Press release

Maltodextrin Market to Reach GACR 6,2% by 2031 Top 20 Company Globally

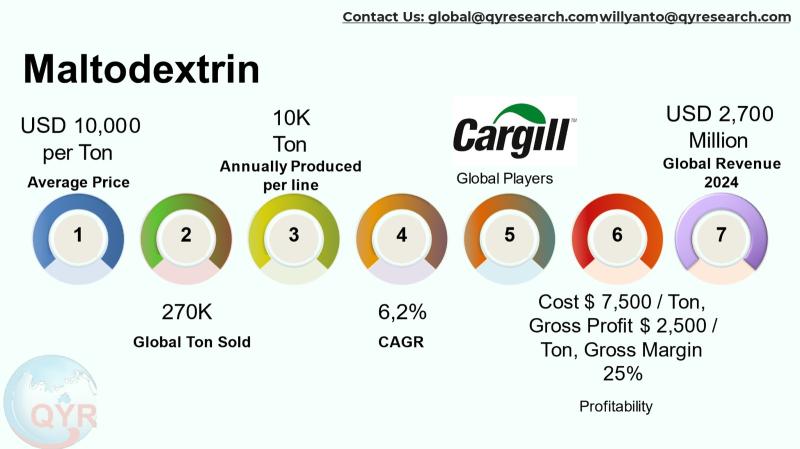

Maltodextrin is a low-sweetness, water-soluble carbohydrate produced by partial hydrolysis of starch; it serves as a bulking agent, texture modifier, carrier, and stabilizer across food & beverage, pharmaceutical, nutrition, and personal-care formulations. The purpose of this research is to present an investor-grade picture of the maltodextrin value chain and commercial dynamics with emphasis on Asia and Southeast Asia covering how the ingredients functional properties translate into steady industrial demand, how upstream feedstock and process choices shape unit economics, and how recent product innovations and sustainability/clean-label trends are changing formulators buying behavior.The global maltodextrin market size is at USD 2,700 million in 2024 with a growing CAGR of 6,2% reaching market size USD 4,160 by 2031. With an average selling price of USD 10,000 per ton, the implied total global volume sold in 2024 is 270K tons. Factory gross margin is at 25% implies factory gross profit of about USD 2,500 per ton and an average cost of goods sold is USD 7,500 per ton. A COGS breakdown is raw starch feedstock, energy and utilities, enzymes and chemicals, direct labor, packaging, transport & logistics, maintenance and other overheads. A single line full machine capacity production is around 10K ton per line per year. Downstream demand is moving towards health, nutrition, and functionality. With consumers becoming more conscious of the nutritional value and health benefits of their food choices, maltodextrin, as a low-calorie and efficient sugar alternative, will continue to be favored. The sports nutrition and weight-loss food markets are also driving the demand for maltodextrin, especially in products that offer energy with lower calorie content. Additionally, due to its excellent solubility and stability, maltodextrin has strong growth potential in niche markets such as baby food and senior nutrition products.

Latest Trends and Technological Developments

Ingredient manufacturers continue to pursue cleaner-label alternatives, process innovation and diversification of starch feedstocks. Notable items include: Cargills ongoing commercialization and marketing of soluble rice-based products and label-friendly bulking solutions that can replace or complement traditional maltodextrin (company documentation released by Cargill in 2025 highlights these product lines and positioning). Roquette has continued to pursue scale-up and partnership activity in starch-derived ingredient space (company 2024/early-2025 disclosures and annual reporting show R&D and investment emphasis on starch derivatives and alternative carbohydrates). Industry partnerships to scale enzymatic processes for specialty sweeteners and starch derivatives were publicized in mid-2024, reflecting technology transfers that indirectly affect maltodextrin production and co-product opportunities. Price indices and spot price monitoring in 2024mid-2025 show material volatility driven by raw-starch price swings (corn/maize and cassava), energy costs and logistics; price indices published in mid-2025 reported elevated but variable regional spot prices which continue to influence contract negotiations and margins. These items illustrate how formulators are balancing clean-label pressure with cost volatility and how manufacturers prioritize feedstock flexibility and energy efficiency to protect margins.

A major global food and beverage corporation like PepsiCo regularly purchases large quantities of food-grade maltodextrin from leading producers such as Ingredion Incorporated or Cargill. These bulk purchases are essential for the production of products like meal replacement shakes and powdered drink mixes, where maltodextrin acts as a low-cost carbohydrate source and bulking agent. A typical long-term supply contract might see PepsiCo procuring maltodextrin at a price ranging from $800 to $1,200 per metric ton, with the final price fluctuating based on the source (corn, tapioca, etc.), purity, and prevailing agricultural commodity markets.

Maltodextrin is a critical component in the production of Soylent, a popular complete nutrition meal replacement. In their manufacturing facilities, Soylent uses maltodextrin as a primary source of easily digestible carbohydrates to provide energy and create the desired smooth texture of their powdered and ready-to-drink products. The cost of the maltodextrin used in a single batch of their powder, which yields thousands of units, can amount to several thousand dollars, integrating into their overall Cost of Goods Sold (COGS). On a per-unit basis, the maltodextrin used in one bottle of a Soylent ready-to-drink shake may cost the company approximately $0.08 to $0.15 per unit, representing a significant portion of the raw material cost.

Asia remains the dominant global region for both maltodextrin production and consumption owing to the regions large starch base (corn, cassava/tapioca, and wheat), strong food processing sectors and rapidly growing processed-food demand. Asia-Pacific production capacity and output are significant and several regional reports estimate multi-million-ton starch processing throughput in 2024, with the region contributing strongly to global maltodextrin output. Feedstock availability especially cassava in Southeast Asia and corn in China and India gives local manufacturers cost advantages when logistics and domestic starch markets are favorable. At the same time, Asia faces rising input energy costs, regulatory scrutiny around labeling and growing demand for specialty or resistant maltodextrin and clean-label substitutes. Multinationals and regional champions are therefore investing in flexible lines able to process multiple starch types and to produce a spectrum of DE (dextrose equivalent) grades to serve regional confectionery, powdered beverage, instant foods, and pharmaceutical excipient needs. For Asia investors, the most attractive country and plant investments are those close to low-cost starch supply, port logistics, and large F&B clusters those attributes shorten cash-to-cash cycles and improve utilization economics.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5044191

Maltodextrin by Type:

Maltodextrin MD 20

Maltodextrin MD 15

Maltodextrin MD 10

Maltodextrin by Product Category:

Corn-based

Potato-based

Wheat-based

Rice-based

Others

Maltodextrin by Market Segment:

Enzymatic hydrolysis

Acid hydrolysis

Physical method

Maltodextrin by Product Division:

High Solubility

Medium Solubility

Low Solubility

Maltodextrin by Shape:

Powdered Maltodextrin

Granular Form

Liquid Maltodextrin

Microencapsulation Form

Others

Maltodextrin by Application:

Food & Beverage

Pharm & Cosmetics

Industrial

Others

Global Top 20 Key Companies in the Maltodextrin Market

GPC(Grain Processing Corp.)

Roquette

Cargill

Matsutani Chemical

ADM

Ingredion

Tate & Lyle

Agrana Group

Avebe

Nowamyl

San Soon Seng(3A Resources)

Kraft Chemical

WGC

Xiwang Group (Starch Sugars)

Zhucheng Dongxiao

Zhucheng Xingmao

Global Corn (Jinyu Corn, Shandong)

Qinhuangdao Lihua Starch

Shijiazhuang Huachen

Henan Feitian

Regional Insights

Southeast Asia is notable for cassava (tapioca) as a dominant feedstock for starch derivatives in countries like Thailand, Vietnam, and Indonesia. Indonesia has both rising domestic demand from instant and processed foods and an export orientation for certain starch products. ASEAN manufacturers benefit from proximate feedstocks and lower labor costs relative to some Western producers, but they must manage seasonality of cassava harvests, competition for feedstock from other starch derivatives (glucose syrups, modified starch) and logistics bottlenecks for exports. The ASEAN market is also a growth hotspot for value-added maltodextrin uses (sports nutrition powders, ready-to-mix beverage systems, snack coatings) that pay a premium over commodity grades, opening margin expansion opportunities for specialty producers. Regional policy support for agro-processing, and private investment in mid-sized spray-drying lines, are common strategic moves to capture this growth.

Key challenges for maltodextrin producers include raw-material price volatility (corn, cassava, wheat), energy and utility cost shocks that hit spray-drying and evaporation stages, growing customer preference for clean-label and single-ingredient solutions that can substitute maltodextrin, and regulatory/labeling shifts in different markets. Capacity expansion decisions require careful demand forecasting because line commissioning and return on invested capital are sensitive to sustained utilization rates. Another structural challenge is margin compression for commodity grades when feedstock cycles turn adverse; hence manufacturers are increasingly targeting specialty grades, co-products or integrated upstream feedstock security to protect margins.

Manufacturers should prioritize feedstock flexibility (ability to process cassava, corn and wheat starch), energy efficiency in drying (investment in modern dryer technology and heat integration), and product premiumization (resistant maltodextrin, high-function low-DE grades, spray-dried carriers for flavors). For buyers/brand owners, sourcing strategies that favor multi-source supply agreements, forward contracts for starch, and technical partnerships to support formulation switching will mitigate price risk. Investors should look for asset light expansions via contract manufacturing or JV with local starch suppliers to secure margins while limiting capex exposure.

Product Models

An Uncrewed Surface Vehicle (USV) is an autonomous or remotely operated watercraft designed to perform missions such as mapping, monitoring, surveillance, and logistics across marine and inland waterways.

Maltodextrin MD 10 has a DE value around 10, indicating low sweetness and high viscosity. It is ideal for products requiring body and thickness, such as soups, sauces, dairy powders, and infant nutrition formulations. Notable products include:

Maltrin M100 - Grain Processing Corporation (GPC): High-quality maltodextrin with excellent bulk and mouthfeel properties for food applications.

Glucidex 10 - Roquette: Used in baby food and nutritional drinks for its smooth texture and energy-providing characteristics.

C*Dry MD 10 - Cargill: Provides consistent bulking and low sweetness, suitable for powdered beverages.

Star-Dri 10 - Tate & Lyle: Designed for dry mixes and instant beverages, offering excellent dispersibility.

FiniMalt MD 10 - Ingredion: Delivers body and improved texture in dairy and savory applications.

Maltodextrin MD 15, with a DE value of approximately 15, offers moderate sweetness, solubility, and viscosity. It balances energy release and mouthfeel, making it suitable for confectionery, beverages, and instant mixes. Examples include:

Glucidex 15 - Roquette: Offers mild sweetness and high solubility for instant powdered drinks.

Maltrin M150 - GPC: Medium DE maltodextrin designed for spray-dried flavor carriers.

Star-Dri 15 - Tate & Lyle: Ideal for flavor encapsulation and instant soups.

C*Dry MD 15 - Cargill: Balances sweetness and mouthfeel for beverage and bakery applications.

Maltodex 15 - Zhucheng Dongxiao Biotechnology Co., Ltd: Suitable for seasoning powders and milk replacers.

Maltodextrin MD 20 has a DE around 20, resulting in higher sweetness and excellent solubility but lower viscosity. It is commonly used in powdered beverages, confectionery, and nutritional energy formulations for rapid energy absorption. Notable products include:

Maltodex 20 - Zhucheng Dongxiao Biotechnology Co., Ltd: Ideal for confectionery coatings and instant drink powders.

FiniMalt MD 20 - Ingredion: Used in energy snacks and sports supplements for quick carbohydrate intake.

Xiwang DE-20 Maltodextrin - Shandong Xiwang Group: Known for its fast dissolving capability and sweet taste.

Lycatab MD 20 - Roquette: Acts as a water-soluble carrier for active ingredients in pharmaceuticals.

TapiOKA MD 20 - Avebe: Tapioca-derived maltodextrin with clean taste and high dispersibility in instant mixes.

Maltodextrin remains a stable, functionally important ingredient with consistent demand from food & beverage and growing niche applications in nutrition and pharma. The 2024 baseline you provided (USD 2.7 billion) and a 6.2% CAGR to 2031 point to a steady expansion driven by processed food penetration in Asia, product innovation (clean-label alternatives and specialty grades), and rising use in formulated powdered systems. Profitability and investment returns will track feedstock sourcing strategy, energy efficiency, and the ability to sell premium grades rather than commoditized product alone.

Investor Analysis

This report frames the industry size/volume relationship, realistic factory economics and the likely per-line capacity needed to scale profitable production. How: Investors can use the unit economics to model IRR scenarios for greenfield lines, brownfield expansion, or M&A of local producers. Why: The report highlights Asia/ASEAN as the most operationally attractive region (feedstock proximity, domestic demand growth), shows where margin uplift can be captured (specialty grades and downstream formulation partnerships), and signals the key operational levers (feedstock contracts, energy/utility optimization, dryer uptime) that directly influence payout speed and downside protection.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5044191

5 Reasons to Buy This Report

Clear, investor-usable unit economics ready for financial modelling.

Asia & ASEAN operational intelligence (feedstock, capacity, and demand splits) for locating production or evaluating target acquisitions.

Up-to-date trend coverage and named industry players to inform commercial/partnering decisions.

Practical COGS breakdown and capacity guidance that translate into capex and OPEX planning assumptions.

Tactical insight on premiumization pathways (specialty grades, clean-label substitutes) to defend margins.

5 Key Questions Answered

What is the implied global volume sold given a market size?

What is a conservative factory margin and per-ton gross profit that show factory margin?

How is COGS typically composed for maltodextrin production?

Where in Asia/ASEAN should investors preferentially consider capacity expansion?

Which companies lead the market and what strategic moves are shaping the competitive picture?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Maltodextrin Market Research Report 2025

https://www.qyresearch.com/reports/3472522/maltodextrin

Global Maltodextrin Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/4683126/maltodextrin

Global Maltodextrin Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5044191/maltodextrin

Maltodextrin - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5375658/maltodextrin

Global Corn Maltodextrin Market Research Report 2025

https://www.qyresearch.com/reports/3543781/corn-maltodextrin

Global Food Maltodextrins Market Research Report 2025

https://www.qyresearch.com/reports/3454310/food-maltodextrins

Global Maltodextrin Powder Market Research Report 2025

https://www.qyresearch.com/reports/3796966/maltodextrin-powder

Global Low DE Maltodextrin Market Research Report 2025

https://www.qyresearch.com/reports/4159195/low-de-maltodextrin

Global Tapioca Maltodextrin Market Research Report 2025

https://www.qyresearch.com/reports/4159573/tapioca-maltodextrin

Global Resistant Maltodextrin Market Research Report 2025

https://www.qyresearch.com/reports/3473338/resistant-maltodextrin

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Maltodextrin Market to Reach GACR 6,2% by 2031 Top 20 Company Globally here

News-ID: 4262357 • Views: …

More Releases from QY Research

Top 30 Indonesian Steel Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Krakatau Steel Tbk

PT Steel Pipe Industry of Indonesia Tbk

PT Gunung Raja Paksi Tbk

PT Gunawan Dianjaya Steel Tbk

PT Betonjaya Manunggal Tbk

PT Pelat Timah Nusantara Tbk

PT Saranacentral Bajatama Tbk

PT Lionmesh Prima Tbk

PT Super Iron & Steel Tbk

PT Indo Kordsa Tbk

PT Surya Esa Perkasa Tbk

PT Indah Kiat Pulp & Paper (steel fittings)

PT KRAH Grand Kartech Tbk

PT Keyprint Tbk

PT Singaraja Putra Tbk

PT Prima Alloy Steel Tbk

PT Akebono…

Coloring the Future: Market Dynamics and Opportunities in Dual Tip Alcohol Marke …

The Dual Tip Alcohol Marker market is a dynamic segment within the broader art and creative stationery industry, driven by demand from artists, designers, students, hobbyists, and creative professionals worldwide. Dual tip markers with broad and fine ends offer multifunctional use for detailed illustration and coverage work, blending artistic precision with vibrant color performance. Alcohol markers more broadly (which include dual tip varieties) continue to expand as art supplies gain…

Acupressure Pillow Market Report 2026: Asia & ASEAN Growth, Trends, and Investme …

The global acupressure pillow industry encompasses products designed to provide therapeutic pressure relief, stress reduction, muscle relaxation, and wellness benefits. These pillows, often integrated with acupressure points or ergonomic contours, attract both health-conscious consumers and wellness-oriented markets seeking non-pharmaceutical solutions for pain management and quality of sleep. Unlike broader pillow segments such as sleeping or cervical pillows, the acupressure pillow niche blends traditional healing principles with contemporary lifestyle and wellness…

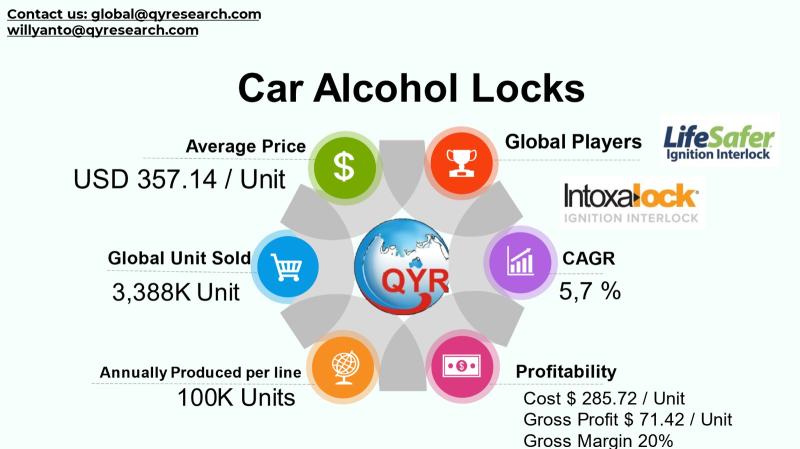

Road Safety Revolution: How Car Alcohol Locks Are Accelerating Adoption in Asia …

The Car Alcohol Lock industry, also known as the Ignition Interlock Device (IID) or Alcohol Interlock Systems market, has emerged as a crucial segment of automotive safety technologies aimed at reducing alcohol-related road accidents and enforcing drunk driving regulations. These systems are primarily in-vehicle alcohol detection devices that require drivers to pass a breath alcohol test before starting the engine, ensuring compliance with safety standards and legal mandates in many…