Press release

Brazil Freight and Logistics Market Size, Share & Growth, Trends, Report 2026-2034

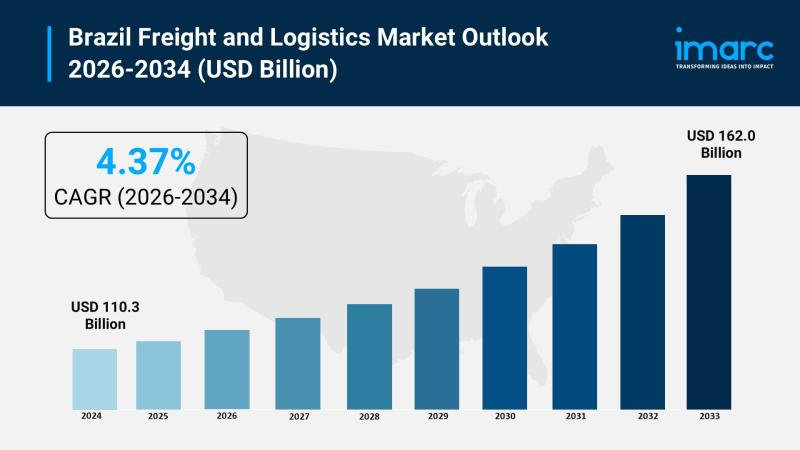

Market OverviewThe Brazil Freight and Logistics Market reached a value of USD 110.3 Billion in 2025 and is projected to reach USD 162.0 Billion by 2034, exhibiting a CAGR of 4.37% during 2026-2034.

The market's growth is driven by increasing demand for faster and transparent delivery systems, expanding domestic and international trade activities, and rising adoption of eco-friendly transportation technologies such as electric and hybrid vehicles. Rapid digital transformation through technologies like IoT and blockchain is enhancing transparency, route optimization, and supply chain efficiency. In addition, e-commerce expansion, infrastructure investments, and regulatory reforms in transport logistics are creating long-term growth opportunities across Brazil's logistics ecosystem.

Study Assumption Years

● Base Year: 2025

● Historical Year/Period: 2020-2025

● Forecast Year/Period: 2026-2034

Brazil Freight and Logistics Market Key Takeaways

● Current Market Size (2025): USD 110.3 Billion

● CAGR (2026-2034): 4.37%

● Forecast Period: 2026-2034

● The sector plays a vital role in trade enablement, ensuring efficient movement, storage, and management of goods.

● Adoption of logistics services helps businesses manage compliance complexity and reduce penalties.

● Domestic and cross-border trade expansion continues to strengthen logistics infrastructure.

● The e-commerce boom is driving significant demand for parcel deliveries and warehousing.

● Eco-friendly logistics solutions, including electric and hybrid fleets, are emerging as key growth areas.

● Digital integration through IoT and blockchain enhances real-time visibility, operational reliability, and supply chain security.

Sample Request Link: https://www.imarcgroup.com/Brazil-Freight-Logistics-Market/requestsample

Brazil Freight and Logistics Market Growth Factors

Expansion of Trade and Demand for Faster Deliveries

The growth in freight and logistics in Brazil is also being driven by increased trade and commerce both internally and externally. Brazil is growing its trade with Latin America, Europe and Asia and logistics capacity is being expanded to meet this growth. Businesses rely on logistics providers for meeting delivery schedules, and navigating complex and varied regulatory requirements.

As people demand faster and more reliable deliveries, companies invest in clever logistics hubs, automate and use multimodal transport systems to deliver faster, track goods and lower costs, ensuring Brazilian exports compete.

E-Commerce Boom Driving Logistics Modernization

E-commerce growth inside Brazil has changed the logistics industry. There is demand for express delivery. There is demand for last-mile connections. There is demand for temperature-controlled warehouses. In Brazil, warehouse and fulfillment centers increasingly use automated equipment to sort parcels and use real-time systems for tracking. To meet rising customer expectations with greater transparency and same-day fulfillment for e-commerce last-mile delivery, logistics companies increasingly invest in distribution centers.

The growth of e-commerce is also changing reverse logistics as companies focus on improving product returns, and improving packaging, logistics and customer experience in a sustainable manner. Major carriers are partnering with e-retailers to efficiently deliver more parcels for the customer's benefit.

Green Logistics and Digital Transformation

Sustainable logistics practices are emerging as a prime driver of growth. The adoption of electric-powered and hybrid-powered commercial vehicles to transport freight is helping drive down carbon dioxide emissions and operating costs. Support from governments for sustainable mobility and energy-efficient transport systems has further helped the transition.

At the same time, technologies like the IoT, artificial intelligence and blockchain are transforming logistics and supply chain management with real-time shipment and tracking information, predictive software applications and optimized routing, increasing the reliability and transparency of logistics while also improving warehouse management, increasing asset use and reducing delivery times.

Continued investments in ports, airports, and logistics are designed to make Brazil a regional logistics hub to support the continent's largest trade corridors in South America.

Brazil Freight and Logistics Market Segmentation

Logistics Function Insights

● Courier, Express and Parcel (CEP):

○ Destination Type: Domestic, International

○ Description: Covers rapid delivery of parcels and documents within Brazil and across international destinations.

● Freight Forwarding:

○ Mode of Transport: Air, Sea and Inland Waterways, Others

○ Description: Coordination of shipment logistics across multimodal routes, enabling global trade facilitation.

● Freight Transport:

○ Mode of Transport: Air, Pipelines, Rail, Road, Sea and Inland Waterways

○ Description: Involves transport of goods through multiple channels ensuring flexibility and coverage for diverse cargo types.

● Warehousing and Storage:

○ Temperature Control: Non-Temperature Controlled, Temperature Controlled, Others

○ Description: Includes advanced warehousing for industrial, perishable, and retail products, supported by automation and inventory management systems.

● Others:

○ Description: Additional logistics services not categorized under major segments, including third-party logistics (3PL) and value-added services.

End Use Industry Insights

● Agriculture, Fishing, and Forestry

● Construction

● Manufacturing

● Oil and Gas, Mining, and Quarrying

● Wholesale and Retail Trade

● Others

These industries represent the backbone of Brazil's logistics demand, reflecting its diverse economic landscape and strong industrial output across sectors.

Regional Insights

The Brazil Freight and Logistics Market is segmented into:

● Southeast

● South

● Northeast

● North

● Central-West

While the report does not specify regional CAGRs, the Southeast region, home to São Paulo and Rio de Janeiro, dominates due to dense industrial activity, port infrastructure, and e-commerce fulfillment networks. The South and Northeast regions are emerging as logistics growth corridors, supported by transport modernization projects, port expansions, and agribusiness exports.

Strategic government programs and private sector investments are reinforcing regional logistics connectivity, especially between inland agricultural centers and export terminals.

Competitive Landscape

The report presents a detailed overview of the competitive environment, analyzing market structure, key player positioning, and strategic initiatives undertaken by leading logistics operators.

Key competitive trends include:

● Expansion of multimodal logistics services.

● Investment in green and digital freight technologies.

● Formation of strategic alliances with e-commerce and retail sectors.

● Automation of warehousing and AI-driven fleet management.

Companies continue to prioritize customer-centric innovation and sustainability-driven growth strategies to strengthen Brazil's role in global supply chains.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request Customization: https://www.imarcgroup.com/request?type=report&id=13740&flag=E

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company offers a comprehensive suite of market entry and expansion services, including market assessments, feasibility studies, factory setup assistance, regulatory approvals, branding and sales strategies, competitive benchmarking, pricing analysis, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Brazil Freight and Logistics Market Size, Share & Growth, Trends, Report 2026-2034 here

News-ID: 4265611 • Views: …

More Releases from IMARC Group

United States Secondhand Luxury Goods Market Size, Trends, Growth and Forecast 2 …

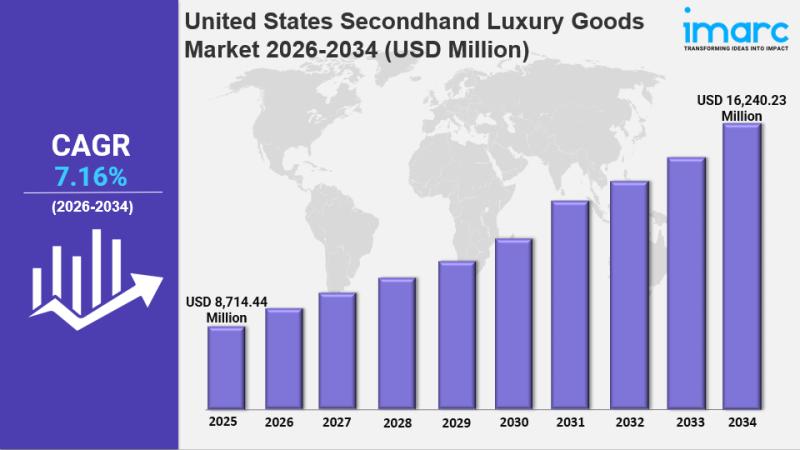

IMARC Group has recently released a new research study titled "United States Secondhand Luxury Goods Market Size, Share, Trends and Forecast by Product Type, Demography, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States secondhand luxury goods market was valued at USD 8,714.44 Million in 2025 and is…

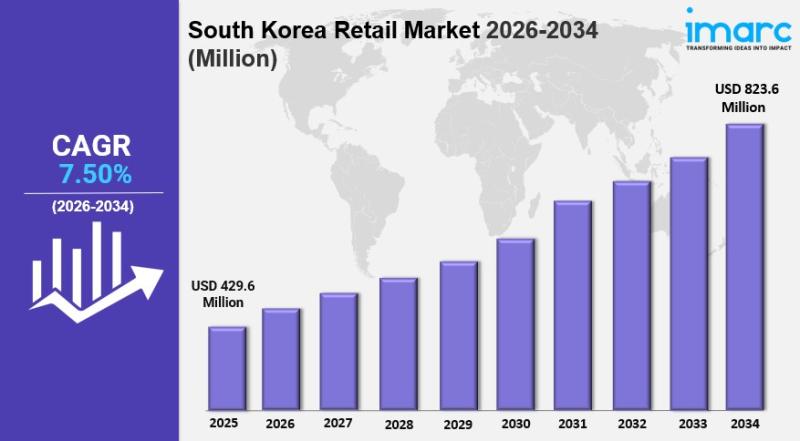

South Korea Retail Market Size Growth, Share Trends & Industry Demand 2026-2034

IMARC Group has recently released a new research study titled "South Korea Retail Market Report by Product Type (Food, Beverage, and Tobacco Products, Personal Care and Household, Apparel, Footwear, and Accessories, Furniture, Toys, and Hobby, Industrial and Automotive, Electronic and Household Appliances, Pharmaceuticals, Luxury Goods, and Others), Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Department Stores, Specialty Stores, Online, and Others), and Region 2026-2034", offers a detailed analysis of the…

Wood Pellet Market Insights 2026-2034: Feedstock Evolution, Application Expansio …

The global Wood Pellet Market was valued at USD 14.8 Billion in 2025 and is expected to reach USD 23.3 Billion by 2034. The market is projected to grow at a CAGR of 5.20% during 2026-2034, driven by increasing demand for renewable energy, government incentives, advancements in pellet production technology, and environmental concerns promoting carbon neutrality.

STUDY ASSUMPTION YEARS

Base Year: 2025

Historical Year/Period: 2020-2024

Forecast Year/Period: 2026-2034

WOOD PELLET MARKET KEY TAKEAWAYS

Current Market Size:…

Agricultural Chelates Market Size, Share & Growth by Type, Crop, Application and …

The global agricultural chelates market reached a value of USD 750.8 million in 2024 and is projected to grow to USD 1,222.6 million by 2033. It is forecasted to expand at a CAGR of 5.57% during the period 2025-2033. Growth is driven by the demand for high-efficiency fertilizers, increasing awareness of sustainable farming practices, and technological advancements.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Agricultural Chelates Market Key Takeaways

The…

More Releases for Brazil

Brazil Clinical Trials Market ANVISA Brazil Guidelines Brazil Clinical Trials Re …

Brazil Cancer Drugs Clinical Trials Insight 2024 Report Offering:

• Brazil Clinical Trials Market Opportunity 2024 and 2030 (In US$ Billion)

• Clinical Trials Regulatory Framework In Brazil

• Total Number of Cancer Drugs In Clinical Trials In Brazil

• Total Number Of Cancer Drugs Approved In Brazil

• 400 Pages Clinical Trials Insight On All Cancer Drugs In Clinical Trials By Company, Indication and Phase

• 80 Pages Clinical Insight On All Cancer Drugs Approved in Market By Company and Indication

• Insight…

South East Brazil growing with major share in the Brazil Professional Hair Care …

In the Report “Brazil Professional Hair Care Market: By Categories (Coloring, Perming & Straightening, Shampoo & Conditioning & Styling); Sales Channel (Back Bar and Take Home) & By Company - (2018-2023)“ published by IndustryARC, the market is driven by the growing awareness of special functionalities of products, boosting the sales of treatment and hair conditioning market.

South East Brazil growing with major share in the Brazil Professional Hair Care Market

The Northern…

ATM Machine Market is Booming (18% CAGR)| NCR Brazil, Diebold Brazil, Wincor Nix …

HTF MI recently introduced ATM Machine Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Itautec S/A, NCR Brazil, Diebold Brazil, Wincor Nixdorf Brazil,…

Brazil: Country Intelligence Report 2018 By Claro, Sky Brazil, Oi, Vivo, TIM Bra …

"Brazil: Country Intelligence Report", by GlobalData provides an executive-level overview of the telecommunications market in Brazil today, with detailed forecasts of key indicators up to 2021. Published annually, the report provides detailed analysis of the near-term opportunities, competitive dynamics and evolution of demand by service type and technology/platform across the fixed telephony, broadband, and mobile, as well as a review of key regulatory trends. …

Agrochemicals Market in Brazil

ReportsWorldwide has announced the addition of a new report title Brazil: Agrochemicals: Market Intelligence (2016-2021) to its growing collection of premium market research reports.

The report “Brazil: Agrochemicals: Market Intelligence (2016-2021)” provides market intelligence on the different market segments, based on type, active ingredient, formulation, crop, and pest. Market size and forecast (2016-2021) has been provided in terms of both, value (000 USD) and volume (000 KG) in the report. A…

ATM Machine Market in Brazil 2015-2019: Competitive analysis of key vendors, inc …

Albany, NY, Feb 23, 2017: This report segments the ATM machine market in Brazil by revenue generated and the unit shipment. It also includes the competitive analysis of key vendors, including Itautec S/A, NCR Brazil, Diebold Brazil and Wincor Nixdorf Brazil.

Market scope of the ATM machine market in Brazil

Technavios market research analyst predict that the ATM machine market in Brazil will continue to grow at CAGR of 18.72%. The key…