Press release

ESG (Environmental, Social, Governance) Consulting Project Report 2025: Market Trends and Business Opportunities

ESG (Environmental, Social, Governance) Consulting Business Plan & Project Report OverviewIMARC Group's "ESG (Environmental, Social, Governance) Consulting Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful ESG consulting business. The critical areas, including market trends, investment opportunities, revenue models, and financial forecasts, are discussed in this in-depth report and are therefore useful resources to entrepreneurs, consultants and investors. Whether evaluating the viability of a new venture or streamlining an existing one, the report gives an in-depth analysis of all the ingredients that make it successful, starting with business formation and profitability over time.

What is an ESG (Environmental, Social, Governance) Consulting Business?

An ESG (Environmental, Social, Governance) Consulting firm is a specialized professional service organization designed to deliver comprehensive sustainability and corporate responsibility strategies for organizations seeking to integrate ESG principles into their operations, governance structures, and stakeholder communications. These consultancies emphasize materiality assessments, ESG risk identification, sustainability reporting frameworks, stakeholder engagement strategies, regulatory compliance guidance, and performance measurement systems, catering to corporations, financial institutions, investment firms, and public sector entities pursuing sustainable business practices and enhanced ESG performance.

They offer a variety of services including ESG strategy development, materiality assessments and stakeholder mapping, carbon footprint measurement and reduction planning, supply chain sustainability audits, diversity and inclusion program design, board governance advisory, ESG reporting and disclosure preparation, regulatory compliance consulting, investor relations support, impact measurement and verification, ESG data management systems, and third-party assurance coordination for organizations committed to transparent sustainability practices and responsible corporate citizenship.

The category encompasses strategic ESG advisory firms, sustainability reporting specialists, climate risk consultancies, and comprehensive corporate responsibility transformation partners, each prioritizing evidence-based analysis, international framework alignment (GRI, SASB, TCFD, CDP), industry-specific best practices, multi-stakeholder engagement, data integrity and verification, impact quantification methodologies, regulatory foresight, and continuous improvement strategies.

To achieve these goals, ESG Consulting firms integrate state-of-the-art ESG data management platforms, carbon accounting software, materiality assessment tools, stakeholder engagement systems, regulatory tracking databases, ESG performance benchmarking analytics, reporting automation technologies, and comprehensive sustainability dashboard solutions.

Depending on their positioning, these establishments may operate as specialized climate strategy advisories, comprehensive ESG transformation consultancies, sustainability reporting experts, or integrated corporate responsibility and governance firms, delivering complete ESG solutions tailored to diverse industry sectors, organizational maturity levels, stakeholder expectations, and regulatory environments.

Request for a Sample Report: https://www.imarcgroup.com/esg-consulting-business-plan-feasibility-report/requestsample

ESG (Environmental, Social, Governance) Consulting Business Market Trends and Growth Drivers

The trends and drivers of an ESG (Environmental, Social, Governance) Consulting business are shaped by the exponential growth in sustainable investing, increasingly stringent ESG disclosure regulations, and heightened stakeholder expectations for corporate accountability. These factors, combined with growing awareness of climate risks, social inequality concerns, and governance failures, are fuelling demand for expert ESG guidance and implementation support. Contributing to this shift is the expanding mandatory ESG reporting requirements across global jurisdictions, investor pressure for transparent sustainability performance, board-level prioritization of ESG issues, reputational risk management needs, along with organizational preferences for standardized reporting frameworks, data-driven ESG metrics, third-party verification processes, and integration of sustainability into core business strategy within the evolving responsible business ecosystem.

To meet these demands, operators are investing in advanced ESG data analytics platforms, industry-specific expertise development, regulatory intelligence capabilities, stakeholder engagement methodologies, and deep knowledge of evolving reporting standards and frameworks. These investments not only enhance client outcomes but also strengthen business credibility by aligning with broader trends in sustainable finance, corporate accountability, and stakeholder capitalism.

Revenue diversification is another critical factor in building financial resilience. In addition to direct consulting fees, income streams may include ESG strategy development retainers, materiality assessment projects, sustainability reporting services, assurance readiness preparation, board training and governance advisory, supply chain auditing, ESG technology platform implementation, ongoing performance monitoring subscriptions, crisis management and reputational advisory, and specialized climate transition planning engagements.

Location and network development play a vital role in success. Consultancies positioned in major financial centers, regions with progressive ESG regulations, areas with high concentrations of publicly traded companies, and access to ESG ecosystem partners including data providers, auditors, and rating agencies benefit from steady client demand and market authority. At the same time, deep technical expertise, proven track records with recognized frameworks, and adherence to professional standards ensure service excellence and client trust.

However, the business also faces risk factors, such as rapidly evolving ESG regulations and reporting standards that can affect service delivery approaches, intense competition from established Big Four accounting firms and large management consultancies entering the ESG space, dependence on regulatory enforcement momentum and sustained investor interest in ESG factors, and challenges related to ESG data availability, quality, and comparability across organizations and industries.

A successful ESG (Environmental, Social, Governance) Consulting business model requires careful financial planning-including capital investment in ESG software platforms and data analytics tools, development of proprietary assessment methodologies, and establishment of strategic partnerships with technology providers, auditors, and industry associations. It also demands highly skilled professionals with expertise in sustainability science, financial analysis, regulatory compliance, stakeholder engagement, and change management, supported by effective marketing strategies to build thought leadership, foster client relationships, and establish long-term partnerships with corporations, investors, regulators, and ESG standard-setting bodies. By delivering rigorous analysis, actionable recommendations, and exceptional implementation support, these businesses can accelerate the corporate sustainability transformation while helping clients achieve enhanced ESG performance, stakeholder trust, and long-term value creation.

Report Coverage

The ESG (Environmental, Social, Governance) Consulting Business Plan and Project Report includes the following areas of focus:

• Business Model & Operations Plan

• Technical Feasibility

• Financial Feasibility

• Market Analysis

• Marketing & Sales Strategy

• Risk Assessment & Mitigation

• Licensing & Certification Requirements

The comprehensive nature of this report ensures that all aspects of the business are covered, from market trends and risk mitigation to regulatory requirements and client acquisition strategies.

Key Elements of ESG (Environmental, Social, Governance) Consulting Business Setup

Business Model & Operations Plan

A solid business model is crucial to a successful venture. The report covers:

• Service Overview: A breakdown of ESG strategy development, materiality assessments, carbon footprint analysis, sustainability reporting preparation, supply chain audits, diversity and inclusion consulting, board governance advisory, regulatory compliance support, stakeholder engagement facilitation, ESG data management, impact measurement, and assurance readiness services offered

• Service Workflow: How each client engagement, diagnostic assessment, strategy formulation, data collection and analysis, reporting development, stakeholder consultation, and performance verification process is managed

• Revenue Model: An exploration of the mechanisms driving revenue across multiple service lines and engagement models

• SOPs & Service Standards: Guidelines for consistent methodological rigor, data integrity, reporting quality, stakeholder engagement excellence, and client satisfaction

This section ensures that all operational and client service aspects are clearly defined, making it easier to scale and maintain service quality.

Buy Report Now: https://www.imarcgroup.com/checkout?id=41710&method=1911

Technical Feasibility

Setting up a successful business requires proper consulting infrastructure planning. The report includes:

• Location Selection Criteria: Key factors to consider when establishing office locations and targeting priority client markets and industry sectors

• Space & Costs: Estimations for required office space, client meeting facilities, research and analysis workstations, and associated costs

• Equipment & Systems: Identifying essential ESG data management platforms, carbon accounting software, reporting tools, stakeholder engagement systems, and analytical technologies

• Office & Technical Setup: Guidelines for creating advanced ESG consulting work environments and client collaboration spaces

• Utility Requirements & Costs: Understanding the technology infrastructure and utilities necessary to run ESG consulting operations

• Human Resources & Wages: Estimating staffing needs, roles, and compensation for senior ESG consultants, sustainability analysts, reporting specialists, stakeholder engagement managers, business development professionals, and administrative support personnel

This section provides practical, actionable insights into the consulting infrastructure needed for setting up your business, ensuring service excellence and client satisfaction.

Financial Feasibility

The ESG (Environmental, Social, Governance) Consulting Business Plan and Project Report provides a detailed analysis of the financial landscape, including:

• Capital Investments & Operating Costs: Breakdown of initial and ongoing investments

• Revenue & Expenditure Projections: Projected income and cost estimates for the first five years

• Profit & Loss Analysis: A clear picture of expected financial outcomes

• Taxation & Depreciation: Understanding tax obligations and equipment depreciation

• ROI, NPV & Sensitivity Analysis: Comprehensive financial evaluations to assess profitability

This in-depth financial analysis supports effective decision-making and helps secure funding, making it an essential tool for evaluating the business's potential.

Market Insights & Strategy

Market Analysis

A deep dive into the ESG consulting market, including:

• Industry Trends & Segmentation: Identifying emerging trends and key market segments across corporate ESG strategy, sustainability reporting, climate risk advisory, supply chain sustainability, social impact consulting, and governance transformation services

• Regional Demand & Cost Structure: Regional variations in ESG regulatory requirements and cost factors affecting consulting service demand

• Competitive Landscape: An analysis of the competitive environment including Big Four accounting firms, specialized ESG consultancies, sustainability boutiques, management consulting firms with ESG practices, and ESG technology-enabled service providers

Profiles of Key Players

The report provides detailed profiles of leading players in the industry, offering a valuable benchmark for new businesses. It highlights their strategies, service portfolios, industry specializations, and market positioning, helping you identify strategic opportunities and areas for differentiation.

Capital & Operational Expenditure Breakdown

The report includes a comprehensive breakdown of both capital and operational costs, helping you plan for financial success. The detailed estimates for office development, technology systems, and operating costs ensure you're well-prepared for both initial investments and ongoing expenses.

• Capital Expenditure (CapEx): Focused on office space renovation and design, ESG software and analytics platforms, computing infrastructure, presentation and collaboration technologies, research library development, and proprietary methodology development

• Operational Expenditure (OpEx): Covers ongoing costs like consultant salaries, ESG software subscriptions, professional certifications and training, marketing and thought leadership expenses, professional liability insurance, industry association memberships, research and data subscriptions, and office maintenance

Financial projections ensure you're prepared for cost fluctuations, including adjustments for technology platform upgrades, talent acquisition costs in competitive markets, regulatory training requirements, and competitive pricing pressures over time.

Profitability Projections

The report outlines a detailed profitability analysis over the first five years of operations, including projections for:

• Total revenue from strategy consulting, reporting services, training programs, software solutions, and ongoing advisory retainers, expenditure breakdown, gross profit, and net profit

• Profit margins for each revenue stream and year of operation

• Revenue per client projections and market penetration growth estimates

These projections offer a clear picture of the expected financial performance and profitability of the business, allowing for better planning and informed decision-making.

Request For Customization: https://www.imarcgroup.com/request?type=report&id=41710&flag=E

Our expertise includes:

• Market Entry and Expansion Strategy

• Feasibility Studies and Business Planning

• Company Incorporation and Consulting Practice Setup Support

• Regulatory and Licensing Navigation

• Competitive Analysis and Benchmarking

• Industry Partnership Development

• Branding, Marketing, and Client Acquisition Strategy

About Us

IMARC Group is a leading global market research and management consulting firm. We specialize in helping organizations identify opportunities, mitigate risks, and create impactful business strategies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ESG (Environmental, Social, Governance) Consulting Project Report 2025: Market Trends and Business Opportunities here

News-ID: 4266574 • Views: …

More Releases from IMARC Group

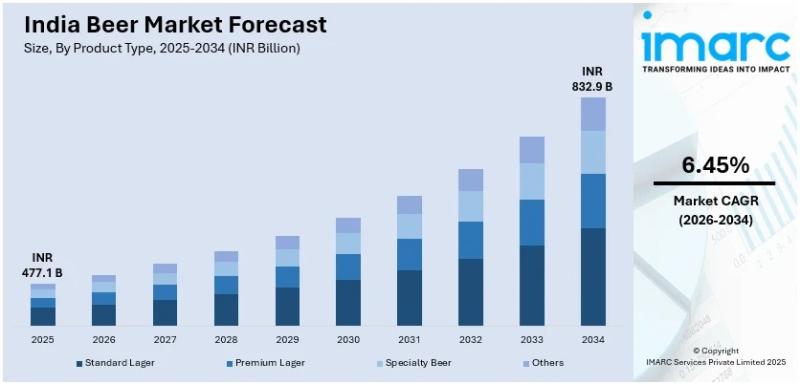

India Beer Market Size to Reach INR 832.93 Billion by 2034: Industry Trends, Gro …

Summary

The beer market size in india reached INR 477.05 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Driven by rapid urbanization, a burgeoning young demographic, and a massive cultural shift toward premium and craft beverages, the market is projected to reach INR 832.93 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 6.45% during the forecast period (2026-2034).

What are the Key…

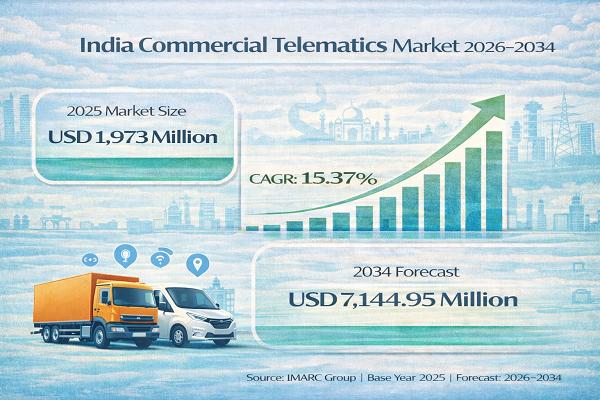

India Commercial Telematics Market Expected to Reach USD 7,144.95 Million by 203 …

India Commercial Telematics Market : Report Introduction

According to IMARC Group's report titled "India Commercial Telematics Market Size, Share, Trends and Forecast by Type, System Type, Provider Type, End Use Industry, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Free Sample Download PDF (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-commercial-telematics-market/requestsample

Commercial Telematics Market in India : Overview (2026-2034)

The India commercial telematics market…

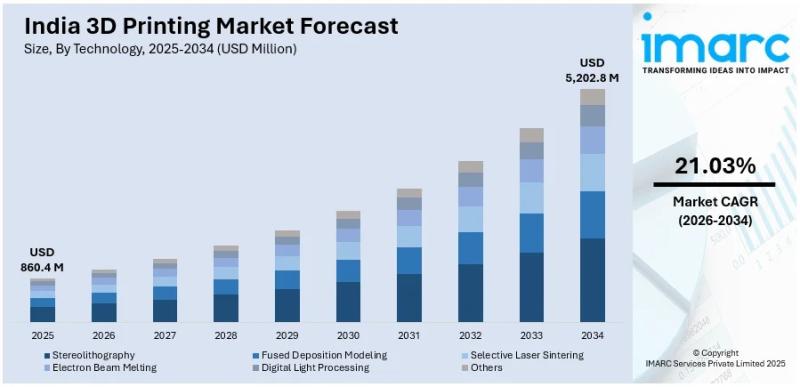

India 3D Printing Market Growing at 21.03% CAGR Through 2034, Led by Healthcare …

Summary

The 3d printing market size in india reached USD 860.4 Million in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by the rapid adoption of additive manufacturing across the aerospace, healthcare, and construction sectors, along with strong government backing for digital manufacturing, the market is projected to reach an impressive USD 5,202.8 Million by 2034. This represents a massive compound annual growth rate (CAGR) of 21.03%…

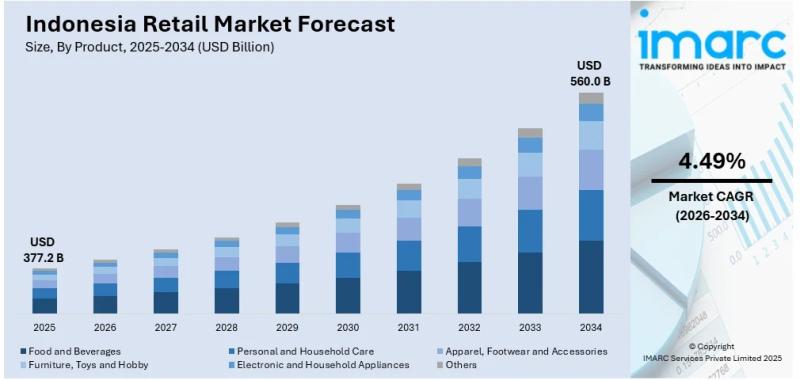

Indonesia Retail Market to Reach USD 560 Billion by 2034, Led by Modern Formats …

Summary

The retail market in indonesia reached a size of USD 377.2 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by a rapidly expanding urban population, rising consumer purchasing power, and a massive shift toward digital commerce, the market is projected to reach USD 560.0 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 4.49% during the forecast period (2026-2034).

What are…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…