Press release

Mobility as a Service (MaaS) Market Scope, Key Drivers, and Future Opportunities Forecast 2035

Top Companies & Their StrategiesThe Mobility as a Service (MaaS) market is rapidly evolving as digital integration, sustainability mandates, and user-centric mobility ecosystems reshape how people move. The market is defined by collaborations between mobility providers, urban planners, and technology companies working toward a shared vision of seamless multimodal transportation. Key players are leveraging data analytics, AI-driven routing, and strategic partnerships to create integrated mobility networks.

➤ Request Free Sample PDF Report @https://www.researchnester.com/sample-request-3412

1. Uber Technologies Inc.

Uber remains a dominant force in the MaaS ecosystem, extending beyond ride-hailing into multimodal transport solutions such as bikes, scooters, and car rentals. Its investment in autonomous mobility and subscription-based offerings (like Uber One) strengthens its customer retention strategy and ecosystem integration. Uber's strength lies in its vast operational scale, AI capabilities, and dynamic pricing models.

2. Lyft Inc.

Lyft continues to consolidate its U.S. market presence with a strong focus on sustainability and fleet electrification. The company's partnerships with transit agencies and micro-mobility providers exemplify its commitment to intermodal connectivity. Its data-driven route optimization and affordable mobility subscription models make it a key enabler of urban MaaS networks.

3. Siemens Mobility GmbH

Siemens Mobility leads the integration of infrastructure and technology for smart transportation. Through its MaaS platform "SiMobility," the company offers real-time mobility management solutions that connect public transit, ride-sharing, and personal vehicles. Siemens' advantage lies in its deep experience in transportation infrastructure, digital twins, and smart city planning.

4. Moovit (an Intel Company)

Moovit operates one of the world's most widely used urban mobility apps and provides a robust data layer for transit authorities and mobility platforms. Since being acquired by Intel, Moovit has become central to Intel's autonomous mobility strategy. Its strength lies in data aggregation, mobility intelligence, and integration with automotive systems.

➤ Get deeper insights into competitive positioning and strategic benchmarking: Download our sample Insight Mobility as a Service (MaaS) Market report here → https://www.researchnester.com/sample-request-3412

5. Whim (MaaS Global)

Based in Finland, Whim is among the first companies to operationalize a fully integrated MaaS subscription model. Users can plan, book, and pay for various transport modes-taxis, car rentals, trains, and shared bikes-through a single app. Whim's competitive edge is its innovative payment ecosystem and successful public-private partnerships in Europe.

6. BlaBlaCar

The France-based company has evolved from carpooling into a multimodal transport network that integrates buses and shared rides. BlaBlaCar's low-cost, community-driven model provides strong scalability in emerging economies and complements public transport in underserved regions. Its customer loyalty and operational efficiency strengthen its competitive position.

7. Didi Chuxing Technology Co.

Didi is one of Asia's leading MaaS providers, with a diverse mobility ecosystem that includes ride-hailing, e-bikes, and autonomous vehicles. Its strong AI-based fleet management systems and partnerships with regional governments in China give it a strategic edge. Didi's growing focus on data privacy compliance and electrification underscores its sustainability leadership.

8. Via Transportation Inc.

Via specializes in transit technology solutions that optimize on-demand shuttle and bus networks for cities and companies. It stands out for its enterprise partnerships with municipalities and corporate mobility programs. Via's software-first model and AI-based routing have positioned it as a preferred partner for government-led MaaS initiatives globally.

➤ View our Mobility as a Service (MaaS) Market Report Overview here: https://www.researchnester.com/reports/mobility-as-a-service-market/3412

SWOT Analysis of Leading MaaS Companies

Strengths:

Leading MaaS providers benefit from strong data-driven platforms, advanced route optimization, and robust partner ecosystems that link public and private transportation services. Many have invested in electrification and sustainability, aligning with global environmental goals. Their adaptability to regional transport policies and ability to integrate multiple mobility modes provide a competitive moat against new entrants.

Weaknesses:

Despite strong digital capabilities, profitability remains a challenge due to high operational costs and thin margins in mobility services. Fragmented regulations across markets can slow deployment of unified MaaS solutions. Moreover, dependence on partnerships with local transit authorities introduces integration complexities and delays in scaling services globally.

Opportunities:

Growing urbanization and government push for sustainable transport create immense opportunities for MaaS adoption. Integration with autonomous vehicles, AI-powered traffic management, and connected infrastructure can unlock new revenue models. The rise of subscription-based and corporate mobility services presents long-term growth potential, especially in smart cities of Europe, North America, and Asia-Pacific.

Threats:

Cybersecurity and data privacy risks are major threats to the MaaS ecosystem, as platforms rely heavily on user and location data. Intense competition from traditional transport operators and emerging startups may drive pricing pressures. Additionally, policy shifts or slow public infrastructure upgrades could limit MaaS implementation in developing markets.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report →https://www.researchnester.com/sample-request-3412

Investment Opportunities & Emerging Trends

The Mobility as a Service (MaaS) market is witnessing dynamic investment flows as technology, mobility, and infrastructure players converge. Venture funding and M&A activity have accelerated, especially around mobility data platforms, electric fleet management, and integrated payment solutions. Over the past year, several notable deals and strategic developments have reshaped the competitive landscape.

1. Mergers and Acquisitions (M&A):

The sector has seen strategic consolidations-such as Uber's divestiture of non-core units to focus on MaaS integration and Via's acquisitions of Remix and Citymapper to enhance data intelligence and mapping capabilities. Siemens Mobility's partnerships with regional transit operators have also underscored the increasing alignment between traditional transport infrastructure firms and digital mobility enablers.

2. Funding & Startups:

Investment activity has been particularly strong in Europe and North America, where startups are developing micro-mobility and integrated payment ecosystems. Companies like Whim and Bolt have attracted venture funding to expand subscription-based models that simplify transport access for commuters. Governments are also investing in public-private MaaS projects, particularly in the EU and Japan, to reduce congestion and emissions.

3. Technology Integration:

AI, IoT, and blockchain are emerging as critical technologies in MaaS deployment. AI enables dynamic route optimization and demand prediction, while blockchain ensures transparent fare collection and identity verification. Data-driven personalization-offering real-time route suggestions or carbon footprint tracking-is becoming a key differentiator for service providers.

4. Regional Expansion:

Europe leads in MaaS maturity, driven by supportive policy frameworks, urban mobility pilots, and open data mandates. The Asia-Pacific region, led by China, Japan, and Singapore, is rapidly scaling MaaS through integration with smart city platforms and public transport authorities. North America is increasingly adopting corporate MaaS models, supported by technology partnerships and green commuting initiatives.

Recent Developments:

• 2024: Via acquired Citymapper, strengthening its real-time mapping and routing data capabilities.

• 2024: Uber announced expanded EV partnerships with automakers to accelerate zero-emission goals.

• 2025: Whim launched new subscription tiers integrating regional rail and air travel options.

• 2025: Siemens Mobility introduced AI-powered MaaS dashboards to enhance city-level transport planning.

These developments reflect how the MaaS market is transitioning from fragmented mobility services to unified, city-integrated ecosystems.

➤ Request Free Sample PDF Report @https://www.researchnester.com/sample-request-3412

➤ Related News -

https://www.linkedin.com/pulse/what-factors-driving-global-growth-beta-testing-tools-xqxyf

https://www.linkedin.com/pulse/what-future-digital-transformation-consulting-services-ehsyf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobility as a Service (MaaS) Market Scope, Key Drivers, and Future Opportunities Forecast 2035 here

News-ID: 4266875 • Views: …

More Releases from Research Nester Pvt Ltd

Produced Water Treatment Market Dominance: Top Companies Strengthening Share & I …

The produced water treatment market is shaped by established oilfield service providers, water technology specialists, and emerging cleantech innovators. As regulatory scrutiny intensifies and sustainability becomes central to energy operations, leading companies are positioning themselves through technology integration, digitalization, and geographic expansion.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8290

Top Companies & Their Strategies

1. Veolia Water Technologies

Veolia is a global leader in water and wastewater solutions, with a strong footprint…

Aquaculture Feed Market Key Players - Share Consolidation Trends & Capital Growt …

The aquaculture feed market is undergoing rapid structural transformation as global seafood consumption, sustainability mandates, and feed innovation reshape competitive dynamics. Feed represents the single largest operating cost in aquaculture production, making it a strategic lever for profitability, environmental compliance, and productivity gains. As aquaculture continues to replace wild capture fisheries in meeting protein demand, feed manufacturers are positioning themselves at the center of value creation.

This article provides a strategic…

Dark Fiber Networks Market Dominance: Top Companies Strengthening Share & Invest …

The dark fiber networks market has become a critical pillar of global digital infrastructure, enabling scalable, high-capacity connectivity for enterprises, telecom operators, hyperscale data centers, and public sector networks. As demand accelerates for low-latency communication, 5G backhaul, cloud interconnection, and private network deployments, dark fiber has emerged as a strategic asset rather than a passive infrastructure layer.

Unlike lit services, dark fiber networks offer customers full control over bandwidth, security, and…

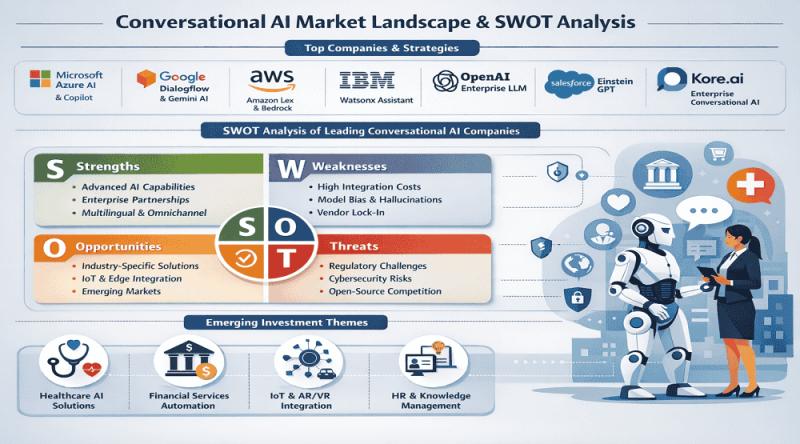

Conversational AI Market Players - Competitive Positioning, Strategic Strengths …

The Conversational AI market has rapidly evolved from rule-based chatbots to sophisticated, context-aware systems powered by large language models (LLMs), machine learning, and natural language processing (NLP). Enterprises across banking, healthcare, retail, telecom, and government are integrating conversational AI platforms to automate customer engagement, enhance operational efficiency, and deliver hyper-personalized experiences.

As adoption deepens, the competitive landscape of the conversational AI market is defined by platform scalability, data integration capabilities, model…

More Releases for MaaS

What is MaaS?

What is MaaS?

Metaverse as a Service _ MaaS, was all the rage at CES this year, and many people were curious about what it is. To put it simply, MaaS is the concept of servicing a metaverse space as a SaaS. Let's take a look at why SaaS has become the dominant approach in the metaverse industry.

What are the different ways to build a metaverse space?

Until now, there have been…

MaaS Market Business Strategies, and Regional Outlook

By merging several private and public transportation services and pricing structures into a single digital platform, Mobility as a Service (MaaS) aims to deliver tailored and ideal travel to move us from one place to another. The global mobility-as-a-service market accounted for $128,489.2 million in 2021, which is predicted to hit $519,697.5 million by 2030. The adoption of MaaS is expected to accelerate market growth due to growing worries about…

Global Mobility as a Service (MaaS) Market Competition Situation 2027-

Global Mobility as a Service (MaaS) Market Size Is Projected To Reach US$ 394000 Million By 2027, From US$ 87620 Million In 2020, At A CAGR Of 23.9% During 2021-2027

Los Angeles United States 25th April 2022:QY Research recently published a research report titled, "Global Mobility as a Service (MaaS) Market Report, History and Forecast , Breakdown Data by Manufacturers, Key Regions, Types and Application". The research report attempts to give…

Mobility as a Service (MaaS) Market 2021 | Detailed Report

The Mobility as a Service (MaaS) research report undoubtedly meets the strategic and specific needs of the businesses and companies. The report acts as a perfect window that provides an explanation of market classification, market definition, applications, market trends, and engagement. The competitive landscape is studied here in terms of product range, strategies, and prospects of the market’s key players. Furthermore, the report offers insightful market data and information about…

Mobility as a Service (MaaS) Market 2025 -Lyft, Uber Technologies Inc., Beeline …

The Mobility as a Service (MaaS) market accounted for US$ 44.33 Bn in 2017 and is expected to grow at a CAGR of 36.4% during the forecast period 2018 – 2025, to account for US$ 476.34 Bn in 2025.

Download PDF Sample Copy @ www.theinsightpartners.com/sample/TIPTE100000803/?utm_source=OpenPR&utm_medium=10387

Major Players in the market are: Lyft, Uber Technologies Inc., Beeline Singapore, SKEDGO PTY LTD., UbiGo AB, Whim App (MaaS Global Oy), Moovel Group GmbH, QIXXIT, Splyt…

Mobility as a Service (MaaS) Market To Witness Massive Growth | Competitive Outl …

Mobility as a Service (MaaS) market report is an in-depth study on the ICT industry while also explaining what Mobility as a Service (MaaS) market definition, classifications, applications, engagements, and global industry trends are.

Lyft, Uber Technologies LLC, Beeline, SkedGo, UbiGo, MaaS Global Ltd, Qixxit, Citymapper are turning heads in the Mobility as a Service (MaaS) market because of their product launches, their researches, joint ventures, merges, and accusations.…