Press release

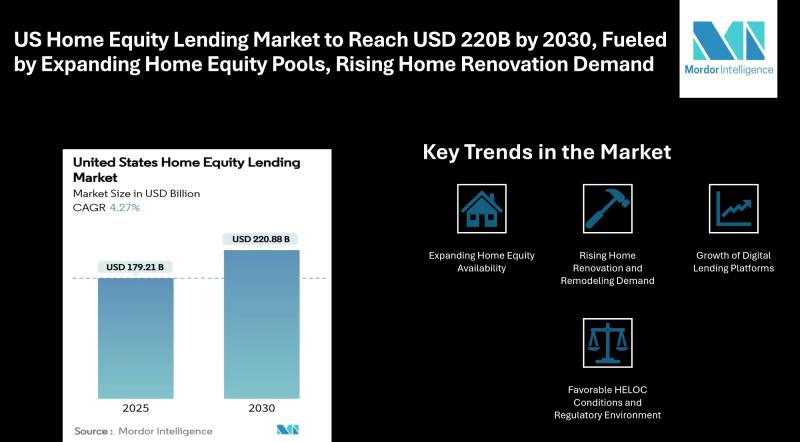

US Home Equity Lending Market to Reach USD 220B by 2030, Fueled by Expanding Home Equity Pools and Rising Home Renovation Demand

Mordor Intelligence has published a new report on the United States Home Equity Lending Market, offering a comprehensive analysis of trends, growth drivers, and future projections.US Home Equity Lending Market Overview

The United States Home Equity Lending Market size reached a value of USD 179.21 billion in 2025 and is forecasted to expand to USD 220.88 billion by 2030, reflecting a 4.27% CAGR. As households continue to seek second-lien solutions to maintain favorable first-mortgage rates, the competitive landscape of the United States Home Equity Lending Market share is evolving.

Report overview: https://www.mordorintelligence.com/industry-reports/us-home-equity-lending-market?utm_source=openpr

Key Trends in the United States Home Equity Lending Market

1. Expanding Home Equity Availability

U.S. households hold large pools of tappable equity, creating significant lending opportunities. Lenders are using data analytics to identify potential borrowers and optimize loan offerings.

2. Rising Home Renovation and Remodeling Demand

Post-pandemic, many homeowners are using home equity for upgrades, energy-efficient improvements, and repairs, driving increased borrowing.

3. Growth of Digital Lending Platforms

Online-first underwriting and e-closing solutions are speeding up approvals, lowering origination costs, and improving market accessibility for borrowers.

4. Favorable HELOC Conditions and Regulatory Environment

Declining introductory HELOC rates make credit lines more attractive, while regulatory clarity ensures a transparent and compliant lending environment.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/us-home-equity-lending-market?utm_source=openpr

Segmentation of the US Home Equity Lending Market

By Product Type:

Fixed Rate Loans

Home Equity Line of Credit (HELOC)

By Provider:

Banks

Credit Unions

Non-Banking Financial Institutions

Others (Fintech, Brokers, etc.)

By Mode:

Online

Offline

Explore Our Full Library of Financial Services and Investment Intelligence Research Reports- https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players in the US Home Equity Lending Market

Bank of America: Offers a wide range of home equity loans and HELOCs, combining branch presence with digital tools for seamless loan origination.

JPMorgan Chase: Provides competitive HELOC and fixed-rate home equity loans, with streamlined digital applications for faster approvals.

Wells Fargo: Focuses on customer-centric home equity lending solutions, including both fixed-rate and variable-rate loans.

U.S. Bank: Offers personalized home equity products and leverages technology to facilitate efficient approvals and funding.

PNC Financial Services: Provides flexible home equity lending options and emphasizes digital convenience alongside traditional banking services.

Explore more insights on the US Home Equity Lending Market competitive landscape: https://www.mordorintelligence.com/industry-reports/us-home-equity-lending-market/companies?utm_source=openpr

Conclusion

The United States Home Equity Lending Market is poised for steady growth, supported by rising tappable home equity, strong renovation demand, and adoption of digital lending platforms. With HELOCs leading product growth and online origination channels expanding rapidly, the market is set to maintain momentum over the coming years.

Get the latest industry insights on the US Home Equity Lending Market: https://www.mordorintelligence.com/industry-reports/us-home-equity-lending-market?utm_source=openpr

Industry Related Reports:

Home Equity Lending Market

The global Home Equity Lending Market reached USD 342.39 billion in 2025 and is projected to grow to USD 439.49 billion by 2030, reflecting a 5.12% CAGR. The market is driven by rising home renovation demand and increasing adoption of digital lending platforms, which are making home equity borrowing more accessible and convenient for consumers worldwide.

Get more insights: https://www.mordorintelligence.com/industry-reports/global-home-equity-lending-market?utm_source=openpr

Mexico Home Equity Lending Market

The Mexico Home Equity Lending Market is anticipated to grow at a CAGR exceeding 5% during the forecast period. Growth is supported by increasing homeownership rates and rising demand for home renovation financing. Additionally, digital lending platforms and flexible credit solutions are expanding market accessibility and driving broader adoption among Mexican homeowners.

Get more insights: https://www.mordorintelligence.com/industry-reports/mexico-home-equity-lending-market?utm_source=openpr

USA Home Loan Market

The USA Home Loan Market was valued at USD 2.29 trillion in 2025 and is projected to reach USD 3.02 trillion by 2030, growing at a 5.63% CAGR. Market growth is driven by rising demand for residential properties and increasing adoption of digital mortgage platforms. Favorable interest rates and government-backed loan programs are also supporting expanded access to home financing.

Get more insights: https://www.mordorintelligence.com/industry-reports/usa-home-loan-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release US Home Equity Lending Market to Reach USD 220B by 2030, Fueled by Expanding Home Equity Pools and Rising Home Renovation Demand here

News-ID: 4271371 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

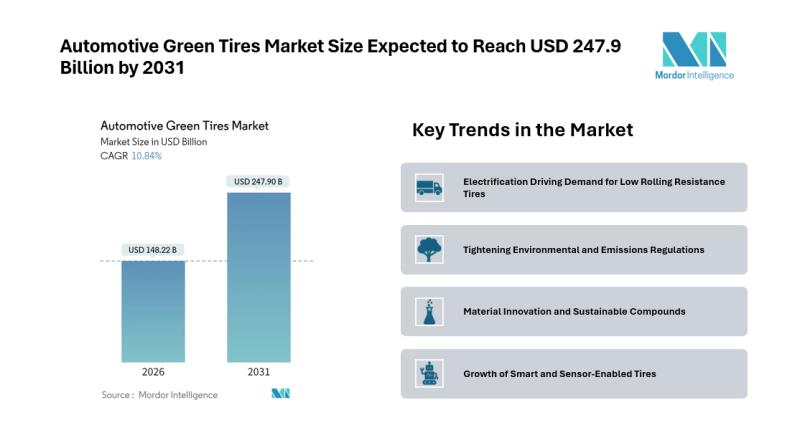

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for Equity

Shah Equity Launches the World's First Integrated Global Private Equity & Hedge …

Shah Equity, a leading innovator in financial services, proudly announces the launch of the world's first integrated Global Private Equity & Hedge Fund. With a strategic focus on Commercial Real Estate, Healthcare, Home Services, and a robust Hedge Fund, Shah Equity is dedicated to maximizing value and fueling sustainable growth, all while expertly hedging investment risks.

In an era where traditional investment models face unprecedented challenges, Shah Equity steps forward with…

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Establishment Consultation,Chinese private equity company,

Pandacu China is a leading private equity firm that specializes in making long-term investments in small and medium-sized enterprises (SMEs) in China. The company was founded in China by a team of experienced finance professionals with a deep understanding of the Chinese market and a strong network of contacts in the private equity and venture capital industry.

https://boomingfaucet.com/

China Private Equity Establishment Consultation

E-mail:nolan@pandacuads.com

SMEs are the backbone of the Chinese economy, and they…