Press release

Shah Equity Launches the World's First Integrated Global Private Equity & Hedge Fund

Shah Equity, a leading innovator in financial services, proudly announces the launch of the world's first integrated Global Private Equity & Hedge Fund. With a strategic focus on Commercial Real Estate, Healthcare, Home Services, and a robust Hedge Fund, Shah Equity is dedicated to maximizing value and fueling sustainable growth, all while expertly hedging investment risks.In an era where traditional investment models face unprecedented challenges, Shah Equity steps forward with its groundbreaking approach-unifying the distinct realms of private equity and hedge funds into a seamless financial ecosystem. This innovative synergy enables the company to diversify its portfolio, strategically manage risk, and capitalize on lucrative opportunities across various sectors.

A Visionary Approach to Investment

Shah Equity's pioneering model is crafted to redefine investor expectations and cater to the evolving needs of the global marketplace. "We are excited to introduce a paradigm shift in investment strategy. By integrating private equity and hedge fund methodologies, Shah Equity not only diversifies risk but also enhances our ability to deliver robust returns across multiple asset classes," said the CEO of Shah Equity.

Key Strategic Investments

- Commercial Real Estate: Shah Equity targets high-potential properties worldwide, optimizing returns through expert asset management and innovative financial strategies.

- Healthcare: Recognizing the sector's critical importance, the company invests in cutting-edge healthcare ventures that promise sustainability and innovation.

- Home Services: Shah Equity invests in dynamic home service companies that are driving quality and reliability in the market.

- Hedge Fund: Employing sophisticated financial instruments, Shah Equity's Hedge Fund is designed to protect capital and generate consistent returns.

Commitment to Sustainable Growth

Sustainability lies at the core of Shah Equity's investment philosophy. By selecting opportunities that align with both economic and environmental priorities, Shah Equity ensures its impact drives positive change beyond mere financial gain. This commitment not only secures long-term value for investors but also contributes to the global community's well-being.

About Shah Equity

Based in Los Angeles, CA, Shah Equity is a trailblazer in the financial services industry, committed to revolutionizing investment with innovative solutions. For more information about Shah Equity and its services, visit Shah Equity's website [https://shah-equity.com/].

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: Shah Equity

Contact Person: Omar Khan

Email: Send Email [http://www.universalpressrelease.com/?pr=shah-equity-launches-the-worlds-first-integrated-global-private-equity-hedge-fund]

Phone: +1 (866) 603-0609

Country: United States

Website: https://shah-equity.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. GetNews makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Shah Equity Launches the World's First Integrated Global Private Equity & Hedge Fund here

News-ID: 4060181 • Views: …

More Releases from Getnews

Spring Senior Home Care in Manhattan Restores Joy with Touching Hearts at Home N …

2026 Best of Home Care - Provider of Choice award winner turns NYC apartments back into homes for living well.

NEW YORK, NY - February 16, 2026 - As the first hints of spring arrive in Manhattan, a season of renewal can sometimes cast a subtle shadow for the city's seniors. In apartments overlooking bustling streets, the challenge is not a lack of life, but finding a way to fully participate…

The TCL TAB 10 Gen 4 Launches in the U.S., Amazon Exclusive with 10.1" Full HD D …

TCL Registered , one of the world's best-selling and leading technology companies, is proud to announce the launch of the TCL TAB 10 Gen 4 [https://amzn.to/4qo5eEO] on Amazon, a versatile and high-value 10.1-inch Android tablet tailored for learning, entertainment, and everyday use. Designed with students, young adults, and families in mind, this new tablet combines immersive visuals, powerful performance, and long-lasting battery life with family-friendly features, all in a sleek,…

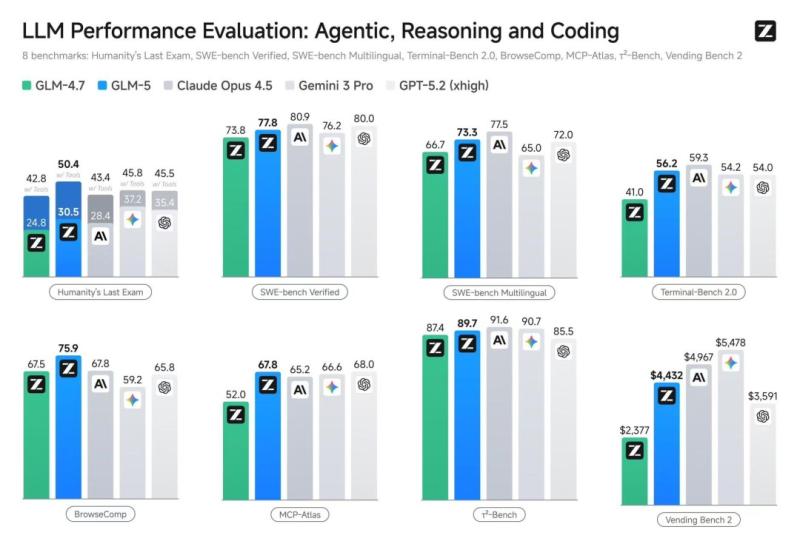

GLM-5 Launch Signals a New Era in AI: When Models Become Engineers

GLM-5, newly released as open source, signals a broader shift in artificial intelligence. Large language models are moving beyond generating code snippets or interface prototypes toward building complete systems and carrying out complex, end-to-end tasks. The change marks a transition from so-called "vibe coding" to what researchers increasingly describe as agentic engineering.

Image: https://www.globalnewslines.com/uploads/2026/02/6894e6efb8e875ffcaa9e3667323ccd2.jpg

Built for this new phase, GLM-5 ranks among the strongest open-source models for coding and autonomous task execution.…

National Trust Selects Cora Systems for Project Portfolio Management

Image: https://www.globalnewslines.com/uploads/2026/02/1770996943.jpg

Europe's largest conservation charity partners with Cora to modernize how it plans and delivers projects across the organization.

Cora Systems [https://corasystems.com/], a provider of project portfolio management (PPM) software [https://corasystems.com/project-portfolio-management-software-ppm], today announced that the National Trust has selected the Cora platform to support its project management practice [https://corasystems.com/news/national-trust-selects-cora-ppm-software]. National Trust, founded in 1895, is Europe's largest conservation charity, protecting historic buildings, coastlines, and natural spaces across England, Wales, and Northern…

More Releases for Equity

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Establishment Consultation,Chinese private equity company,

Pandacu China is a leading private equity firm that specializes in making long-term investments in small and medium-sized enterprises (SMEs) in China. The company was founded in China by a team of experienced finance professionals with a deep understanding of the Chinese market and a strong network of contacts in the private equity and venture capital industry.

https://boomingfaucet.com/

China Private Equity Establishment Consultation

E-mail:nolan@pandacuads.com

SMEs are the backbone of the Chinese economy, and they…

China Private Equity Financing Consulting, China Private Equity Investment Corpo …

Pandacu China is a venture capital firm that focuses on early-stage investments in technology companies based in China. The firm was founded in 2015 by a group of experienced venture capitalists and entrepreneurs who have a deep understanding of the Chinese market and a strong network of contacts in the tech industry.

http://pandacuads.com/

China Private Equity Financing Consulting

Email:nolan@pandacuads.com

Pandacu China's mission is to help innovative and ambitious entrepreneurs turn their ideas into successful…