Press release

AI Platform Lending Market Trends, Competitive Landscape, and Forecast Report 2037

Market Outlook and ForecastThe global AI platform lending market is experiencing a pivotal transformation, underpinned by the convergence of artificial intelligence (AI), machine learning (ML), cloud-native infrastructure and the evolving demands of the lending sector. According to recent research, the market was sized at approximately USD 109.73 billion in 2024 and is anticipated to reach roughly USD 2.01 trillion by 2037, representing a robust growth trajectory over the 2025-2037 period.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-4651

Regional Performance Highlights

In terms of regional dynamics within the AI platform lending market, several key geographies merit attention:

North America is poised to lead in terms of revenue share, accounting for approximately 32 % of the market by 2037. This dominance reflects mature banking infrastructure, advanced fintech ecosystems and high penetration of digital credit services.

Europe remains an important secondary region, driven by regulatory shifts, open banking initiatives, and established institutions modernising their lending operations.

Asia-Pacific is emerging as a significant hotspot, with high growth potential driven by digital banking expansion, underserved credit markets, and large populations of new borrowers in countries such as India and China. While specific share percentages are less clearly documented, the region's potential is widely recognised.

➤ Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our AI Platform Lending Market Report Overview here: https://www.researchnester.com/reports/ai-platform-lending-market/4651

Market Segmentation

The AI platform lending market can be dissected across two notable segmentation axes: end-user segments (who is consuming the technology) and technology segments (which AI/ML techniques are being deployed).

The bank segment represents one of the major growth areas. Traditional banks, credit unions and financial institutions are rapidly deploying AI-enabled lending platforms to streamline underwriting, reduce risk, automate decisioning and serve previously underserved segments. The bank segment is expected to see major growth over the forecast period, as institutions seek digital transformation and cost efficiencies.

Technology Segment - Machine Learning: Within the technology stack of AI-based lending platforms, the machine learning segment-covering predictive analytics, algorithmic credit scoring, risk modelling-is identified as having a significant share. ML-driven modules are becoming standard in modern lending platforms, powering automation of credit decisions, fraud detection and portfolio monitoring.

➤ Discover how the AI Platform Lending Market is evolving globally - access your free sample report → https://www.researchnester.com/sample-request-4651

Top Market Trends

The trajectory of the AI platform lending market is being shaped by a number of interlinked trends. Below are four of the most influential trends, each illustrated with recent developments.

Digitalisation and Embedded Lending

One of the most prominent forces in the AI platform lending market is the acceleration of digital lending platforms and the embedding of credit into non-traditional channels. According to a recent article by Ernst & Young, AI is playing an "incredible" role in risk assessment, credit scoring and customer experience - enabling lending to be embedded into broader digital ecosystems.

Embedded lending allows, for example, retail merchants or digital platforms to offer financing at the point of sale or via API-based lending offers. This trend is reshaping how the AI platform lending market evolves: lenders and platform providers are increasingly partnering with non-bank digital ecosystems.

Machine Learning & Data-Driven Underwriting Innovation

The second major trend is the evolution of machine learning and data-driven underwriting in the AI platform lending market. AI-enabled platforms are increasingly using behavioural data, alternative data sources, and advanced risk modelling to improve decisioning. For example, the AI in lending industry guide highlights how AI platforms are being used for credit scoring, loan approval automation, fraud detection and collection management.

The adoption of machine learning permits better accuracy, improved risk-adjusted returns, and faster turn-around times, thereby driving demand within the AI platform lending market.

Fraud, Risk Management & Regulatory Compliance

A third critical trend in the AI platform lending market is the escalating focus on fraud prevention, risk management and compliance - all enabled by AI. As underwriting becomes more automated and digital, the risk surface increases, and lenders are turning to AI platforms to enhance fraud detection, identity verification and ongoing monitoring. Reports show that AI platforms in lending are increasingly deployed to detect suspicious behaviour, manage KYC/AML workflows and embed regulatory controls in loan-lifecycle management.

In this way the AI platform lending market is being driven not just by growth but also by the imperative to secure the lending chain.

➤ Unlock detailed analysis of key market trends transforming hybrid mobility. Get your sample report → https://www.researchnester.com/sample-request-4651

Recent Company Developments

To ground the discussion of the AI platform lending market in real‐world activity, below are eight companies (mix of established and emerging) making notable moves in the last 12-16 months.

1. Upstart Holdings, Inc. - A leading AI lending marketplace that reported strong Q4 performance, with transaction revenue up 68 % year-on-year and the number of loans nearly doubling. This illustrates strong momentum in the AI platform lending market.

2. Pagaya Technologies - Engaged in a forward‐flow agreement to sell up to US $500 million in auto-loans, leveraging its AI-driven credit decision platform. The move highlights how the AI platform lending market is evolving in asset-backed financing channels.

3. Zest AI - A provider of AI‐automated underwriting and fair-lending technology. Its platform supports lenders in automating decisions and serving broader borrower segments.

4. Alloy, Inc. - A fintech specialising in identity and decisioning platforms for lenders and embedded finance. In recent months, Alloy announced partnerships to deliver fraud and identity monitoring for embedded finance and commercial lending.

5. Enova International, Inc. - Known for applying AI and ML in its lending platforms to serve under-banked and non-prime segments.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-4651

Each of these companies reflects a different dimension of the market: from pure AI-lending platforms (Upstart, Pagaya), to underwriting engines (Zest AI), identity/fraud engines (Alloy), and broader fintech/technology players (Fiserv, Pegasystems). Their recent developments underscore the vitality of the AI platform lending market ecosystem.

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI Platform Lending Market Trends, Competitive Landscape, and Forecast Report 2037 here

News-ID: 4269482 • Views: …

More Releases from Research Nester Pvt Ltd

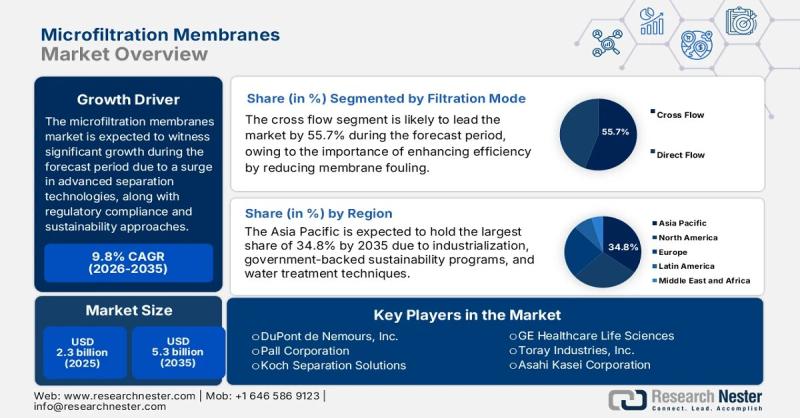

Microfiltration Membranes Market size to reach $5.3Billion by 2035 | Key players …

Market Outlook and Forecast

The microfiltration membranes market size reached USD 2.3 billion in 2025 and is projected to expand to USD 5.3 billion by 2035, reflecting strong industry fundamentals and sustained adoption across diverse end-use industries. The market is expected to grow at a compound annual growth rate (CAGR) of 9.8% between 2026 and 2035, driven by industrial modernization, environmental regulations, and technological innovation.

➤ Request Free Sample PDF Report @…

Top Companies in Food Grade Alcohol Market - Benchmarking Performance & Future V …

The food grade alcohol market is shaped by multinational ingredient producers, regional distillation leaders, and specialized ethanol processors. Competitive positioning is largely determined by feedstock access, regulatory compliance, supply chain resilience, and product customization for food and beverage applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8307

Top Companies & Their Strategies

Archer Daniels Midland Company (ADM)

ADM remains one of the most influential players in the Food Grade Alcohol Market due to…

Energy Harvesting System Market Dominance: Top Companies Strengthening Share & I …

The energy harvesting system market is rapidly evolving as industries seek sustainable, maintenance-free power solutions for IoT devices, wireless sensor networks, industrial automation, healthcare wearables, and smart infrastructure. Energy harvesting systems convert ambient energy sources - including solar, thermal, vibration, and radio frequency (RF) - into usable electrical power.

As the global transition toward energy efficiency and decentralized power accelerates, the competitive landscape within the energy harvesting system market is intensifying.…

Luxury Hotel Market Players - Competitive Positioning, Strategic Strengths & Inv …

The Luxury Hotel Market is undergoing structural transformation as global travelers increasingly prioritize curated experiences, sustainability, and digital-first service models. No longer defined solely by opulence, the luxury hotel market now revolves around personalization, wellness integration, brand storytelling, and technological innovation. Leading hospitality companies are repositioning portfolios, expanding into high-growth destinations, and investing in asset-light models to strengthen competitive positioning.

This strategic analysis explores the top companies shaping the luxury hotel…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…