Press release

Brazil Carbon Credits Market Size, Share, Growth and Forecast 2034

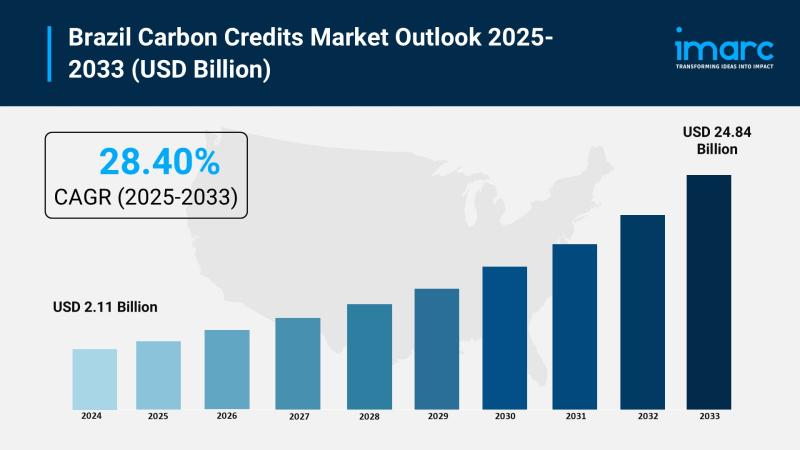

Market OverviewThe Brazil Carbon Credits Market reached a value of USD 2.7 Billion in 2025 and is projected to grow significantly, reaching USD 25.2 Billion by 2034, expanding at a robust CAGR of 28.10% during 2026-2034.

This exceptional growth is driven by Brazil's expanding sustainability initiatives, biodiversity potential, and regulatory advancements, including the establishment of a national carbon pricing system. Increasing participation from both domestic and international corporations in carbon offset trading, coupled with Brazil's strong forest conservation programs, underpins the country's rise as a global leader in the carbon credit ecosystem.

Study Assumption Years

● Base Year: 2025

● Historical Year/Period: 2020-2025

● Forecast Year/Period: 2026-2034

Brazil Carbon Credits Market Key Takeaways

● Current Market Size (2025): USD 2.7 Billion

● CAGR (2026-2034): 28.10%

● Forecast Period: 2026-2034

● The Brazilian government is developing a regulatory framework aligned with international climate commitments, including a national carbon pricing mechanism.

● REDD+ programs and forest conservation projects-especially in the Amazon rainforest-remain central to Brazil's carbon offset initiatives.

● Brazil plans to launch the "Tropical Forests Forever" fund, valued at USD 250 Billion, to finance global tropical forest preservation.

● The market is segmented by compliance and voluntary credits, project type, and end-use industry.

● Brazil's biodiversity richness, combined with global net-zero commitments, accelerates investment and market development.

Sample Request Link: https://www.imarcgroup.com/brazil-carbon-credits-market/requestsample

Brazil Carbon Credits Market Growth Factors

Regulatory Reforms and Policy Framework Development

As part of the Brazilian government's climate policy, Brazil plans to implement a national carbon pricing scheme, the Brazilian Carbon Market System (SBCE). This SBCE would regulate emissions from nearly 5000 businesses emitting more than 10,000 tCO2 per year and utilize compliance-based trading to ease market activity.

The system tries to help Brazil's Nationally Determined Contribution (NDC) under the Paris Agreement. A goal exists for reduction of greenhouse gas emissions by 53% from 2005 levels by 2030. Modeled from the EU ETS, the system should engage international groups and finance initiatives that reduce emissions and protect forests.

Forest Conservation and REDD+ Initiatives

Land-use programs through forest conservation have continued to be one of the primary components of Brazil's carbon credit market. REDD+ (Reducing Emissions from Deforestation and Forest Degradation) programs promote incentives toward communities and private investors to conserve and restore areas like the Amazon biome, which is the world's largest carbon sink.

Brazil announced the creation of the "Tropical Forests Forever" fund in December 2023. The fund is expected to mobilize USD 250 Billion in international finance to reward countries that preserve tropical forests. It will lead Brazil across the globe in climate mitigation and fund efforts toward sustainably managing forests and generating carbon offsets.

Corporate Net-Zero Commitments and Technological Innovation

Due to its biodiversity and renewable resources, Brazil is in a strong position to be part of the nature-based carbon credits market, with high demand for high-quality carbon credits from Brazil, driven by multinational corporations seeking to meet commitments for net-zero targets.

Satellite monitoring, remote sensing, and blockchain logging improve carbon credit verifiability and bring foreign buyers and investors to Brazil by providing a transparent, trustworthy, credible market with high-potential projects, including those that offer additional co-benefits.

Brazil Carbon Credits Market Segmentation

Type Insights

● Compliance: Credits generated and traded under mandatory environmental regulations enforced by government authorities.

● Voluntary: Credits traded voluntarily by corporations and institutions aiming to offset emissions beyond regulatory requirements.

Project Type Insights

● Avoidance/Reduction Projects: Initiatives aimed at preventing or minimizing carbon emissions, such as renewable energy and methane capture projects.

● Removal/Sequestration Projects:

○ Nature-Based: Projects involving reforestation, afforestation, and forest conservation to absorb atmospheric carbon.

○ Technology-Based: Projects leveraging carbon capture, utilization, and storage (CCUS) or direct air capture (DAC) technologies.

End-Use Industry Insights

● Power: Electricity generation and utilities using credits for emission balancing.

● Energy: Broader energy producers engaging in offset markets to meet sustainability targets.

● Aviation: Airlines purchasing credits to comply with global aviation emission standards (CORSIA).

● Transportation: Logistics and mobility sectors offsetting carbon-intensive operations.

● Buildings: Green construction and real estate developers participating in voluntary markets.

● Industrial: Manufacturing sectors reducing emissions through verified offset mechanisms.

● Others: Additional industries adopting carbon trading as part of ESG commitments.

Regional Insights

The report covers five major regions-Southeast, South, Northeast, North, and Central-West.

While specific regional market shares or CAGRs are not provided, the Southeast region, including São Paulo and Rio de Janeiro, is expected to dominate due to its concentration of corporate headquarters, financial institutions, and carbon trading hubs. The North region, encompassing the Amazon Basin, remains pivotal for forest-based carbon sequestration projects, contributing significantly to credit generation through REDD+ and restoration efforts.

Recent Developments & News

● May 2025: AgriCapture launched Brazil's first rice carbon project in Rio Grande do Sul with NatCap, introducing methane-reducing irrigation techniques and enabling farmer access to international carbon markets.

● December 2024: Brazil enacted Law No. 15,042/2024, establishing the SBCE carbon market, targeting firms emitting more than 10,000 tCO2/year and promoting regulated carbon credit trading.

● September 2024: Google purchased 50,000 metric tons of nature-based carbon removal credits from Mombak, a Brazilian reforestation startup focused on Amazon restoration.

● September 2024: Amazon and five partner firms invested USD 180 Million via the LEAF Coalition to protect forest areas in Pará state, reinforcing Brazil's role in global climate finance.

These initiatives underscore Brazil's growing influence as a hub for high-quality carbon credit projects and sustainable forest management.

However, the market ecosystem features a mix of domestic environmental startups, multinational corporations, forest conservation organizations, and global technology firms investing in climate mitigation and carbon offset projects.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request Customization: https://www.imarcgroup.com/request?type=report&id=32567&flag=E

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company offers a full suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation, factory setup support, regulatory compliance, branding and marketing strategies, competitive benchmarking, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Brazil Carbon Credits Market Size, Share, Growth and Forecast 2034 here

News-ID: 4268252 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Brazil

Brazil Clinical Trials Market ANVISA Brazil Guidelines Brazil Clinical Trials Re …

Brazil Cancer Drugs Clinical Trials Insight 2024 Report Offering:

• Brazil Clinical Trials Market Opportunity 2024 and 2030 (In US$ Billion)

• Clinical Trials Regulatory Framework In Brazil

• Total Number of Cancer Drugs In Clinical Trials In Brazil

• Total Number Of Cancer Drugs Approved In Brazil

• 400 Pages Clinical Trials Insight On All Cancer Drugs In Clinical Trials By Company, Indication and Phase

• 80 Pages Clinical Insight On All Cancer Drugs Approved in Market By Company and Indication

• Insight…

South East Brazil growing with major share in the Brazil Professional Hair Care …

In the Report “Brazil Professional Hair Care Market: By Categories (Coloring, Perming & Straightening, Shampoo & Conditioning & Styling); Sales Channel (Back Bar and Take Home) & By Company - (2018-2023)“ published by IndustryARC, the market is driven by the growing awareness of special functionalities of products, boosting the sales of treatment and hair conditioning market.

South East Brazil growing with major share in the Brazil Professional Hair Care Market

The Northern…

ATM Machine Market is Booming (18% CAGR)| NCR Brazil, Diebold Brazil, Wincor Nix …

HTF MI recently introduced ATM Machine Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Itautec S/A, NCR Brazil, Diebold Brazil, Wincor Nixdorf Brazil,…

Brazil: Country Intelligence Report 2018 By Claro, Sky Brazil, Oi, Vivo, TIM Bra …

"Brazil: Country Intelligence Report", by GlobalData provides an executive-level overview of the telecommunications market in Brazil today, with detailed forecasts of key indicators up to 2021. Published annually, the report provides detailed analysis of the near-term opportunities, competitive dynamics and evolution of demand by service type and technology/platform across the fixed telephony, broadband, and mobile, as well as a review of key regulatory trends. …

Agrochemicals Market in Brazil

ReportsWorldwide has announced the addition of a new report title Brazil: Agrochemicals: Market Intelligence (2016-2021) to its growing collection of premium market research reports.

The report “Brazil: Agrochemicals: Market Intelligence (2016-2021)” provides market intelligence on the different market segments, based on type, active ingredient, formulation, crop, and pest. Market size and forecast (2016-2021) has been provided in terms of both, value (000 USD) and volume (000 KG) in the report. A…

ATM Machine Market in Brazil 2015-2019: Competitive analysis of key vendors, inc …

Albany, NY, Feb 23, 2017: This report segments the ATM machine market in Brazil by revenue generated and the unit shipment. It also includes the competitive analysis of key vendors, including Itautec S/A, NCR Brazil, Diebold Brazil and Wincor Nixdorf Brazil.

Market scope of the ATM machine market in Brazil

Technavios market research analyst predict that the ATM machine market in Brazil will continue to grow at CAGR of 18.72%. The key…