Press release

India Software Market Size, Share, Industry Outlook, New Technologies and Forecast Report 2025-2033

India Software Market 2025-2033According to IMARC Group's report titled "India Software Market Size, Share, Trends and Forecast by Type, Deployment Mode, Enterprise Size, Industry Vertical, and Region, 2025-2033", the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

How Big is the India Software Industry?

The India software market size was valued at USD 21.1 Billion in 2024 and is expected to reach USD 61.5 Billion by 2033, exhibiting a growth rate (CAGR) of 11.7% during 2025-2033.

Request for a free sample copy of this report: https://www.imarcgroup.com/india-software-market/requestsample

India Software Market Trends:

India's software landscape is undergoing a dramatic shift, powered by accelerating digital adoption and technological breakthroughs. Artificial Intelligence platforms witnessed remarkable expansion in the market with approximately 91% growth, followed by collaborative applications and endpoint management solutions recording 33% and 30% growth respectively. This surge reflects how businesses across the nation are racing to embed intelligent automation into their operations.

Cloud computing continues to reshape how companies consume software, with organizations gravitating toward scalable solutions that eliminate heavy infrastructure investments. Software spending is projected to record the highest annual growth rate, increasing 17% as the expansion is fueled by both application and infrastructure software markets. The shift toward Software-as-a-Service models has become particularly pronounced, allowing enterprises of all sizes to access enterprise-grade applications through subscription pricing rather than capital-intensive licenses.

Government initiatives promoting indigenous software development and adoption of emerging technologies such as AI, cloud computing, and IoT have pushed companies to take digitalization to newer heights across industry verticals, with increasing demand visible in industry-specific applications, particularly in healthcare, education, and logistics. The Digital India initiative, combined with programs like Smart Manufacturing and Make in India, has created a fertile environment for software innovation and widespread adoption.

Indian chief information officers are starting to allocate budgets for generative AI beyond initial proof-of-concept projects, while significantly boosting spending on technologies such as cybersecurity, business intelligence, and data analytics. This trend indicates a maturing approach to emerging technologies, moving from experimentation to production deployment.

Growing enterprise AI and cloud adoption is expected to contribute $35 billion in market expansion, with companies across BFSI, healthcare, and manufacturing investing in AI-powered automation and cloud-based efficiencies. The Banking, Financial Services, and Insurance sector has emerged as the largest consumer of enterprise software solutions, accounting for a significant share of overall spending.

The cybersecurity dimension has taken center stage as digital threats become more sophisticated. The cybersecurity market is expected to grow sixfold, driven by rising cyber threats and tightening data protection regulations, as companies invest heavily in solutions like endpoint protection and cloud security. This heightened focus on security reflects the critical importance businesses now place on protecting their digital assets and customer data.

Small and medium-sized businesses are emerging as powerful growth drivers through the adoption of vertical SaaS solutions. SMBs are becoming a major driver of growth, as vertical SaaS solutions are set to unlock a $13 billion opportunity. These tailored software products address industry-specific challenges, making advanced technology accessible to businesses that previously couldn't afford customized enterprise solutions.

Digital-native businesses are increasing their software spend, building deeper digital capabilities to compete in an increasingly technology-driven marketplace. This shift represents a fundamental change in how modern enterprises approach technology-not as a support function, but as a core competitive differentiator.

Access Complete Report: https://www.imarcgroup.com/checkout/detail?id=21605&method=1337

India Software Market Scope and Growth Factors:

India's software sector stands at a pivotal moment, propelled by an exceptional confluence of factors that position it for sustained expansion. The nation's demographic advantage-a young, tech-savvy population coupled with a vast pool of skilled IT professionals-provides an unmatched foundation for growth. With over five million professionals working in the software services sector, India's talent ecosystem continues to attract global attention and investment.

The rising internet penetration and smartphone adoption have created an enormous addressable market for software solutions. As connectivity reaches deeper into Tier 2 and Tier 3 cities, businesses across these emerging markets are discovering the transformative power of digital tools. This geographic expansion is opening entirely new revenue streams for software providers who can tailor their offerings to meet regional needs and local language requirements.

Enterprise technology spending is rising to almost $160 billion, with Indian vendors delivering complex transformations at 40 to 60% lower cost than on-shore teams. This cost advantage, combined with high-quality delivery, continues to make India an attractive destination for global technology investments. However, the market is evolving beyond pure cost arbitrage to value-driven innovation partnerships.

Government support has become a crucial enabler of growth.

The Union Budget sanctioned Rs. 2,000 crore to accelerate AI adoption and infrastructure development, while production-linked incentives, SEZ tax holidays, and export credits lower operating costs and encourage export expansion. These policy initiatives demonstrate the government's commitment to positioning India as a global software powerhouse.

The market faces certain headwinds that require strategic navigation. Indian organizations remain heavily reliant on legacy systems, and modernizing these systems often involves significant costs and specialized talent, while demand for advanced skills in AI, cybersecurity, and cloud continues to outpace supply. To address this skills gap, the government and major technology firms have launched extensive reskilling and upskilling initiatives.

Infrastructure development continues at pace, with investments flowing into dedicated technology parks, high-speed internet connectivity, and digital payment systems. Reliance Industries is set to build the world's largest data center in Jamnagar, Gujarat, marking a major step in its entry into India's artificial intelligence sector. Such mega-investments signal the market's long-term growth potential and the confidence major players have in India's digital future.

The startup ecosystem deserves special mention as a growth catalyst. India's thriving community of software startups is driving innovation in areas ranging from fintech to healthtech to edtech. These companies are not only serving domestic needs but increasingly building products for global markets, creating a new generation of Indian software product companies.

Cross-industry collaboration is accelerating market growth, with telecommunications operators offering data packages optimized for software usage, while hardware manufacturers launch affordable devices that make digital tools accessible to a broader population. This ecosystem approach ensures that growth is not constrained by any single bottleneck.

As educational institutions introduce software development and technology management programs, India is building a sustainable talent pipeline that will support long-term growth. The integration of emerging technologies into academic curricula ensures that graduates enter the workforce with relevant, contemporary skills.

India Software Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Type:

• Application Software

o Enterprise Resource Planning (ERP)

o Customer Relationship Management (CRM)

o Supply Chain Management (SCM)

o Enterprise Collaboration Software

o Enterprise Content Management (ECM) Software

o Education Software

o Others

• System Infrastructure Software

o Network Management Systems (NMS)

o Storage Software

o Security Software

• Development and Deployment Software

o Enterprise Data Management (EDM)

o Business Analytics and Reporting Tools

o Application Servers

o Integration and Orchestration Middleware

o Data Quality Tools

• Productivity Software

o Office Software

o Creative Software

o Others

Breakup by Deployment Mode:

• On-premises

• Cloud-based

Breakup by Enterprise Size:

• Small and Medium-sized Enterprises

• Large Enterprises

Breakup by Industry Vertical:

• IT and Telecom

• BFSI

• Retail

• Government/Public Sector

• Energy and Utilities

• Healthcare

• Others

Breakup by Region:

• North India

• West and Central India

• South India

• East and Northeast India

Recent News and Developments:

• In January 2025, HCLTech expanded its strategic partnership with Microsoft to transform contact centers through generative AI and cloud-based solutions, becoming the exclusive professional-services partner for existing Nuance customers

• In April 2025, Infosys reported an 11.7% decline in consolidated net profit to INR 7,033 crore for Q4 FY25 and guided to 0-3% FY26 revenue growth amid softer demand

• In April 2025, Wipro announced a 26% year-on-year net-profit increase to INR 3,570 crore for Q4 FY25, supported by a 48.5% surge in large-deal bookings

• In January 2025, TCS approved the Rs. 1,625 crore acquisition of TRIL Bengaluru Real Estate Five & Six Ltd. to develop delivery centers, acquiring 100% equity in one year

• In May 2025, Renesas Electronics partnered with India's Ministry of Electronics and IT under the Chips-to-Startup program, targeting more than 10% global revenue from India by 2030

• In June 2025, AiVANTA and Slangit Technologies launched an AI-based customer-engagement platform for Arabic markets, leveraging AiVANTA's Indian client experience

• In December 2024, TCS expanded its partnership with Bank of Baroda, India's second largest public sector bank, to continue implementing an end-to-end financial inclusion solution over the next five years

• Microsoft, Oracle, and SAP maintained their leadership position in the Indian market, with the three companies continuing to dominate the enterprise software landscape

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Other key areas covered in the report:

• COVID-19 Impact on the Market

• Porter's Five Forces Analysis

• Strategic Recommendations

• Market Dynamics

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

• Top Winning Strategies

• Recent Industry News

• Key Technological Trends & Development

Request For Customization: https://www.imarcgroup.com/request?type=report&id=21605&flag=E

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Software Market Size, Share, Industry Outlook, New Technologies and Forecast Report 2025-2033 here

News-ID: 4266131 • Views: …

More Releases from IMARC GROUP

India Plastic Pipes Market Outlook 2026-2034: Size, Share, Growth, Trends, Deman …

According to IMARC Group's report titled "India Plastic Pipes Market Size, Share, Trends and Forecast by Type, Diameter, End Use, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Plastic Pipes Market Report

The India plastic pipes market size was valued at USD 2.10 Billion in 2025 and is projected to reach USD 3.65 Billion by 2034, exhibiting a CAGR…

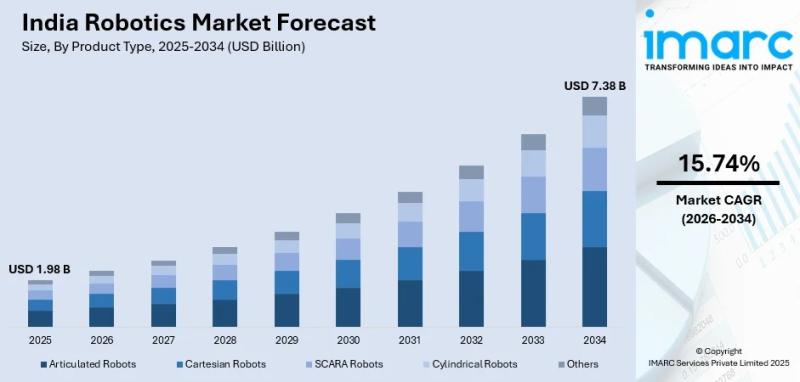

India Robotics Market Expanding at 15.74% CAGR by 2034, Driven by Make in India …

Summary

The India robotics market size reached USD 1.98 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by a massive push toward manufacturing modernization, rising labor costs, and robust government support for digital transformation, the market is projected to reach an impressive USD 7.38 Billion by 2034. This highlights a rapid compound annual growth rate (CAGR) of 15.74% during the forecast period (2026-2034).

Request a…

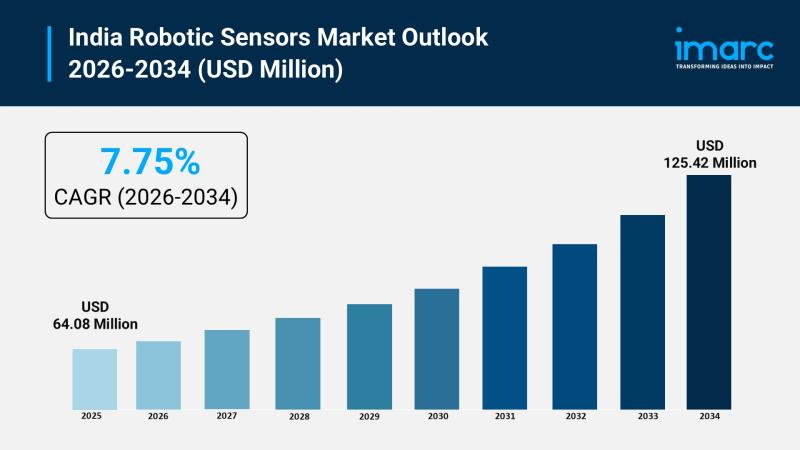

India Robotic Sensors Market Growing at 7.75% CAGR Through 2034, Driven by AI & …

Summary

The India robotic sensors market size reached USD 64.08 Million in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by robust government initiatives, escalating labor costs, and the rapid integration of artificial intelligence in industrial automation, the market is projected to reach USD 125.42 Million by 2034. This highlights a steady compound annual growth rate (CAGR) of 7.75% during the forecast period (2026-2034).

Request a Free Sample…

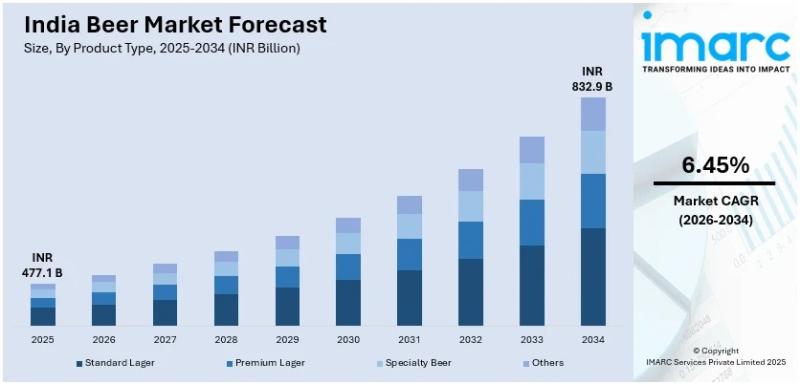

India Beer Market Size to Reach INR 832.93 Billion by 2034: Industry Trends, Gro …

Summary

The beer market size in india reached INR 477.05 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Driven by rapid urbanization, a burgeoning young demographic, and a massive cultural shift toward premium and craft beverages, the market is projected to reach INR 832.93 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 6.45% during the forecast period (2026-2034).

What are the Key…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2019 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2019 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2019 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…