Press release

Overcoming Tax Debt - Christian Onyemem's Newly Released Book Offers Highly Effective Tax Resolution Strategies

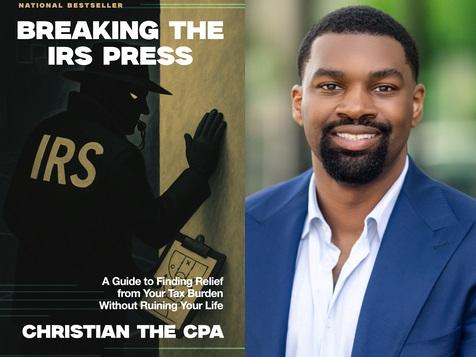

Lexington, Kentucky, USA - November 6, 2025 - Tax resolution specialist and Certified Public Accountant Christian Onyemem has now released his new book, Breaking The IRS Press: A Guide to Finding Relief from Your Tax Burden Without Ruining Your Life . This book is an empowering guide for everyday American citizens to understand how the IRS works, enabling them to put an end to the nerve-racking calls and letters. It simplifies complex concepts and provides readers with a comprehensive roadmap for success in the IRS game.Image: https://www.globalnewslines.com/uploads/2025/11/933b7f1b0a339e903ebc61e6d579c2f8.jpg

Breaking The IRS Press shares the mindset and methods for facing the IRS with confidence and moving from panic to control on the journey towards tax resolution. By drawing a parallel between the IRS and the defense of a full-court basketball press, the author guides readers in navigating pressure tactics, negotiating more favorable offers, and avoiding costly mistakes that can jeopardize their business. The book clarifies resolution tools such as penalty abatements, installment agreements, and Offers in Compromise, while also shedding light on the human side of tax struggles. In addition to financial knowledge, Breaking the IRS Press also shares a deeply personal story. The author writes about profound experiences that reshaped his life, leading him to a career built on empowerment and advocacy. From insider knowledge and real-life wisdom to actionable strategies and beyond, the book covers all important topics, offering a step-by-step approach to permanent tax resolution.

Christian Onyemem is a Certified Public Accountant, a seasoned entrepreneur, and a passionate financial educator. Throughout his career in the financial services industry, he has helped Americans from all walks of life face the IRS with knowledge and confidence. As the founder of his own CPA firm based in Houston, Texas, he leads a team of dedicated professionals who have reduced more than 5 million dollars in tax and IRS penalties for the firm's clients. With genuine empathy for people facing tax struggles, he empowers his clients to regain control and stability.

Over the years, Christian and his team have pioneered advanced strategies and reliable tools that help reduce taxes and generate long-term wealth. Now distilling years of knowledge and expertise in his new book, he is helping people break free from the emotional and financial weight of tax debt, giving them a chance to rebuild their financial life with integrity and purpose. Christian Onyemem is available for interviews.

Breaking The IRS Press: A Guide to Finding Relief from Your Tax Burden Without Ruining Your Life is now available on Amazon.com.

Book Preview: https://www.amazon.com/dp/B0FV9ZL76M

About Christian Onyemem: https://www.linkedin.com/in/christian-onyemem-cpa-cfe-caa-70b37611a

Media Contact

Company Name: Paperback Expert

Contact Person: Michael DeLon

Email: Send Email [http://www.universalpressrelease.com/?pr=overcoming-tax-debt-christian-onyemems-newly-released-book-offers-highly-effective-tax-resolution-strategies]

Phone: 501-404-8690

Country: United States

Website: https://paperbackexpert.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. GetNews makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Overcoming Tax Debt - Christian Onyemem's Newly Released Book Offers Highly Effective Tax Resolution Strategies here

News-ID: 4258090 • Views: …

More Releases from Getnews

gardenLAB Expands Thoughtful Landscape Design Services in Dallas, TX

Image: https://www.globalnewslines.com/uploads/2026/02/1771523043.jpg

gardenLAB, a Dallas-based landscape design studio, continues to shape resilient and design-forward outdoor spaces across North Texas. Known for a refined, site-responsive approach, gardenLAB delivers landscapes that balance aesthetics, function, and long-term adaptability to the regional climate.

February 20, 2026 - Dallas, TX - With a focus on integrated planning and horticultural expertise, gardenLAB supports residential and commercial properties through services aligned with Groundskeeping Dallas [https://www.gardenlab.design/services#:~:text=GARDENING%20%26%20SEASONAL%20COLOR] standards, ensuring landscapes remain…

Let Kids Be Kids, Arshiner's 2026 Spring/Summer Collection Brings Festive Joy in …

In 2026, American parents' approach to choosing children's clothing is undergoing a quiet transformation. Instead of focusing on outfits for specific festive occasions to create a sense of ritual, they are now embracing real-life daily scenarios. During those moments of running, exploring, laughing, and growing, clothing should be an extension of joy and freedom. At the heart of this trend is the idea that children should not only shine on…

"One Outfit, Multiple Wears" Becomes a New Travel Trend: EKOUAER Travel Homewear …

From an overstuffed suitcase that's hard to zip up, to tight outfits on the plane that make it difficult to breathe, to the moment when you check into a hotel and want to go out for a cup of coffee but can't find a comfortable and appropriate outfit... At such times, we often lament: A truly enjoyable journey really requires a set of homewear that can "go wherever you go."…

HowtoAchieveBothSafetyandComfortinSpringandSummerClose-to-SkinOutfits, COOFANDYO …

Image: https://www.globalnewslines.com/uploads/2026/02/14ee3a9cbf6b505268b80216af836535.jpg

As temperatures gradually warm, spring and summer styling has become a focus in men's daily dressing. Compared to autumn and winter, spring and summer clothing is lighter, thinner, and more close-fitting, with longer and more extensive contact with the skin. This shift has led people to pay greater attention to the safety, comfort, and breathability of clothing materials. When garments almost become a "second skin," factors such as skin-friendliness,…

More Releases for IRS

Mobiniti Dedicated Toll-Free Numbers Handle IRS Negotiation Queries

United States, 17th Oct 2025 - Mobiniti's dedicated toll-free numbers are transforming how businesses manage IRS negotiation queries by offering a simple and effective communication tool. Through seamless integration with SMS platforms, businesses can provide clients with immediate access to dedicated lines, ensuring they receive expert assistance on tax-related matters without unnecessary delays. This solution improves customer satisfaction while streamlining the process of handling complex financial inquiries.

How Toll-Free Numbers Enhance…

The REBO Foundation Earns IRS 501(c)(3) Status

BARTLESVILLE, OK - October 15, 2025 - The Bartlesville Education Fund, operating publicly as The REBO Foundation, announced today that it has been officially recognized by the Internal Revenue Service (IRS) as a 501(c)(3) tax-exempt charitable organization, effective July 4, 2025 (EIN 39-2993969).

The REBO Foundation's mission is to build shelters, rehabilitation centers, and mental health programs throughout Oklahoma and beyond. With this IRS determination, the organization can now accept tax-deductible…

Torchlight Tax Offers Free Ebook on Understanding IRS Notices

Torchlight Tax LLC, a full service tax firm, is offering a free ebook entitled Understanding IRS Notices.

Dave Horwedel, CEO of Torchlight Tax, says that many taxpayers are confused and traumatized by receiving an IRS notice.

Mr.Horwedel stated "The IRS sends out a wide variety of notices to taxpayers that often strike fear into the heart of that taxpayer. If you understand what each type of notice is and…

National Tax Debt Offers Help Amidst IRS Collections

Image: https://www.getnews.info/wp-content/uploads/2024/08/1724781499.png

The Internal Revenue Service (IRS) is gearing up to intensify tax collections after a temporary lull during the COVID-19 pandemic. This heightened focus is largely due to increased funding from the Inflation Reduction Act, which has enabled the IRS to expand its workforce and enhance its collection capabilities.

IRS Collections Resuming

Taxpayers who owe back taxes should be aware that the IRS is becoming more aggressive in its collection efforts. This…

Understanding IRS Notices and Navigating Effective Responses

Dealing with the Internal Revenue Service (IRS) can be a daunting task for many taxpayers. Whether it's a simple notification or a more complex issue, understanding the nuances of can significantly impact how one responds and resolves any issues presented.

Identifying Different Types of IRS Notices

The first step in managing Internal Revenue Service [https://sbkass.com/irs-notices-and-effective-responses/] communications effectively is to identify the type of notice you've received. The IRS sends various notices for…

Things you need to know about IRS tax refunds

Tax season is here, and taxpayers across the United States are finalizing their tax filing strategies, as a high tax bill is not desirable at all. Taxpayers intend to obtain as much tax deduction as possible, and several attributes affect the total amount of taxes that are to be paid by a taxpayer. Every taxpayer needs to be aware of the IRS refunds they are entitled to so they can…