: Largely driven by increase in healthcare spending by aging population (~$ 260 per person by 2050), rising income levels, rising awareness for preventive testing, advanced healthcare diagnostic tests offerings, and central government's healthcare measures.

Developments in Testing and Preference for Evidence based testing: There is also a rising number…

Baby Food Sector in Indonesia Market 2019 By PT Nestlé Indonesia, Danone, PT Ka …

"The Baby Food Sector in Indonesia, 2018", is an analytical report by GlobalData which provides extensive and highly detailed current and future market trends in the Indonesian market.

Dietary habits have inhibited sales of commercially prepared baby foods in Indonesia. With the exception of Jakarta, many Indonesians have a traditional diet, based on rice, fresh fruit, and vegetables, supplemented with meat, although, 80% of the population is Muslim, and do not…