Press release

Semiconductor Packaging Underfill Adhesives Market to Reach CAGR 11% by 2031 Top 20 Company Globally

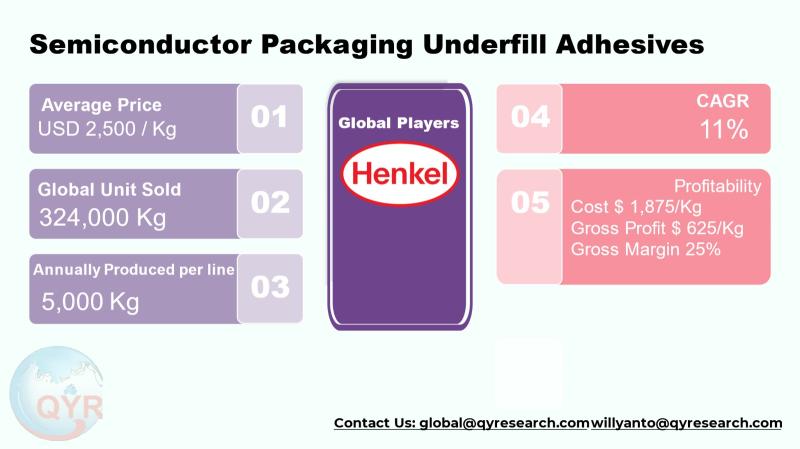

Semiconductor underfill adhesives are specialty epoxy and polymer chemistries applied beneath flip-chip, CSP/BGA, Cu-pillar and wafer-level packages to mechanically support solder joints, improve thermal cycling reliability, and enable higher density and thinner form factors. These materials are a critical but often under-the-radar part of the advanced packaging supply chain because they directly enable package miniaturization, heterogeneous integration and the reliability requirements of mobile, compute, networking and automotive end markets. The industry sits at the intersection of specialty chemicals, automated dispensing/processing equipment and high-precision packaging services, and is shaped by packaging architecture shifts (e.g., wafer-level vs molded underfill), supply-chain regionalization, and rising reliability standards in automotive and 5G/AI applications.The global market size in 2024 is USD 810 million with a growing CAGR to 2031 is 11%, reaching market size USD 1,683 million by 2031. With an average selling price at USD 2,500 per kg, the implied global volume sold in 2024 is 324,000 kg. A factory gross margin is 25%, a factory gross profit of USD 625 per kg and cost of goods sold of USD 1,875 per kg. A COGS breakdown is raw materials, energy & utilities, labor, packaging and overhead. A single line full machine is around 5,000 kg per line per year. Downstream demand is concentrated in semiconductor packaging and OSATs, consumer electronics, automotive electronics and industrial.

Latest Trends and Technological Developments

The last 1824 months have seen three linked trends: (1) faster migration to wafer-level underfill (WLUF) and no-flow/pre-applied solutions to support high-throughput wafer-level packaging; (2) greater emphasis on underfills with enhanced thermal conductivity and controlled modulus profiles to support higher power density packages; and (3) closer collaboration between adhesive formulators and dispensing/jetting equipment suppliers to meet micro-dispense accuracy at high throughput. For example, Henkel published a release on January 2025 announcing high-tech underfill solutions for large-die packages that stress safe and sustainable formulation choices while enabling advanced package reliability improvements. Equipment vendors such as Nordson continue to promote automated dispensing systems optimized for underfill fluids to reduce variability and increase line throughput. Market research firms continue to report price bands for high-performance chip-level underfills in the USD 2,500 per kg range depending on thermal fillers and electrical properties, which matches the premium, performance-driven nature of these products. These developments are accelerating adoption in high-reliability segments (automotive ADAS, industrial AI edge devices) and enabling wafer-scale processes that improve cost per package at high volumes.

Leading global electronics manufacturers like Apple Inc. consistently procure advanced capillary underfill adhesives from specialized suppliers such as Henkel Loctite or NAMICS Corporation to protect the delicate solder bumps in their A-series and M-series chipsets. For a high-volume product like the iPhone, Apple's annual procurement for its assembly partners can amount to thousands of kilograms, with premium, fast-flowing underfill formulations commanding a price of $800 to $1,200 per kilogram. This strategic sourcing is critical for ensuring the mechanical robustness and long-term reliability of their devices, preventing failure from thermal cycling and physical shock.

The underfill adhesive is precisely dispensed and capillary flowed into the gap between the application processor and the substrate within Samsung Electronics' Galaxy smartphone motherboards during their assembly process. For a single high-end model's production run, a contract manufacturer like Foxconn might utilize several hundred kilograms of a specific underfill material, for instance, from Henkel's Loctite ECCOBOND UF 9000 series, purchased at a cost of approximately $950 per kilogram, to ensure the structural integrity of the millions of units produced.

Asia is the engine of underfill adhesive demand and production. Japan and South Korea host major materials specialists and formulation R&D (Shin-Etsu, Hitachi Chemical/Showa Denko, Sumitomo, etc.), China hosts both large domestic formulators and contract manufacturers, while Taiwan is dominant in OSAT and advanced packaging demand (WLCSP, flip-chip) which drives local underfill consumption. Suppliers in the region emphasize compatibility with wafer-level processes, thermal-conductive fillers for power packages, and formulations tuned to high-temperature automotive and 5G/AI applications. Asias strength comes from the combination of upstream materials R&D, regional OSAT capacity, and proximity to large consumer-electronics OEMs which reduces logistics latency for high-mix, short-run specialty underfills. Recent market outlooks and specialist reports list many of these Asia-based chemical and materials companies among the active players in underfill markets.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5486376

Semiconductor Packaging Underfill Adhesives by Type:

Molded Underfill (MUF)

Wafer-Level Underfill (WLUF)

Reworkable Underfill

Semiconductor Packaging Underfill Adhesives by Product category:

Capillary Flow Underfill (CFU)

No-Flow Underfill (NFU)

Semiconductor Packaging Underfill Adhesives by Market Segment:

Epoxy-based Underfill

Polyurethane-based Underfill

Silicone-based Underfill

Semiconductor Packaging Underfill Adhesives by Product Division:

Thermal Cured Underfill

UV Cured Underfill

Semiconductor Packaging Underfill Adhesives by Shape:

Liquid Underfill

Paste Underfill

Film Underfill

Pre Applied Underfill

Others

Semiconductor Packaging Underfill Adhesives by Application:

Industrial Electronics

Consumer Electronics

Automotive Electronics

Others

Global Top 20 Key Companies in the Semiconductor Packaging Underfill Adhesives Market

Henkel

NAMICS Corporation

Panasonic Lexcm

Resonac (Showa Denko)

Hanstars

Shin-Etsu Chemical

MacDermid Alpha

ThreeBond

Parker LORD

Nagase ChemteX

Bondline

AIM Solder

Zymet

Panacol-Elosol GmbH

Dover

Darbond Technology

Yantai Hightite Chemicals

Sunstar

DeepMaterial

SINY

Regional Insights

Within Southeast Asia, demand is emerging fastest where packaging and assembly capacity is growing specifically Malaysia, the Philippines, Vietnam and increasingly Indonesia as service providers and smaller OSATs expand capabilities to capture back-shored assembly work. Indonesias local electronics manufacturing base and rising automotive electronics production create pockets of higher underfill demand, but many ASEAN OSATs still source advanced underfills from regional formulators in Japan, Korea and Taiwan due to qualification timelines and performance requirements. ASEANs opportunity is in contract manufacturing and localized logistics for final assembly: shorter lead times and lower freight risk are increasingly valued by OEMs, and local production can be profitable where a regional OSAT can amortize a production line (~500,000 kg/year nameplate) across multiple customer programs. For equipment and process support, regional integrators partner with vendors such as Nordson and Asymtek to deploy automated dispense/jetting cells.

The underfill adhesives segment faces several challenges: raw-material volatility (resin and high-performance filler prices), lengthy customer qualification cycles (especially for automotive and medical), the need for tight process control (dispense, cure, rheology) which raises entry barriers, and environmental/REACH/ELV compliance for specialty chemistries. Another structural challenge is the balance between proprietary, high-value formulations and the commoditization pressure at the lower performance end companies that cannot differentiate on performance often compete on price, squeezing margins. Supply chain regionalization and geopolitical friction also raise the cost of some critical fillers and catalysts, prompting formulators to dual-source or regionalize manufacturing. Several market reports and supplier briefings highlight these same constraints and the importance of equipment+materials co-qualification for reliability.

Formulators should prioritize WLUF and no-flow chemistries for wafer-level packaging and invest in thermally conductive, low-stress formulations to address power-dense AI/compute packages. Contract manufacturers and OSATs should co-invest with adhesive suppliers on dispensing/jetting qualification and inline metrology to reduce first-pass reject rates. Regional strategy matters: Asia remains essential for scale, but ASEAN offers lower cost assembly and favorable logistics for certain finished-goods flows; Indonesia is a market to watch for automotive electronics ramp. For investors, look for companies with strong IP in thermal-filler dispersion and low-modulus chemistries, long term contracts with OSATs/OEMs, and companies that combine formulation and dispensing hardware partnerships (those integrations shorten qualification cycles and raise switching costs). SEMI and major market research houses continue to track packaging material demand and note the substitution towards advanced underfills for next-gen packages.

Product Models

Semiconductor Packaging Underfill Adhesives are specialty epoxy-based materials applied between the semiconductor die and substrate to mechanically support interconnects and prevent fault propagation caused by thermal cycling.

Molded Underfill (MUF) is an underfill material integrated into the molding compound during encapsulation, commonly used in high-volume mobile and consumer electronics to reduce process steps and enhance reliability. Notable products include:

EPICOND MUF-4000 Namics: Optimized for fine-pitch flip-chip packages with high thermal cycling resistance.

EME-G781 Series Sumitomo Bakelite: A low-warpage compound for high-volume FC-CSP production.

CEL-FA Series MUF Shin-Etsu Chemical: Designed for advanced mobile devices needing enhanced thermo-mechanical stability.

XL-Mold UF 1800 H.B. Fuller: High-adhesion MUF suited for large panel processing.

FC-MUF 800 Nagase ChemteX: Delivers controlled flow and low voiding for thin-core substrates.

Wafer-Level Underfill is applied at the wafer processing stage prior to dicing, providing uniform coating and high-precision protection for WLP, CSP, and fan-out/fan-in applications. Examples include:

WLUF 7000 Series Namics: A widely used capillary-flow WLUF for fan-in WLP.

LOCTITE WLUF 3000 Henkel: A low-modulus formulation compatible with advanced redistribution layers.

WL-UF-800 Shin-Etsu Chemical: Designed for low-stress encapsulation in ultra-thin wafers.

AIT-WLUF 1000 AI Technology Inc.: High-flexibility WLUF supporting large warpage control.

Latent-Cure WLUF IBM / Sumitomo Bakelite: A low-outgassing, latent-curing WLUF developed in IBM / Sumitomo research for fine-pitch Pb-free flip-chip.

Reworkable Underfill materials allow component removal and replacement without damaging the PCB, making them suitable for high-value assemblies, prototyping, and advanced consumer electronics. Notable products include:

Namics RUF-300 Series Namics: Offers low-temperature reworkability with strong adhesion after curing.

UF-R Series Won Chemical: Combines thermal stability with rework compatibility for mobile chipsets.

R-Series Rework Underfill Indium Corporation: Enables controlled debonding with minimal residue.

RC-UF 1000 Nagase ChemteX: Suitable for boards requiring multiple assembly cycles.

Rework-Tech UF 90 Momentive Performance Materials: Provides balanced modulus and rework temperature for fine-pitch devices.

The underfill adhesives market is a specialized, higher-margin subsector of electronic adhesives with growth driven by advanced packaging adoption (WLUF, no-flow, capillary underfill), higher power density packages, and regional shifts in OSAT/assembly footprints. With an assumed 2024 baseline market value and a premium unit price, the segment represents a modest tonnage market (hundreds of tonnes annually) but with outsized technical importance to semiconductor reliability and package scaling. Asia especially Japan, Korea, Taiwan and China will continue to be the center of product development and supply, while ASEAN, including Indonesia, grows as a regional assembly and demand center.

Investor Analysis

This report highlights three investor-relevant takeaways. First, the market is relatively small by tonnage but high value by revenue per kg; this creates attractive per-unit margins for differentiated formulations and provides opportunities for premium pricing where reliability is mission-critical. Second, barriers to entry are significant (R&D, equipment integration, customer qualification), so companies that already have OSAT relationships or equipment partnerships are better positioned to capture growth. Third, regional strategy matters: players that combine Asia R&D/production with ASEAN logistics and local technical support can win share as packaging work diversifies geographically. Investors evaluating targets should prioritize: (a) proven product qualifications with ≥1 major OSAT/OEM, (b) stable raw-material sourcing or dual-sourcing strategies, (c) partnerships with dispense/equipment vendors to reduce qualification time, and (d) realistic production capacity plans (line nameplate vs. expected uptake). These points together explain how an investor can size opportunities, de-risk adoption timelines and value a companys competitive advantage.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5486376

5 Reasons to Buy This Report

Get a concise set of commercially actionable numbers (market size, implied volumes, price per kg) tailored to investor due diligence.

Understand regional dynamics in Asia and ASEAN (including Indonesia) to shape manufacturing and go-to-market strategies.

See up-to-date supplier and equipment trends (wafer-level underfill, thermal conductive formulations, dispense automation).

Gain a practical cost structure view (COGS breakdown, factory gross profit examples) to model target margins.

Identify strategic criteria for M&A or JV screening (customer qualifications, equipment integration, supply-chain resilience).

5 Key Questions Answered

What is the 2024 market value and implied volume for underfill adhesives?

Who are the major global players and what is their strategic positioning?

Which packaging trends drive demand (WLUF, thermal conductive underfills, no-flow)?

How do COGS and typical factory gross margins look per kg for specialty underfills?

Where should investors and manufacturers focus regionally for production and sales growth?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Semiconductor Packaging Underfill Adhesives Market Research Report 2025

https://www.qyresearch.com/reports/5486378/semiconductor-packaging-underfill-adhesives

Global Semiconductor Packaging Underfill Adhesives Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5486376/semiconductor-packaging-underfill-adhesives

Global Semiconductor Packaging Underfill Adhesives Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5486377/semiconductor-packaging-underfill-adhesives

Semiconductor Packaging Underfill Adhesives - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5486379/semiconductor-packaging-underfill-adhesives

Global Underfill Adhesives Market Research Report 2025

https://www.qyresearch.com/reports/4157809/underfill-adhesives

Global Chip Level Underfill Adhesives Market Research Report 2025

https://www.qyresearch.com/reports/3534090/chip-level-underfill-adhesives

Global Epoxy Resin Underfill Adhesive Market Research Report 2025

https://www.qyresearch.com/reports/4489799/epoxy-resin-underfill-adhesive

Global BGA (Ball Grid Array) Package Underfill Adhesive Market Research Report 2025

https://www.qyresearch.com/reports/4490431/bga--ball-grid-array--package-underfill-adhesive

Global Semiconductor Packaging Adhesives Market Research Report 2025

https://www.qyresearch.com/reports/3494493/semiconductor-packaging-adhesives

Global Semiconductor Packaging Conductive Adhesive Market Research Report 2025

https://www.qyresearch.com/reports/3836299/semiconductor-packaging-conductive-adhesive

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Semiconductor Packaging Underfill Adhesives Market to Reach CAGR 11% by 2031 Top 20 Company Globally here

News-ID: 4278730 • Views: …

More Releases from QY Research

Top 30 Indonesian Palm Oil Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Astra Agro Lestari Tbk (AALI) Plantation & CPO producer; reported Q3 2025 net profit of ~USD 64.3 million.

PT Andira Agro Tbk (ANDI) Palm oil plantation & processing.

PT Eagle High Plantations Tbk (BWPT) Plantation & CPO operations.

PT Cisadane Sawit Raya Tbk (CSRA) Plantation & crude palm oil.

PT Dharma Satya Nusantara Tbk (DSNG) Plantation & palm…

Smart Thrusters Power the Future of Marine Automation: Market Outlook & Strategy …

Underwater thrusters are compact marine propulsion systems used to maneuver ROVs (Remotely Operated Vehicles), AUVs (Autonomous Underwater Vehicles), USVs, inspection drones, subsea robots, small submersibles, and dynamic positioning modules.

Core function: provide vector thrust, station keeping, precise navigation, and stability control in harsh underwater environments.

Typical construction: brushless DC motors, corrosion-resistant housings (aluminum/SS316/titanium), magnetic coupling seals, pressure compensation, and modular ESC integration.

Used heavily across offshore energy, subsea inspection, aquaculture, defense, marine research,…

Paper Replaces Plastic: The USD 1.4B Honeycomb Kraft Packaging Boom

Honeycomb kraft packaging is a paper-based cushioning and void-fill material manufactured by die-cutting and expanding kraft paper into a hexagonal honeycomb structure that provides shock absorption, compression strength, and lightweight protection.

Used as a plastic-free substitute for bubble wrap, EPS foam, and plastic fillers.

Global Market Overview

2025 market size: USD 1,420 million

2031 market size: USD 2,449 million

Forecast CAGR (2025 to 2032): 8.1%

Average selling price (ASP): USD 1,150/ton

Total unit volume sold (2025): 1,234K…

How High-Flex and EV Demand Are Transforming the Ribbon Cable Business

Flat ribbon cables are multi-conductor cables with parallel insulated wires bonded together in a flat strip format, enabling compact routing, high pin-count interconnection, and cost-efficient mass termination.

Widely used across electronics, computing, telecom, automotive electronics, industrial automation, and consumer devices where space savings, airflow, and organized harnessing are critical.

Increasing integration of compact electronics, IoT hardware, and high-density connectors is accelerating demand for flexible, lightweight interconnect solutions.

Industry Overview & Global Market Snapshot

Standard…

More Releases for Underfill

Semiconductor Underfill Market Trends: the global Semiconductor Underfill market …

QY Research Inc. (Global Market Report Research Publisher) announces the release of 2025 latest report "Semiconductor Underfill- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031". Based on current situation and impact historical analysis (2020-2024) and forecast calculations (2025-2031), this report provides a comprehensive analysis of the global Wire Drawing Dies market, including market size, share, demand, industry development status, and forecasts for the next few years.

The global…

YINCAE: UF 158UL Redefines Underfill for Large Chips

03/11/2025 (Albany, NY) - YINCAE, a leading innovator in advanced materials solutions, today announced the launch of its groundbreaking underfill material, UF 158UL. This cutting-edge product is designed to meet the increasing demands of large format chips, offering unparalleled performance in room temperature flow, fast cure, and high reliability.

UF 158UL boasts exceptional flowability, allowing it to effortlessly fill gaps as small as 10 microns, even in large 100x100 mm chips.…

Underfill Market Size, Future Trends

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- The global Underfill Market is expected to record a CAGR of XX.X% from 2024 to 2031 In 2024, the market size is projected to reach a valuation of USD XX.X Billion. By 2031 the valuation is anticipated to reach USD XX.X Billion.

The underfill market has witnessed significant growth, driven by increasing demand in various electronic applications, particularly in the semiconductor and microelectronics industries. Underfill materials are crucial…

Global Underfill Drug Market Research Report 2023-2029

This report studies the Underfill market, Underfill is used to fill space beneath a die and adhere to its carrier. They add structural strength, increase impact resistance, bolster thermal cycling resistance and improve overall reliability. Underfill can be found in a wide variety of applications including mobile phone, game console, computor, tablet PC and digital camera.

Underfill report published by QYResearch reveals that COVID-19 and Russia-Ukraine War impacted the market dually…

Underfill Dispenser Market Growth Global health Infrastructure

The underfill dispenser market is expected to witness market growth at a rate of 19.50% in the forecast period of 2021 to 2028 and is expected to reach USD value of 185,036.18 million by 2028. Data Bridge Market Research report on underfill dispenser market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The increase…

Molded Underfill Material Market Competitive Analysis 2019-2027

Zion Market Research analysts forecast the latest report on "Molded Underfill Material Market: Global Industry Analysis, Size, Share, Growth, Trends, and Forecasts 2016-2024", according to their latest report the Molded Underfill Material Market report covers the overall and all-inclusive analysis of the Molded Underfill Material Market with all its factors that have an impact on market growth. The Molded Underfill Material Market's complete outline is crystal clear penned down in…